UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

GRAHAM CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

We are a global business that designs, manufactures and sells critical equipment for the energy, defense and chemical/petrochemical industries. Our roots are founded in the following:

| James R. Lines Chief Executive Officer | ||

|

|

||

| Graham Corp. 20 Florence Avenue Batavia, NY 14020 |

June 16, 2021

Dear Stockholder:

On behalf of the board of directors and management, it is my pleasure to invite you to attend the 2021 Annual Meeting of Stockholders of Graham Corporation. Due to the unprecedented health impact of the COVID-19 pandemic, even as more people are becoming vaccinated, we will hold our meeting in a virtual only format at 11:00 a.m. Eastern Time on Wednesday, July 28, 2021. The meeting can be accessed at www.proxydocs.com/GHM.

Success in a Challenging Year

Despite a year overshadowed by a global pandemic, we were able to drive revenue and net income growth. Our team was resilient, flexible and dedicated. And, even while we shut down production in early fiscal 2021 at the onset of the pandemic, we maintained compensation and benefits for all recognizing that our strong cash reserves were well intended to protect our most valuable asset—our employees.

Advancing our Diversification Strategy

After many years of persistence and dedication to our strategy to diversify beyond the refining and petrochemical industries, we successfully generated 25% of our fiscal 2021 revenue from sales to the defense industry. Notably, our backlog at fiscal 2021 year end was comprised primarily of defense industry orders at 76% of total backlog.

Furthering our strategic efforts, we announced on June 1, 2021, that we had acquired Barber-Nichols which brings additional opportunities in the defense industry, but also in the aerospace/space industries as well. We are transforming as an organization.

Our ESG Sustainability Journey

We believe in the importance of environmental stewardship, social responsibility, and leading governance practices (“ESG”). As such, we have appointed Jeff Glajch, our Chief Financial Officer and Corporate Secretary, the lead officer with the responsibility to oversee and advance our ESG efforts. We recognize that our commitment to advancing ESG matters as an organization is critical as we manage the risks inherent in running a business, but we also appreciate that our efforts are centered on sustainability.

As we transform and grow Graham, we remain guided by our values and operating principles. We believe this provides the foundation for an organization that can change and evolve while also enduring as we have for over 85 years. I am always open to your input and look forward to future conversations.

Sincerely,

James R. Lines

Chief Executive Officer

Certain statements in this proxy statement contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “intends,” “anticipates,” “believes,” “opportunities,” “will,” “may,” and other similar words. All statements addressing operating performance, events, or developments that we expect or anticipate will occur in the future, including but not limited to, the integration and operation of Barber-Nichols, our growth, diversification strategy, markets, returns and solutions, and our ability to achieve our operating priorities are forward-looking statements and should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in our Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize or should any of our underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on our forward-looking statements. These forward-looking statements are not guarantees of future performance and speak only as of the date made, and except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained herein.

Notice of Annual Meeting

of Stockholders

|

Meeting Details:

| ||||||||||||

| Meeting Business

The principal business of the 2021 Annual Meeting of Stockholders (the “Annual Meeting”), as described in the accompanying proxy materials will be:

(1) Election of three director nominees;

(2) To approve, on an advisory basis, the compensation of our named executive officers;

(3) To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2022; and

(4) To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

|

Date: Wednesday, July 28, 2021

|

|

Place: www.proxydocs.com/GHM

In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions at the meeting. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person. | ||||||||

|

|

Time: 11:00 a.m. Eastern Time

| |||||||||||

|

|

Record Date: June 2, 2021 |

|||||||||||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JULY 28, 2021:

The Notice of Annual Meeting, Proxy Statement and the Annual Report are available at www.proxydocs.com/GHM

BY ORDER OF THE BOARD OF DIRECTORS

Jeffrey F. Glajch Vice President – Finance & Administration, Chief Financial Officer and Corporate Secretary | ||||||||||||

Dated: June 16, 2021

Vote Your Shares

How to Vote

Your vote is very important, and we hope that you will participate in the Annual Meeting. You are eligible to vote if you were a stockholder of record at the close of business on June 2, 2021. In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting. Please read the proxy statement and vote right away using any of the following methods.

Stockholders of Record:

|

Vote By Internet Before or During the Meeting Visit: www.proxypush.com/GHM and follow the instructions |

|

Vote By Telephone Call 1-866-256-0715 and follow the instructions |

|

Vote By Mail Sign, date, and return your proxy card, if you received one, using the enclosed envelope | |||||||||

Beneficial Stockholders:

If you are a beneficial stockholder, you will receive instructions from your brokerage firm, bank, broker-dealer, nominee, custodian, fiduciary or other nominee that you must follow in order for your shares to be voted. Your broker may not vote your shares for director nominees or on the advisory vote on executive compensation unless you provide your broker with voting instructions.

Table of Contents

To assist you in reviewing the proposals to be considered and voted upon at our annual meeting of stockholders (the “Annual Meeting”) to be held on July 28, 2021, we have summarized information contained elsewhere in this proxy statement or in our Annual Report on Form 10-K for the fiscal year ended March 31, 2021 (the “Annual Report”). This summary does not contain all of the information you should consider about Graham Corporation (the “Company”) and the proposals being submitted to stockholders at the Annual Meeting. We encourage you to read the entire proxy statement and Annual Report carefully before voting.

The Annual Meeting

| Date and Time: | Wednesday, July 28, 2021 11:00 a.m. Eastern Time | |

| Location: | Online via: www.proxydocs.com/GHM | |

| Record Date: | June 2, 2021 | |

In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions at the meeting. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person.

Meeting Agenda and Voting Matters

| Item | Proposal | Board Vote Recommendation |

Page Reference (for more information) | |||

| 1 |

Election of three director nominees named in this proxy statement | FOR each nominee | 7 | |||

| 2 |

Advisory vote on the compensation of our named executive officers (“say on pay”) | FOR | 45 | |||

| 3 |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2022 | FOR | 46 | |||

Directors and Nominees

|

Name |

Age | Recent Professional Experience | Board Committees |

|||||||

| James J. Barber, Ph.D.* |

67 | Independent Consultant and Principal of Barber Advisors, LLC | AC, NCGC | |||||||

| Alan Fortier*◆ |

64 | President of Fortier & Associates, Inc. | CC, NCGC** | |||||||

| James R. Lines◆ |

60 | Chief Executive Officer of the Company | — | |||||||

| James J. Malvaso* |

71 | Chairman of the Company’s Board; Former President and Chief Executive Officer of Toyota Material Handling North America | AC,CC, NCGC | |||||||

| Gerard T. Mazurkiewicz* |

74 | Tax Partner with Dopkins & Company, LLP | AC**, NCGC | |||||||

| Jonathan W. Painter* |

62 | Chair of Kadant Inc. | AC, CC | |||||||

| Lisa M. Schnorr*◆ |

55 | Senior Vice President and Project Lead, Digital Enablement for Constellation Brands, Inc. | AC, CC** | |||||||

* — Independent Director

◆ — Director Nominee

** — Chair

AC — Audit Committee

CC — Compensation Committee

NCGC — Nominating and Corporate Governance Committee

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 1 | |

|

Proxy Statement Summary • Our Business

|

Our Business

We are a global business that designs, manufactures and sells critical equipment for the energy, defense and chemical/petrochemical industries. Our energy markets include oil refining, cogeneration, and alternative power. For the defense industry, our equipment is used in nuclear propulsion power systems for the U.S. Navy. For the chemical and petrochemical industries, our equipment is used in fertilizer, ethylene, methanol and downstream chemical facilities.

