UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

or

For the transition period from _____________ to ___________

Commission File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

☒ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No

As of January 31, 2023, there were outstanding

Graham Corporation and Subsidiaries

Index to Form 10-Q

As of December 31, 2022 and March 31, 2022 and for the three and nine months ended December 31, 2022 and 2021

|

|

Page |

Part I. |

|

|

|

|

|

Item 1. |

3 |

|

|

|

|

Item 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

|

|

Item 3. |

33 |

|

|

|

|

Item 4. |

34 |

|

|

|

|

Part II. |

|

|

|

|

|

Item 1A. |

35 |

|

|

|

|

Item 6. |

36 |

|

|

|

|

37 |

||

|

|

|

2

GRAHAM CORPORATION AND SUBSIDIARIES

FORM 10-Q

DECEMBER 31, 2022

PART I – FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollar amounts in thousands, except per share data)

(Unaudited)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

||||

Net sales |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

Cost of products sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other expenses and income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Selling, general and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Selling, general and administrative – amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other operating expense (income), net |

|

|

|

|

|

|

|

|

|

|

|

( | ) |

|

|||

Operating income (loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

||

Other income, net |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Interest income |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Income (loss) before provision (benefit) for income taxes |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

||

Provision (benefit) for income taxes |

|

|

|

|

|

( | ) |

|

|

|

|

|

( |

) |

|

||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

Per share data |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

Weighted average common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Dividends declared per share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

See Notes to Condensed Consolidated Financial Statements.

3

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Dollar amounts in thousands)

(Unaudited)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

||||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign currency translation adjustment |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|||

Defined benefit pension and other postretirement plans net |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total other comprehensive income (loss) |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|||

Total comprehensive income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

See Notes to Condensed Consolidated Financial Statements.

4

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollar amounts in thousands, except per share data)

(Unaudited)

5

|

|

December 31, 2022 |

|

|

March 31, 2022 |

|

|

||

Assets |

|

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

|

||

Trade accounts receivable, net of allowances ($ |

|

|

|

|

|

|

|

||

Unbilled revenue |

|

|

|

|

|

|

|

||

Inventories |

|

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

||

Income taxes receivable |

|

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

|

||

Property, plant and equipment, net |

|

|

|

|

|

|

|

||

Prepaid pension asset |

|

|

|

|

|

|

|

||

Operating lease assets |

|

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

|

||

Customer relationships, net |

|

|

|

|

|

|

|

||

Technology and technical know-how, net |

|

|

|

|

|

|

|

||

Other intangible assets, net |

|

|

|

|

|

|

|

||

Deferred income tax asset |

|

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

|

||

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

|

||

Current portion of long-term debt |

|

$ |

|

|

$ |

|

|

||

Current portion of finance lease obligations |

|

|

|

|

|

|

|

||

Accounts payable |

|

|

|

|

|

|

|

||

Accrued compensation |

|

|

|

|

|

|

|

||

Accrued expenses and other current liabilities |

|

|

|

|

|

|

|

||

Customer deposits |

|

|

|

|

|

|

|

||

Operating lease liabilities |

|

|

|

|

|

|

|

||

Income taxes payable |

|

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

|

||

Long-term debt |

|

|

|

|

|

|

|

||

Finance lease obligations |

|

|

|

|

|

|

|

||

Operating lease liabilities |

|

|

|

|

|

|

|

||

Deferred income tax liability |

|

|

|

|

|

|

|

||

Accrued pension and postretirement benefit liabilities |

|

|

|

|

|

|

|

||

Other long-term liabilities |

|

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

Stockholders’ equity: |

|

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

|

||

Capital in excess of par value |

|

|

|

|

|

|

|

||

Retained earnings |

|

|

|

|

|

|

|

||

Accumulated other comprehensive loss |

|

|

( |

) |

|

|

( |

) |

|

Treasury stock ( |

|

|

( |

) |

|

|

( |

) |

|

Total stockholders’ equity |

|

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

|

||

See Notes to Condensed Consolidated Financial Statements.

6

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollar amounts in thousands)

(Unaudited)

|

|

Nine Months Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Operating activities: |

|

|

|

|||||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

Adjustments to reconcile net income (loss) to net cash provided (used) by operating |

|

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

|

||

Amortization of intangible assets |

|

|

|

|

|

|

||

Amortization of actuarial losses |

|

|

|

|

|

|

||

Amortization of debt issuance costs |

|

|

|

|

|

|

||

Equity-based compensation expense |

|

|

|

|

|

|

||

Gain on disposal or sale of property, plant and equipment |

|

|

|

|

|

|

||

Change in fair value of contingent consideration |

|

|

|

|

|

( |

) |

|

Deferred income taxes |

|

|

|

|

|

|

||

(Increase) decrease in operating assets: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

