UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE |

| ACT OF 1934 |

For the quarterly period ended December 31, 2014

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE |

| ACT OF 1934 |

For the transition period from to

Commission File Number 1-8462

GRAHAM CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

16-1194720 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 20 Florence Avenue, Batavia, New York |

14020 | |

| (Address of principal executive offices) |

(Zip Code) | |

585-343-2216

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

x | |||

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ | |||

| (Do not check if a smaller reporting company) |

||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

As of January 30, 2015, there were outstanding 10,127,342 shares of the registrant’s common stock, par value $.10 per share.

Graham Corporation and Subsidiaries

Index to Form 10-Q

As of December 31 and March 31, 2014 and for the Three and Nine-Month Periods

Ended December 31, 2014 and 2013

| Page | ||||

| Part I. | FINANCIAL INFORMATION | |||

| Item 1. | Unaudited Condensed Consolidated Financial Statements | 4 | ||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 | ||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 29 | ||

| Item 4. | Controls and Procedures | 31 | ||

| Part II. | OTHER INFORMATION | |||

| Item 6. | Exhibits | 32 | ||

| Signatures | 33 | |||

| 34 | ||||

2

GRAHAM CORPORATION AND SUBSIDIARIES

FORM 10-Q

December 31, 2014

PART I - FINANCIAL INFORMATION

3

| Item 1. | Unaudited Condensed Consolidated Financial Statements |

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND RETAINED EARNINGS

(Unaudited)

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||

| (Amounts in thousands, except per share data) |

||||||||||||||||

| Net sales |

$ | 33,646 | $ | 23,385 | $ | 97,714 | $ | 76,131 | ||||||||

| Cost of products sold |

23,543 | 17,295 | 68,695 | 51,737 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

10,103 | 6,090 | 29,019 | 24,394 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other expenses and income: |

||||||||||||||||

| Selling, general and administrative |

4,424 | 4,047 | 13,413 | 12,786 | ||||||||||||

| Selling, general and administrative - amortization |

59 | 55 | 171 | 168 | ||||||||||||

| Interest income |

(50 | ) | (10 | ) | (139 | ) | (31 | ) | ||||||||

| Interest expense |

2 | (11 | ) | 8 | (2 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expenses and income |

4,435 | 4,081 | 13,453 | 12,921 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before provision for income taxes |

5,668 | 2,009 | 15,566 | 11,473 | ||||||||||||

| Provision for income taxes |

1,676 | 578 | 4,996 | 3,645 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

3,992 | 1,431 | 10,570 | 7,828 | ||||||||||||

| Retained earnings at beginning of period |

99,237 | 90,426 | 93,469 | 84,632 | ||||||||||||

| Dividends |

(405 | ) | (302 | ) | (1,215 | ) | (905 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Retained earnings at end of period |

$ | 102,824 | $ | 91,555 | $ | 102,824 | $ | 91,555 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per share data: |

||||||||||||||||

| Basic: |

||||||||||||||||

| Net income |

$ | .39 | $ | .14 | $ | 1.04 | $ | .78 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted: |

||||||||||||||||

| Net income |

$ | .39 | $ | .14 | $ | 1.04 | $ | .78 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding: |

||||||||||||||||

| Basic: |

10,127 | 10,070 | 10,119 | 10,063 | ||||||||||||

| Diluted: |

10,149 | 10,107 | 10,142 | 10,099 | ||||||||||||

| Dividends declared per share |

$ | .04 | $ | .03 | $ | .12 | $ | .09 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See Notes to Condensed Consolidated Financial Statements.

4

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||

| (Amounts in thousands) | ||||||||||||||||

| Net income |

$ | 3,992 | $ | 1,431 | $ | 10,570 | $ | 7,828 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income: |

||||||||||||||||

| Foreign currency translation adjustment |

(40 | ) | 28 | 4 | 73 | |||||||||||

| Defined benefit pension and other postretirement plans, net of income tax of $46 and $78 for the three months ended December 31, 2014 and 2013, respectively, and $137 and $234 for the nine months ended December 31, 2014 and 2013, respectively |

84 | 143 | 252 | 429 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive income |

44 | 171 | 256 | 502 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive income |

$ | 4,036 | $ | 1,602 | $ | 10,826 | $ | 8,330 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See Notes to Condensed Consolidated Financial Statements.

5

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| December 31, | March 31, | |||||||

| 2014 |

2014 |

|||||||

| (Amounts in thousands, except per share data) |

||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 29,496 | $ | 32,146 | ||||

| Investments |

33,000 | 29,000 | ||||||

| Trade accounts receivable, net of allowances ($44 and $46 at December 31 and March 31, 2014, respectively) |

15,274 | 10,339 | ||||||

| Unbilled revenue |

13,292 | 7,830 | ||||||

| Inventories |

14,632 | 16,518 | ||||||

| Prepaid expenses and other current assets |

805 | 457 | ||||||

| Income taxes receivable |

- | 498 | ||||||

| Deferred income tax asset |

996 | 668 | ||||||

|

|

|

|

|

|||||

| Total current assets |

107,495 | 97,456 | ||||||

| Property, plant and equipment, net |

19,884 | 16,449 | ||||||

| Prepaid pension asset |

6,603 | 5,759 | ||||||

| Goodwill |

6,938 | 6,938 | ||||||

| Permits |

10,300 | 10,300 | ||||||

| Other intangible assets, net |

4,473 | 4,608 | ||||||

| Other assets |

181 | 124 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 155,874 | $ | 141,634 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Current liabilities: |

||||||||

| Current portion of capital lease obligations |

$ | 55 | $ | 80 | ||||

| Accounts payable |

12,702 | 10,084 | ||||||

| Accrued compensation |

6,604 | 5,701 | ||||||

| Accrued expenses and other current liabilities |

3,296 | 2,233 | ||||||

| Customer deposits |

7,048 | 8,012 | ||||||

| Income taxes payable |

244 | - | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

29,949 | 26,110 | ||||||

| Capital lease obligations |

96 | 136 | ||||||

| Accrued compensation |

- | 158 | ||||||

| Deferred income tax liability |

8,393 | 8,197 | ||||||

| Accrued pension liability |

304 | 272 | ||||||

| Accrued postretirement benefits |

877 | 853 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

39,619 | 35,726 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 11) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $1.00 par value, 500 shares authorized |

- | - | ||||||

| Common stock, $.10 par value, 25,500 shares authorized 10,433 and 10,409 shares issued and 10,127 and 10,098 shares outstanding |

1,043 | 1,041 | ||||||

| Capital in excess of par value |

20,961 | 20,274 | ||||||

| Retained earnings |

102,824 | 93,469 | ||||||

| Accumulated other comprehensive loss |

(5,509 | ) | (5,765 | ) | ||||

| Treasury stock, 306 and 311 shares |

(3,064 | ) | (3,111 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

116,255 | 105,908 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 155,874 | $ | 141,634 | ||||

|

|

|

|

|

|||||

See Notes to Condensed Consolidated Financial Statements.

