NYSE: GHM • August 2021 Graham Corporation Investor Presentation Daniel J. Thoren, President and Chief Operating Officer Jeffrey F. Glajch, Vice President & Chief Financial Officer Exhibit 99.1

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “estimates,” “confidence,” “projects,” “typically,” “outlook,” “anticipates,” “indicates”, “believes,” “appears,” “could,” “opportunities,” “seeking,” “plans,” “aim,” “pursuit,” “look towards” and other similar words. All statements addressing operating performance, events, “growing”, “pro forma”, or developments that Graham Corporation (“Graham or the “Company”) expects or anticipates will occur in the future, including but not limited to, effects of the COVID-19 global pandemic, the integration of the BN acquisition, the future expected contributions of BN, expected expansion and growth opportunities within its domestic and international markets, anticipated revenue, the timing of conversion of backlog to sales, market presence, profit margins, tax rates, foreign sales operations, its ability to improve cost competitiveness and productivity, customer preferences, changes in market conditions in the industries in which it operates, the effect on its business of volatility in commodities prices, including, but not limited to, changes in general economic conditions and customer behavior, forecasts regarding the timing and scope of the economic recovery in its markets, its acquisition and growth strategy and its operations in China, India and other international locations, are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in Graham Corporation’s most recent Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and its other filings with the Securities and Exchange Commission, including under the heading entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize or should any of Graham Corporation’s underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on Graham Corporation’s forward-looking statements. Except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this presentation. This presentation includes some non-GAAP financial measures, which the Company believes are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The Company has provided a discussion of these non-GAAP financial measures and reconciliations of comparable GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation. Pro forma information and Company estimates included in this presentation are used for illustrative purposes only, are not forecasts and may not reflect actual results.