( |

) |

|

|

( |

) |

Unbilled revenue |

|

|

( |

) |

|

|

|

|

Inventories |

|

|

( |

) |

|

|

|

|

Prepaid expenses and other current and non-current assets |

|

|

( |

) |

|

|

( |

) |

Income taxes receivable |

|

|

( |

) |

|

|

( |

) |

Operating lease assets |

|

|

|

|

|

|

||

Prepaid pension asset |

|

|

( |

) |

|

|

( |

) |

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

|

|

|

|

( |

) |

|

Accrued compensation, accrued expenses and other current and non-current |

|

|

|

|

|

|

||

Customer deposits |

|

|

|

|

|

|

||

Operating lease liabilities |

|

|

( |

) |

|

|

( |

) |

Long-term portion of accrued compensation, accrued pension and |

|

|

( |

) |

|

|

|

|

Net cash provided (used) by operating activities |

|

|

|

|

|

( |

) |

|

Investing activities: |

|

|

|

|

|

|

||

Purchase of property, plant and equipment |

|

|

( |

) |

|

|

( |

) |

Redemption of investments at maturity |

|

|

|

|

|

|

||

Acquisition of Barber-Nichols, LLC |

|

|

|

|

|

( |

) |

|

Net cash used by investing activities |

|

|

( |

) |

|

|

( |

) |

Financing activities: |

|

|

|

|

|

|

||

Borrowings of short-term debt obligations |

|

|

|

|

|

|

||

Principal repayments on debt |

|

|

( |

) |

|

|

( |

) |

Proceeds from the issuance of debt |

|

|

|

|

|

|

||

Repayments on financing lease obligations |

|

|

( |

) |

|

|

( |

) |

Payment of debt issuance costs |

|

|

( |

) |

|

|

( |

) |

Dividends paid |

|

|

|

|

|

( |

) |

|

Purchase of treasury stock |

|

|

( |

) |

|

|

( |

) |

Net cash (used) provided by financing activities |

|

|

( |

) |

|

|

|

|

Effect of exchange rate changes on cash |

|

|

( |

) |

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

|

|

|

( |

) |

|

Cash and cash equivalents at beginning of period |

|

|

|

|

|

|

||

Cash and cash equivalents at end of period |

|

$ |

|

|

$ |

|

||

See Notes to Condensed Consolidated Financial Statements.

7

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

NINE MONTHS ENDED DECEMBER 31, 2022

(Dollar amounts in thousands)

(Unaudited)

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

Accumulated |

|

|

|

|

|

Total |

|

||||||||||

|

|

|

|

|

Par |

|

|

Excess of |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

Stockholders' |

|

|||||||

|

|

Shares |

|

|

Value |

|

|

Par Value |

|

|

Earnings |

|

|

Loss |

|

|

Stock |

|

|

Equity |

|

|||||||

Balance at April 1, 2022 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|||||

Comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

||||||

Forfeiture of shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

||||

Recognition of equity-based |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|||||

Balance at June 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

Comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

( |

) |

||||

Issuance of shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

||||||

Forfeiture of shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

||||

Recognition of equity-based |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Issuance of treasury stock |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance at September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Recognition of equity-based |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Balance at December 31, 2022 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

8

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

NINE MONTHS ENDED DECEMBER 31, 2021

(Dollar amounts in thousands)

(Unaudited)

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

Accumulated |

|

|

|

|

|

Total |

|

||||||||||

|

|

|

|

|

Par |

|

|

Excess of |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

Stockholders' |

|

|||||||

|

|

Shares |

|

|

Value |

|

|

Par Value |

|

|

Earnings |

|

|

Loss |

|

|

Stock |

|

|

Equity |

|

|||||||

Balance at April 1, 2021 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|||||

Comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|||||

Issuance of shares |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|||||

Forfeiture of shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

||||

Dividends |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|||||

Recognition of equity-based |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Issuance of treasury stock |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|||||

Balance at June 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

Comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|||||

Issuance of shares |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|||||

Forfeiture of shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

||||

Dividends |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|||||

Recognition of equity-based |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||||

Issuance of treasury stock |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance at September 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|||||

Comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|||||

Dividends |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

|||||

Recognition of equity-based |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Balance at December 31, 2021 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

See Notes to Condensed Consolidated Financial Statements.