Our global brand is built upon our world-renowned engineering expertise in vacuum and heat transfer technology, responsive and flexible service and high quality standards. We design and manufacture custom-engineered ejectors, vacuum pumping systems, surface condensers and vacuum systems. Our equipment can also be found in other diverse applications such as hydrogen fueling systems, compressed natural gas distribution or feeding systems, metal refining, pulp and paper processing, water heating, refrigeration, desalination, food processing, pharmaceutical, and heating, ventilating and air conditioning.

Stockholder Engagement

During 2020, members of management continued to engage with our stockholders on a variety of topics. Despite the pandemic, in 2020 we continued to hold virtual meetings with stockholders and analysts. The feedback gathered from these conversations helped inform the Board’s thinking and helped shape our disclosures in this proxy statement. Some examples of feedback we received and how we responded follow:

| What we heard |

How we responded | |

| A desire for increased proxy disclosure clarity |

We substantially enhanced our disclosures in this proxy statement, adding a summary section and using graphics to provide greater clarity and improve readability. | |

| A continued focus on the compensation of our named executive officers |

Even though we are allowed to utilize certain scaled disclosure requirements with respect to the compensation of our named executive officers, to provide transparency, we continue to provide enhanced compensation information in this proxy statement.

Further, as described in this proxy statement, in March 2021, pursuant to an amendment to the employment agreement with Jeffrey F. Glajch, a named executive officer, we revised the severance amounts payable in the event of a termination of Mr. Glajch’s employment with the Company within two years after a change in control. | |

| An interest in our approach to environment, social and governance matters |

We have expanded disclosures with respect to our approach to environment, social and governance (“ESG”) matters in this proxy statement.

To help ensure our accountability and progress in these areas, we have appointed Mr. Glajch, our Chief Financial Officer and Corporate Secretary, as the lead officer with responsibility for overseeing and advancing our efforts with respect to ESG initiatives.

In addition, in March 2021, we adopted a Human Rights Policy Statement and a Conflict Minerals Policy, each of which our suppliers and vendors are expected to comply with, as well as a Political Contributions Policy. These policies are further described in this proxy statement. | |

| 2 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

Questions and Answers About the Annual Meeting

Why am I receiving these proxy materials?

These proxy materials are being furnished to you in connection with the solicitation of proxies by our Board for the Annual Meeting to be held on Wednesday, July 28, 2021, at 11:00 a.m., Eastern Time, and at any adjournment or postponement thereof. The Annual Meeting will be conducted as a virtual meeting of stockholders by means of a live audio-only webcast. We believe that hosting a virtual meeting will enable greater stockholder participation from any location, especially in light of the ongoing pandemic. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person.

We made our proxy materials available to stockholders via the internet or in printed form if requested on or about June 16, 2021. Our proxy materials include the Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), the Notice of the Annual Meeting, this proxy statement and the Annual Report. If you requested and received paper copies of the proxy materials by mail, our proxy materials also include the proxy card. These proxy materials, other than the proxy card, can be accessed at www.proxydocs.com/GHM.

The Securities and Exchange Commission’s (the “SEC”) e-proxy rules allow companies to post their proxy materials on the internet and provide only a Notice of Internet Availability to stockholders as an alternative to mailing full sets of proxy materials except upon request. Similar to last year, we elected to use this notice and access model. Unless you previously indicated your preference to receive paper copies of our proxy statement and Annual Report, you should have received a Notice of Internet Availability. The Notice of Internet Availability includes information on how to access our proxy materials on the internet, how to vote and how to request a paper or email copy of the proxy materials at no extra charge this year or on an ongoing basis.

What am I voting on?

At the Annual Meeting, you will vote upon:

| (1) | the election of three director nominees identified in this proxy statement; |

| (2) | a proposal to approve, on an advisory basis, the compensation of our named executive officers; and |

| (3) | a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2022. |

Will there be any other items of business addressed at the Annual Meeting?

As of the date of this proxy statement, we are not aware of any other matter to be presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is intended that the holders of the proxies will act in accordance with their best judgment.

What must I do if I want to participate in the Annual Meeting?

You can participate in the Annual Meeting so long as you register in advance to attend the Annual Meeting at www.proxydocs.com/GHM. You will be asked to provide the control number located inside the shaded gray box on your Notice of Internet Availability or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. Please be sure to follow the instructions found on your Notice of Internet Availability, proxy card and/or voting instruction card and subsequent instructions that will be delivered to you via email.

By visiting www.proxydocs.com/GHM, pre-registering and then accessing the Annual Meeting as instructed, you will be able to participate in the Annual Meeting, vote your shares and ask questions during the meeting. However, if you do not comply with the procedures outlined above, you may not be admitted to the Annual Meeting.

As always, we encourage you to vote your shares prior to the Annual Meeting. This proxy statement furnishes you with the information you need in order to vote, whether or not you participate in the Annual Meeting.

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 3 | |

|

Questions and Answers about the Annual Meeting

|

Who may vote and how many shares can be cast?

If you owned shares of our common stock at the close of business on June 2, 2021, which is the record date for the annual meeting, then you are entitled to vote your shares at the Annual Meeting. At the close of business on the record date, we had 10,693,486 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote on each proposal.

How do I vote?

Stockholder of Record: Shares Registered in Your Name. If on the record date, your shares of our common stock were registered directly in your name with our transfer agent, then you are a stockholder of record and your shares will be voted as you indicate. If you are a stockholder of record, there are four ways to vote:

| • | By internet at www.proxypush.com/GHM. We encourage you to vote this way. |

| • | By touch tone telephone: call toll-free at 1-866-256-0715. |

| • | By completing and mailing your proxy card. |

| • | By voting during the Annual Meeting before the polls close: To be admitted to the Annual Meeting and vote your shares, you must register and provide the control number as described in the Notice of Internet Availability or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. |

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote to ensure your vote is counted. You may still attend and vote during the meeting if you have already voted by proxy. Only the latest vote you submit will be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank. If on the record date, your shares of our common stock were held in an account at a brokerage firm, bank, dealer or other similar organization which we collectively refer to as a broker, then you are the beneficial owner of shares held in “street name” and these proxy materials are being made available to you by that organization along with a voting instruction card. As a beneficial owner, you must vote your shares in the manner prescribed by your broker. Your broker has enclosed or otherwise provided a voting instruction card for you to use in directing the broker how to vote your shares. Your shares will be voted as you indicate. Check the voting instruction card used by that organization to see if it offers internet or telephone voting.

