UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8462

GRAHAM CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 16-1194720 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 20 Florence Avenue, Batavia, New York | 14020 | |

| (Address of principal executive offices) | (Zip Code) | |

585-343-2216

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of February 1, 2013, there were outstanding 10,002,292 shares of the registrant’s common stock, par value $.10 per share.

Graham Corporation and Subsidiaries

Index to Form 10-Q

As of December 31, 2012 and March 31, 2012 and for the Three and Nine-Month Periods

Ended December 31, 2012 and 2011

| Page | ||||||

| Part I. |

||||||

| Item 1. |

4 | |||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 | ||||

| Item 3. |

29 | |||||

| Item 4. |

30 | |||||

| Part II. |

||||||

| Item 5. |

31 | |||||

| Item 6. |

31 | |||||

| 32 | ||||||

| 33 | ||||||

2

GRAHAM CORPORATION AND SUBSIDIARIES

FORM 10-Q

December 31, 2012

PART I - FINANCIAL INFORMATION

3

| Item 1. | Unaudited Condensed Consolidated Financial Statements |

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND RETAINED EARNINGS

(Unaudited)

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| (Amounts in thousands, except per share data) | ||||||||||||||||

| Net sales |

$ | 25,633 | $ | 24,329 | $ | 74,068 | $ | 82,936 | ||||||||

| Cost of products sold |

18,505 | 17,856 | 52,791 | 55,357 | ||||||||||||

| Cost of goods sold - amortization |

— | 11 | — | 120 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of goods sold |

18,505 | 17,867 | 52,791 | 55,477 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

7,128 | 6,462 | 21,277 | 27,459 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other expenses and income: |

||||||||||||||||

| Selling, general and administrative |

3,131 | 3,764 | 11,538 | 11,754 | ||||||||||||

| Selling, general and administrative - amortization |

57 | 56 | 170 | 163 | ||||||||||||

| Interest income |

(13 | ) | (12 | ) | (38 | ) | (48 | ) | ||||||||

| Interest expense |

19 | 55 | (271 | ) | 260 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expenses and income |

3,194 | 3,863 | 11,399 | 12,129 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before provision for income taxes |

3,934 | 2,599 | 9,878 | 15,330 | ||||||||||||

| Provision for income taxes |

887 | 959 | 2,826 | 5,206 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

3,047 | 1,640 | 7,052 | 10,124 | ||||||||||||

| Retained earnings at beginning of period |

77,989 | 72,711 | 74,383 | 64,623 | ||||||||||||

| Dividends |

(200 | ) | (198 | ) | (599 | ) | (594 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Retained earnings at end of period |

$ | 80,836 | $ | 74,153 | $ | 80,836 | $ | 74,153 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per share data: |

||||||||||||||||

| Basic: |

||||||||||||||||

| Net income |

$ | .30 | $ | .16 | $ | .70 | $ | 1.02 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted: |

||||||||||||||||

| Net income |

$ | .30 | $ | .16 | $ | .70 | $ | 1.01 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding: |

||||||||||||||||

| Basic: |

10,034 | 9,955 | 10,023 | 9,954 | ||||||||||||

| Diluted: |

10,057 | 9,991 | 10,046 | 9,991 | ||||||||||||

| Dividends declared per share |

$ | .02 | $ | .02 | $ | .06 | $ | .06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See Notes to Condensed Consolidated Financial Statements.

4

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| (Amounts in thousands) | ||||||||||||||||

| Net income |

$ | 3,047 | $ | 1,640 | $ | 7,052 | $ | 10,124 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income: |

||||||||||||||||

| Foreign currency translation adjustment |

34 | 15 | 22 | 71 | ||||||||||||

| Defined benefit pension and other postretirement plans net of tax of $78 and $35 for the three months ended December 31, 2012 and 2011, respectively, and $235 and $105 for the nine months ended December 31, 2012 and 2011, respectively |

144 | 62 | 431 | 188 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive income |

178 | 77 | 453 | 259 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive income |

$ | 3,225 | $ | 1,717 | $ | 7,505 | $ | 10,383 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See Notes to Condensed Consolidated Financial Statements.

5

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| December 31, 2012 |

March 31, 2012 |

|||||||

| (Amounts in thousands, except per share data) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 28,110 | $ | 25,189 | ||||

| Investments |

26,997 | 16,499 | ||||||

| Trade accounts receivable, net of allowances ($72 and $43 at December 31 and March 31, 2012, respectively) |

11,389 | 11,593 | ||||||

| Unbilled revenue |

7,655 | 12,667 | ||||||

| Inventories |

7,385 | 6,047 | ||||||

| Prepaid expenses and other current assets |

412 | 467 | ||||||

| Income taxes receivable |

3,126 | 4,479 | ||||||

| Deferred income tax asset |

91 | 37 | ||||||

|

|

|

|

|

|||||

| Total current assets |

85,165 | 76,978 | ||||||

| Property, plant and equipment, net |

13,101 | 13,453 | ||||||

| Prepaid pension asset |

2,813 | 2,238 | ||||||

| Goodwill |

6,938 | 6,938 | ||||||

| Permits |

10,300 | 10,300 | ||||||

| Other intangible assets, net |

4,833 | 4,968 | ||||||

| Other assets |

188 | 102 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 123,338 | $ | 114,977 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Current liabilities: |

||||||||

| Current portion of capital lease obligations |

$ | 88 | $ | 85 | ||||

| Accounts payable |

6,125 | 6,303 | ||||||

| Accrued compensation |

4,482 | 4,652 | ||||||

| Accrued expenses and other current liabilities |

2,581 | 3,707 | ||||||

| Customer deposits |

9,353 | 7,257 | ||||||

| Deferred income tax liability |

2,347 | 2,244 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

24,976 | 24,248 | ||||||

| Capital lease obligations |

150 | 203 | ||||||

| Accrued compensation |

298 | 293 | ||||||

| Deferred income tax liability |

7,473 | 7,404 | ||||||

| Accrued pension liability |

228 | 229 | ||||||

| Accrued postretirement benefits |

922 | 895 | ||||||

| Other long-term liabilities |

92 | 85 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

34,139 | 33,357 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 12) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $1.00 par value - |

||||||||

| Authorized, 500 shares |

||||||||

| Common stock, $.10 par value - |

||||||||

| Authorized, 25,500 shares |

||||||||

| Issued, 10,329 and 10,297 shares at December 31 and March 31, 2012, respectively |

1,033 | 1,030 | ||||||

| Capital in excess of par value |

18,338 | 17,745 | ||||||

| Retained earnings |

80,836 | 74,383 | ||||||

| Accumulated other comprehensive loss |

(7,707 | ) | (8,160 | ) | ||||

| Treasury stock (336 and 346 shares at December 31 and March 31, 2012, respectively) |

(3,301 | ) | (3,378 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

89,199 | 81,620 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 123,338 | $ | 114,977 | ||||

|

|

|

|

|

|||||

See Notes to Condensed Consolidated Financial Statements.