9

GRAHAM CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Dollar amounts in thousands, except per share data)

NOTE 1 – BASIS OF PRESENTATION:

Graham Corporation's (the "Company's") Condensed Consolidated Financial Statements include its wholly-owned subsidiaries located in Suzhou, China and Ahmedabad, India at December 31, 2022 and March 31, 2022, and its recently acquired wholly-owned subsidiary, Barber-Nichols, LLC ("BN"), located in Arvada, Colorado at December 31, 2022 and for the period June 1, 2021 through December 31, 2021 (See Note 2). The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. ("GAAP") for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X, each as promulgated by the U.S. Securities and Exchange Commission. The Company's Condensed Consolidated Financial Statements do not include all information and notes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Balance Sheet as of March 31, 2022 presented herein was derived from the Company’s audited Consolidated Balance Sheet as of March 31, 2022. For additional information, please refer to the consolidated financial statements and notes included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2022 ("fiscal 2022"). In the opinion of management, all adjustments, including normal recurring accruals considered necessary for a fair presentation, have been included in the Company's Condensed Consolidated Financial Statements.

The Company's results of operations and cash flows for the three and nine months ended December 31, 2022 are not necessarily indicative of the results that may be expected for the current fiscal year, which ends March 31, 2023 ("fiscal 2023").

NOTE 2 – ACQUISITION:

On June 1, 2021, the Company completed its acquisition of Barber-Nichols, LLC, a privately-owned designer and manufacturer of turbomachinery products located in Arvada, Colorado that serves the defense and aerospace industry as well as the energy and cryogenic markets. The Company believes this acquisition furthers its growth strategy through market and product diversification, broadens its offerings and strengthens its presence in the defense industry, builds on its presence in the energy markets and adds capabilities in the space industry.

This transaction was accounted for as a business combination which requires that assets acquired and liabilities assumed be recognized at their fair value as of the acquisition date. The purchase price of $

The cost of the acquisition was allocated to the assets acquired and liabilities assumed based upon its estimated fair value at the date of acquisition.

10

|

|

June 1 |

|

|

|

|

2021 |

|

|

Assets acquired: |

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

Accounts receivable, net of allowances |

|

|

|

|

Unbilled revenue |

|

|

|

|

Inventories |

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

Property, plant & equipment, net |

|

|

|

|

Operating lease assets |

|

|

|

|

Goodwill |

|

|

|

|

Customer relationships |

|

|

|

|

Technology and technical know-how |

|

|

|

|

Other intangibles, net |

|

|

|

|

Total assets acquired |

|

|

|

|

Liabilities assumed: |

|

|

|

|

Accounts payable |

|

|

|

|

Accrued compensation |

|

|

|

|

Accrued expenses and other current |

|

|

|

|

Customer deposits |

|

|

|

|

Operating lease liabilities |

|

|

|

|

Other long-term liabilities |

|

|

|

|

Total liabilities assumed |

|

|

|

|

Purchase price |

|

$ |

|

|

The fair value of acquisition-related intangible assets includes customer relationships, technology and technical know-how, backlog and tradename. Backlog and trade name are included in the line item "Other intangible assets, net" in the Condensed Consolidated Balance Sheets. The fair value of customer relationships was calculated using an income approach, specifically the Multi Period Excess Earning method, which incorporates assumptions regarding retention rate, new customer growth and customer related costs. The fair value of trade name and technology and technical know-how were both calculated using a Relief from Royalty method, which develops a market based royalty rate used to reflect the after tax royalty savings attributable to owning the intangible asset. The fair value of backlog was determined using a net realizable value methodology, and was computed as the present value of the expected sales attributable to backlog less the remaining costs to fulfill the backlog.

The purchase price was allocated to specific intangible assets as follows:

|

Weighted Average Amortization Period |

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net Carrying Amount |

|

|||

At December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|||

Intangibles subject to amortization: |

|

|

|

|

|

|

|

|

|

|

|||

Customer relationships |

|

$ |

|

|

$ |

|

|

$ |

|

||||

Technology and technical know-how |

|

|

|

|

|

|

|

|

|

||||

Backlog |

|

|

|

|

|

|

|

|

|

||||

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

Intangibles not subject to amortization: |

|

|

|

|

|

|

|

|

|

|

|||

Tradename |

|

$ |

|

|

$ |

— |

|

|

$ |

|

|||

|

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

||

Technology and technical know-how and customer relationships are amortized in selling, general and administrative expense on a straight line basis over their estimated useful lives. Backlog is amortized in cost of products sold over the projected conversion period based on management estimates at time of purchase. Intangible amortization was $

11

|

|

Annual Amortization |

|

|

Remainder of 2023 |

|

$ |

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 and thereafter |

|

|

|

|

Total intangible amortization |

|

$ |

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

December 31, 2021 |

|

|

Net sales |

|

$ |

|

|

Net loss |

|

|

( |

) |

Loss per share |

|

|

|

|

Basic |

|

$ |

( |

) |

Diluted |

|

$ |

( |

) |

The unaudited pro forma information presents the combined operating results of Graham Corporation and BN, with the results prior to the acquisition date adjusted to include the pro forma impact of the adjustment of depreciation of fixed assets based on the preliminary purchase price allocation, the adjustment to interest income reflecting the cash paid in connection with the acquisition, including acquisition-related expenses, at the Company’s weighted average interest income rate, interest expense and loan origination fees at the Company’s current interest rate, amortization expense related to the fair value adjustments for intangible assets, non-recurring acquisition-related costs and the impact of income taxes on the pro forma adjustments utilizing the applicable statutory tax rate.