If you hold your shares in street name, you will receive instructions from your broker, bank or nominee that you must follow in order to submit your voting instructions and have your shares voted at the Annual Meeting. If you want to vote in person virtually at the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the Annual Meeting as described above so that your vote will be counted if you later decide not to attend or are unable to attend the Annual Meeting.

What happens if I do not give specific voting instructions?

If you are a stockholder of record and you indicate when voting over the internet or by telephone that you wish to vote as recommended by our Board or sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by our Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then a “broker non-vote” occurs. In that case, the broker has discretionary authority to vote your shares with respect to the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm (because it is considered a “routine” proposal under the rules of the New York Stock Exchange (the “NYSE”), but cannot vote your shares on any other matters being considered at the Annual Meeting (because they are considered to be non-routine proposals under NYSE rules). When our inspector of election tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. We therefore encourage you to provide voting instructions on each proposal to the organization that holds your shares.

| 4 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Questions and Answers about the Annual Meeting

|

What constitutes a quorum for the Annual Meeting?

A quorum is required for our stockholders to conduct business at the Annual Meeting. Pursuant to our amended and restated by-laws, the holders of record of a majority of the shares of our common stock present in person or by proxy and entitled to vote at the Annual Meeting will constitute a quorum.

What vote is required to approve each proposal and how does the Board recommend that I vote?

The vote required to approve each proposal, and the Board’s recommendation with respect to each proposal are described below:

| Proposal Number |

Proposal Description | Board Recommendation |

Vote Required | Effect of Abstentions |

Effect of Broker Non-Votes | |||||

| One |

Election of the three director nominees identified in this proxy statement | FOR each nominee |

Plurality of the shares present, in person or by proxy, and entitled to vote at the Annual Meeting(1) | None | None | |||||

| Two |

Approval, on an advisory basis, of the compensation of our named executive officers | FOR | Majority of the shares eligible to be cast by holders present, in person or by proxy, and entitled to vote at the Annual Meeting(2) | Same effect as a vote cast against the proposal | None | |||||

| Three |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2022 | FOR | Majority of the shares eligible to be cast by holders present, in person or by proxy, and entitled to vote at the Annual Meeting(3) | Same effect as vote cast against proposal | N/A because this proposal is a routine matter on which brokers may vote | |||||

| (1) | Our stockholders elect directors by a plurality vote, which means that the director nominees receiving the most votes will be elected. However, our Corporate Governance Guidelines provide that any nominee for director who receives a greater number of votes “withheld” from his or her election than “for” such election must tender his or her resignation for consideration by the Nominating and Corporate Governance Committee of our Board. The Nominating and Corporate Governance Committee will recommend to the Board the action to be taken with respect to such resignation. |

| (2) | The advisory vote to approve the compensation of our named executive officers is not binding upon our Board or the Compensation Committee of our Board. However, the Board and the Compensation Committee will consider the outcome of this vote when making future compensation decisions. |

| (3) | We are presenting the appointment of Deloitte & Touche LLP to our stockholders for ratification. The Audit Committee of our Board will consider the outcome of this vote in its future discussions regarding the appointment of our independent registered public accounting firm. |

How can I obtain a stockholder list?

A stockholder list will be available for examination by our stockholders during the Annual Meeting and at our principal executive offices at 20 Florence Avenue, Batavia, New York 14020, during ordinary business hours throughout the ten-day period prior to the Annual Meeting for any purpose germane to the meeting.

Can I change or revoke my vote?

Your attendance at the Annual Meeting will not automatically revoke your proxy. However, if you are a stockholder of record you can change or revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | timely voting again via the internet or by telephone; |

| • | delivering a timely written notice of revocation to our Corporate Secretary at Graham Corporation, 20 Florence Avenue, Batavia, New York 14020; |

| • | completing, signing, dating and mailing a timely new proxy card to the address above; or |

| • | attending the Annual Meeting and voting again. |

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 5 | |

|

Questions and Answers about the Annual Meeting

|

Only your last-submitted, timely vote will count at the Annual Meeting.

If you are a street name holder, you must contact your broker to receive instructions as to how you may revoke your proxy instructions.

We encourage you to vote in advance of the Annual Meeting to ensure your vote is counted should you be unable to participate in the Annual Meeting. Stockholders who have pre-registered to attend the Annual Meeting and who have not voted their shares prior to the Annual Meeting or who wish to change their vote will be able to vote their shares electronically at the Annual Meeting while the polls are open. If you properly provide your proxy in time to be voted at the Annual Meeting, it will be voted as you specify unless it is properly revoked prior thereto. If you properly provide your proxy but do not include your voting specifications, the shares represented by the proxy will be voted in accordance with the recommendations of the Board, as described in this proxy statement.

Who is paying for this proxy solicitation?

This proxy solicitation is made by our Board on our behalf, and we will bear the cost of soliciting proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone or other means of communication. We will not compensate our directors, officers or employees for making proxy solicitations on our behalf. We will provide persons holding shares in their name or in the names of nominees, which in either case are beneficially owned by others, soliciting materials for delivery to those beneficial owners and will reimburse the record owners for their expenses in doing so.

Can I ask questions at the annual meeting?

If you registered in advance and attend the Annual Meeting, you may submit questions during the Annual Meeting. We encourage you to submit questions at www.proxydocs.com/GHM after logging in with your unique control number provided in connection with your pre-registration for the Annual Meeting.

We expect to respond to questions during the Annual Meeting that are pertinent to meeting matters as time permits. We may group together questions that are substantially similar to avoid repetition.

How can I find out the voting results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. We will publish the voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days after the Annual Meeting.

Where can I obtain additional information?

You can obtain, free of charge, a copy of our annual report on Form 10-K for the fiscal year ended March 31, 2021 (“fiscal year 2021”) by:

| • | accessing our website at http://www.graham-mfg.com/annual-meeting-proxy-materials; |

| • | writing to us at: Graham Corporation, Attention: Annual Report Request, 20 Florence Avenue, Batavia, New York 14020; or |

| • | telephoning us at (585) 343-2216. |

You can also obtain a copy of our annual report on Form 10-K and all other reports and information that we file with, or furnish to, the SEC from the SEC’s EDGAR database located at www.sec.gov.

| 6 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Proposal One: Election of Directors • Nominees Proposed for Election as Directors at the Annual Meeting

|

Election of Directors

The Board currently consists of seven members. Our amended and restated by-laws provide for a classified board of directors consisting of three classes of directors, with each class serving a staggered three-year term. As a result, stockholders elect only a portion of our Board each year. The terms of three of our directors, Alan Fortier, James R. Lines, and Lisa M. Schnorr, will expire at the Annual Meeting.