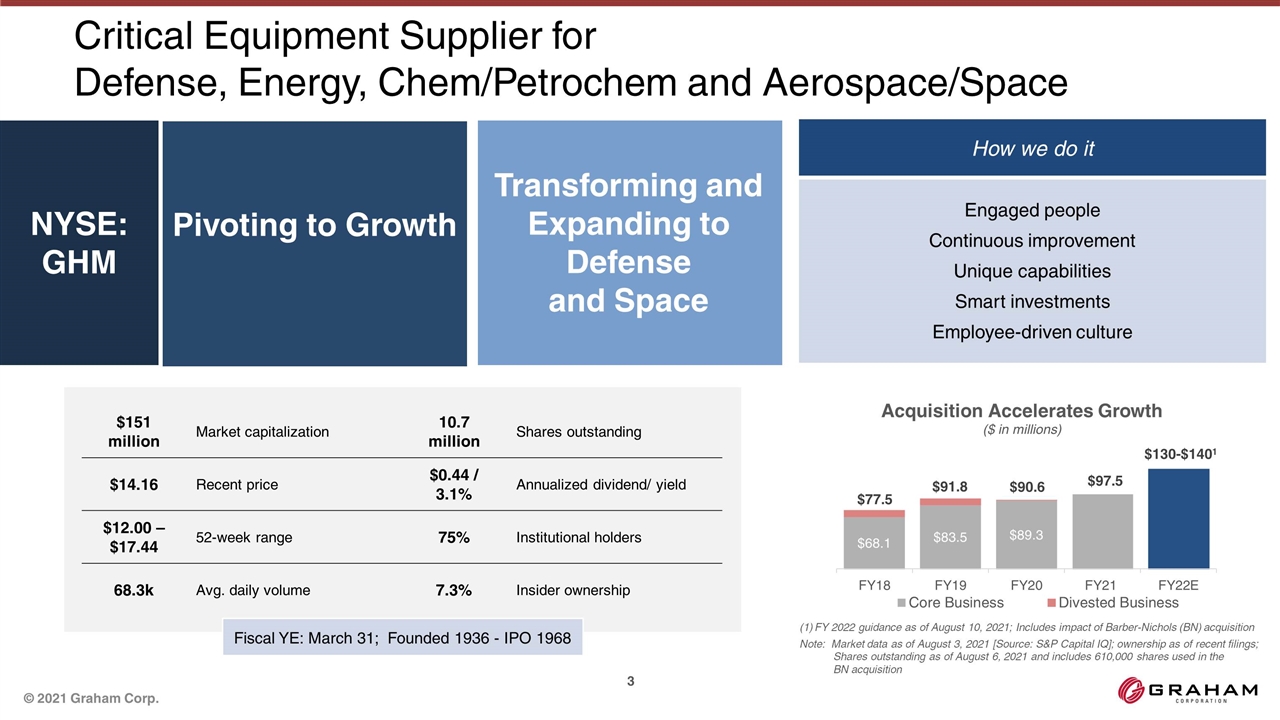

Critical Equipment Supplier for Defense, Energy, Chem/Petrochem and Aerospace/Space Note: Market data as of August 3, 2021 [Source: S&P Capital IQ]; ownership as of recent filings; Shares outstanding as of August 6, 2021 and includes 610,000 shares used in the BN acquisition $151 million Market capitalization 10.7 million Shares outstanding $14.16 Recent price $0.44 / 3.1% Annualized dividend/ yield $12.00 – $17.44 52-week range 75% Institutional holders 68.3k Avg. daily volume 7.3% Insider ownership NYSE: GHM Pivoting to Growth Transforming and Expanding to Defense and Space How we do it Engaged people Continuous improvement Unique capabilities Smart investments Employee-driven culture (1) FY 2022 guidance as of August 10, 2021; Includes impact of Barber-Nichols (BN) acquisition Fiscal YE: March 31; Founded 1936 - IPO 1968