The unaudited pro forma results are presented for illustrative purposes only. These pro forma results do not purport to be indicative of the results that would have actually been obtained if the acquisition occurred as of the beginning of each of the periods presented, nor does the pro forma data intend to be a projection of results that may be obtained in the future.

NOTE 3 – REVENUE RECOGNITION:

The Company recognizes revenue on contracts when or as it satisfies a performance obligation by transferring control of the product to the customer. For contracts in which revenue is recognized upon shipment, control is generally transferred when products are shipped, title is transferred, significant risks of ownership have transferred, the Company has rights to payment, and rewards of ownership pass to the customer. For contracts in which revenue is recognized over time, control is generally transferred as the Company creates an asset that does not have an alternative use to the Company and the Company has an enforceable right to payment for the performance completed to date.

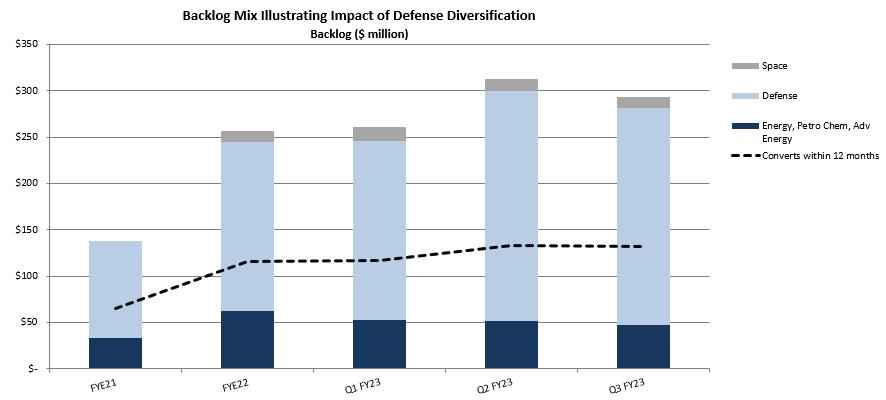

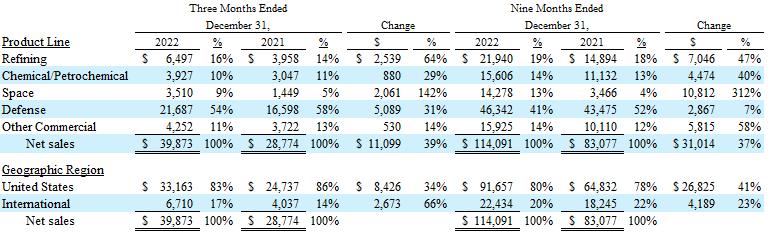

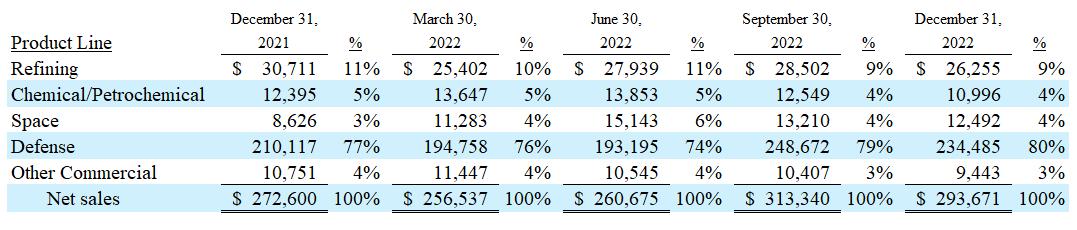

The following table presents the Company’s revenue disaggregated by product line and geographic area:

12

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

||||||||||

Product Line |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Refining |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Chemical/Petrochemical |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Defense |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Space |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other Commercial |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net sales |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Geographic Region |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Asia |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Canada |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Middle East |

|

|

|

|

|

|

|

|

|

|

|

|

||||

South America |

|

|

|

|

|

|

|

|

|

|

|

|

||||

U.S. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

All other |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net sales |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

A performance obligation represents a promise in a contract to provide a distinct good or service to a customer. The Company accounts for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. Transaction price reflects the amount of consideration to which the Company expects to be entitled in exchange for transferred products. A contract’s transaction price is allocated to each distinct performance obligation and revenue is recognized as the performance obligation is satisfied. In certain cases, the Company may separate a contract into more than one performance obligation, while in other cases, several products may be part of a fully integrated solution and are bundled into a single performance obligation. If a contract is separated into more than one performance obligation, the Company allocates the total transaction price to each performance obligation in an amount based on the estimated relative standalone selling prices of the promised goods underlying each performance obligation. The Company has made an accounting policy election to exclude from the measurement of the contract price all taxes assessed by government authorities that are collected by the Company from its customers. The Company does not adjust the contract price for the effects of a financing component if the Company expects, at contract inception, that the period between when a product is transferred to a customer and when the customer pays for the product will be one year or less. Shipping and handling fees billed to the customer are recorded in revenue and the related costs incurred for shipping and handling are included in cost of products sold.