The Nominating and Corporate Governance Committee of our Board has nominated Alan Fortier, James R. Lines, and Lisa M. Schnorr for re-election as directors. If elected, each of Messrs. Fortier and Lines and Ms. Schnorr will hold office for a three-year term expiring in 2024 or until his or her successor is duly elected and qualified. Our Board does not contemplate that any of the nominees will be unable to serve as a director, but if that contingency should occur before the proxies are voted, the designated proxies reserve the right to vote for such substitute nominee(s) as they, in their discretion, determine. Our amended and restated by-laws do not permit re-election after a director reaches the age of 75.

The Board unanimously recommends a vote FOR the election of each of Messrs. Fortier and Lines and Ms. Schnorr as a director to serve for a three-year term expiring in 2024.

Nominees Proposed for Election as Directors at the Annual Meeting

| Alan Fortier

Mr. Fortier has served as President of Fortier & Associates, Inc., a strategy and profit improvement consulting firm focused on petrochemicals and capital goods companies, since 1988. He has also been a Strategic Advisory Board member for Genstar Capital, a middle market private equity group, since January 2019. In addition, between 2007 and 2016, Mr. Fortier was a guest lecturer at Columbia Business School’s MBA and Executive Education programs.

|

President of Fortier & Associates, Inc.

AGE DIRECTOR SINCE

64 2008

COMMITTEES ▶ Nominating and Corporate Governance (Chair) ▶ Compensation | |||||||

| Qualifications |

||||||||

| Mr. Fortier brings to the Board more than 35 years of global industrial experience as a strategy and execution consultant, educator and manager, having helped create value for hundreds of businesses while exceeding aggressive profit targets. Our Board and management team benefit from his extensive background in our served markets, including energy, petrochemicals, chemicals and large engineering firms, as well as his extensive experience advising boards and senior executives of global capital goods businesses on business strategy, mergers and acquisitions, global growth, pricing, organizational development and management control.

|

||||||||

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 7 | |

|

Proposal One: Election of Directors • Nominees Proposed for Election as Directors at the Annual Meeting

|

| James R. Lines

Mr. Lines became our Chief Executive Officer in January 2008, having previously served as our President and Chief Operating Officer from June 2006 to June 2021. Mr. Lines has served the Company in various capacities since 1984, including Vice President and General Manager, Vice President of Engineering, and Vice President of Sales and Marketing. Prior to joining our management team, he served us as an application engineer and sales engineer as well as a product supervisor. Mr. Lines has been an independent director of Superior Drilling Products (NYSE American: SDPI) since December 2016, where he chairs the audit committee and is a member of the nominating and corporate governance committee and compensation committee.

|

Chief Executive Officer of the Company

AGE DIRECTOR SINCE

60 2006 | |||||||

| Qualifications |

||||||||

| As our Chief Executive Officer, and as a result of his day-to-day leadership of the business, Mr. Lines provides the Board with valuable insight regarding the operations of our Company and our management team and he performs a critical role in the Board’s discussions regarding strategic planning and development. Our Board also benefits from his historical knowledge of the Company and his broad and in-depth understanding of our markets and customers. Mr. Lines has served the Company in various executive capacities for more than 20 years, and has more than 30 years of experience interacting with our customers, engineering contractors, competitors and similar companies serving the energy markets.

|

||||||||

| Lisa M. Schnorr

Ms. Schnorr has served as a Senior Vice President for Constellation Brands, Inc. (NYSE: STZ), a leading international producer and marketer of beer, wine and spirits, since January 2018 and has held the role of Project Lead, Digital Enablement for Constellation Brands since October 2019. Ms. Schnorr joined Constellation Brands in May 2004 as Director, Investor Relations and served in various roles including Vice President, JV Business Development from January 2010 to April 2011, Vice President, Compensation & HRIS from May 2011 to January 2014, Senior Vice President, Total Rewards from January 2014 to July 2015, Corporate Controller from July 2015 to January 2018 and most recently served as Chief Financial Officer for Constellation Brands’ Wine and Spirits Division from January 2018 to October 2019.

|

Senior Vice President and Project Lead, Digital Enablement for Constellation Brands, Inc.

AGE DIRECTOR SINCE

55 2014

COMMITTEES ▶ Compensation (Chair) ▶ Audit | |||||||

| Qualifications |

||||||||

| With her background in human resources, investor relations and finance with large public companies, Ms. Schnorr offers a global business and organizational perspective to the Board. The Board believes that Ms. Schnorr’s background and expertise enables her to guide us through a continued period of organic and acquisition-related growth and allows her to provide insight and leadership to our Compensation Committee.

|

||||||||

| 8 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Proposal One: Election of Directors • Directors Whose Terms Do Not Expire at the Annual Meeting

|

Directors Whose Terms Do Not Expire at the Annual Meeting

| James J. Malvaso

After his retirement as President and Chief Executive Officer of Toyota Material Handling North America, a manufacturer and distributor of Toyota material handling equipment, and Managing Officer of Toyota Industries Corporation, positions he held from April 2010 until March 2012, Mr. Malvaso acted as a senior advisor to Toyota Material Handling Group until May 2013. From 1997 until 2010, Mr. Malvaso served as the Chair, President and Chief Executive Officer of The Raymond Corporation, a subsidiary of Toyota and the North American market leader in electric warehouse trucks, located in Greene, New York.

|

Chairman of the Company’s Board; Former President and Chief Executive Officer of Toyota Material Handling North America

AGE DIRECTOR SINCE

71 2003

TERM EXPIRES

2022

COMMITTEES ▶ Audit ▶ Compensation ▶ Nominating and Corporate Governance | |||||||

| Qualifications |

||||||||

| Mr. Malvaso has proven business acumen, having successfully served as the chief executive officer of large, complex businesses with global operations. His experience with a major industrial equipment company is particularly helpful to our Board in understanding the challenges of global manufacturing, distribution and sales as it relates to the business and strategy of the Company.

|

||||||||

| Jonathan W. Painter

Mr. Painter has served as the Chair, since July 2019, and a director, since January 2010, of Kadant Inc. (NYSE: KAI), a leading global supplier of components and engineered systems used in process industries, including the pulp and paper industry. From September 2009 to March 2019, Mr. Painter served as President of Kadant and from January 2010 to June 2019, Mr. Painter also served as the Chief Executive Officer of Kadant. Prior to becoming its President, Mr. Painter served as an Executive Vice President from 1997 to September 2009, with supervisory responsibility for Kadant’s stock-preparation and fiber-based products businesses from March 2007 to September 2009.

|

Chair of Kadant Inc.

AGE DIRECTOR SINCE

62 2014

TERM EXPIRES

2022

COMMITTEES ▶ Audit ▶ Compensation | |||||||

| Qualifications |

||||||||

| Mr. Painter brings valuable experience to the Board and management as an executive officer of a public company that, similar to us, is in the business of designing, manufacturing and marketing specialized, engineered equipment. The Board believes that Mr. Painter’s diverse experience in operations, finance, mergers and acquisitions and corporate strategy enables him to provide critical insight to the Board and management that will help us to achieve our strategic goals.

|

||||||||

| James J. Barber, Ph.D.