6

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Nine Months Ended December 31, |

||||||||||

| 2014 |

2013 |

|||||||||

| (Amounts in thousands) | ||||||||||

| Operating activities: |

||||||||||

| Net income |

$ | 10,570 | $ | 7,828 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||

| Depreciation |

1,561 | 1,478 | ||||||||

| Amortization |

171 | 168 | ||||||||

| Amortization of unrecognized prior service cost and actuarial losses |

389 | 663 | ||||||||

| Discount accretion on investments |

- | (6 | ) | |||||||

| Stock-based compensation expense |

481 | 489 | ||||||||

| Loss on disposal of property, plant and equipment |

3 | 207 | ||||||||

| Deferred income taxes |

(281 | ) | 88 | |||||||

| (Increase) decrease in operating assets: |

||||||||||

| Accounts receivable |

(4,938 | ) | (3,019 | ) | ||||||

| Unbilled revenue |

(5,463 | ) | 6,559 | |||||||

| Inventories |

1,887 | 275 | ||||||||

| Prepaid expenses and other current and non-current assets |

(430 | ) | (326 | ) | ||||||

| Prepaid pension asset |

(845 | ) | (595 | ) | ||||||

| Increase (decrease) in operating liabilities: |

||||||||||

| Accounts payable |

2,584 | (1,429 | ) | |||||||

| Accrued compensation, accrued expenses and other current and non-current liabilities |

2,138 | 76 | ||||||||

| Customer deposits |

(964 | ) | 1,305 | |||||||

| Income taxes payable/receivable |

743 | 904 | ||||||||

| Long-term portion of accrued compensation, accrued pension liability and accrued postretirement benefits |

(101 | ) | (94 | ) | ||||||

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

7,505 | 14,571 | ||||||||

|

|

|

|

|

|||||||

| Investing activities: |

||||||||||

| Purchase of property, plant and equipment |

(4,965 | ) | (2,161 | ) | ||||||

| Proceeds from disposal of property, plant and equipment |

1 | 32 | ||||||||

| Purchase of investments |

(41,000 | ) | (80,495 | ) | ||||||

| Redemption of investments at maturity |

37,000 | 77,500 | ||||||||

|

|

|

|

|

|||||||

| Net cash used by investing activities |

(8,964 | ) | (5,124 | ) | ||||||

|

|

|

|

|

|||||||

| Financing activities: |

||||||||||

| Principal repayments on capital lease obligations |

(64 | ) | (65 | ) | ||||||

| Issuance of common stock |

48 | 421 | ||||||||

| Dividends paid |

(1,215 | ) | (905 | ) | ||||||

| Excess tax benefit on stock awards |

37 | 220 | ||||||||

|

|

|

|

|

|||||||

| Net cash used by financing activities |

(1,194 | ) | (329 | ) | ||||||

|

|

|

|

|

|||||||

| Effect of exchange rate changes on cash |

3 | 95 | ||||||||

|

|

|

|

|

|||||||

| Net (decrease) increase in cash and cash equivalents |

(2,650 | ) | 9,213 | |||||||

| Cash and cash equivalents at beginning of period |

32,146 | 24,194 | ||||||||

|

|

|

|

|

|||||||

| Cash and cash equivalents at end of period |

$ | 29,496 | $ | 33,407 | ||||||

|

|

|

|

|

|||||||

See Notes to Condensed Consolidated Financial Statements.

7

GRAHAM CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Amounts in thousands, except per share data)

NOTE 1 – BASIS OF PRESENTATION:

Graham Corporation’s (the “Company’s”) Condensed Consolidated Financial Statements include: (i) its wholly-owned foreign subsidiary located in China; and (ii) its wholly-owned domestic subsidiary located in Lapeer, Michigan. The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, each as promulgated by the Securities and Exchange Commission. The Company’s Condensed Consolidated Financial Statements do not include all information and notes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Balance Sheet as of March 31, 2014 presented herein was derived from the Company’s audited Consolidated Balance Sheet as of March 31, 2014. For additional information, please refer to the consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2014 (“fiscal 2014”). In the opinion of management, all adjustments, including normal recurring accruals considered necessary for a fair presentation, have been included in the Company’s Condensed Consolidated Financial Statements.

The Company’s results of operations and cash flows for the three and nine months ended December 31, 2014 are not necessarily indicative of the results that may be expected for the fiscal year ending March 31, 2015 (“fiscal 2015”).

NOTE 2 – REVENUE RECOGNITION:

The Company recognizes revenue on all contracts with a planned manufacturing process in excess of four weeks (which approximates 575 direct labor hours) using the percentage-of-completion method. The majority of the Company’s revenue is recognized under this methodology. The percentage-of-completion method is determined by comparing actual labor incurred to a specific date to management’s estimate of the total labor to be incurred on each contract. Contracts in progress are reviewed monthly, and sales and earnings are adjusted in current accounting periods based on revisions in the contract value and estimated costs at completion. Losses on contracts are recognized immediately when evident to management. There is no reserve for credit losses related to unbilled revenue recorded for contracts accounted for on the percentage-of-completion method. Any reserve for credit losses related to unbilled revenue is recorded as a reduction to revenue.

Revenue on contracts not accounted for using the percentage-of-completion method is recognized utilizing the completed contract method. The majority of the Company’s contracts (as opposed to revenue) have a planned manufacturing process of less than four weeks and the results reported under this method do not vary materially from the percentage-of-completion method. The Company recognizes revenue and all related costs on these contracts upon substantial completion or shipment to the customer. Substantial completion is consistently defined as at least 95% complete with regard to direct labor hours. Customer acceptance is generally required throughout the construction process and the Company has no further material obligations under its contracts after the revenue is recognized.

Receivables billed but not paid under retainage provisions in its customer contracts were $1,401 and $901 at December 31, 2014 and March 31, 2014, respectively.

8

NOTE 3 – INVESTMENTS:

Investments consist solely of certificates of deposit with financial institutions and fixed income debt securities issued by the U.S. Treasury. All investments have original maturities of greater than three months and less than one year and are classified as held-to-maturity, as the Company has the intent and ability to hold the securities to maturity. The investments are stated at amortized cost which approximates fair value. All investments held by the Company at December 31, 2014 are scheduled to mature on or before November 17, 2015.

NOTE 4 – INVENTORIES:

Inventories are stated at the lower of cost or market, using the average cost method. For contracts accounted for on the completed contract method, progress payments received are netted against inventory to the extent the payment is less than the inventory balance relating to the applicable contract. Progress payments that are in excess of the corresponding inventory balance are presented as customer deposits in the Condensed Consolidated Balance Sheets. Unbilled revenue in the Condensed Consolidated Balance Sheets represents revenue recognized that has not been billed to customers on contracts accounted for using the percentage-of-completion method. For contracts accounted for using the percentage–of–completion method, progress payments are netted against unbilled revenue to the extent the payment is less than the unbilled revenue for the applicable contract. Progress payments exceeding unbilled revenue are netted against inventory to the extent the payment is less than or equal to the inventory balance relating to the applicable contract, and the excess is presented as customer deposits in the Condensed Consolidated Balance Sheets.