The Company recognizes revenue over time when contract performance results in the creation of a product for which the Company does not have an alternative use and the contract includes an enforceable right to payment in an amount that corresponds directly with the value of the performance completed. To measure progress towards completion on performance obligations for which revenue is recognized over time the Company utilizes an input method based upon a ratio of direct labor hours incurred to date to management’s estimate of the total labor hours to be incurred on each contract, an input method based upon a ratio of total contract costs incurred to date to management’s estimate of the total contract costs to be incurred or an output method based upon completion of operational milestones, depending upon the nature of the contract. The Company has established the systems and procedures essential to developing the estimates required to account for performance obligations over time. These procedures include monthly review by management of costs incurred, progress towards completion, identified risks and opportunities, sourcing determinations, changes in estimates of costs yet to be incurred, availability of materials, and execution by subcontractors. Sales and earnings are adjusted in current accounting periods based on revisions in the contract value due to pricing changes and estimated costs at completion. Losses on contracts are recognized immediately when evident to management. Revenue on the majority of the Company’s contracts, as measured by number of contracts, is recognized upon shipment to the customer. Revenue on larger contracts, which are fewer in number but represent the majority of revenue, is recognized over time.

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenue recognized over time |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Revenue recognized at shipment |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

13

The timing of revenue recognition, invoicing and cash collections affect trade accounts receivable, unbilled revenue (contract assets) and customer deposits (contract liabilities) on the Condensed Consolidated Balance Sheets. Unbilled revenue represents revenue on contracts that is recognized over time and exceeds the amount that has been billed to the customer. Unbilled revenue is separately presented in the Condensed Consolidated Balance Sheets. The Company may have an unconditional right to payment upon billing and prior to satisfying the performance obligations. The Company will then record a contract liability and an offsetting asset of equal amount until the deposit is collected and the performance obligations are satisfied. Customer deposits are separately presented in the Condensed Consolidated Balance Sheets. Customer deposits are not considered a significant financing component as they are generally received less than one year before the product is completed or used to procure specific material on a contract, as well as related overhead costs incurred during design and construction.

Net contract assets (liabilities) consisted of the following:

|

|

December 31, 2022 |

|

|

March 31, 2022 |

|

|

Change |

|

|

Change due to revenue recognized |

|

|

Change due to invoicing customers/ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Unbilled revenue (contract assets) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|||||

Customer deposits (contract liabilities) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

||

Net contract (liabilities) assets |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

||

Contract liabilities at December 31, and March 31, 2022 include $

Receivables billed but not paid under retainage provisions in the Company’s customer contracts were $

Incremental costs to obtain a contract consist of sales employee and agent commissions. Commissions paid to employees and sales agents are capitalized when paid and amortized to selling, general and administrative expense when the related revenue is recognized. Capitalized costs, net of amortization, to obtain a contract were $

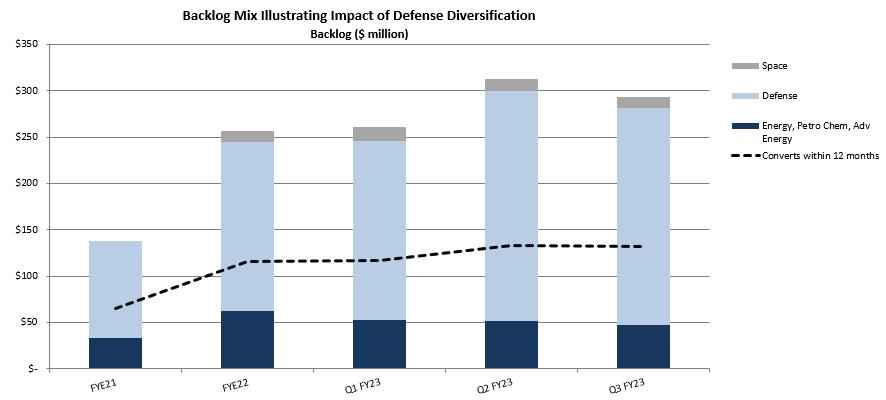

The Company’s remaining unsatisfied performance obligations represent a measure of the total dollar value of work to be performed on contracts awarded and in progress. The Company also refers to this measure as backlog. As of December 31, 2022, the Company had remaining unsatisfied performance obligations of $

NOTE 4 – INVENTORIES:

Inventories are stated at the lower of cost or net realizable value, using the average cost method.