6

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Nine Months Ended December 31, |

||||||||

| 2012 | 2011 | |||||||

| (Amounts in thousands) | ||||||||

| Operating activities: |

||||||||

| Net income |

$ | 7,052 | $ | 10,124 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation |

1,390 | 1,177 | ||||||

| Amortization |

170 | 283 | ||||||

| Amortization of unrecognized prior service cost and actuarial losses |

666 | 293 | ||||||

| Discount accretion on investments |

(10 | ) | (4 | ) | ||||

| Stock-based compensation expense |

463 | 465 | ||||||

| Loss on disposal of property, plant and equipment |

8 | 5 | ||||||

| Deferred income taxes |

(259 | ) | 192 | |||||

| (Increase) decrease in operating assets: |

||||||||

| Accounts receivable |

210 | (1,657 | ) | |||||

| Unbilled revenue |

5,017 | 1,642 | ||||||

| Inventories |

(1,335 | ) | 2,264 | |||||

| Prepaid expenses and other current and non-current assets |

74 | (224 | ) | |||||

| Prepaid pension asset |

(575 | ) | (624 | ) | ||||

| Increase (decrease) in operating liabilities: |

||||||||

| Accounts payable |

(257 | ) | (3,665 | ) | ||||

| Accrued compensation, accrued expenses and other current and non-current liabilities |

(1,138 | ) | 678 | |||||

| Customer deposits |

2,087 | (4,893 | ) | |||||

| Income taxes receivable |

1,354 | (2,196 | ) | |||||

| Long-term portion of accrued compensation, accrued pension liability and accrued postretirement benefits |

31 | 54 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

14,948 | 3,914 | ||||||

|

|

|

|

|

|||||

| Investing activities: |

||||||||

| Purchase of property, plant and equipment |

(971 | ) | (2,621 | ) | ||||

| Proceeds from disposal of property, plant and equipment |

4 | 4 | ||||||

| Purchase of investments |

(60,488 | ) | (16,398 | ) | ||||

| Redemption of investments at maturity |

50,000 | 37,920 | ||||||

| Acquisition of Energy Steel & Supply Co. |

— | 384 | ||||||

|

|

|

|

|

|||||

| Net cash (used) provided by investing activities |

(11,455 | ) | 19,289 | |||||

|

|

|

|

|

|||||

| Financing activities: |

||||||||

| Principal repayments on capital lease obligations |

(61 | ) | (57 | ) | ||||

| Issuance of common stock |

55 | 378 | ||||||

| Dividends paid |

(599 | ) | (594 | ) | ||||

| Purchase of treasury stock |

— | (221 | ) | |||||

| Excess tax (deficiency) benefit on stock awards |

(2 | ) | 197 | |||||

|

|

|

|

|

|||||

| Net cash used by financing activities |

(607 | ) | (297 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash |

35 | 47 | ||||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

2,921 | 22,953 | ||||||

| Cash and cash equivalents at beginning of period |

25,189 | 19,565 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 28,110 | $ | 42,518 | ||||

|

|

|

|

|

|||||

See Notes to Condensed Consolidated Financial Statements.

7

GRAHAM CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Amounts in thousands, except per share data)

NOTE 1 – BASIS OF PRESENTATION:

Graham Corporation’s (the “Company’s”) Condensed Consolidated Financial Statements include (i) its wholly-owned foreign subsidiary located in China and (ii) its wholly-owned domestic subsidiary located in Lapeer, Michigan. The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, each as promulgated by the Securities and Exchange Commission (“SEC”). The Company’s Condensed Consolidated Financial Statements do not include all information and notes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Balance Sheet as of March 31, 2012 presented herein was derived from the Company’s audited Consolidated Balance Sheet as of March 31, 2012. For additional information, please refer to the consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2012 (“fiscal 2012”). In the opinion of management, all adjustments, including normal recurring accruals considered necessary for a fair presentation, have been included in the Company’s Condensed Consolidated Financial Statements.

The Company’s results of operations and cash flows for the three and nine months ended December 31, 2012 are not necessarily indicative of the results that may be expected for the fiscal year ending March 31, 2013 (“fiscal 2013”).

NOTE 2 – ACQUISITION:

On December 14, 2010, the Company completed its acquisition of Energy Steel & Supply Co. (“Energy Steel”), a nuclear code accredited fabrication and specialty machining company located in Lapeer, Michigan dedicated primarily to the nuclear power industry. The transaction was accounted for under the acquisition method of accounting and the purchase price was $17,899 in cash, subject to the adjustments described below.

The purchase agreement included a contingent earn out, which ranged from $0 to $2,000, dependant upon Energy Steel’s earnings performance in calendar years 2011 and 2012. In the fourth quarter of fiscal 2012, $1,000 of the earn out was paid. Energy Steel did not achieve the earnings performance requirements for calendar year 2012. Therefore, in the third quarter of fiscal 2013, the liability for the remaining contingent earn out of $975 was reversed. The Condensed Consolidated Statement of Operations for each of the three and nine months ended December 31, 2012 includes income of $975 in selling, general and administrative expense related to this adjustment.

During fiscal 2012, the Company received $384 from the seller due to a reduction in purchase price based upon the final determination of the working capital acquired in accordance with the purchase agreement. The Company’s Condensed Consolidated Statement of Cash Flows for the nine months ended December 31, 2011 reflects this adjustment.

8

NOTE 3 – REVENUE RECOGNITION:

The Company recognizes revenue on all contracts with a planned manufacturing process in excess of four weeks (which approximates 575 direct labor hours) using the percentage-of-completion method. The majority of the Company’s revenue is recognized under this methodology. The percentage-of-completion method is determined by comparing actual labor incurred to a specific date to management’s estimate of the total labor to be incurred on each contract. Contracts in progress are reviewed monthly, and sales and earnings are adjusted in current accounting periods based on revisions in the contract value and estimated costs at completion. Losses on contracts are recognized immediately when evident. There is no reserve for credit losses related to unbilled revenue recorded for contracts accounted for on the percentage-of-completion method. Any reserve for credit losses related to unbilled revenue is recorded as a reduction to revenue.

Revenue on contracts not accounted for using the percentage-of-completion method is recognized utilizing the completed contract method. The majority of the Company’s contracts (as opposed to revenue) have a planned manufacturing process of less than four weeks and the results reported under this method do not vary materially from the percentage-of-completion method. The Company recognizes revenue and all related costs on these contracts upon substantial completion or shipment to the customer. Substantial completion is consistently defined as at least 95% complete with regard to direct labor hours. Customer acceptance is generally required throughout the construction process and the Company has no further material obligations under its contracts after the revenue is recognized.

NOTE 4 – INVESTMENTS:

Investments consist solely of fixed-income debt securities issued by the U.S. Treasury with original maturities of greater than three months and less than one year. All investments are classified as held-to-maturity, as the Company has the intent and ability to hold the securities to maturity. The investments are stated at amortized cost which approximates fair value. All investments held by the Company at December 31, 2012 are scheduled to mature prior to April 25, 2013.

NOTE 5 – INVENTORIES:

Inventories are stated at the lower of cost or market, using the average cost method. For contracts accounted for on the completed contract method, progress payments received are netted against inventory to the extent the payment is less than the inventory balance relating to the applicable contract. Progress payments that are in excess of the corresponding inventory balance are presented as customer deposits in the Condensed Consolidated Balance Sheets. Unbilled revenue in the Condensed Consolidated Balance Sheets represents revenue recognized that has not been billed to customers on contracts accounted for on the percentage-of-completion method. For contracts accounted for on the percentage-of–completion method, progress payments are netted against unbilled revenue to the extent the payment is less than the unbilled revenue for the applicable contract. Progress payments exceeding unbilled revenue are netted against inventory to the extent the payment is less than or equal to the inventory balance relating to the applicable contract, and the excess is presented as customer deposits in the Condensed Consolidated Balance Sheets.