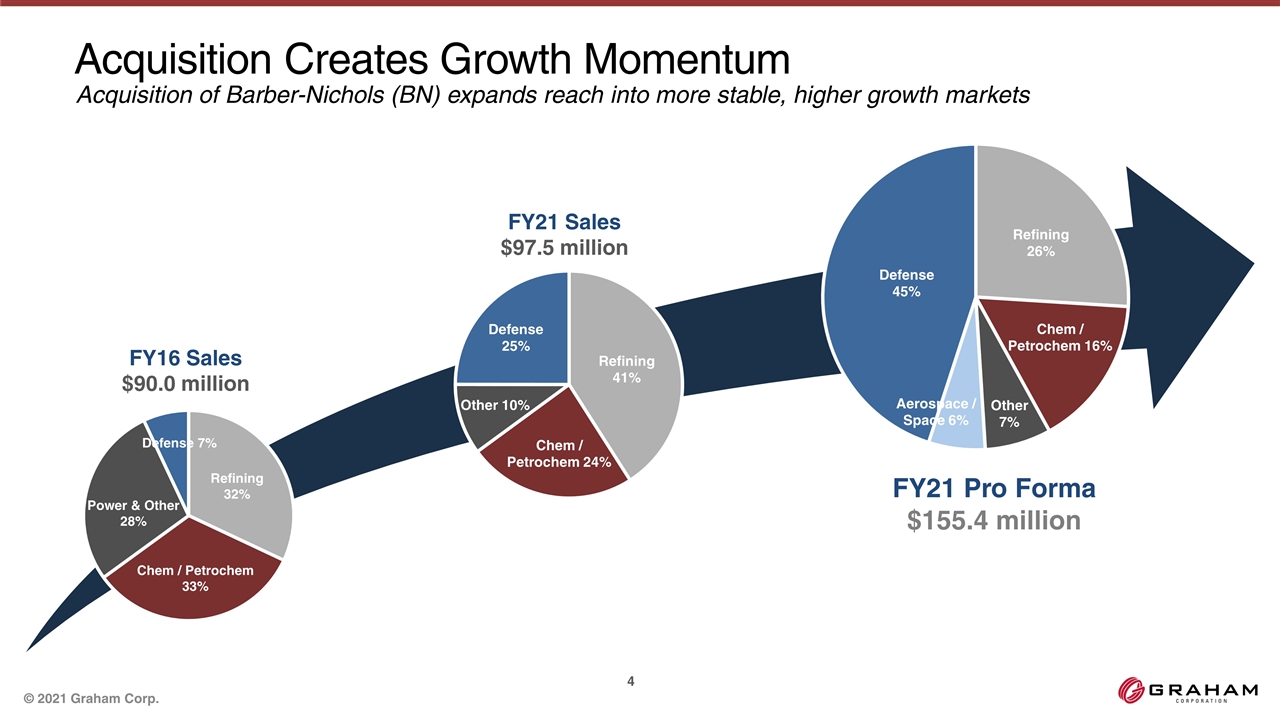

Acquisition Creates Growth Momentum FY21 Sales $97.5 million FY21 Pro Forma $155.4 million FY16 Sales $90.0 million Acquisition of Barber-Nichols (BN) expands reach into more stable, higher growth markets

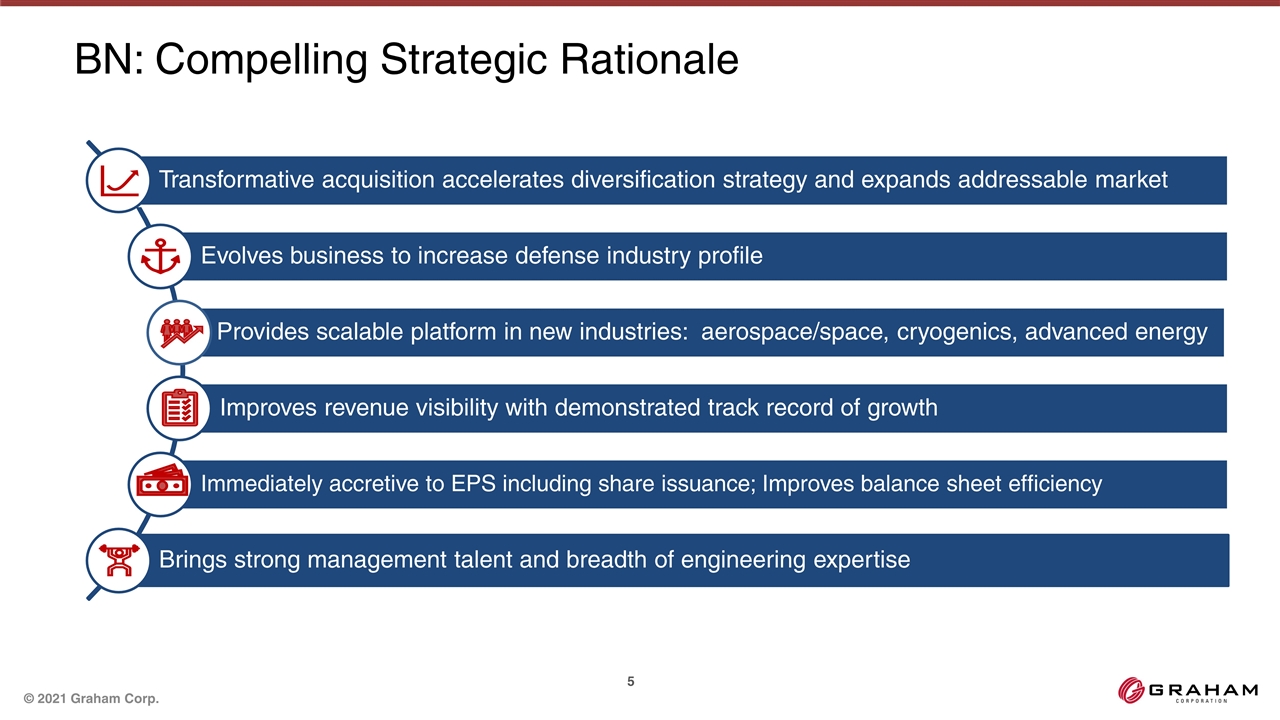

BN: Compelling Strategic Rationale Transformative acquisition accelerates diversification strategy and expands addressable market Evolves business to increase defense industry profile Improves revenue visibility with demonstrated track record of growth Immediately accretive to EPS including share issuance; Improves balance sheet efficiency Brings strong management talent and breadth of engineering expertise Provides scalable platform in new industries: aerospace/space, cryogenics, advanced energy