Dr. Barber has been an independent consultant and the principal of Barber Advisors, LLC, a consulting business advising firms and non-profits in the areas of strategy, management, marketing and operations, since September 2007. From January 2000 to May 2007, Dr. Barber was the President and Chief Executive Officer of Metabolix, Inc. (NASDAQ: MBLX), a bioscience company focused on plastics, chemicals and energy. He was responsible for transforming Metabolix, Inc. from a research boutique into a leader in “clean tech” and industrial biotechnology.

Dr. Barber has served as the independent non-executive Chair of Itaconix plc (formerly Revolymer plc) (LON: ITX), a specialty chemicals company, since December 2018, and served as a non-executive director of Itaconix plc from September 2016 to November 2018. He has also served as a director of numerous private companies.

|

Independent Consultant and

AGE DIRECTOR SINCE

67 2011

TERM EXPIRES

2023

COMMITTEES ▶ Audit ▶ Nominating and Corporate Governance | |||||||

| Qualifications |

||||||||

| Dr. Barber brings to our Board substantial executive level leadership experience and a deep understanding of product and business development in highly technical industries and alternative energy markets. Dr. Barber also has significant experience in structuring both joint venture and acquisition transactions.

|

||||||||

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 9 | |

|

Proposal One: Election of Directors • Directors Whose Terms Do Not Expire at the Annual Meeting

|

| Gerard T. Mazurkiewicz

Mr. Mazurkiewicz has been a Tax Partner with Dopkins & Company, LLP, a regional accounting firm located in Buffalo, New York, since 2004. Prior to his tenure at Dopkins & Company, LLP, Mr. Mazurkiewicz spent more than 32 years with KPMG, LLP, and was the partner in charge of KPMG’s upstate New York/Albany tax practice prior to his retirement in 2002. Mr. Mazurkiewicz also serves as a director of a number of private companies and has served on numerous not-for-profit boards and foundations. Mr. Mazurkiewicz is a member of the American Institute of Certified Public Accountants and the Buffalo Chapter of the New York State Society of Certified Public Accountants.

|

Tax Partner with Dopkins & Company, LLP

AGE DIRECTOR SINCE

74 2007

TERM EXPIRES

2023

COMMITTEES ▶ Audit (Chair) ▶ Nominating and Corporate Governance | |||||||

| Qualifications |

||||||||

| With his background of significant accounting and financial experience, Mr. Mazurkiewicz brings to the Board substantial leadership skills and an understanding of how to provide value related to finance, management, operations, and risk.

|

||||||||

| 10 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Corporate Governance • Director Independence

|

Our Corporate Governance Guidelines provide that the independence standards of the NYSE govern the independence determinations for the members of our Board. The Board has affirmatively determined that each of Messrs. Barber, Fortier, Malvaso, Mazurkiewicz, Painter and Ms. Schnorr is independent and has no material relationship with us as required by the independence standards of the NYSE. As our employee, Mr. Lines, our Chief Executive Officer, is not independent.

Mr. Malvaso, a non-executive independent director, serves as Chair of the Board. Our Board believes that its leadership structure, with a non-executive Chair position separate from our Chief Executive Officer, provides appropriate, independent oversight of management. As Chair of our Board, Mr. Malvaso presides at all meetings of the Board and stockholders; presides during regularly held sessions with only the independent directors; encourages and facilitates active participation of all directors; develops the calendar of and agendas for Board meetings in consultation with our Chief Executive Officer and other members of the Board; determines, in consultation with our Chief Executive Officer, the information that should be provided to the Board in advance of meetings; and performs any other duties requested by the Board from time to time.

Committees and Meetings of the Board; Meeting Attendance

Our Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The duties and responsibilities of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are set forth in their respective charters and are described below. The current charter of each committee is available on our website at www.graham-mfg.com under the heading “Investor Relations” and the subheading “Corporate Governance.” Information contained on our website is not a part of this proxy statement.

The following table lists the committees of the Board, the Chairs of each committee, the directors who currently serve on them and the number of committee meetings held in fiscal year 2021.

| Committee Membership | ||||||||||

| Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | |||||||

| James J. Barber, Ph.D. |

|

|

|

|

|

| ||||

| Alan Fortier |

|

|

|

|

|

| ||||

| James J. Malvaso |

|

|

|

|

|

| ||||

| Gerard T. Mazurkiewicz |

|

|

|

|

|

| ||||

| Jonathan W. Painter |

|

|

|

|

|

| ||||

| Lisa M. Schnorr |

|

|

|

|

|

| ||||

| Meetings in fiscal year 2021: |

|

|

|

5 | 3 | 4 | ||||

= Chairman

= Chairman

= Member

= Member

During fiscal year 2021, the Board held a total of seven meetings. Each director attended at least 75% of the aggregate of the total number of meetings of the Board, and the total number of meetings of all committees of the Board on which he or she served.

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 11 | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

The non-management directors meet without members of management present during regularly scheduled executive sessions and at such other times as they deem necessary or appropriate. The Chair of the Board presides over these executive sessions.

Our policy requires that each director attend our annual meeting of stockholders or provide the Chair of the Board with advance notice of the reason for not attending. All of our directors attended our 2020 annual meeting of stockholders.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has affirmatively determined that each member of the Audit Committee satisfies the independence standards of the NYSE applicable to audit committee members and applicable SEC rules. The Board has also determined that Mr. Mazurkiewicz qualifies as an “audit committee financial expert” in accordance with applicable SEC rules based on his education and experience as a certified public accountant and extensive professional work experience as described in his biography under “Proposal One: Election of Directors.”

The Audit Committee reviews with Deloitte & Touche LLP, our independent registered public accounting firm, our financial statements and internal control over financial reporting, Deloitte & Touche LLP’s auditing procedures and fees, and the possible effects of professional services upon the independence of Deloitte & Touche LLP.

The Audit Committee works closely with the Board, our executive management team and our independent registered public accounting firm to assist the Board in overseeing our accounting and financial reporting processes and financial statement audits. In furtherance of these responsibilities, the Audit Committee assists the Board in its oversight of:

| • | the integrity of our financial statements and internal controls; |

| • | our compliance with legal and regulatory requirements; |

| • | the qualifications and independence of our independent registered public accounting firm; |

| • | the performance of our independent registered public accounting firm; |

| • | the planning for and performance of our internal audit function; and |

| • | risk management (including risk management relating to cybersecurity). |

In addition, the Audit Committee’s responsibilities include reviewing and overseeing any transactions between us and any related person as defined by the SEC’s rules and discussing our guidelines and policies with respect to risk assessment and risk management. The Audit Committee is also responsible for preparing the Audit Committee’s report that the SEC’s rules require to be included in our annual proxy statement, and performing such other tasks that are consistent with the Audit Committee’s charter. The Audit Committee’s report appears under the heading “Report of the Audit Committee.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee evaluates, interviews and nominates candidates for election to the Board and is responsible for oversight of our corporate governance practices.