9

Major classifications of inventories are as follows:

| December 31, 2012 |

March 31, 2012 |

|||||||

| Raw materials and supplies |

$ | 2,940 | $ | 2,366 | ||||

| Work in process |

12,556 | 12,405 | ||||||

| Finished products |

623 | 587 | ||||||

|

|

|

|

|

|||||

| 16,119 | 15,358 | |||||||

| Less - progress payments |

8,734 | 9,311 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 7,385 | $ | 6,047 | ||||

|

|

|

|

|

|||||

NOTE 6 – INTANGIBLE ASSETS:

Intangible assets are comprised of the following:

| Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

||||||||||

| At December 31, 2012 |

||||||||||||

| Intangibles subject to amortization: |

||||||||||||

| Backlog |

$ | 170 | $ | 170 | $ | — | ||||||

| Customer relationships |

2,700 | 367 | 2,333 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 2,870 | $ | 537 | $ | 2,333 | |||||||

|

|

|

|

|

|

|

|||||||

| Intangibles not subject to amortization: |

||||||||||||

| Permits |

$ | 10,300 | $ | — | $ | 10,300 | ||||||

| Tradename |

2,500 | — | 2,500 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 12,800 | $ | — | $ | 12,800 | |||||||

|

|

|

|

|

|

|

|||||||

| At March 31, 2012 |

||||||||||||

| Intangibles subject to amortization: |

||||||||||||

| Backlog |

$ | 170 | $ | 170 | $ | — | ||||||

| Customer relationships |

2,700 | 232 | 2,468 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 2,870 | $ | 402 | $ | 2,468 | |||||||

|

|

|

|

|

|

|

|||||||

| Intangibles not subject to amortization: |

||||||||||||

| Permits |

$ | 10,300 | $ | — | $ | 10,300 | ||||||

| Tradename |

2,500 | — | 2,500 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 12,800 | $ | — | $ | 12,800 | |||||||

|

|

|

|

|

|

|

|||||||

Intangible assets are amortized on a straight line basis over their estimated useful lives. Intangible amortization expense for each of the three-month periods ended December 31, 2012 and 2011 was $45. Intangible amortization expense for the nine months ended December 31, 2012 and 2011 was $135 and $206, respectively. As of December 31, 2012, amortization expense is estimated to be $45 for the remainder of fiscal 2013 and $180 in each of fiscal 2014, fiscal 2015, fiscal 2016 and fiscal 2017.

10

NOTE 7 – STOCK-BASED COMPENSATION:

The Amended and Restated 2000 Graham Corporation Incentive Plan to Increase Shareholder Value provides for the issuance of up to 1,375 shares of common stock in connection with grants of incentive stock options, non-qualified stock options, stock awards and performance awards to officers, key employees and outside directors; provided, however, that no more than 250 shares of common stock may be used for awards other than stock options. Stock options may be granted at prices not less than the fair market value at the date of grant and expire no later than ten years after the date of grant.

There were no stock option awards granted in the three months ended December 31, 2012 and 2011, respectively. Stock option awards granted in the nine months ended December 31, 2012 and 2011 were 49 and 9, respectively. The stock option awards vest 33 1/3% per year over a three-year term. All stock options have a term of ten years from their grant date.

Restricted stock awards granted in the three-month periods ended December 31, 2012 and 2011 were 0 and 4, respectively. Restricted stock awards granted in the nine-month periods ended December 31, 2012 and 2011 were 26 and 32, respectively. Performance-vested restricted stock awards granted to officers in fiscal 2013 and fiscal 2012 vest 100% on the third anniversary of the grant date, subject to the satisfaction of the performance metrics established for the applicable three-year period. Time-vested restricted stock awards granted to officers in fiscal 2012 vest 50% on the second anniversary of the grant date and 50% on the fourth anniversary of the grant date. Time-vested restricted stock awards granted to directors in fiscal 2013 and fiscal 2012 vest 100% on the first anniversary of the grant date.

During the three months ended December 31, 2012 and 2011, the Company recognized stock-based compensation costs related to stock option and restricted stock awards of $131 and $131, respectively. The income tax benefit recognized related to stock-based compensation was $46 and $47 for the three months ended December 31, 2012 and 2011, respectively. During the nine months ended December 31, 2012 and 2011, the Company recognized stock-based compensation costs related to stock option and restricted stock awards of $423 and $421, respectively. The income tax benefit recognized related to stock-based compensation was $149 and $150 for the nine months ended December 31, 2012 and 2011, respectively.

The Company has an Employee Stock Purchase Plan (the “ESPP”), which allows eligible employees to purchase shares of the Company’s common stock on the last day of a six-month offering period at a purchase price equal to the lesser of 85% of the fair market value of the common stock on either the first day or the last day of the offering period. A total of 200 shares of common stock may be purchased under the ESPP. During the three months ended December 31, 2012 and 2011, the Company recognized stock-based compensation costs of $13 and $14, respectively, related to the ESPP and $5 and $5, respectively, of related tax benefits. During the nine months ended December 31, 2012 and 2011, the Company recognized stock-based compensation costs of $40 and $44, respectively, related to the ESPP and $13 and $15, respectively, of related tax benefits.

11

NOTE 8 – INCOME PER SHARE:

Basic income per share is computed by dividing net income by the weighted average number of common shares outstanding for the period. Common shares outstanding include share equivalent units, which are contingently issuable shares. Diluted income per share is calculated by dividing net income by the weighted average number of common shares outstanding and, when applicable, potential common shares outstanding during the period. A reconciliation of the numerators and denominators of basic and diluted income per share is presented below:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Basic income per share |

||||||||||||||||

| Numerator: |

||||||||||||||||

| Net income |

$ | 3,047 | $ | 1,640 | $ | 7,052 | $ | 10,124 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted common shares outstanding |

9,991 | 9,913 | 9,980 | 9,902 | ||||||||||||

| Share equivalent units (“SEUs”) |

43 | 42 | 43 | 52 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares and SEUs |

10,034 | 9,955 | 10,023 | 9,954 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic income per share |

$ | .30 | $ | .16 | $ | .70 | $ | 1.02 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted income per share |

||||||||||||||||

| Numerator: |

||||||||||||||||

| Net income |

$ | 3,047 | $ | 1,640 | $ | 7,052 | $ | 10,124 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted average shares and SEUs outstanding |

10,034 | 9,955 | 10,023 | 9,954 | ||||||||||||

| Stock options outstanding |

23 | 35 | 23 | 36 | ||||||||||||

| Contingently issuable SEUs |

— | 1 | — | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common and potential common shares outstanding |

10,057 | 9,991 | 10,046 | 9,991 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted income per share |

$ | .30 | $ | .16 | $ | .70 | $ | 1.01 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Options to purchase a total of 71 and 24 shares of common stock were outstanding at December 2012 and 2011, respectively, but were not included in the above computation of diluted income per share given their exercise prices as they would be anti-dilutive upon issuance.

12

NOTE 9 – PRODUCT WARRANTY LIABILITY:

The reconciliation of the changes in the product warranty liability is as follows:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Balance at beginning of period |

$ | 174 | $ | 239 | $ | 215 | $ | 202 | ||||||||

| (Income) expense for product warranties |

65 | (5 | ) | 73 | 67 | |||||||||||

| Product warranty claims paid |

(79 | ) | (7 | ) | (128 | ) | (42 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at end of period |

$ | 160 | $ | 227 | $ | 160 | $ | 227 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The income of $5 for product warranties in the three months ended December 31, 2011, resulted from the reversal of provisions made that were no longer required due to lower claims experience.

The product warranty liability is included in the line item “Accrued expenses and other liabilities” in the Condensed Consolidated Balance Sheets.