Major classifications of inventories are as follows:

| December 31, 2014 |

March 31, 2014 |

|||||||||

| Raw materials and supplies |

$ | 3,074 | $ | 3,185 | ||||||

| Work in process |

17,077 | 17,767 | ||||||||

| Finished products |

675 | 646 | ||||||||

|

|

|

|

|

|||||||

| 20,826 | 21,598 | |||||||||

| Less - progress payments |

6,194 | 5,080 | ||||||||

|

|

|

|

|

|||||||

| Total |

$ | 14,632 | $ | 16,518 | ||||||

|

|

|

|

|

|||||||

9

NOTE 5 – INTANGIBLE ASSETS:

Intangible assets are comprised of the following:

| Gross Carrying Amount |

Accumulated Amortization |

Net Carrying Amount |

||||||||||||||

| At December 31, 2014 |

||||||||||||||||

| Intangibles subject to amortization: |

||||||||||||||||

| Backlog |

$ | 170 | $ | 170 | $ | - | ||||||||||

| Customer relationships |

2,700 | 727 | 1,973 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 2,870 | $ | 897 | $ | 1,973 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Intangibles not subject to amortization: |

||||||||||||||||

| Permits |

$ | 10,300 | $ | - | $ | 10,300 | ||||||||||

| Tradename |

2,500 | - | 2,500 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 12,800 | $ | - | $ | 12,800 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| At March 31, 2014 |

||||||||||||||||

| Intangibles subject to amortization: |

||||||||||||||||

| Backlog |

$ | 170 | $ | 170 | $ | - | ||||||||||

| Customer relationships |

2,700 | 592 | 2,108 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 2,870 | $ | 762 | $ | 2,108 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Intangibles not subject to amortization: |

||||||||||||||||

| Permits |

$ | 10,300 | $ | - | $ | 10,300 | ||||||||||

| Tradename |

2,500 | - | 2,500 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 12,800 | $ | - | $ | 12,800 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

Intangible assets are amortized on a straight line basis over their estimated useful lives. Intangible amortization expense for each of the three-month periods ended December 31, 2014 and 2013 was $45. Intangible amortization expense for each of the nine months ended December 31, 2014 and 2013 was $135. As of December 31, 2014, amortization expense is estimated to be $45 for the remainder of fiscal 2015 and $180 in each of the fiscal years ending March 31, 2016, 2017, 2018 and 2019.

NOTE 6 – STOCK-BASED COMPENSATION:

The Amended and Restated 2000 Graham Corporation Incentive Plan to Increase Shareholder Value provides for the issuance of up to 1,375 shares of common stock in connection with grants of incentive stock options, non-qualified stock options, stock awards and performance awards to officers, key employees and outside directors; provided, however, that no more than 250 shares of common stock may be used for awards other than stock options. Stock options may be granted at prices not less than the fair market value at the date of grant and expire no later than ten years after the date of grant.

10

There were no restricted stock awards granted in the three-month periods ended December 31, 2014 and 2013. Restricted stock awards granted in the nine-month periods ended December 31, 2014 and 2013 were 30 and 32, respectively. Restricted shares of 12 and 14 granted to officers in fiscal 2015 and fiscal 2014, respectively, vest 100% on the third anniversary of the grant date subject to the satisfaction of the performance metrics for the applicable three-year period. Restricted shares of 11 and 12 granted to officers and key employees in fiscal 2015 and fiscal 2014, respectively, vest 33 1⁄3% per year over a three-year term. Restricted shares of 7 and 6 granted to directors in fiscal 2015 and fiscal 2014, respectively, vest 100% on the first year anniversary of the grant date. There were no stock option awards granted in the three-month or nine-month periods ended December 31, 2014 and 2013.

During the three months ended December 31, 2014 and 2013, the Company recognized stock-based compensation costs related to stock option and restricted stock awards of $166 and $134, respectively. The income tax benefit recognized related to stock-based compensation was $59 and $47 for the three months ended December 31, 2014 and 2013, respectively. During the nine months ended December 31, 2014 and 2013, the Company recognized stock-based compensation costs related to stock option and restricted stock awards of $435 and $447, respectively. The income tax benefit recognized related to stock-based compensation was $153 and $157 for the nine months ended December 31, 2014, respectively.

The Company has an Employee Stock Purchase Plan (“ESPP”), which allows eligible employees to purchase shares of the Company’s common stock on the last day of a six-month offering period at a purchase price equal to the lesser of 85% of the fair market value of the common stock on either the first day or the last day of the offering period. A total of 200 shares of common stock may be purchased under the ESPP. During the three months ended December 31, 2014 and 2013, the Company recognized stock-based compensation costs of $16 and $14, respectively, related to the ESPP and $6 and $5, respectively, of related tax benefits. During the nine months ended December 31, 2014 and 2013, the Company recognized stock-based compensation costs of $46 and $42, respectively, related to the ESPP and $16 and $14, respectively, of related tax benefits.

11

NOTE 7 – INCOME PER SHARE:

Basic income per share is computed by dividing net income by the weighted average number of common shares outstanding for the period. Common shares outstanding include share equivalent units, which are contingently issuable shares. Diluted income per share is calculated by dividing net income by the weighted average number of common shares outstanding and, when applicable, potential common shares outstanding during the period. A reconciliation of the numerators and denominators of basic and diluted income per share is presented below:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||

| Basic income per share |

||||||||||||||||

| Numerator: |

||||||||||||||||

| Net income |

$ | 3,992 | $ | 1,431 | $ | 10,570 | $ | 7,828 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted common shares outstanding |

10,127 | 10,070 | 10,119 | 10,045 | ||||||||||||

| Share equivalent units (“SEUs”) outstanding |

- | - | - | 18 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares and SEUs outstanding |

10,127 | 10,070 | 10,119 | $10,063 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic income per share |

$ | .39 | $ | .14 | $ | 1.04 | $ | .78 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted income per share |

||||||||||||||||

| Numerator: |

||||||||||||||||

| Net income |

$ | 3,992 | $ | 1,431 | $ | 10,570 | $ | 7,828 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted average shares and SEUs outstanding |

10,127 | 10,070 | 10,119 | 10,063 | ||||||||||||

| Stock options outstanding |

22 | 37 | 23 | 36 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common and potential common shares outstanding |

10,149 | 10,107 | 10,142 | 10,099 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted income per share |

$ | .39 | $ | .14 | $ | 1.04 | $ | .78 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Options to purchase a total of 12 and 2 shares of common stock were outstanding at December 31, 2014 and 2013, respectively, but were not included in the above computation of diluted income per share given their exercise prices as they would be anti-dilutive upon issuance.

NOTE 8 – PRODUCT WARRANTY LIABILITY:

The reconciliation of the changes in the product warranty liability is as follows:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||

| Balance at beginning of period |

$ | 347 | $ | 299 | $ | 308 | $ | 408 | ||||||||

| Expense for product warranties |

436 | (47 | ) | 573 | 11 | |||||||||||

| Product warranty claims paid |

(63 | ) | (29 | ) | (161 | ) | (196 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at end of period |

$ | 720 | $ | 223 | $ | 720 | $ | 223 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

The income of $47 for product warranties in the three months ended December 31, 2013 resulted from the reversal of provisions made that were no longer required due to lower claim experience.

The product warranty liability is included in the line item “Accrued expenses and other current liabilities” in the Condensed Consolidated Balance Sheets.

NOTE 9 – CASH FLOW STATEMENT:

Interest paid was $8 and $9 for the nine-month periods ended December 31, 2014 and 2013, respectively. In addition, income taxes paid for the nine months ended December 31, 2014 and 2013 were $4,497 and $2,567, respectively.

During the nine months ended December 31, 2014 and 2013, respectively, stock option awards were exercised and restricted stock awards vested. The related income tax benefit realized exceeded the tax benefit that had been recorded pertaining to the compensation cost recognized by $37 and $220, respectively, for such periods. This excess tax benefit has been separately reported under “Financing activities” in the Condensed Consolidated Statements of Cash Flows.

At December 31, 2014 and 2013, there were $35 and $66, respectively, of capital purchases that were recorded in accounts payable and are not included in the caption “Purchase of property, plant and equipment” in the Condensed Consolidated Statements of Cash Flows.