When identifying director nominees, the Nominating and Corporate Governance Committee solicits suggestions from incumbent directors, management and stockholders. In identifying and evaluating nominees, the Nominating and Corporate Governance Committee seeks candidates possessing the highest standards of personal and professional ethics and integrity; practical wisdom, independent thinking, maturity and the ability to exercise sound business judgment; skills, experience and demonstrated abilities that help meet the current needs of the Board; and a firm commitment to the interests of our stockholders. Although the Nominating and Corporate Governance Committee does not maintain a specific written diversity policy, it recognizes the value of diversity and seeks diverse candidates when possible and appropriate and considers diversity in its review of candidates. The Nominating and Corporate Governance Committee believes that diversity includes not only gender and ethnicity, but the various perspectives that come from having differing geographic and cultural backgrounds, viewpoints and life experiences.

In addition, the Nominating and Corporate Governance Committee takes into consideration such other factors as it deems appropriate. These factors may include knowledge of our industry and markets, experience with businesses and other organizations of comparable size, the interplay of the nominee’s experience with the experience of other

| 12 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

members of the Board, and the extent to which the candidate would be a desirable addition to the Board and any of its committees. The Nominating and Corporate Governance Committee may consider, among other factors, experience or expertise in our industry, global business, science and technology, competitive positioning, corporate governance, risk management, finance or economics, and public affairs.

Stockholders entitled to vote in the election of directors at any annual meeting may recommend candidates for consideration by the Nominating and Corporate Governance Committee as potential nominees by submitting written recommendations to the attention of our Corporate Secretary at the following address: Graham Corporation, 20 Florence Avenue, Batavia, New York 14020. Stockholder recommendations must contain: (i) each candidate’s name, age, business and residence addresses; (ii) the candidate’s principal occupation or employment; (iii) each candidate’s written consent to serve as a director, if elected; (iv) whether each candidate would be an independent director if elected, and the basis therefore, under the NYSE listing standards; (v) a description of the candidate’s qualifications to be a director; and (vi) such other information regarding each candidate as would be required to be included in the proxy statement pursuant to the SEC’s rules. Any stockholder submitting a recommendation must provide his or her own name and address as they appear on our books and records, as well as the class and number of our shares owned of record and the dates he or she acquired such shares. In addition, any stockholder submitting a recommendation must provide (i) a description of all arrangements or understandings between the stockholder and each candidate and any other person pursuant to which the nominations were made; (ii) the identification of any person retained by the stockholder or by any candidate, or any person acting on his or her behalf to make solicitations for the purpose of electing such candidate and a brief description of the terms of such arrangement; (iii) a description of any arrangement, the effect or intent of which is to mitigate loss, manage risk or benefit from changes in the Company’s share price, or increase or decrease the voting power of the stockholder or beneficial owner with respect to the Company’s shares, and the stockholder’s agreement to notify the Company in writing within five business days after the record date for such meeting of any such arrangement in effect as of the record date for the meeting; and (iv) any such information regarding the stockholder as would be required to be included in a proxy statement or provided to the Company pursuant to the SEC’s rules. The Nominating and Corporate Governance Committee will evaluate director candidates proposed by stockholders using the same criteria, and in the same manner, as described above for other potential nominees.

Compensation Committee

The Compensation Committee annually reviews and approves the goals and objectives relevant to the compensation of the Chief Executive Officer, evaluates the Chief Executive Officer’s performance and either as a committee or with the other independent directors of the Board, determines and approves the Chief Executive Officer’s compensation levels. The Compensation Committee also annually reviews and approves salaries, incentive cash awards and other forms of compensation paid to our other executive officers, approves recipients of equity-based awards and establishes the number of shares and other terms applicable to such awards. The Compensation Committee also construes the provisions of and generally administers the 2020 Graham Corporation Equity Incentive Plan (the “Equity Incentive Plan”), and any successor plan thereto. The Compensation Committee operates pursuant to its charter and may delegate its authority or responsibility to one or more subcommittees.

The Compensation Committee also reviews and makes recommendations regarding the compensation paid to the Board. More information about the compensation of our directors is set forth under the heading “Director Compensation.” The Compensation Committee annually conducts a performance evaluation of its operation and function and recommends any proposed changes to the Board for approval.

In addition, the Compensation Committee is responsible for reviewing and discussing with management the Compensation Discussion and Analysis that is included in our annual proxy statement and performing such other tasks that are consistent with its charter.

The Compensation Committee recognizes the importance of using an independent consultant that provides services solely to the Compensation Committee and not to management. The Compensation Committee engaged an independent compensation consultant in fiscal year 2021. For more information on the role of the Compensation Committee in determining executive compensation, including its use of an independent consultant, see Compensation Discussion and Analysis under the heading “Executive Compensation.”

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 13 | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to promote the effective functioning of the Board in its governance of our business and corporate operations. The Corporate Governance Guidelines are available on our website at www.graham-mfg.com under the heading “Investor Relations” and the subheading “Corporate Governance.”

Political Contribution Policy Statement

In March 2021, the Board adopted a political contribution policy statement, which outlines the Company’s policies, procedures and philosophy regarding its political contributions and activities. It is the Company’s policy not to make independent political expenditures in support of the election or defeat of particular candidates and not to maintain a political action committee. This policy is available on our website at www.graham-mfg.com under the heading “About Graham” and the subheading “Social Responsibility.”

The Board’s Role in Risk Oversight

The Board oversees our risk profile and management’s processes for managing risk, primarily through the Board’s committees. Our Audit Committee focuses on financial risks, including those that could arise from our accounting and financial reporting processes. Additionally, our Audit Committee monitors and directs the formal risk management projects implemented by management. Our Nominating and Corporate Governance Committee focuses on the management of risks associated with board organization, membership and structure, corporate governance, and the recruitment and retention of talented Board members. Our Compensation Committee focuses on the management of risks that could arise from our compensation policies and programs and, in particular, our executive compensation programs and policies.

As part of its risk oversight responsibilities, the Board and its committees review the policies and processes that senior management uses to manage our risk exposure. In doing so, the Board and its committees review our overall risk function and senior management’s establishment of appropriate systems and processes for managing areas of material risk to the Company, including, but not limited to, operational, financial, legal, regulatory, strategic and information technology risks (including with respect to cybersecurity).

Communications from Stockholders and other Interested Parties

Stockholders and other interested parties who wish to contact the Board or an individual director, including the independent Chair of the Board or independent directors as a group, should send their communications to the attention of the Corporate Secretary, Graham Corporation, 20 Florence Avenue, Batavia, New York 14020. The Corporate Secretary will forward all such communications as directed unless the communication is inappropriate.

| 14 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Environmental and Social Matters • Our Employees

|

Environmental and Social Matters

To help ensure our accountability and progress, we have appointed Mr. Glajch, our Chief Financial Officer and Corporate Secretary, as the lead officer with responsibility for overseeing and advancing the Company’ efforts with respect to ESG initiatives. In such capacity, Mr. Glajch reviews our ESG efforts with the Board and the various Board committees as appropriate.