NOTE 10 – CASH FLOW STATEMENT:

Interest paid was $55 and $9 for the nine-month periods ended December 31, 2012 and 2011, respectively. In addition, income taxes paid for the nine months ended December 31, 2012 and 2011 were $949 and $7,000, respectively.

During the nine months ended December 31, 2012 and 2011, respectively, stock option awards were exercised and restricted stock awards vested. In connection with such stock option exercises and restricted stock award vesting, the related income tax benefit realized exceeded (reduced) the tax benefit that had been recorded pertaining to the compensation cost recognized by $(2) and $197, respectively, for such periods. This excess tax benefit (deficiency) has been separately reported under “Financing activities” in the Condensed Consolidated Statements of Cash Flows.

At December 31, 2012 and 2011, respectively, there were $68 and $16 of capital purchases that were recorded in accounts payable and are not included in the caption “Purchase of property, plant and equipment” in the Condensed Consolidated Statements of Cash Flows. In the nine months ended December 31, 2012 and 2011, capital expenditures totaling $11 and $205, respectively, were financed through the issuance of capital leases.

13

NOTE 11 – EMPLOYEE BENEFIT PLANS:

The components of pension income are as follows:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Service cost |

$ | 136 | $ | 115 | $ | 408 | $ | 345 | ||||||||

| Interest cost |

357 | 355 | 1,070 | 1,065 | ||||||||||||

| Expected returns on assets |

(684 | ) | (678 | ) | (2,053 | ) | (2,034 | ) | ||||||||

| Amortization of: |

||||||||||||||||

| Unrecognized prior service cost |

1 | 1 | 3 | 3 | ||||||||||||

| Actuarial loss |

252 | 129 | 758 | 387 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net pension expense (income) |

$ | 62 | $ | (78 | ) | $ | 186 | $ | (234 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Company made no contributions to its defined benefit pension plan during the nine months ended December 31, 2012 and does not expect to make any contributions to the plan for the balance of fiscal 2013.

The components of the postretirement benefit income are as follows:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Service cost |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Interest cost |

9 | 11 | 28 | 33 | ||||||||||||

| Amortization of prior service cost |

(41 | ) | (41 | ) | (124 | ) | (124 | ) | ||||||||

| Amortization of actuarial loss |

10 | 9 | 29 | 27 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net postretirement benefit income |

$ | (22 | ) | $ | (21 | ) | $ | (67 | ) | $ | (64 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

The Company paid benefits of $2 related to its postretirement benefit plan during the nine months ended December 31, 2012. The Company expects to pay benefits of approximately $102 for the balance of fiscal 2013.

NOTE 12 – COMMITMENTS AND CONTINGENCIES:

The Company has been named as a defendant in certain lawsuits alleging personal injury from exposure to asbestos contained in products made by the Company. The Company is a co-defendant with numerous other defendants in these lawsuits and intends to vigorously defend itself against these claims. The claims are similar to previous asbestos suits that named the Company as defendant, which either were dismissed when it was shown that the Company had not supplied products to the plaintiffs’ places of work or were settled for immaterial amounts.

14

As of December 31, 2012, the Company was subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

Although the outcome of the lawsuits to which the Company is a party cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made, management does not believe that the outcomes, either individually or in the aggregate, will have a material effect on the Company’s results of operations, financial position or cash flows.

NOTE 13 – INCOME TAXES:

The Company files federal and state income tax returns in several domestic and international jurisdictions. In most tax jurisdictions, returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. During fiscal 2012, the Company reached a resolution with the U.S. Internal Revenue Service (the “IRS”) with regard to research and development tax credits claimed during tax years 2006 through 2008. As a result of such resolution, the tax credits claimed during such years were reduced by approximately 40% and interest was assessed on the underpayment of tax. In the first quarter of fiscal 2013, the Company also reached a resolution with the IRS that reduced the research and development tax credits claimed by the Company during tax years 2009 and 2010 by approximately 30%.

The cumulative tax benefit related to the research and development tax credit for the tax years ended March 31, 1999 through March 31, 2010 was $2,244. The liability for unrecognized tax benefits related to the tax position for this period was $824 at March 31, 2012. During the nine months ended December 31, 2012, the Company paid the settlement amount to the IRS thereby reducing this liability for unrecognized tax benefits to $0. The liability for unrecognized tax benefits related to the research and development tax credit for the tax years ended March 31, 2011 and 2012 was $84 and $81 at December 31, 2012 and March 31, 2012, respectively. The Company had one additional unrecognized tax benefit of $882 as of March 31, 2012 which was resolved with the IRS during the six months ended September 30, 2012, resulting in a reversal of the liability.

The Company is subject to examination in federal and state tax jurisdictions for tax years 2011 through 2012 and tax years 2008 through 2012, respectively. The Company is subject to examination in its international tax jurisdiction for tax years 2010 through 2012. It is the Company’s policy to recognize any interest related to uncertain tax positions in interest expense and any penalties related to uncertain tax positions in selling, general and administrative expense. During the three months ended December 31, 2012, the Company recorded $2 for interest related to its uncertain tax positions. During the three months ended September 30, 2012, the Company reversed provisions that had been made in previous periods for interest related to its uncertain tax positions due to lower interest assessments by the IRS than expected. Including this reversal, the Company recorded $(323) for interest related to its uncertain tax positions during the nine months ended December 31, 2012. During the three and nine months ended December 31, 2011, the Company recorded $21 and $62, respectively, for interest related to its uncertain tax positions. No penalties related to uncertain tax positions were recorded in the three or nine-month periods ended December 31, 2012 or 2011.

15

NOTE 14 – ACCOUNTING AND REPORTING CHANGES:

In the normal course of business, management evaluates all new accounting pronouncements issued by the Financial Accounting Standards Board (“FASB”), the SEC, the Emerging Issues Task Force, the American Institute of Certified Public Accountants or any other authoritative accounting body to determine the potential impact they may have on the Company’s consolidated financial statements.

In September 2011, the FASB amended its guidance related to the periodic testing of goodwill for impairment. This guidance allows companies to first assess qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the entity determines that this threshold is not met, then performing the two-step impairment test may not be necessary. The provisions of the amended guidance were effective for the Company in the first quarter of fiscal 2013. This guidance did not have a material impact on the Company’s condensed consolidated financial statements.

Management does not expect any other recently issued accounting pronouncements, which have not already been adopted, to have a material impact on the Company’s consolidated financial statements.

16

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

(Dollar amounts in thousands, except per share data)

Overview

We are a global business that designs, manufactures and sells custom-engineered ejectors, vacuum systems, condensers, liquid ring pump packages and heat exchangers to the refining and petrochemical industries, and a nuclear code accredited supplier of components and raw materials to the nuclear power generating market. Our equipment is used in critical applications in the petrochemical, oil refining and electric power generation industries, including nuclear, cogeneration and geothermal plants. Our equipment can also be found in ethanol, biodiesel, coal-to-liquids and gas-to-liquids industries, as well as in other diverse applications, such as metal refining, pulp and paper processing, shipbuilding (e.g., the nuclear propulsion program of the U.S. Navy), water heating, refrigeration, desalination, soap manufacturing, food processing, pharmaceuticals, and heating, ventilating and air conditioning.

Our corporate offices are located in Batavia, New York and we have production facilities in both Batavia, New York and at our wholly-owned subsidiary, Energy Steel & Supply Co., located in Lapeer, Michigan. We also have a wholly-owned foreign subsidiary, Graham Vacuum and Heat Transfer Technology (Suzhou) Co., Ltd., located in Suzhou, China, which supports sales orders from China and other parts of Asia and provides engineering support and supervision of subcontracted fabrication.