NOTE 10 – EMPLOYEE BENEFIT PLANS:

The components of pension cost are as follows:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||||||

| Service cost |

$ | 136 | $ | 144 | $ | 409 | $ | 432 | ||||||||||||

| Interest cost |

359 | 340 | 1,076 | 1,019 | ||||||||||||||||

| Expected return on assets |

(758 | ) | (682 | ) | (2,275 | ) | (2,046 | ) | ||||||||||||

| Amortization of: |

||||||||||||||||||||

| Unrecognized prior service cost |

1 | 1 | 3 | 3 | ||||||||||||||||

| Actuarial loss |

145 | 250 | 435 | 751 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net pension cost |

$ | (117 | ) | $ | 53 | $ | (352 | ) | $ | 159 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

The Company made contributions to its defined benefit pension plan during the nine months ended December 31, 2014 of $55. The Company does not expect to make any contributions to its defined benefit pension plan for the balance of fiscal 2015.

13

The components of the postretirement benefit income are as follows:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||||||

| Service cost |

$ | - | $ | - | $ | - | $ | - | ||||||||||||

| Interest cost |

8 | 8 | 24 | 24 | ||||||||||||||||

| Amortization of prior service benefit |

(26 | ) | (41 | ) | (79 | ) | (124 | ) | ||||||||||||

| Amortization of actuarial loss |

10 | 11 | 30 | 33 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net postretirement benefit income |

$ | (8 | ) | $ | (22 | ) | $ | (25 | ) | $ | (67 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

The Company paid benefits of $2 related to its postretirement benefit plan during the nine months ended December 31, 2014. The Company expects to pay benefits of approximately $96 during the balance of fiscal 2015.

The Company self-funds the medical insurance coverage it provides to its U.S. based employees. The Company has obtained a stop loss insurance policy in an effort to limit its exposure to claims. The liability of $300 and $221 on December 31, 2014 and March 31, 2014, respectively, related to the Company’s self-insured medical plan is primarily based upon claim history and is included in the caption “Accrued compensation” in the Condensed Consolidated Balance Sheets.

NOTE 11 – COMMITMENTS AND CONTINGENCIES:

The Company has been named as a defendant in lawsuits alleging personal injury from exposure to asbestos allegedly contained in products made by the Company. The Company is a co-defendant with numerous other defendants in these lawsuits and intends to vigorously defend itself against these claims. The claims are similar to previous asbestos suits that named the Company as defendant, which either were dismissed when it was shown that the Company had not supplied products to the plaintiffs’ places of work or were settled for immaterial amounts.

As of December 31, 2014, the Company was subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

Although the outcome of the lawsuits to which the Company is a party cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made, management does not believe that the outcomes, either individually or in the aggregate, will have a material effect on the Company’s results of operations, financial position or cash flows.

14

NOTE 12 – INCOME TAXES:

The Company files federal and state income tax returns in several domestic and international jurisdictions. In most tax jurisdictions, returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. The Company is subject to U.S. federal examination for the tax years 2013 through 2014 and examination in state tax jurisdictions for the tax years 2010 through 2014. The Company is subject to examination in the People’s Republic of China for tax years 2012 through 2014.

The liability for unrecognized tax benefits was $0 at both December 31, 2014 and March 31, 2014. It is the Company’s policy to recognize any interest related to uncertain tax positions in interest expense and any penalties related to uncertain tax positions in selling, general and administrative expense. During each of the three and nine months ended December 31, 2014, the Company recorded no interest related to its uncertain tax positions. During the three and nine months ended December 31, 2013, the Company reversed provisions made in previous periods for interest related to its uncertain tax positions of $15 and $11, respectively, based upon the results of the IRS examination of tax years 2011 and 2012. No penalties related to uncertain tax positions were recorded in the three or nine month periods ended December 31, 2014 or 2013.

NOTE 13 – CHANGES IN ACCUMULATED OTHER COMPREHENSIVE LOSS:

The changes in accumulated other comprehensive loss by component for the nine months ended December 31, 2014 and 2013 are as follows:

| Pension and Other Postretirement Benefit Items |

Foreign Currency Items |

Total | ||||||||||||||

| Balance at April 1, 2014 |

$ | (6,168) | $ | 403 | $ | (5,765) | ||||||||||

| Other comprehensive income before reclassifications |

- | 4 | 4 | |||||||||||||

| Amounts reclassified from accumulated other comprehensive loss |

252 | - | 252 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Net current-period other comprehensive income |

252 | 4 | 256 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Balance at December 31, 2014 |

$ | (5,916) | $ | 407 | $ | (5,509) | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Pension and Other Postretirement Benefit Items |

Foreign Currency Items |

Total | ||||||||||||||

| Balance at April 1, 2013 |

$ | (8,443) | $ | 410 | $ | (8,033) | ||||||||||

| Other comprehensive income before reclassifications |

- | 73 | 73 | |||||||||||||

| Amounts reclassified from accumulated other comprehensive loss |

429 | - | 429 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Net current-period other comprehensive income |

429 | 73 | 502 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Balance at December 31, 2013 |

$ | (8,014) | $ | 483 | $ | (7,531) | ||||||||||

|

|

|

|

|

|

|

|||||||||||

15

The reclassifications out of accumulated other comprehensive loss by component for the three and nine months ended December 31, 2014 and 2013 are as follows:

| Details about Accumulated Other Comprehensive Loss Components |

Amount Reclassified from |

Affected Line Item in the

Condensed | ||||||||

| Three Months Ended December 31, 2014 |

Three Months Ended December 31, 2013 |

|||||||||

| Pension and other postretirement benefit items: |

||||||||||

| Amortization of unrecognized prior service benefit |

$ | 25 | (1) | $ | 40 | (1) | ||||

| Amortization of actuarial loss |

(155 | )(1) | (261 | )(1) | ||||||

|

|

|

|

|

|||||||

| (130 | ) | (221 | ) | Income before provision for income taxes | ||||||

| (46 | ) | (78 | ) | Provision for income taxes | ||||||

|

|

|

|

|

|||||||

| $ | (84 | ) | $ | (143 | ) | Net income | ||||

|

|

|

|

|

|||||||

| Details about Accumulated Other Comprehensive Loss Components |

Amount Reclassified from |

Affected Line Item in the

Condensed | ||||||||

| Nine Months Ended December 31, 2014 |

Nine Months Ended December 31, 2013 |

|||||||||

| Pension and other postretirement benefit items: |

||||||||||

| Amortization of unrecognized prior service benefit |

$ | 76 | (1) | $ | 121 | (1) | ||||

| Amortization of actuarial loss |

(465 | )(1) | (784 | )(1) | ||||||

|

|

|

|

|

|||||||

| (389 | ) | (663 | ) | Income before provision for income taxes | ||||||

| (137 | ) | (234 | ) | Provision for income taxes | ||||||

|

|

|

|

|

|||||||

| $ | (252 | ) | $ | (429 | ) | Net income | ||||

|

|

|

|

|

|||||||

| (1) | These accumulated other comprehensive loss components are included within the computation of net periodic pension and other postretirement benefit costs. See Note 10. |

16

NOTE 14 – ACCOUNTING AND REPORTING CHANGES:

In the normal course of business, management evaluates all new accounting pronouncements issued by the Financial Accounting Standards Board (“FASB”), the Securities and Exchange Commission, the Emerging Issues Task Force, the American Institute of Certified Public Accountants or any other authoritative accounting body to determine their potential impact on the Company’s consolidated financial statements.

In May 2014, the FASB issued guidance related to the accounting for revenue from contracts with customers. This guidance establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from a company’s contracts with customers. The guidance requires companies to apply a five-step model when recognizing revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods and services. The guidance also includes a comprehensive set of disclosure requirements regarding revenue recognition. The provisions of the guidance are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. The Company is currently evaluating the impact this guidance will have on its financial position, results of operations and cash flows. See Note 2 for a description of the Company’s current revenue recognition policy.