The Company’s goal is to be the preferred place to work in our industry, and to attract the best people by creating a culture that is exciting, creative, fun and embraces continuous improvement. The Company’s team members are viewed as an expandable resource and an asset of the Company. We believe that employee development is vital to our continued success and we support the development of our employees through programs such as our internal weld school training, our partnerships for external weld training, our tuition assistance program, and management training classes. Our management is continuously focused on developing an inclusive and respectful work environment where our employees are highly engaged and motivated. Management regularly engages with employees on a broad range of topics, including corporate culture, diversity and inclusion, health and safety, training and development, and compensation and benefits. Safety of our employees is our top priority.

In response to the COVID-19 pandemic, we took steps to ensure the health and safety of our employees, including restricting business travel and site visitors, implementing remote working for certain office employees, deep cleaning of our facilities, prohibiting group gatherings, and encouraging hygiene practices advised by health authorities. We continue to enhance our practices to remain aligned with state and federal guidelines. In addition, we committed to and continued to fully pay our employees, even while our operations were partially or fully shutdown from late March 2020 to the end of May 2020.

We believe that to be successful we need to push ourselves to do our best, for our customers, for our stockholders, for the Company, for ourselves, for those around us, and for the world that we all share. We are committed to supporting the communities in which we do business by leveraging the power of our Company through donations, scholarships, education and participation with certain charitable organizations. We strive to use our capabilities, reach and resources to make a lasting difference in the world.

We believe it is our responsibility to respect human rights in our operations, including, among other things, by opposing human trafficking and the exploitation of children. Accordingly, in March 2021, we adopted a Human Rights Policy Statement to emphasize our strong commitment to human rights. This policy is available on our website at www. graham-mfg.com under the heading “About Graham” and the subheading “Social Responsibility.” We expect our business partners to also treat workers fairly and not engage in human rights abuses.

As another part of being a good corporate citizen, in March 2021, we adopted a Conflict Minerals Policy. This policy, available on our website at graham-mfg.com under the heading “About Graham” and the subheading “Social Responsibility”, is intended to support our commitment to sourcing components and materials from companies that share our values around human rights and ethics. We also communicate to our suppliers our expectation that they will cooperate with our efforts in this area.

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 15 | |

|

Environmental and Social Matters • Environmental

|

We believe that a focus on environmental responsibility is fundamental and integral to the work we do every day to serve our customers, create value for our stockholders, and benefit our global community. We have taken steps at our main operations in Batavia, New York to improve energy efficiencies and air quality that are intended to lessen our impact on the environment. In addition, during fiscal 2020, we initiated a capital project to recycle production related wastewater at our Batavia, New York facility. Further, in addition to serving mature fossil-based end markets, we are also entrenched in and support the development of emerging and transformative end markets that rely on alternate and renewable energy sources.

| 16 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Executive Officers

|

As of June 2, 2021, we were served by the following executive officers and Section 16 officers, each of whom was appointed by the Board:

James R. Lines, age 60, became our Chief Executive Officer in January 2008 and served as our President and Chief Operating Officer from June 2006 to June 2021. Further information about Mr. Lines is set forth under “Proposal One: Election of Directors.”

Daniel J. Thoren, age 57, became our President and Chief Operating Officer in June 2021. Prior to joining the Company, Mr. Thoren had been employed by Barber-Nichols Inc. (“BNI”), a premier supplier of specialty turbomachinery, pumps and electronic drives that address critical applications for the defense and aerospace/space industries, from 1991 until June 2021 and served in progressively increasing roles, including his service as BNI’s President and Chief Executive Officer from 1997 until May 2021 and Chairman of the Board of Directors of BNI through June 2021.

Jeffrey F. Glajch, age 58, became our Vice President—Finance & Administration and Chief Financial Officer in March 2009 and our Corporate Secretary in June 2011. Since March 2021, Mr. Glajch has served on the advisory board of M42, a private company utilizing artificial intelligence to assist companies in identifying healthcare fraud. From October 2006 until February 2009, he served as the Chief Financial Officer of Nukote International, a privately held global re-manufacturer of printing and imaging products. Previously, between June 2000 and May 2006, Mr. Glajch was the Chief Financial Officer of Fisher Scientific Canada, a global healthcare and laboratory equipment company.

Matthew Malone, age 34, became our Vice President—Barber-Nichols in June 2021. Prior to joining the Company, Mr. Malone served as the President and Chief Executive Officer of BNI from May 2021 through June 2021, having previously served as BNI’s Vice President of Operations from May 2020 to May 2021, Project Management Office Manager from November 2017 to May 2020, and Project Engineer from July 2015 to November 2017.

Alan E. Smith, age 54, became our Vice President and General Manager—Batavia in July 2015. Mr. Smith served as our Vice President of Operations from July 2007 until July 2015. Previously, from 2005 until July 2007, Mr. Smith served as Director of Operations for Lydall, Inc., a designer and manufacturer of specialty engineering products. Prior to that, he had been employed by us for fourteen years, progressing from Project Engineer to Engineering Manager.

Jennifer R. Condame, age 56, became our Chief Accounting Officer in July 2008. She also serves as our Corporate Controller, a position she has held since 1994. From 1992 to 1994, she was our Manager of Accounting and Financial Reporting. Prior to joining us in 1992, Ms. Condame was employed as an Audit Manager by Price Waterhouse, a predecessor to PricewaterhouseCoopers LLP.

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 17 | |

|

Executive Compensation • Compensation Discussion and Analysis

|

As a smaller reporting company under the Exchange Act we are not required to provide certain disclosures pursuant to Item 402 of Regulation S-K, however, we have elected to provide such executive compensation information in accordance with certain scaled disclosure requirements allowed of smaller reporting companies to provide transparency with respect to the compensation of our named executive officers.

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis (the “CD&A”), provides information about the compensation programs for certain of our executive officers named in the fiscal year 2021 Summary Compensation Table. These named executive officers are:

| • | James R. Lines, our Chief Executive Officer; |

| • | Jeffrey F. Glajch, our Vice President - Finance & Administration, Chief Financial Officer and Corporate Secretary; and |

| • | Alan E. Smith, our Vice President and General Manager - Batavia. |

This CD&A includes the philosophy and objectives of the Compensation Committee of our Board, descriptions of each of the elements of our executive compensation programs, and the basis for the compensation decisions we made during fiscal year 2021.

Executive Summary

Fiscal Year 2021 Results

The Compensation Committee’s philosophy focuses on aligning the interests of our named executive officers with those of our stockholders by rewarding performance that enhances the objective of increasing both current and long-term stockholder value. Our executive compensation programs are designed to provide a strong link between the amounts earned by our named executive officers and Company and individual performance.

During fiscal year 2021, our named executive officers continued to implement our strategic plan to diversify, increase productivity, improve processes, and grow our market share in our existing businesses.