Highlights

Highlights for the three and nine months ended December 31, 2012 (the fiscal year ending March 31, 2013 is referred to as “fiscal 2013”) include:

| • | Net sales for the third quarter of fiscal 2013 were $25,633, an increase of 5% compared with $24,329 for the third quarter of the fiscal year ended March 31, 2012, referred to as “fiscal 2012.” |

| • | Net sales for the first nine months of fiscal 2013 were $74,068, down 11% compared with net sales of $82,936 for the first nine months of fiscal 2012. |

| • | Net income and income per diluted share for the third quarter of fiscal 2013 were $3,047 and $0.30, compared with net income of $1,640 and income per diluted share of $0.16 for the third quarter of fiscal 2012. |

| • | Net income and income per diluted share for the first nine months of fiscal 2013 were $7,052 and $0.70, respectively, compared with net income of $10,124 and income per diluted share of $1.01 for the first nine months of fiscal 2012. |

| • | The three and nine-month periods ended December 31, 2012 included the reversal of a $975 reserve related to the expected value of the earn out from the Energy Steel acquisition. Excluding this reversal, net income and income per diluted share for the third quarter of fiscal 2013 were $2,072 and $0.21, respectively. Net income and income per diluted share for the first nine months of fiscal 2013 were $6,077 and $0.61, respectively. |

| • | Orders booked in the third quarter of fiscal 2013 were $24,579, up 12% compared with the third quarter of fiscal 2012, when orders were $21,933. |

17

| • | Orders booked in the first nine months of fiscal 2013 were $69,919, up 9% compared with the first nine months of fiscal 2012, when orders were $64,440. |

| • | Backlog decreased slightly to $90,741 on December 31, 2012, compared with $91,784 on September 30, 2012 and $94,934 on March 31, 2012. |

| • | Gross profit margin and operating margin for the third quarter of fiscal 2013 were 28% and 15%, compared with 27% and 11%, respectively, for the third quarter of fiscal 2012. |

| • | Gross profit margin and operating margin for the first nine months of fiscal 2013 were 29% and 13%, compared with 33% and 19%, respectively, for the first nine months of fiscal 2012. |

| • | Cash and short-term investments at December 31, 2012 were $55,107, up 32% compared with $41,688 at March 31, 2012. |

Forward-Looking Statements

This report and other documents we file with the Securities and Exchange Commission include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results implied by the forward-looking statements. Such factors include, but are not limited to, the risks and uncertainties identified by us under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for fiscal 2012.

Forward-looking statements may also include, but are not limited to, statements about:

| • | the current and future economic environments affecting us and the markets we serve; |

| • | expectations regarding investments in new projects by our customers; |

| • | sources of revenue and anticipated revenue, including the contribution from the growth of new products, services and markets; |

| • | plans for future products and services and for enhancements to existing products and services; |

| • | our operations in foreign countries; |

| • | our ability to continue to pursue our acquisition and growth strategy; |

| • | our ability to expand nuclear power work, including into new markets; |

| • | our ability to successfully execute our existing contracts; |

| • | estimates regarding our liquidity and capital requirements; |

| • | timing of conversion of backlog to sales; |

| • | our ability to attract or retain customers; |

| • | the outcome of any existing or future litigation; and |

| • | our ability to increase our productivity and capacity. |

18

Forward-looking statements are usually accompanied by words such as “anticipate,” “believe,” “estimate,” “may,” “might,” “intend,” “appear,” “expect,” “plan” and similar expressions. Actual results could differ materially from historical results or those implied by the forward-looking statements contained in this report.

Undue reliance should not be placed on our forward-looking statements. Except as required by law, we undertake no obligation to update or announce any revisions to forward-looking statements contained in this report, whether as a result of new information, future events or otherwise.

Fiscal 2013 and the Near-Term Market Conditions

We believe current market conditions are more positive than they have been in the past few years. The business environment in our markets appears to continue to be improving and we believe that our customers now may be more inclined to move forward with their projects. This supports our belief that our oil refining, petrochemical and related markets remain in the early stages of a business recovery. We believe the quantity, magnitude and quality of our bidding activity supports this view of improved market conditions. We also believe that delayed purchase decisions by our customers are more due to their timing than conditions of our markets.

Near-term demand trends that we believe are affecting our customers’ investments include:

| • | As the world recovers from the global recession, many emerging economies continue to have relatively strong economic growth. This expansion is driving growing energy requirements and the need for more refined petroleum products. Although uncertainty in the capital and sovereign debt markets continues, we believe that improved access to capital has resulted in projects being released. |

| • | The expansion of the economies of oil producing Middle Eastern countries, their desire to extract greater value from their oil and gas resources, and the continued global growth in demand for oil and refined products has renewed investment activity in that region. We do not believe that the ongoing political unrest in the Middle East has impacted our business. Moreover, the planned timeline of refinery projects in the major Middle Eastern countries is encouraging. |

| • | Asian countries, specifically China and India, are experiencing increased demand for refined petroleum products such as gasoline. This renewed demand is driving increased investment in petrochemical and refining projects. Although economic growth in Asia appears to be moderating to a lower level, we believe that it remains a fast growing area and Chinese and Indian investments in refining, petrochemical and energy facilities appear to continue to be strong. |

| • | South America, specifically Brazil, Venezuela and Colombia, is seeing increased refining and petrochemical investments that are driven by their expanding economies and increased local demand for gasoline and other products that are made from oil as the feedstock. |

| • | We expect that the U.S. refining markets will not return to the levels experienced during the last up cycle, but that such markets will improve compared with the past few years. We also expect that the U.S. refining markets will continue to be an important aspect of our business. |

| • | We are beginning to see renewed signs of planned investments in the U.S. to convert greater percentages of crude oil to transportation fuels, such as revamping distillation columns to extract residual higher-value components from the low-value waste stream. We are also seeing renewed investment to expand the flexibility of facilities to allow them to utilize multiple feedstocks. |

19

| • | Investments, including foreign investments, in North American oil sands projects have recently increased, especially for extraction projects in Alberta. Such investments suggest that downstream spending involving our equipment might increase in the next one to three years. |

| • | The recent dramatic reduction in natural gas costs in the U.S. has led to a revival in the U.S. petrochemical market and has created interest in potential major investment. There are numerous projects in the planning or initial engineering phases for the construction of new petrochemical producing facilities, including ethylene, ammonia and urea. We historically have had strong market share within these facilities. Proposed ethylene capacity expansion and re-opening of mothballed facilities, in the U.S., as well as downstream products, are also being discussed by petrochemical producers for the first time in well over a decade. Lower natural gas costs are driven by recent technology advancements in drilling, and have created a significant increase in supply. This has made the U.S. production of raw material for ethylene, ethane (which is a side product of natural gas production) globally competitive with naphtha (the alternative feedstock for ethylene used in most of the world). We believe that future investment in the U.S. petrochemical market could be significant. |

| • | Investments in existing U.S. nuclear plants to extend their operating life and add incremental capacity are expected to continue. |

| • | Investment in new U.S. nuclear reactor projects planned for the Summer (South Carolina) and Vogtle (Georgia) facilities suggest continued growth in the domestic nuclear market, although such growth may be slowed by the potential impact of increased use of natural gas for power generation. |

| • | Investment in new nuclear power capacity internationally may become subject to increased uncertainty due to political and social pressures, which were augmented by the tragic earthquake and tsunami that occurred in Japan in March 2011. However, we believe that the need for additional safety and back up redundancies at the 104 existing domestic nuclear plants in the U.S. could increase demand for Energy Steel’s products in the near-term. |

We expect that the consequences of these near-term trends, and specifically projected expansion in petrochemical and oil refining outside of North America, primarily in the growing Asian and South American markets, will result in continued pressure on our pricing and gross margins, as these markets historically provided lower margins than North American refining markets. A potential offset to margin pressure from international markets may come from investments in new petrochemical capacity built in North America and the timing of such investments.