Building Opportunities on Two Primary Platforms Defense and Space Strong visibility into future naval programs – ships and submarines Engaged in Space development programs Energy and Chemical/Petrochemical Expanding geographically and into more price sensitive markets Expect petrochem to decouple from refinery

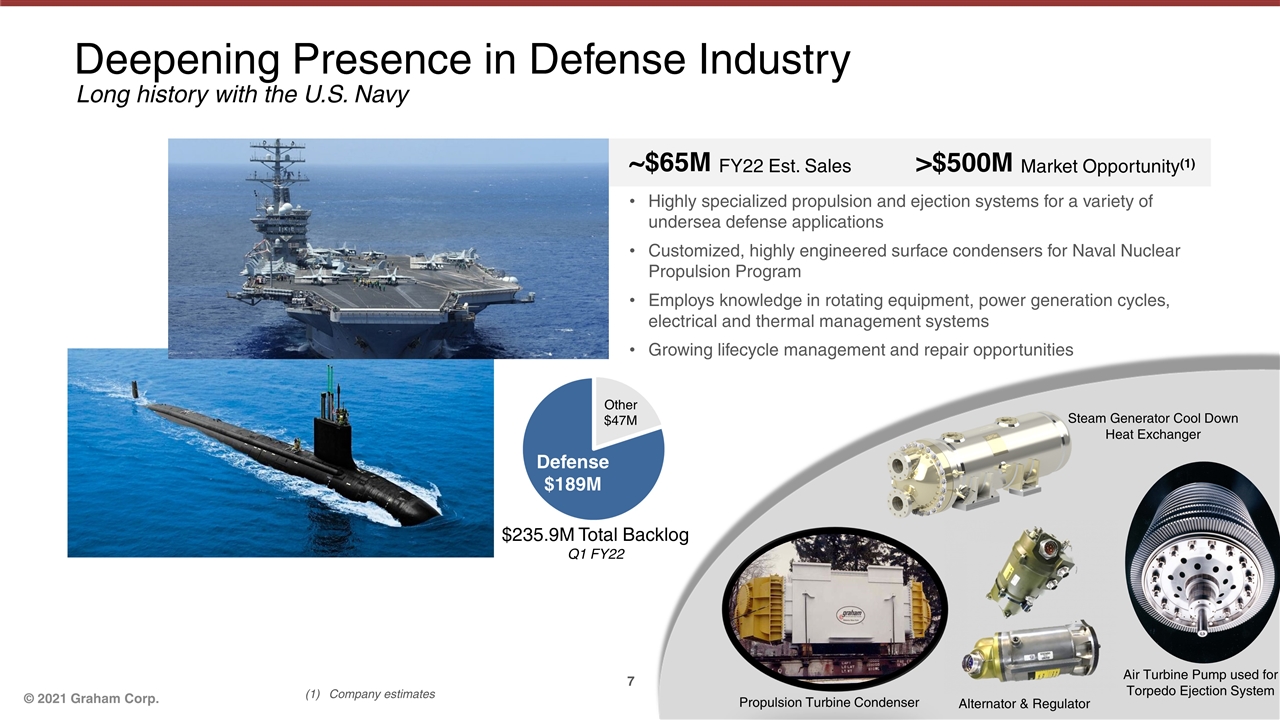

Deepening Presence in Defense Industry Highly specialized propulsion and ejection systems for a variety of undersea defense applications Customized, highly engineered surface condensers for Naval Nuclear Propulsion Program Employs knowledge in rotating equipment, power generation cycles, electrical and thermal management systems Growing lifecycle management and repair opportunities Long history with the U.S. Navy ~$65M FY22 Est. Sales >$500M Market Opportunity(1) Air Turbine Pump used for Torpedo Ejection System Company estimates $235.9M Total Backlog Q1 FY22 Alternator & Regulator Propulsion Turbine Condenser Steam Generator Cool Down Heat Exchanger