Major classifications of inventories are as follows:

|

|

December 31, |

|

|

March 31, |

|

||

|

|

2022 |

|

|

2022 |

|

||

Raw materials and supplies |

|

$ |

|

|

$ |

|

||

Work in process |

|

|

|

|

|

|

||

Finished products |

|

|

|

|

|

|

||

Total |

|

$ |

|

|

$ |

|

||

14

NOTE 5 – EQUITY-BASED COMPENSATION:

The 2020 Graham Corporation Equity Incentive Plan (the "2020 Plan"), as approved by the Company’s stockholders at the annual meeting of stockholders on August 11, 2020, provides for the issuance of

The following restricted stock units were granted in the nine months ended December 31, 2022:

|

|

Nine Months Ended |

|

|

|

|

December 31, |

|

|

|

|

2022 |

|

|

Officers |

|

$ |

|

|

Directors |

|

|

|

|

|

|

$ |

|

|

The Company has an Employee Stock Purchase Plan, as amended (the "ESPP"), which allows eligible employees to purchase shares of the Company's common stock at a discount of up to

The Company has recognized equity-based compensation costs as follows:

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Restricted stock awards |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Restricted stock units |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Employee stock purchase plan |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Income tax benefit recognized |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

NOTE 6 – INCOME (LOSS) PER SHARE:

Basic income (loss) per share is computed by dividing net income (loss) by the weighted average number of common shares outstanding for the period. Diluted income (loss) per share is calculated by dividing net income (loss) by the weighted average number

15

of common shares outstanding and, when applicable, potential common shares outstanding during the period.

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

||||

Basic income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic income (loss) per share |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income (loss) |

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

||

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Restricted stock units outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average common and |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted income (loss) per share |

|

$ |

|

|

$ |

( |

) |

|

|

|

|

$ |

( |

) |

|

||

NOTE 7 – PRODUCT WARRANTY LIABILITY:

The reconciliation of the changes in the product warranty liability is as follows:

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

||||

Balance at beginning of period |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

BN warranty accrual acquired |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expense (income) for product warranties |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|||

Product warranty claims paid |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Balance at end of period |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

Income of $

The product warranty liability is included in the line item "Accrued expenses and other current liabilities" in the Condensed Consolidated Balance Sheets.

NOTE 8 – CASH FLOW STATEMENT:

Interest paid was $

At December 31, 2022 and 2021, there were $

The $

16

In the nine months ended December 31, 2021, non-cash activities included pension adjustments, net of income tax, of $

NOTE 9 – COMMITMENTS AND CONTINGENCIES:

The Company has been named as a defendant in lawsuits alleging personal injury from exposure to asbestos allegedly contained in, or accompanying, products made by the Company. The Company is a co-defendant with numerous other defendants in these lawsuits and intends to vigorously defend itself against these claims. The claims in the Company’s current lawsuits are similar to those made in previous asbestos-related suits that named the Company as a defendant, which either were dismissed when it was shown that the Company had not supplied products to the plaintiffs’ places of work or were settled for immaterial amounts. The Company cannot provide any assurances that any pending or future matters will be resolved in the same manner as previous lawsuits.

As of December 31, 2022, the Company was subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

Although the outcome of the lawsuits, legal proceedings or potential claims to which the Company is, or may become, a party to cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made for the majority of the claims, management does not believe that the outcomes, either individually or in the aggregate, will have a material adverse effect on the Company’s results of operations, financial position or cash flows.

NOTE 10 – INCOME TAXES:

The Company files federal and state income tax returns in several domestic and international jurisdictions. In most tax jurisdictions, returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. The Company is subject to U.S. federal examination for the tax years

There was

NOTE 11 – CHANGES IN ACCUMULATED OTHER COMPREHENSIVE LOSS:

The changes in accumulated other comprehensive loss by component for the nine months ended December 31, 2022 and 2021 are as follows:

|

|

Pension and |

|

|

Foreign |

|

|

Total |

|

|||

Balance at April 1, 2022 |

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

Other comprehensive loss before reclassifications |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Amounts reclassified from accumulated other comprehensive |

|

|

|

|

|

|

|

|

|

|||

Net current-period other comprehensive income (loss) |

|

|

|

|

|

( |

) |

|

$ |

( |

) |

|

Balance at December 31, 2022 |

|

$ |

( |

) |

|

$ |

( | ) |

|

$ |

( |

) |

|

|

Pension and |

|

|

Foreign |

|

|

Total |

|

|||

Balance at April 1, 2021 |

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

Other comprehensive income before reclassifications |

|

|

|

|

|

|

|

|

|

|||

Amounts reclassified from accumulated other comprehensive |

|

|

|

|

|

|

|

|

|

|||

Net current-period other comprehensive income |

|

|

|

|

|

|

|

|

|

|||

Balance at December 31, 2021 |

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

17

The reclassifications out of accumulated other comprehensive loss by component for the three and nine months ended December 31, 2022 and 2021 are as follows:

Details about Accumulated Other |

|

Amount Reclassified from |

|

|

|

Affected Line Item in the Condensed |

||||||

|

|

Three Months Ended |

|

|

|

|

||||||

|

|

December 31, |

|

|

|

|

||||||

|

|

2022 |

|

|

|

2021 |

|

|

|

|

||

Pension and other postretirement benefit items: |

|

|

|

|

|

|

|

|

|

|

||

Amortization of actuarial loss |

|

$ |

( |

) |

(1) |

|

$ |

( |

) |

(1) |

|

Loss before benefit for income taxes |

|

|

|

( |

) |

|

|

|

( |

) |

|

|

Benefit for income taxes |

|

|

$ |

( |

) |

|

|

$ |

( |

) |

|

|

Net loss |

Details about Accumulated Other |

|

Amount Reclassified from |

|

|

|

Affected Line Item in the Condensed |

||||||

|

|

Nine Months Ended |

|

|

|

|

||||||

|

|

December 31, |

|

|

|

|

||||||

|

|

2022 |

|

|

|

2021 |

|

|

|

|

||

Pension and other postretirement benefit items: |

|

|

|

|

|

|

|

|

|

|

||

Amortization of actuarial loss |

|

$ |

( |

) |

(1) |

|

$ |

( |

) |

(1) |

|

Loss before benefit for income taxes |

|

|

|

( |

) |

|

|

|

( |

) |

|

|

Benefit for income taxes |

|

|

$ |

( |

) |

|

|

$ |

( |

) |

|

|

Net loss |

NOTE 12 – LEASES:

The Company leases certain manufacturing facilities, office space, machinery and office equipment. An arrangement is considered to contain a lease if it conveys the right to use and control an identified asset for a period of time in exchange for consideration. If it is determined that an arrangement contains a lease, then a classification of a lease as operating or finance is determined by evaluating the five criteria outlined in the lease accounting guidance at inception. Leases generally have remaining terms of

Right-of-use ("ROU") lease assets and lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make payments in exchange for that right of use. Finance lease ROU assets and operating lease ROU assets are included in the line items "Property, plant and equipment, net" and "Operating lease assets", respectively, in the Condensed Consolidated Balance Sheets. The current portion and non-current portion of finance and operating lease liabilities are all presented separately in the Condensed Consolidated Balance Sheets.

The Company previously entered into related party operating leases with Ascent Properties Group, LLC ("Ascent"), for an office and manufacturing building in Arvada, Colorado, as well as machinery and equipment. During the third quarter of fiscal 2023, the Company entered into another lease with Ascent for another manufacturing building in Arvada, Colorado. In connection with such leases, the Company made fixed minimum lease payments to the lessor of $

18

The discount rate implicit within the Company’s leases is generally not readily determinable, and therefore, the Company uses an incremental borrowing rate in determining the present value of lease payments based on rates available at commencement.

The weighted average remaining lease term and discount rate for finance and operating leases are as follows:

|

|

December 31, |

|

|

December 31, |

|

|

||

|

|

2022 |

|

|

2021 |

|

|

||

Finance Leases |

|

|

|

|

|

|

|

||

Weighted-average remaining lease term in years |

|

|

|

|

|

|

|

||

Weighted-average discount rate |

|

|

% |

|

|

% |

|

||

|

|

|

|

|

|

|

|

||

Operating Leases |

|

|

|

|

|

|

|

||

Weighted-average remaining lease term in years |

|

|

|

|

|

|

|

||

Weighted-average discount rate |

|

|

% |

|

|

% |

|

||

19

The components of lease expense are as follows:

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

||||

Finance lease cost: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Amortization of right-of-use assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

Interest on lease liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating lease cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Short-term lease cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total lease cost |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

Operating lease costs during the nine months ended December 31, 2022 and 2021 were included within cost of sales and selling, general and administrative expenses.