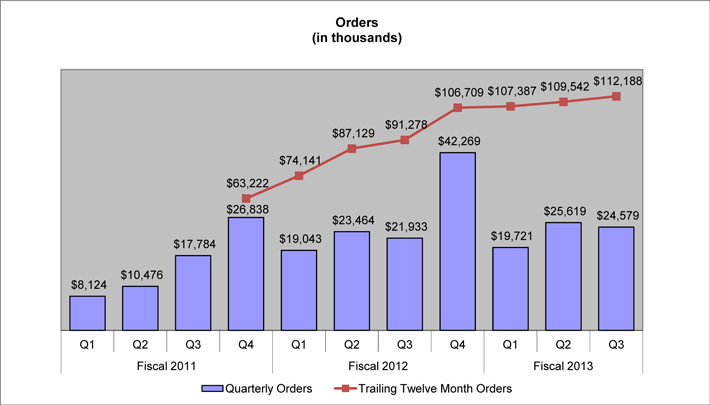

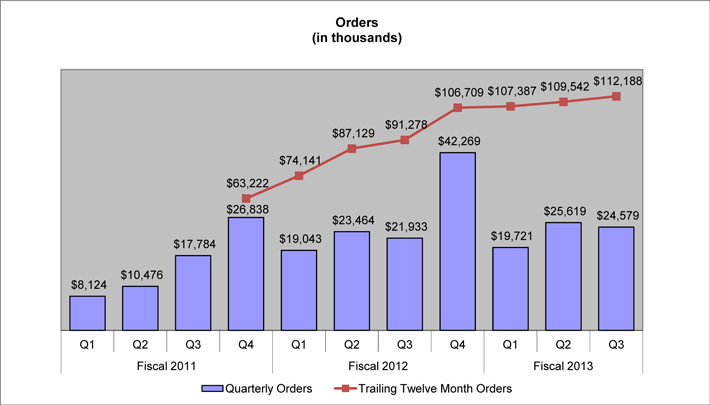

Because of continued global economic and financial uncertainty and the risk associated with growth in emerging economies, we continue to expect our new order levels to remain volatile. We expect that this volatility will result in both relatively strong and weak quarters over the next several quarters. Quarterly orders can vary significantly as indicated in the following chart which depicts our quarterly order levels for the first, second and third quarters of fiscal 2013 as well as the four quarters of each of fiscal 2012 and the fiscal year ending March 31, 2011, which we refer to as “fiscal 2011”.

20

We believe that looking at our order level in any one quarter does not provide an accurate indication of our future expectations or performance. Rather, we believe that looking at our orders and backlog over a one-to two-year period provides a better measure of our business. We believe looking at trailing twelve month order levels provides a better view of the direction of our business. In the near-term, we expect to continue to see smaller value projects than what we had seen during the last expansion cycle. This will require more orders for us to achieve a similar revenue level and will adversely impact our ability to realize margin gains through volume leverage.

Expect Stronger International Growth in Refining and Chemical Processing while Domestic Growth is Expected to be in Nuclear Power, U.S. Navy Projects and Petrochemical Industries

We expect growth in the refining and chemical processing markets to be driven by emerging markets, as well by U.S. petrochemical growth, should it occur. We have also expanded our addressable markets through the acquisition of Energy Steel and our focus on U.S. Navy nuclear propulsion projects. We believe our revenue opportunities during the near term will be equivalent between the domestic and international markets.

Over the long-term, we expect our customers’ markets to regain their strength and, while remaining cyclical, continue to grow. We believe the long-term trends remain strong and that the drivers of future growth include:

Long-term Demand Trends

| • | Global consumption of crude oil is estimated to expand significantly over the next two decades, primarily in emerging markets. This is expected to offset estimated flat to slightly declining demand in North America and Europe. In addition, an increased trend toward export of finished product from the Middle East to North America and Europe is expected. |

21

| • | Global oil refining capacity is projected to increase, and is expected to be addressed through new facilities, refinery upgrades, revamps and expansions. |

| • | Increased demand is expected for power, refinery and petrochemical products, stimulated by an expanding middle class in Asia, South America and the Middle East. |

| • | Increased development of geothermal electrical power plants in certain regions is expected to address projected growth in demand for electrical power. |

| • | Increased global regulations over the refining, petrochemical and nuclear power industries are expected to continue to drive requirements for capital investments. |

| • | More refineries are expected to convert their facilities to use heavier, more readily available and lower cost crude oil as a feedstock. |

| • | Shale gas development and the resulting increase in available low cost natural gas in the U.S. may change the power landscape. This may drive more future investment in natural gas or combined cycle power plants and away from planned nuclear power facilities. |

| • | The lower cost of natural gas and its by-product, ethane, is leading to renewed planning and investment in North American based chemical/petrochemical facilities to meet domestic needs. Ethane, as a feedstock to ethylene production, is now at a cost advantage to naphtha, the oil-based feedstock for ethylene production used in much of the rest of the world. Because of this cost competitive position of ethane, the opportunity to invest in North American chemical/petrochemical plants is possible for the first time in well over a decade. |

| • | Construction of new petrochemical plants in the Middle East is planned to meet increased global demand. |

| • | Increased focus on safety and redundancy is anticipated in existing nuclear power facilities. |

| • | Long-term increased project development of international nuclear facilities (including in the U.S.) is expected, despite the recent tragedy in Japan. |

| • | Increased investments in new power generation projects are expected in Asia and South America to meet projected consumer demand increases. |

| • | Long-term growth potential is believed to exist in alternative energy markets, such as geothermal, coal-to-liquids, gas-to-liquids and other emerging technologies, such as biodiesel and waste-to-energy. |

We believe that the above factors offer us long-term growth opportunities to meet our customers’ expected capital project needs. In addition, we believe we can continue to grow our less cyclical smaller product lines and aftermarket businesses.

Our domestic sales, as a percentage of aggregate product sales, in the first nine months of fiscal 2013 were 53%. This is similar to fiscal 2012, where domestic sales had increased to 54% of total sales, up from 45% in each of fiscal 2010 and 2011. The increase in

22

domestic sales has been due to our acquisition of Energy Steel in late fiscal 2011, which primarily has a domestic customer base, and the conversion of the U.S. Navy order. The U.S. Navy activity represents our production of surface condensers for the CVN-79 Gerald R. Ford Class nuclear carrier, an order that was won in the third quarter of our fiscal year ended March 31, 2010.

Results of Operations

For an understanding of the significant factors that influenced our performance, the following discussion should be read in conjunction with our condensed consolidated financial statements and the notes to our condensed consolidated financial statements included in Part I, Item 1, of this Quarterly Report on Form 10-Q.