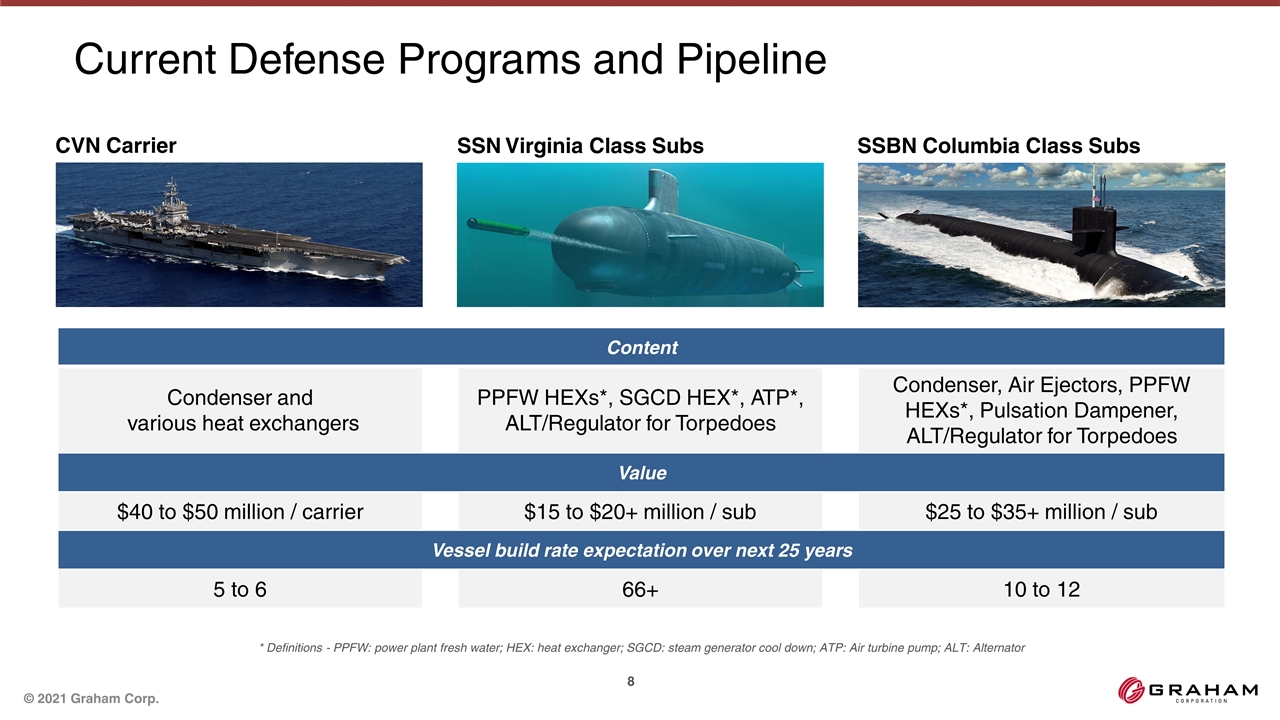

Current Defense Programs and Pipeline SSN Virginia Class Subs CVN Carrier SSBN Columbia Class Subs Content Condenser and various heat exchangers PPFW HEXs*, SGCD HEX*, ATP*, ALT/Regulator for Torpedoes Condenser, Air Ejectors, PPFW HEXs*, Pulsation Dampener, ALT/Regulator for Torpedoes Value $40 to $50 million / carrier $15 to $20+ million / sub $25 to $35+ million / sub Vessel build rate expectation over next 25 years 5 to 6 66+ 10 to 12 * Definitions - PPFW: power plant fresh water; HEX: heat exchanger; SGCD: steam generator cool down; ATP: Air turbine pump; ALT: Alternator

New Frontier: Space Serving the private space exploration market NASA is long time BN customer Relationships at Marshall, Johnson, and Glenn centers Critical space flight hardware Leader in specialized turbomachinery for cryogenic rocket engine fuels High-end turbomachinery and fluid transfer for life support systems Certified with required AS 9100 quality system Clean room assembly to ensure exacting product conformity