Management does not expect any other recently issued accounting pronouncements, which have not already been adopted, to have a material impact on the Company’s consolidated financial statements.

17

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

(Dollar amounts in thousands, except per share data)

Overview

We are a global business that designs, manufactures and sells critical equipment for the energy industry, which includes the oil refining, petrochemical, as well as the cogeneration, nuclear and alternative power markets. With world-renowned engineering expertise in vacuum and heat transfer technology and a leading nuclear code accredited fabrication and specialty machining company, we design and manufacture custom-engineered ejectors, vacuum pump packages, surface condensers and vacuum systems as well as supplies and components for use inside the reactor vessel and outside the containment vessel of nuclear power facilities. Our equipment is also used by the defense industry in nuclear propulsion power systems and can be found in other diverse applications such as metal refining, pulp and paper processing, water heating, refrigeration, desalination, food processing, pharmaceutical, heating, ventilating and air conditioning.

Our corporate headquarters are located in Batavia, New York and we have production facilities in both Batavia, New York and at our wholly-owned subsidiary, Energy Steel & Supply Co. (“Energy Steel”), in Lapeer, Michigan. We also have a wholly-owned foreign subsidiary, Graham Vacuum and Heat Transfer Technology (Suzhou) Co., Ltd. (“GVHTT”), located in Suzhou, China, which supports sales orders from China. GVHTT also provides engineering support, supervision of subcontracted fabrication and sales management oversight throughout Southeast Asia.

Highlights

Highlights for the three and nine months ended December 31, 2014 (the fiscal year ending March 31, 2015 is referred to as “fiscal 2015”) include:

| • | Net sales for the third quarter of fiscal 2015 were $33,646, an increase of 44% compared with $23,385 for the third quarter of the fiscal year ended March 31, 2014 (referred to as “fiscal 2014”). Net sales for the first nine months of fiscal 2015 were $97,714, up 28% compared with net sales of $76,131 for the first nine months of fiscal 2014. |

| • | Net income and income per diluted share for the third quarter of fiscal 2015 were $3,992 and $0.39, compared with net income of $1,431 and income per diluted share of $0.14 for the third quarter of fiscal 2014. Net income and income per diluted share for the first nine months of fiscal 2015 were $10,570 and $1.04, respectively, compared with net income of $7,828 and income per diluted share of $0.78 for the first nine months of fiscal 2014. |

| • | Orders booked in the third quarter of fiscal 2015 were $22,558, compared with $23,450 in the third quarter of fiscal 2014. Orders booked in the first nine months of fiscal 2015 were $89,069, compared with $104,658 in the first nine months of fiscal 2014. |

| • | Backlog was $103,754 on December 31, 2014 compared with $114,816 on September 30, 2014 and $112,108 on March 31, 2014. |

18

| • | Gross profit margin and operating margin for the third quarter of fiscal 2015 were 30% and 17%, compared with 26% and 9%, respectively, for the third quarter of fiscal 2014. Gross profit margin and operating margin for the first nine months of fiscal 2015 were 30% and 16% compared with 32% and 15%, respectively, for the first nine months of fiscal 2014. |

| • | Cash and cash equivalents and investments at December 31, 2014 were $62,496, compared with $64,795 on September 30, 2014 and $61,146 at March 31, 2014. |

Forward-Looking Statements

This report and other documents we file with the Securities and Exchange Commission include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results implied by the forward-looking statements. Such factors include, but are not limited to, the risks and uncertainties identified by us under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for fiscal 2014.

Forward-looking statements may also include, but are not limited to, statements about:

| • | the current and future economic and market environments affecting us and the markets we serve; |

| • | our expectations regarding current market conditions, including but not limited to the supply and demand for and cost of oil and natural gas; |

| • | expectations regarding investments in new projects by our customers; |

| • | sources of revenue and anticipated revenue, including the contribution from the growth of new products, services and markets; |

| • | expectations regarding achievement of revenue and profitability; |

| • | plans for future products and services and for enhancements to existing products and services; |

| • | our operations in foreign countries; |

| • | political instability in regions in which our customers are located; |

| • | our growth and acquisition strategy; |

| • | our ability to expand nuclear power work into new markets; |

| • | our ability to successfully execute our existing contracts; |

| • | estimates regarding our liquidity and capital requirements; |

| • | timing of conversion of backlog to sales; |

| • | our ability to attract or retain customers; |

19

| • | the outcome of any existing or future litigation; and |

| • | our ability to increase our productivity and capacity. |

Forward-looking statements are usually accompanied by words such as “anticipate,” “believe,” “estimate,” “may,” “might,” “intend,” “interest,” “appear,” “expect,” “suggest,” “plan,” “encourage,” “potential” and similar expressions. Actual results could differ materially from historical results or those implied by the forward-looking statements contained in this report.

Undue reliance should not be placed on our forward-looking statements. Except as required by law, we undertake no obligation to update or announce any revisions to forward-looking statements contained in this report, whether as a result of new information, future events or otherwise.

Current Market Conditions and Growth Opportunities

Bidding activity remains strong and generally consistent with the past two years. However, the recent rapid decline in crude oil prices, that are down over 30% since mid-November and more than 50% over the past six months, is expected to impact the timing of investment plans for our customers. The recent decline in crude oil prices appears to be driven by many factors, including:

| 1. | Global economic weakness, especially in Europe and developing countries; |

| 2. | A strong U.S. dollar, the currency in which crude oil prices are denominated and traded; |

| 3. | Projected supply / demand imbalance, partly driven by expanded North American supply increases as well as OPEC keeping production at a high level; |

| 4. | Market reaction to the factors noted above, which may include price speculation, impacting crude oil prices. |

The duration of reduced crude oil pricing is unknown. In the near term, which we would define as the next twelve to eighteen months, we anticipate pressure on pricing power in our markets, reduced backlog growth and restriction on near term revenue expansion. We expect our various end-user segments may be impacted differently by crude oil pricing, with larger capacity expansion projects delayed, especially by state-owned end users, and potentially delayed investment by integrated refiners. Furthermore, those projects without strong funding capacity are likely to be delayed. Projects from independent refiners, those with shorter-term investment horizons such as revamps and debottlenecks, or short cycle opportunities are expected to be minimally impacted. Defense and power markets are also expected to be minimally impacted. Certain global chemical and petrochemical markets are anticipated to experience temporary slowing of planned investment while others may be unaffected.

Our strategy during this period of uncertainty in our markets is to aggressively pursue, and be in position to secure, available work while still leading with our high quality brand. We intend to defend market share and key customer relationships. We believe that our aftermarket and short cycle product strategies will continue to build our predictable base of sales. We also intend to continue to drive our diversification strategy and predictability for our business by effectively executing our defense (U.S. Navy) strategy to enter submarine programs and pursuing growth opportunities in power markets.

20

While we are faced with the near term uncertainty caused by depressed crude oil prices, we believe the long term outlook, which we define as the next five years and continuing well beyond then, is unchanged. We believe the global trends toward improvements in quality of life in developing countries, population growth and the investments to support these trends will continue and will result in increased need for energy and petrochemical products. We continue to believe that we can organically double the size of our business from its last peak of just above $100 million. We also believe that our strong balance sheet provides us with the opportunity to grow further with acquisitions or other business partnerships.

We intend to capture greater market share, expand our addressable opportunities, diversify into defense and power markets, expand into geographic markets we have not fully served in the past, and utilize our capabilities in new applications in order to drive our future growth. We expect that this diversification will couple with the long term market conditions anticipated to impact our customers’ investment needs.