The following table summarizes our results of operations for the periods indicated:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Net sales |

$ | 25,633 | $ | 24,329 | $ | 74,068 | $ | 82,936 | ||||||||

| Net income |

$ | 3,047 | $ | 1,640 | $ | 7,052 | $ | 10,124 | ||||||||

| Diluted income per share |

$ | 0.30 | $ | 0.16 | $ | 0.70 | $ | 1.01 | ||||||||

| Total assets |

$ | 123,338 | $ | 119,850 | $ | 123,338 | $ | 119,850 | ||||||||

The Third Quarter and First Nine Months of Fiscal 2013 Compared With the Third Quarter and First Nine Months of Fiscal 2012

Sales for the third quarter of fiscal 2013 were $25,633, a 5% increase as compared with sales of $24,329 for the third quarter of fiscal 2012. The increase in the current quarter’s sales was driven by improved pricing and added volume from increased subcontracting. International sales were up $3,830 compared with the third quarter of fiscal 2012, primarily driven by increased sales to the Middle East. Domestic sales decreased $2,526 in the third quarter of fiscal 2013 compared with the same quarter in fiscal 2012. Sales in the three months ended December 31, 2012 were 43% to the refining industry, 25% to the chemical and petrochemical industries, 16% to the power industry, including the nuclear market and 16% to other commercial and industrial applications. Sales in the three months ended December 31, 2011 were 31% to the refining industry, 19% to the chemical and petrochemical industries, 27% to the power industry, including the nuclear market and 23% to other commercial and industrial applications. Fluctuations in sales among markets, products and geographic locations can vary measurably from quarter-to-quarter based on, among other things, timing and magnitude of projects. See “Fiscal 2013 and Near Term Market Conditions” above. For additional information on anticipated future sales and our markets, see “Orders and Backlog” below.

Sales for the first nine months of fiscal 2013 were $74,068, a decrease of 11% compared with sales of $82,936 for the first nine months of fiscal 2012. The decrease in year-to-date sales was primarily due to lower international sales, pricing and volume. International sales accounted for 47% and 48% of total sales for the first nine months of fiscal 2013 and fiscal 2012, respectively. International sales year-over-year decreased $5,185, or 13%. In the first nine months of fiscal 2013, sales to the Middle East declined $3,115. The remaining sales decrease came from Asia and South America. Domestic sales decreased $3,683 or 9%, in the nine months ended December 31, 2012 compared with the nine months ended December 31, 2011. Sales in the

23

first nine months of fiscal 2013 were 30% to the refining industry, 28% to the chemical and petrochemical industries, 21% to the power industry, including the nuclear market, and 21% to other commercial and industrial applications. Sales in the first nine months of fiscal 2012 were 38% to the refining industry, 14% to the chemical and petrochemical industries, 27% to the power industry, including the nuclear market, and 21% to other commercial and industrial applications.

Our gross profit margin for the third quarter of fiscal 2013 was 28% compared with 27% for the third quarter of fiscal 2012. Gross profit for the third quarter of fiscal 2013 increased to $7,128 from $6,462, or 10%, compared with the same period in fiscal 2012. Gross profit margin and dollars in the third quarter increased primarily due to improved pricing on projects won a year into the recovery of our markets.

Our gross profit margin for the first nine months of fiscal 2013 was 29% compared with 33% for the first nine months of fiscal 2012. Gross profit dollars for the first nine months of fiscal 2013 decreased 23% to $21,277, compared with the same period in fiscal 2012, which had gross profit of $27,459. The decrease in gross profit margin and dollars had occurred in the first two quarters of fiscal 2013 compared with the same period of fiscal 2012. Gross profit percentage and dollars decreased in the nine-month period primarily due to lower volume and capacity utilization as well as the conversion of projects during the first two quarters of fiscal 2013, which had less favorable pricing compared with the projects converted in the first two quarters of fiscal 2012. Certain projects which converted in the first half of the prior fiscal year were won during the prior market peak, when pricing was strong. This trend reversed itself for the third quarter of fiscal 2013 compared with the same period in the prior year, but the increase in gross profit margin and dollars in the current quarter was not sufficient to offset the decrease experienced in the first half of the year.

Selling, general and administrative (“SG&A”) expense in the three month period ended December 31, 2012 decreased $632, or 17% compared with the same period of the prior year. This decrease was due primarily to the reversal of a $975 reserve related to the expected value of the earn out from the Energy Steel acquisition.

The Energy Steel acquisition provided for a potential earn out to the seller of up to $1,000 per year for each of the first two full calendar years (calendar years 2011 and 2012) that we owned Energy Steel. The first year, calendar year 2011, the earn out was achieved and paid to the seller in January 2012. The earn out for the second year, calendar year 2012, had been partly reserved for at the time of acquisition with the remaining charges added subsequent to the acquisition. However, due to lower order volume levels experienced in calendar year 2012 and project timing, the Energy Steel earn out criteria was not achieved. As a result, the reserve of $975 was adjusted to $0, and $975 was recorded as a reduction of selling, general and administrative expenses in the third quarter.

Selling, general and administrative (“SG&A”) expense in the nine month period ended December 31, 2012 decreased $209, or 2%, compared with the same periods of the prior year. Excluding the impact of the reversal of the earn out reserve described above, SG&A increased 9% in the three month period and 6% in the nine month period ended December 31, 2012, compared to the same periods in the prior year.

The increase for both the three and nine-month periods was due to increased headcount, as we prepare for the anticipated continued recovery in our markets, offset by certain costs related to lower sales volume.

24

SG&A expense as a percent of sales for the three and nine-month periods ended December 31, 2012 was 12% and 16%, respectively. Excluding the impact of the earn out reserve reversal noted above, SG&A expense as a percentage of sales was 16% and 17%, respectively. This compared with 16% and 14%, respectively for the same periods of the prior year. SG&A expense as a percent of sales increased, primarily due to increased commissions, headcount costs and lower comparable sales.

Interest income was $13 and $38 for the three and nine-month periods ended December 31, 2012, compared with $12 and $48 for the same periods ended December 31, 2011. The low level of interest income relative to the amount of cash invested reflects the persistent low level of interest rates on money market funds and short term U.S. government securities in which we invest net cash available from operations.

Interest expense was $19 and $(271) for the three and nine-month periods ended December 31, 2012, compared with $55 and $260 for the same periods ended December 31, 2011. It is our policy to recognize any interest related to uncertain tax positions in interest expense. In the second quarter of fiscal 2013, due to lower than expected assessments by the IRS, we reversed provisions that had been made in earlier periods for interest related to previously uncertain tax positions. See Note 13 of the notes to our unaudited condensed consolidated financial statements included in Part I, Item I, of this Quarterly Report on Form 10-Q.

We project our effective tax rate in fiscal 2013 will be between 29% and 30%. The tax rate used to reflect income tax expense in the current quarter was 23%, and the tax rate for the first nine months of fiscal 2013 was 29%. The lower tax rate realized in the third quarter was related to the reversal of the Energy Steel earn out reserve discussed above, which was not tax affected, since it was a purchase price adjustment. Excluding this reversal, the effective tax rate in each of the three and nine-month periods ended December 31, 2012 would have been 32%. The actual annual effective tax rate for fiscal 2012 was 37%, which included a charge of $374 related to the resolution of an IRS audit related to research and development tax credits taken in tax years 2006 through 2008. Excluding this charge, the effective tax rate in fiscal 2012 was 34%.

Net income for the three and nine months ended December 31, 2012 was $3,047 and $7,052, respectively, compared with $1,640 and $10,124, respectively, for the same periods in the prior fiscal year. Excluding the reversal of the earn out reserve, net income for the three and nine months ended December 31, 2012 was $2,072 and $6,077, respectively. Income per diluted share in fiscal 2013 was $0.30 and $0.70 for the three and nine-month periods, compared with $0.16 and $1.01 for the same three and nine-month periods of fiscal 2012. Excluding the reversal of the earn out reserve, income per diluted share was $0.21 and $0.61 for the three and nine-month periods of fiscal 2013.