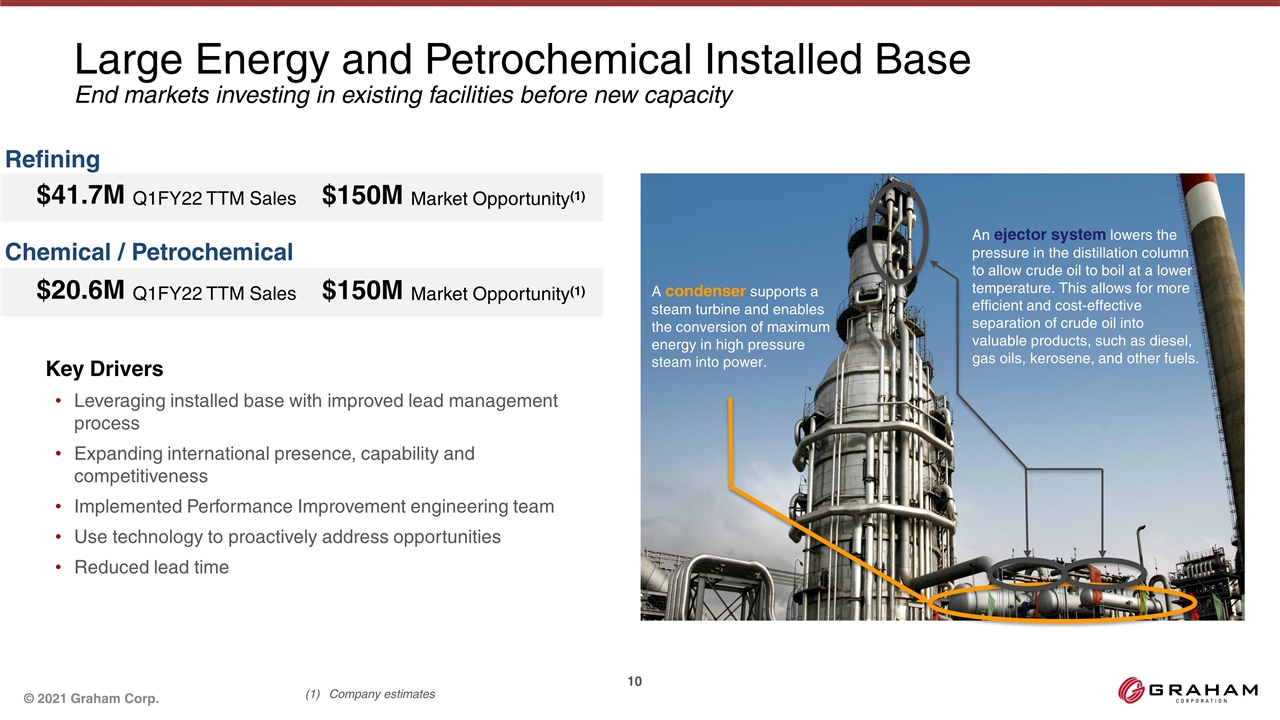

Key Drivers Leveraging installed base with improved lead management process Expanding international presence, capability and competitiveness Implemented Performance Improvement engineering team Use technology to proactively address opportunities Reduced lead time End markets investing in existing facilities before new capacity Large Energy and Petrochemical Installed Base $20.6M Q1FY22 TTM Sales $150M Market Opportunity(1) $41.7M Q1FY22 TTM Sales $150M Market Opportunity(1) A condenser supports a steam turbine and enables the conversion of maximum energy in high pressure steam into power. An ejector system lowers the pressure in the distillation column to allow crude oil to boil at a lower temperature. This allows for more efficient and cost-effective separation of crude oil into valuable products, such as diesel, gas oils, kerosene, and other fuels. Refining Chemical / Petrochemical Company estimates