The long term market trends in the refining and petrochemical markets and the investments required by our customers are expected to be affected by the following:

| • | Changes in domestic natural gas supply and cost have affected the dynamics of the global energy and petrochemical markets. Natural gas serves as both an energy source and feedstock to chemical industries. Natural gas in the U.S. has become globally competitive with oil, even at lower crude oil prices. As such, lower costs and plentiful supply are expected to drive increased domestic use of natural gas in the U.S., as well as the ability of the U.S. to export liquefied natural gas to serve other regions. Low cost and the plentiful supply of North American natural gas have also led to a revival in the U.S. petrochemical industry, where we historically have a strong market share. This phenomenon over the past five years has been driven by technology advancements in drilling. In turn these technology enhancements have created a significant increase in natural gas supply. As a result, U.S. production of the raw material for ethylene, ethane (which is a side product of natural gas production), has become globally competitive with naphtha (the alternative feedstock for ethylene used in most of the world). Furthermore, we have witnessed a significant increase in planned construction of new petrochemical producing facilities, including ethylene, ammonia, methanol, propane dehydrogenation (PDH) and urea facilities. |

| • | Investment by the U.S. refining market to upgrade existing facilities has been occurring over the past few years. This has resulted in the upgrading of existing equipment and acquisition of new equipment to expand capacity, as a result of different crude feedstocks or an improvement in the end product mix. Further investment will be required when additional crude oil supply is available to the North American market. The near term timing may be uncertain, but we expect long term crude supply to increase. |

| • | Increased global consumption of crude oil and oil-refined products has resulted in planned expansion of global oil refining capacity. While some of these projects may be delayed in the near term, demand is projected to increase, and is expected to be addressed through the construction of new facilities, refinery upgrades, revamps and expansions. Furthermore, increased regulation worldwide, impacting the refining, petrochemical and nuclear power industries, is expected to continue to drive requirements for capital investments. Investment is expected in Asia, the Middle East and South America. |

21

| • | Investments, including foreign investments, in North American oil sands projects have occurred over the past few years. However, the recent drop in global crude oil prices may affect future upstream spending as well as investment to convert and refine oil sands crude. |

| • | There continue to be long-term growth opportunities in other alternative energy markets, such as geothermal, coal-to-liquids, gas-to-liquids, as well as in other emerging technologies, such as biodiesel and waste-to-energy, which are expected to provide additional sales opportunities. |

Our diversification strategy into defense (U.S. Navy) and power markets is expected to be driven by the following:

| • | Investment by the U.S. Navy to refresh its nuclear powered propulsion program, including aircraft carriers and submarines, is anticipated. While this investment is expected to continue, order timing can be impacted by changes in the political landscape. |

| • | Investment in new nuclear power capacity in the U.S. and internationally has been effected by political and social pressures, which were augmented by the tragic earthquake and tsunami that occurred in Japan in March 2011. Although the continued progress at the new U.S. nuclear reactor projects planned for the Summer (South Carolina) and Vogtle (Georgia) facilities suggests some growth in the domestic nuclear market will occur, the low cost of natural gas and crude oil could dampen additional near-term expansion plans for new nuclear capacity. |

| • | The focus on additional safety and back-up redundancies at existing domestic nuclear plants could increase demand for our products in the near-term. |

| • | Investments in existing U.S. nuclear plants to extend their operating life and add incremental capacity are expected to continue. The desire to extend the life of the existing nuclear plants, including obtaining new operating licenses and expanding the output (known as re-rating) of such facilities, will require investment and could increase demand for our products. |

| • | Investment in international nuclear facilities continues to occur in regions which lack natural energy sources and are net importers of energy products. |

We expect most of these long term trends in our historic markets, refining and petrochemical as well as our diversification efforts in defense and power, to provide growth opportunities for our business. In addition, we believe we can continue to grow our less cyclical smaller product lines and aftermarket businesses. We do, however, expect pressure on near term and longer term margins. In the near term, margin pressure due to fewer available projects and enhanced competition for those projects is anticipated. In the longer term, margins are unlikely to reach the levels from the previous peaks due to a higher international mix of our business (i.e., more developing market investments compared with prior peaks which included more domestic refining).

22

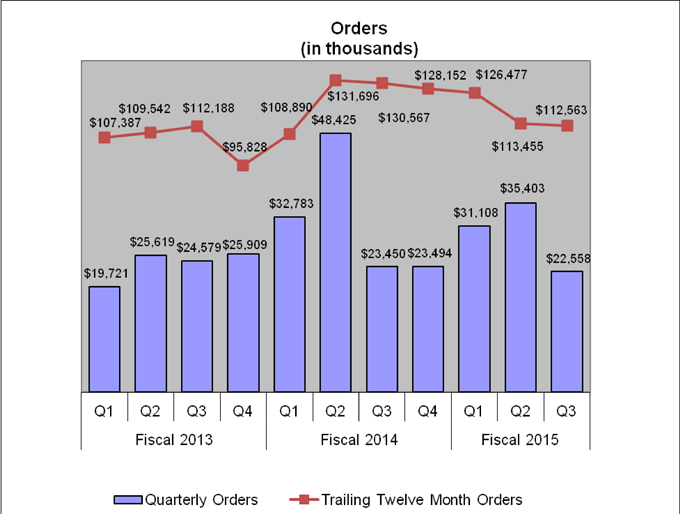

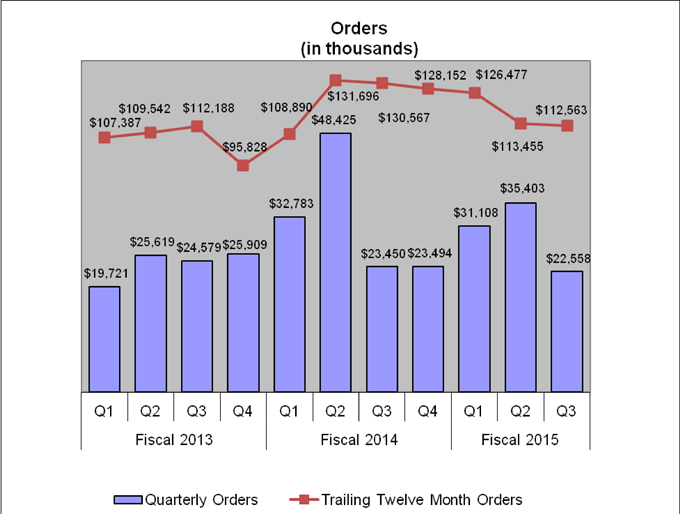

Because of continued global economic and financial uncertainty and the risk associated with growth in emerging economies, we also expect that we will have continued volatility in our order pattern. As the chart below indicates, quarterly orders can vary significantly.

We believe that looking at our order level in any one quarter does not provide an accurate indication of our future expectations or performance. Rather, we believe that looking at our orders and backlog over a trailing twelve month period provides a better measure of our business. Our quarterly order levels and trailing twelve month order levels for the first three quarters of fiscal 2015 as well as each quarter in fiscal 2014 and fiscal 2013, respectively, are set forth in the table below.

23

Results of Operations

For an understanding of the significant factors that influenced our performance, the following discussion should be read in conjunction with our condensed consolidated financial statements and the notes to our condensed consolidated financial statements included in Part I, Item 1, of this Quarterly Report on Form 10-Q.