25

Liquidity and Capital Resources

The following discussion should be read in conjunction with our unaudited condensed consolidated statements of cash flows included in Part I, Item 1 of this Quarterly Report on Form 10-Q:

| December 31, 2012 |

March 31, 2012 |

|||||||

| Cash and investments |

$ | 55,107 | $ | 41,688 | ||||

| Working capital |

60,189 | 52,730 | ||||||

| Working capital ratio(1) |

3.4 | 3.2 | ||||||

| (1) | Working capital ratio equals current assets divided by current liabilities. |

Net cash generated by operating activities for the first nine months of fiscal 2013 was $14,948, compared with $3,914 generated by operating activities for the first nine months of fiscal 2012. The increase in cash generated was due to improvements in unbilled revenue, customer deposits, accounts payable, accounts receivable and income taxes payable, partly offset by higher inventory and lower net income.

Dividend payments and capital expenditures in the first nine months of fiscal 2013 were $599 and $971, respectively, compared with $594 and $2,621, respectively, for the first nine months of fiscal 2012.

Capital expenditures for fiscal 2013 are expected to be between $1,500 and $2,000. Approximately 70% of our fiscal 2013 capital expenditures are expected to be for machinery and equipment, with the remaining amounts to be used for information technology and other items.

Cash and investments were $55,107 on December 31, 2012 compared with $41,688 on March 31, 2012, up $13,419, or 32%.

We invest net cash generated from operations in excess of cash held for near-term needs in either a money market account or in U.S. government instruments, generally with maturity periods of up to 180 days. Our money market account is used to securitize our outstanding letters of credit and allows us to pay a lower cost on those letters of credit.

Our revolving credit facility with Bank of America, N.A. provides us with a line of credit of $25,000, including letters of credit and bank guarantees. In addition, our credit facility allows us to increase the line of credit, at our discretion, up to another $25,000, for total availability of $50,000. Borrowings under our credit facility are secured by all of our assets. Letters of credit outstanding under our credit facility on December 31, 2012 and March 31, 2012 were $11,274 and $9,920, respectively. There were no other amounts outstanding on our credit facility at December 31, 2012 and March 31, 2012. Our borrowing rate as of December 31, 2012 and March 31, 2012 was Bank of America’s prime rate, or 3.25%. Availability under the line of credit was $13,726 at December 31, 2012. We believe that cash generated from operations, combined with our investments and available financing capacity under our credit facility, will be adequate to meet our cash needs for the immediate future.

26

Orders and Backlog

Orders for the three-month period ended December 31, 2012 were $24,579, compared with $21,933 for the same period last year, an increase of 12%. For the three months ended December 31, 2012, orders increased in Canada by $5,864, largely in connection with oil sands opportunities, offsetting an order level decrease of $5,349 in the U.S. Orders represent communications received from customers requesting us to supply products and services.

During the first nine months of fiscal 2013, orders were $69,919, compared with $64,440 for the same period of fiscal 2012, an increase of 9%. For the first nine months of fiscal 2013, orders increased in Canada, up $8,128, and in Asia, up $4,957, which was partly offset by lower domestic orders, down $5,247, and the Middle East, down $2,758.

Domestic orders were 50%, or $12,249, while international orders were 50%, or $12,330, of total orders in the current quarter. During the same period in the prior fiscal year, domestic orders were 80%, or $17,598, and international orders were 20% of total orders, or $4,335.

For the first nine months of fiscal 2013, domestic orders were 53% of total orders or $37,285, while international orders were 47%, or $32,634. During the first nine months of fiscal 2012, domestic orders were 66% of total orders, or $42,532, and international orders were 34%, or $21,908.

Backlog was $90,741 at December 31, 2012, compared with $94,934 at March 31, 2012, a decrease of 4%. Backlog is defined as the total dollar value of orders received for which revenue has not yet been recognized. All orders in backlog represent orders from our traditional markets in established product lines. Approximately 75% to 85% of orders currently in backlog are expected to be converted to sales within the next twelve months. This is lower than our historical conversion rate, which is approximately 85% to 90% over an upcoming 12-month period. The difference in our current backlog is due to the inclusion of the carrier project for the U.S. Navy and two orders for new U.S. nuclear plants. These projects have multi-year conversion cycles and significant stops and starts during their manufacturing processes.

At December 31, 2012, 37% of our backlog was attributable to equipment for refinery project work, 10% for chemical and petrochemical projects, 27% for power projects, including nuclear, and 26% for other industrial or commercial applications (including the U.S. Navy order). At December 31, 2011, 14% of our backlog was attributable to equipment for refinery project work, 22% for chemical and petrochemical projects, 24% for power projects, including nuclear, and 40% for other industrial or commercial applications (including the U.S. Navy order).

At December 31, 2012, no projects were on hold. The one project that was on hold at the end of the second quarter of fiscal 2013, with a value of $1,010 was released by our customer during the third quarter and is expected to be in production during our fiscal year ending March 31, 2014, which we refer to as “fiscal 2014”.

Outlook

We believe that we remain in the early stages of a recovery in the refinery and petrochemical markets. We also believe the strength of the energy markets, including the nuclear market, will continue to improve. During the first three quarters of fiscal 2013, we achieved orders of $19,721, $25,619 and $24,579, sequentially. While the order level for the first nine months of fiscal 2013 was $69,919, or 9% above the same period last year, the fourth quarter of fiscal 2012 had orders of $42,269, a level we do not expect to match in this fiscal year’s fourth quarter. We continue to see significant activity in our pipeline and remain optimistic that we

27

will experience stronger order levels than the first three quarters of fiscal 2013 during the next several quarters. Our backlog was $90,741 as of December 31, 2012, just 4% below our March 31, 2012 level, which represented our record high at $94,934.

We expect revenue in fiscal 2013 to be between $102.5 and $107.5 million, compared with $103.2 million in fiscal 2012. Approximately 16% to 18% of our revenue is expected to come from Energy Steel. In fiscal 2012, Energy Steel contributed 17% of our revenue. In fiscal 2013, revenue was $74,068 in the first nine months of the year, an average of $24,689 per quarter. We expect stronger sales in the fourth quarter of fiscal 2013 compared with the average quarterly revenue achieved during the first nine months of the fiscal year.

We expect gross profit margin in fiscal 2013 to be between 29% and 31%. Gross margin in the first nine months of fiscal 2013 was 29%. During fiscal 2012, we achieved gross margin of 32%, which included a few higher margin projects, especially in the first two quarters of such year. In fiscal 2012, gross margin was 36% and 26% in the first and second halves of the year, respectively.

Gross profit margins are expected to improve with anticipated volume increases. Due to changes in geographic and end use market mix, we do not expect gross margins to reach the 40% range achieved at the peak of the prior cycle. We believe a long term gross profit margin percentage at cycle peak could reach the mid-to-upper 30% range. We also expect this recovery will continue to be more focused on emerging markets, which historically have lower margins and more competitive pricing than developed markets.

SG&A spending for fiscal 2013 is expected to be between 15.5% and 16% of sales. Excluding the impact of the Energy Steel earn out adjustment, SG&A spending for fiscal 2013 is expected to be between 16.5% and 17% of sales. We continue to invest in personnel as we prepare for increased opportunities we expect in fiscal 2014 and beyond. Our effective tax rate during fiscal 2013 is expected to be between 29% and 30%, which includes a benefit to be realized in the fourth quarter of fiscal 2013 as a result of the recent extension of the R&D tax credit.