As of December 31, 2022, future minimum payments required under non-cancelable leases were:

|

|

Operating |

|

|

Finance |

|

||

Remainder of 2023 |

|

$ |

|

|

$ |

|

||

2024 |

|

|

|

|

|

|

||

2025 |

|

|

|

|

|

— |

|

|

2026 |

|

|

|

|

|

— |

|

|

2027 |

|

|

|

|

|

— |

|

|

2028 and thereafter |

|

|

|

|

|

— |

|

|

Total lease payments |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Less – amount representing interest |

|

|

|

|

|

|

||

Present value of net minimum lease payments |

|

$ |

|

|

$ |

|

||

NOTE 13 – DEBT:

On June 1, 2021, the Company entered into a $

Long term debt is comprised of the following:

|

|

December 31, |

|

|

March 31, |

|

|

||

|

|

2022 |

|

|

2022 |

|

|

||

Bank of America term loan |

|

$ |

|

|

$ |

|

|

||

Less: unamortized debt issuance costs |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

||

Less: current portion |

|

|

|

|

|

|

|

||

Total |

|

$ |

|

|

$ |

|

|

||

As of December 31, 2022, future minimum payments required were as follows:

Remainder of 2023 |

|

$ |

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 and thereafter |

|

|

|

|

Total |

|

$ |

|

20

On June 1, 2021, the Company terminated its revolving credit facility agreement with JPMorgan Chase Bank, N.A. and entered into a five-year revolving credit facility with Bank of America that provided a $

Under the original Bank of America term loan agreement and revolving credit facility, the Company covenanted to maintain a maximum total leverage ratio, as defined in such agreements, of

The Company has entered into amendment agreements with Bank of America since origination. Under the amended agreements, the Company is not required to comply with the maximum total leverage ratio and the minimum fixed charge coverage ratio covenants contained in the original term loan agreement for the periods ending December 31, 2021 and March 31, June 30 and September 30, 2022. The principal balance outstanding on the line of credit may not exceed $

In connection with the waiver and amendments discussed above, the Company is required to pay a back-end fee of $

On June 1, 2021, the Company entered into an agreement to amend its letter of credit facility agreement with HSBC Bank USA, N.A. and decreased the Company's line of credit from $

Letters of credit outstanding as of December 31, 2022 and March 31, 2022 were $

NOTE 14 – OTHER OPERATING EXPENSE (INCOME), NET:

On November 29, 2021, the Company and Jeffrey F. Glajch entered into a Severance and Transition Agreement (the "Agreement") pursuant to which Mr. Glajch agreed to retire from his position the earlier of June 30, 2022 or as of a date upon which the Company and Mr. Glajch otherwise mutually agreed. As a result, each month an expense of $

21

On August 9, 2021, the Company and James R. Lines entered into a Severance and Transition Agreement (the "Transition Agreement") pursuant to which Mr. Lines resigned from his position as the Company’s Chief Executive Officer and as a member of the Company's Board of Directors, and from positions he held with all Company subsidiaries and affiliates, effective as of the close of business on August 31, 2021. The Transition Agreement provides that for a period of 18 months following the separation date, Mr. Lines is paid his base salary as well as health care premiums. As a result, a liability was recorded in the amount of $

22

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollar and share amounts in thousands, except per share data)

Overview

We are a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the defense, space, energy and process industries. For the defense industry, our equipment is used in nuclear and non-nuclear propulsion, power, fluid transfer, and thermal management systems primarily for the U.S. Navy. For the space industry, our equipment is used in propulsion, power and energy management systems and for life support systems. Our energy and new energy markets include oil refining, cogeneration, and multiple alternative and clean power applications, including hydrogen. For the chemical and petrochemical industries, our equipment is used in fertilizer, ammonia, ethylene, methanol and downstream chemical facilities.

Our brands are built upon our engineering expertise and close customer collaboration to design, develop, and produce mission critical equipment and systems that enable our customers to meet their economic and operational objectives. Continual improvement of our processes and systems to ensure qualified and compliant equipment are hallmarks of our brand. Our early engagement with customers and support until the end of service life are values upon which our brands are built.

Our corporate headquarters is co-located with our production facilities in Batavia, New York, where surface condensers and ejectors are designed, engineered, and manufactured. Our wholly-owned subsidiary, Barber-Nichols, LLC ("BN"), based in Arvada, Colorado, designs, develops, manufactures and sells specialty turbomachinery products for the aerospace, cryogenic, defense and energy markets (see "Acquisition" below). We also have wholly-owned foreign subsidiaries, Graham Vacuum and Heat Transfer Technology Co., Ltd. ("GVHTT"), located in Suzhou, China and Graham India Private Limited ("GIPL"), located in Ahmedabad, India. GVHTT provides sales and engineering support for us in the People's Republic of China and management oversight throughout Southeast Asia. GIPL serves as a sales and market development office focusing on the refining, petrochemical and fertilizer markets in India and the middle east.

Our current fiscal year ends March 31, 2023 ("fiscal 2023").

Acquisition

We completed the acquisition of BN on June 1, 2021, which changed the composition of our end market mix. For the nine months ended December 31, 2022, sales to the defense and space industries were 53% of our business compared with approximately 25% of sales prior to the acquisition. The remaining 47% of our third quarter fiscal 2023 sales came from the refining, chemical/petrochemical and other commercial markets. These markets represented approximately 75% of our sales prior to the acquisition.