The following table summarizes our results of operations for the periods indicated:

| Three Months Ended December 31, |

Nine Months Ended December 31, |

|||||||||||||||

| 2014 |

2013 |

2014 |

2013 |

|||||||||||||

| Net sales |

$ | 33,646 | $ | 23,385 | $ | 97,714 | $ | 76,131 | ||||||||

| Gross profit |

$ | 10,103 | $ | 6,090 | $ | 29,019 | $ | 24,394 | ||||||||

| Gross profit margin |

30 | % | 26 | % | 30 | % | 32 | % | ||||||||

| SG&A expense (1) |

$ | 4,483 | $ | 4,102 | $ | 13,584 | $ | 12,954 | ||||||||

| SG&A as a percent of sales |

13 | % | 18 | % | 14 | % | 17 | % | ||||||||

| Net income |

$ | 3,992 | $ | 1,431 | $ | 10,570 | $ | 7,828 | ||||||||

| Diluted income per share |

$ | 0.39 | $ | 0.14 | $ | 1.04 | $ | 0.78 | ||||||||

| Total assets |

$ | 155,874 | $ | 135,569 | $ | 155,874 | $ | 135,569 | ||||||||

| Total assets excluding cash, cash equivalents and investments |

$ | 93,378 | $ | 71,664 | $ | 93,378 | $ | 71,664 | ||||||||

| (1) | Selling, general and administrative expense is referred to as “SG&A” |

The Third Quarter and First Nine Months of Fiscal 2015 Compared With the Third Quarter and First Nine Months of Fiscal 2014

Sales for the third quarter of fiscal 2015 were $33,646, a 44% increase as compared with sales of $23,385 for the third quarter of fiscal 2014. Higher sales were a result of the strong order levels experienced in fiscal 2014. Domestic sales, as a percentage of aggregate product sales, were 55% in the third quarter of fiscal 2015 compared with 62% in the third quarter of fiscal 2014. Domestic sales year-over-year increased $3,813, or 26%, driven by strong chemical and petrochemical market sales as a result of orders received in fiscal 2014. International sales increased $6,448, or 73%, in the third quarter of fiscal 2015 compared with the third quarter of fiscal 2014, driven by increases in Canada, South America and the Middle East. Sales in the three months ended December 31, 2014 were 38% to the refining industry, 28% to the chemical and petrochemical industries, 16% to the power industry, including the nuclear market, and 18% to other commercial and industrial applications, including the U.S. Navy. Sales in the three months ended December 31, 2013 were 31% to the refining industry, 23% to the chemical and petrochemical industries, 23% to the power industry, including the nuclear market, and 23% to other commercial and industrial applications, including the U.S. Navy. Fluctuations in sales among markets, products and geographic locations can vary measurably from quarter-to-quarter based on timing and magnitude of projects. See “Current Market Conditions and Growth Opportunities,” above. For additional information on anticipated future sales and market expectations, see “Orders and Backlog” and “Outlook” below.

24

Sales for the first nine months of fiscal 2015 were $97,714, an increase of $21,583, or 28%, compared with sales of $76,131 for the first nine months of fiscal 2014. The increase in year-to-date sales was due to strong domestic sales and somewhat stronger international sales. Domestic sales, as a percentage of aggregate product sales, were 64% in the first nine months of fiscal 2015 compared with 57% in the same period in fiscal 2014. Domestic sales increased $18,811, or 43%, while international sales increased by $2,772, or 9%, driven by higher sales to South America, the Middle East and Canada, partly offset by lower sales in Asia. Domestic sales in the first nine months of fiscal 2015 were driven by the chemical and petrochemical market, and resulted from orders received in fiscal 2014. International sales accounted for 36% and 43% of total sales for the first nine months of fiscal 2015 and fiscal 2014, respectively. Sales in the first nine months of fiscal 2015 were 32% to the refining industry, 35% to the chemical and petrochemical industries, 17% to the power industry, including the nuclear market, and 16% to other commercial and industrial applications, including the U.S. Navy. Sales in the first nine months of fiscal 2014 were 40% to the refining industry, 18% to the chemical and petrochemical industries, 25% to the power industry, including the nuclear market, and 17% to other commercial and industrial applications, including the U.S. Navy.

Gross profit margin for the third quarter of fiscal 2015 was 30% compared with 26% for the third quarter of fiscal 2014. Gross profit margin increased due to leveraging our fixed costs over increased volume. Gross profit for the third quarter of fiscal 2015 increased to $10,103 from $6,090, or 66%, compared with the same period in fiscal 2014. Gross profit dollars increased due to higher margin and increased volume.

Gross profit margin for the first nine months of fiscal 2015 was 30% compared with 32% for the first nine months of fiscal 2014. Gross profit for the first nine months of fiscal 2015 increased 19% to $29,019 compared with the same period in fiscal 2014, which had gross profit of $24,394. The increase in gross profit dollars was due to greater volume partly offset by less favorable product and project mix and a higher level of subcontracting.

SG&A expense in the three and nine-month periods ended December 31, 2014 increased $381, or 9%, and $630, or 5%, respectively, compared with the same periods of the prior year. The increases in SG&A expense for the three and nine-month periods were primarily due to increases in sales expenses related to higher volume.

SG&A expense as a percent of sales for the three and nine-month periods ended December 31, 2014 was 13% and 14%, respectively. This compared with 18% and 17%, respectively, for the same periods of the prior year. This improvement was driven by increased sales volume.

Interest income was $50 and $139 for the three and nine-month periods ended December 31, 2014, compared with $10 and $31 for the same periods ended December 31, 2013. The low level of interest income relative to the amount of cash invested reflects the persistent low level of interest rates on short term U.S. government securities, certificates of deposit and money market accounts.

Interest expense was $2 and $8 for the three and six-month periods ended December 31, 2014, compared with ($11) and ($2) for the same periods ended December 31, 2013.

Our effective tax rate in fiscal 2015 is projected to be between 32% and 33%. The effective tax rate in the current quarter was 30% and was 32% in the first nine months of fiscal 2015. The effective tax rates for the comparable three and nine-month periods of fiscal 2014 were 29% and 32%, respectively. The lower effective tax rate in the current three-month period reflects the impact of the December 2014 retroactive extension of the U.S. federal research and development tax credit.

Net income for the three and nine months ended December 31, 2014 was $3,992 and $10,570, respectively, compared with $1,431 and $7,828, respectively, for the same periods in the prior fiscal year. Income per diluted share in fiscal 2015 was $0.39 and $1.04 for the three and six-month periods, compared with $0.14 and $0.78 for the same three and nine-month periods of fiscal 2014.

25

Liquidity and Capital Resources

The following discussion should be read in conjunction with our Condensed Consolidated Balance Sheets and Consolidated Statements of Cash Flows included in Item 1 of this Quarterly Report on Form 10-Q:

| December 31, 2014 |

March 31, 2014 |

|||||||

| Cash and cash equivalents and investments |

$ | 62,496 | $ | 61,146 | ||||

| Working capital |

77,546 | 71,346 | ||||||

| Working capital ratio(1) |

3.6 | 3.7 | ||||||

(1) Working capital ratio equals current assets divided by current liabilities.

Net cash generated by operating activities for the first nine months of fiscal 2015 was $7,505, compared with $14,571 generated by operating activities for the first nine months of fiscal 2014. The decrease in cash generated was primarily due to an increase in unbilled revenue, which is a timing issue.

Dividend payments and capital expenditures in the first nine months of fiscal 2015 were $1,215 and $4,965, respectively, compared with $905 and $2,161, respectively, for the first nine months of fiscal 2014.

Capital expenditures for fiscal 2015 are expected to be between approximately $5,500 and $6,000. Approximately 60% of this spending is to support the completion of the Batavia, NY capacity expansion which was initiated in fiscal 2014 and completed in the second quarter of fiscal 2015. Approximately 90% of our fiscal 2015 capital expenditures, including the capacity expansion, are expected to be for buildings, machinery and equipment, with the remaining amounts expected to be used for information technology and other items.