We are experiencing weakness in our energy markets, however, our diversification in U.S. Navy work will help mitigate the commercial market challenges. The COVID-19 pandemic has resulted in a significantly volatile economic and capital markets environment, which makes the future performance of our core markets less predictable. Highlights of our financial results for fiscal year 2021 are as follows:

| • | Net sales for fiscal year 2021 were $97.5 million, up 8% compared with $90.6 million in the fiscal year ended March 31, 2020 (“fiscal year 2020”); and |

| • | Net income for fiscal year 2021 was $2.4 million, or $0.24 per diluted share, compared to net income for fiscal year 2020 of $1.9 million, or $0.19 per diluted share. |

During fiscal year 2021:

| • | Corporate resources continued to support stable revenue markets, such as those for the U.S. Navy; |

| • | We returned $4.39 million to our stockholders as dividends in fiscal year 2021, compared with $4.25 million in fiscal year 2020; |

| • | We secured $69 million in new orders for the U.S. Navy and expanded backlog for that market to $104 million; and |

| • | We ended the fiscal year with a solid balance sheet that was free of bank debt, providing us substantial financial flexibility. |

| 18 | GRAHAM CORPORATION 2021 PROXY STATEMENT | |

|

Executive Compensation • Compensation Discussion and Analysis

|

In line with our pay-for-performance philosophy, in fiscal year 2021, our named executive officers realized the following compensation based on our fiscal year 2021 financial performance and their individual performance:

| • | As described more fully under the heading “Annual Cash Incentive Compensation” in this CD&A, for fiscal year 2021 the Compensation Committee set challenging targets for two key financial metrics: net income and bookings. Our performance level of the net income metric exceeded target and met the maximum level for the bookings metric, despite the unprecedented pandemic and its negative impact on our markets. These levels of Company performance, as well as our named executive officers’ achievement against their individual goals, resulted in the payment of annual cash incentive compensation above target levels. We report the annual cash incentive compensation earned by each of the named executive officers during fiscal year 2021 in the “Non-Equity Incentive Plan Compensation” column of the Fiscal Year 2021 Summary Compensation Table. |

| • | The performance-vested restricted stock granted to our named executive officers in fiscal year 2019 vested at 33% of target levels, based on Company results above threshold levels for the total stockholder return and below threshold levels for EBITDA margin(1) metrics. These shares previously were shown at the target level in the “All Other Stock Awards” column of the Fiscal Year 2019 Grants of Plan-Based Awards table in our proxy statement for the 2019 annual meeting. |

| Number of Shares of Performance-Vested Restricted Stock |

||||||||

| Named Executive Officer | Target Grant 2019 | Realized in 2021 | ||||||

| James R. Lines |

5,813 | 1,889 | ||||||

| Jeffrey F. Glajch |

2,675 | 869 | ||||||

| Alan E. Smith |

2,387 | 776 | ||||||

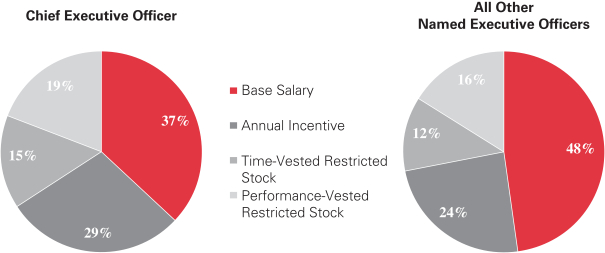

Our “Pay for Performance” Philosophy

Our executive compensation programs contain key components and features that reinforce our “pay for performance” philosophy. For example:

| • | A significant portion of our named executive officers’ compensation is “at-risk,” and depends on either meeting performance-based criteria or continuing in service to the Company. Both our short-term and long-term incentive compensation programs use goals that tie to our performance in key financial metrics. We pay 50% of our long-term incentive compensation in shares of performance-vested restricted stock. The shares of performance-vested restricted stock cliff vest on the third anniversary of the date of grant only upon the achievement of predetermined performance metrics. Our named executive officers receive the other 50% of long-term incentive compensation in restricted stock that time vests in equal installments of 331/3% on each anniversary of the date of grant, subject to the executive officer’s continued service at each such date. |

| • | We require all of our named executive officers to hold substantial amounts of our stock. We believe that our robust stock ownership guidelines drive an ownership culture and enhance the connection between our management and our stockholders. |

| • | We do not reimburse or “gross-up” our named executive officers for any of the taxes associated with any of the compensation and benefits we provide to them. |

| • | We maintain “double-triggered” provisions in our agreements with our named executive officers under which payment is triggered only by certain terminations of employment subsequent to a change in control of our Company. |

| • | The Compensation Committee incorporates tally sheets as an analytical tool as part of its annual executive compensation review to help ensure that compensation is consistent with performance goals. |

| • | We provide limited perquisites and personal benefits beyond those provided to all other employees. |

| • | Our policies strictly prohibit our executive officers and directors from engaging in any hedging, pledging, or other monetization transactions involving our securities. |

| (1) | EBITDA Margin is a financial measure not prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). For a reconciliation of EBITDA Margin to the most directly comparable GAAP measure, see Appendix A to this proxy statement. |

| GRAHAM CORPORATION 2021 PROXY STATEMENT | 19 | |

|

Executive Compensation • Compensation Discussion and Analysis

|

Principles and Objectives

In establishing executive compensation, the guiding principles and objectives of the Compensation Committee are as follows:

| • | to provide market competitive compensation that includes an appropriate balance of fixed and incentive elements which allows us to both attract and retain executive personnel best suited by training, ability, and other relevant criteria for our management requirements; |

| • | to align our incentive compensation programs with superior business performance in order to maximize stockholder value; and |

| • | to avoid compensation incentives that create undue financial or business risk for our Company. |

The Compensation Committee reviews the market median and also considers measures of Company and industry performance when determining named executive officer compensation, including revenue, net income, earnings per share, EBITDA margin, total market value, average working capital, performance relative to the market, and total stockholder return. As described further below under the heading “Use of Peer Group Compensation Data and Tally Sheets,” from time to time, the Compensation Committee reviews data on the executive compensation programs of other comparably-sized companies both within our industry and in our geographic region as part of the process of establishing and maintaining our executive compensation programs.

We designed our executive compensation programs to reward our named executive officers for Company and individual performance that maximizes stockholder value. We describe the Company and individual performance measures that the Compensation Committee takes into account in determining cash and equity-based incentive awards for our named executive officers below under the headings “Annual Cash Incentive Compensation” and “Long-Term Equity Incentive Compensation,” respectively.

How we Make Compensation Decisions

Role of the Compensation Committee

The Compensation Committee designs and implements compensation programs that further the intent and purpose of our fundamental compensation philosophy, principles, and objectives. The Compensation Committee is responsible for setting appropriate compensation levels for our named executive officers, and determines base salary, as well as cash and equity-based incentive awards for each of our named executive officers. We provide additional information about the Compensation Committee under the heading “Corporate Governance.”

Role of Named Executive Officers in Compensation Decisions