Cash and cash equivalents and investments were $62,496 on December 31, 2014 compared with $61,146 on March 31, 2014, up $1,350, or 2%.

We invest net cash generated from operations in excess of cash held for near-term needs in short-term, less than 365 days, certificates of deposit, money market accounts or U.S. government instruments, generally with maturity periods of up to 180 days. Our money market account is used to securitize our outstanding letters of credit, which reduces our cost on those letters of credit. Approximately 95% of our cash and investments is held in the U.S. The remaining 5% is invested by our wholly-owned China subsidiary.

Our revolving credit facility with Bank of America, N.A. provides us with a line of credit of $25,000, including letters of credit and bank guarantees. In addition, the Bank of America agreement allows us to increase the line of credit, at our discretion, up to another $25,000, for total availability of $50,000. Borrowings under our credit facility are secured by all of our assets. We also have a $5,000 unsecured line of credit with HSBC, N.A. Letters of credit outstanding under our credit facilities on December 31, 2014 and March 31, 2014 were $16,185 and $15,473, respectively. There were no other amounts outstanding on either of our credit facilities at December 31, 2014 and March 31, 2014. Our borrowing rate for our Bank of America facility as of December 31, 2014 was the bank’s prime rate, or 3.25%. Availability under the Bank of America and HSBC lines of credit were $13,815 and $9,527, at December 31, 2014 and March 31, 2014, respectively. We believe that cash generated from operations, combined with our investments and available financing capacity under our credit facility, will be adequate to meet our cash needs for the immediate future and to support our growth strategies.

26

Orders and Backlog

Orders for the three-month period ended December 31, 2014 were $22,558, compared with $23,450 for the same period last year, a decrease of $892, or 4%. For the three months ended December 31, 2014, orders from refining increased $4,686 and other commercial and industrial applications, including the U.S. Navy, increased by $3,047. These were offset by lower power orders, which were down $5,022 and chemical and petrochemical orders, which were down $3,603. Orders represent communications received from customers requesting us to supply products and services.

During the first nine months of fiscal 2015, orders were $89,069, compared with $104,658 for the same period of fiscal 2014, a decrease of $15,589, or 15%. For the first nine months of fiscal 2015, orders increased in refining by $16,358. This increase was more than offset by decreased orders in chemical and petrochemical, down $19,439, other commercial and industrial applications, including the U.S. Navy, by $8,426, and power, down $4,082. See “Current Market Conditions and Growth Opportunities” for additional information.

Domestic orders were 55%, or $12,426, while international orders were 45%, or $10,132, of total orders in the current quarter compared with the same period in the prior fiscal year, when domestic orders were 85%, or $19,840, and international orders were 15% of total orders, or $3,610.

For the first nine months of fiscal 2015, domestic orders were 51% of total orders, or $45,531, while international orders were 49%, or $43,538. During the first nine months of fiscal 2014, domestic orders were 75% of total orders, or $78,107, and international orders were 25%, or $26,551.

Backlog was $103,754 at December 31, 2014, compared with $112,108 at March 31, 2014, a 7% decrease. Backlog is defined as the total dollar value of orders received for which revenue has not yet been recognized. Between 70% to 75% of orders currently in backlog are expected to be converted to sales within the next twelve months. At December 31, 2014, 37% of our backlog was attributable to equipment for refinery project work, 23% for chemical and petrochemical projects, 11% for power projects, including nuclear, 21% for U.S. Navy projects and 8% for other industrial or commercial applications. At December 31, 2013, 25% of our backlog was attributed to equipment for refinery project work, 32% for chemical and petrochemical projects, 15% for power projects, 26% for U.S. Navy projects and 2% for other industrial or commercial applications.

At December 31, 2014, $7,827 of current backlog was on hold pending the end-user’s analysis of final project design. This order was secured in our second quarter of fiscal 2015 and is for the oil sands industry. We expect this hold will be released within calendar year 2015. The completion schedule of this project is expected to be between 18 and 30 months subsequent to its release from hold.

27

Outlook

Notwithstanding current market uncertainties associated with lower crude oil prices, we remain focused on and committed to growth. We believe that growth will be based on expanding market share within our key markets of crude oil refining, chemical and petrochemicals, power and defense; entering new markets where our competencies and operating model add value for customers; and deploying a strong balance sheet and cash flow from operations to strengthen and diversify revenue and earnings via acquisitions and other business partnerships. Long-term drivers that underpin a positive projection for our markets remain intact, including population growth, global GDP growth, and the expanding emerging market middle class.

Our bidding pipeline remains at an elevated level. Bidding activity has been a reliable leading indicator for the direction of our markets and for us. We believe that our proactive efforts to increase our addressable market opportunities, combined with continued energy demand, have given us the ability to double the size of our business from its last peak of just over $100 million. The duration of the downturn in crude oil prices is not clear and we expect capital investment by our refining and chemical industry customers will be impacted as a result. In addition, increased pressure on pricing, backlog growth and revenue expansion is anticipated until crude oil pricing stabilizes and begins to return to historically normal levels. This may influence the timeframe within which doubling our business through organic growth can be realized. We have invested, and continue to invest, to gain capacity to serve our commercial customers as well as to expand the work we do for the U.S. Navy. We intend to continue to look for organic growth opportunities as well as acquisitions or other business partnerships that we believe will allow us to expand our presence in our existing and ancillary markets. We remain focused on reducing earnings volatility, growing our business and diversifying our business and product lines.

In the first nine months of fiscal 2015, we saw a broadening of our market opportunities, with orders from international markets supplementing the domestic orders which dominated fiscal 2014. Given our strong project pipeline, we expect to continue to see strong order levels. However, fluctuations in orders can vary measurably from quarter to quarter based on timing and magnitude of projects.

We expect fiscal 2015 revenue to be in the upper half of our previously stated $125,000 to $130,000 range, a 22% to 27% increase as compared with fiscal 2014. Our expected revenue and growth range for fiscal 2015 assumes conversion of existing backlog as well as short cycle sales consistent with recent past levels.

We have a number of large projects which are converting over a multi-year time period. The current U.S. Navy projects and large projects for the new nuclear reactors being built in the southeast U.S. will partially convert in fiscal 2015 and continue beyond fiscal 2015. We expect to convert 70% to 75% of our total backlog to sales over the next 12 months.

We expect gross profit margin in fiscal 2015 to be in the 30% to 31% range. SG&A spending during fiscal 2015 is expected to be between 14% and 14.5% of sales. Our effective tax rate during fiscal 2015 is expected to be between 32% and 33%.

Cash flow in fiscal 2015 is expected to be positive, driven primarily by net income, partly offset by capital spending, which included the completion of our Batavia, NY capacity expansion as well as a minimal need for additional working capital.

28

Commitments and Contingencies

We have been named as a defendant in certain lawsuits alleging personal injury from exposure to asbestos allegedly contained in our products. We are a co-defendant with numerous other defendants in these lawsuits and intend to vigorously defend ourselves against these claims. The claims are similar to previous asbestos lawsuits that named us as a defendant. Such previous lawsuits either were dismissed when it was shown that we had not supplied products to the plaintiffs’ places of work or were settled by us for immaterial amounts.

As of December 31, 2014, we were subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

Although the outcome of the lawsuits to which we are a party cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made, we do not believe that the outcomes, either individually or in the aggregate, will have a material effect on our results of operations, financial position or cash flows.

Critical Accounting Policies, Estimates, and Judgments