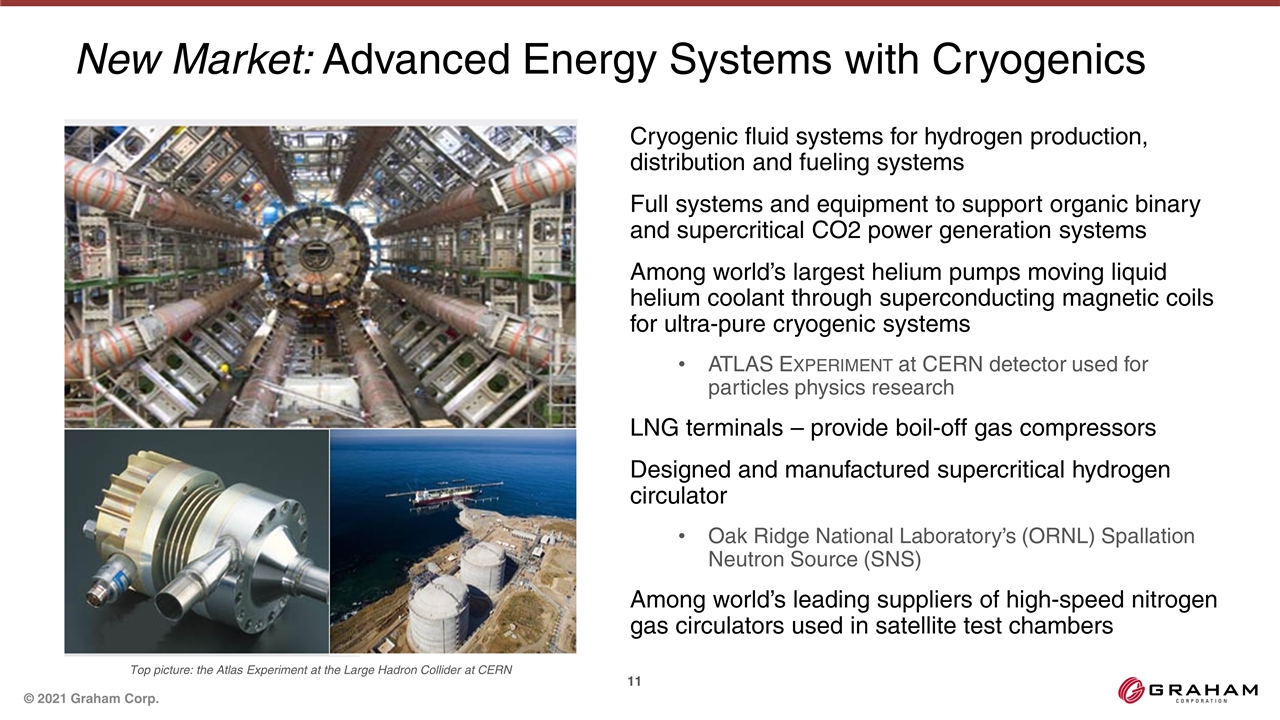

New Market: Advanced Energy Systems with Cryogenics Cryogenic fluid systems for hydrogen production, distribution and fueling systems Full systems and equipment to support organic binary and supercritical CO2 power generation systems Among world’s largest helium pumps moving liquid helium coolant through superconducting magnetic coils for ultra-pure cryogenic systems ATLAS Experiment at CERN detector used for particles physics research LNG terminals – provide boil-off gas compressors Designed and manufactured supercritical hydrogen circulator Oak Ridge National Laboratory’s (ORNL) Spallation Neutron Source (SNS) Among world’s leading suppliers of high-speed nitrogen gas circulators used in satellite test chambers Top picture: the Atlas Experiment at the Large Hadron Collider at CERN

Differentiation with Comprehensive Customer Support Model Provide unique value before and throughout project life cycle Detailed engineering and equipment scope analysis Solutions engineering and prototype developments Deliver in-depth solutions quickly and accurately Consultative Selling Platform and Product Development Complex Project Management and Product Life Cycle Service Custom Fabrication to Tight Tolerances Responsive Operating Model Efficiently pause and re-initiate projects throughout project life-cycle Provide support and overhaul capabilities to large installed base Low volume / high mix operations model Frequent engineering change orders in development and manufacturing Unique capability to fabricate large weldments with special metallurgy to tight tolerances Highly specialized manufacturing and electrochemical milling expertise on turbomachinery equipment Strong quality control with objective quality evidence

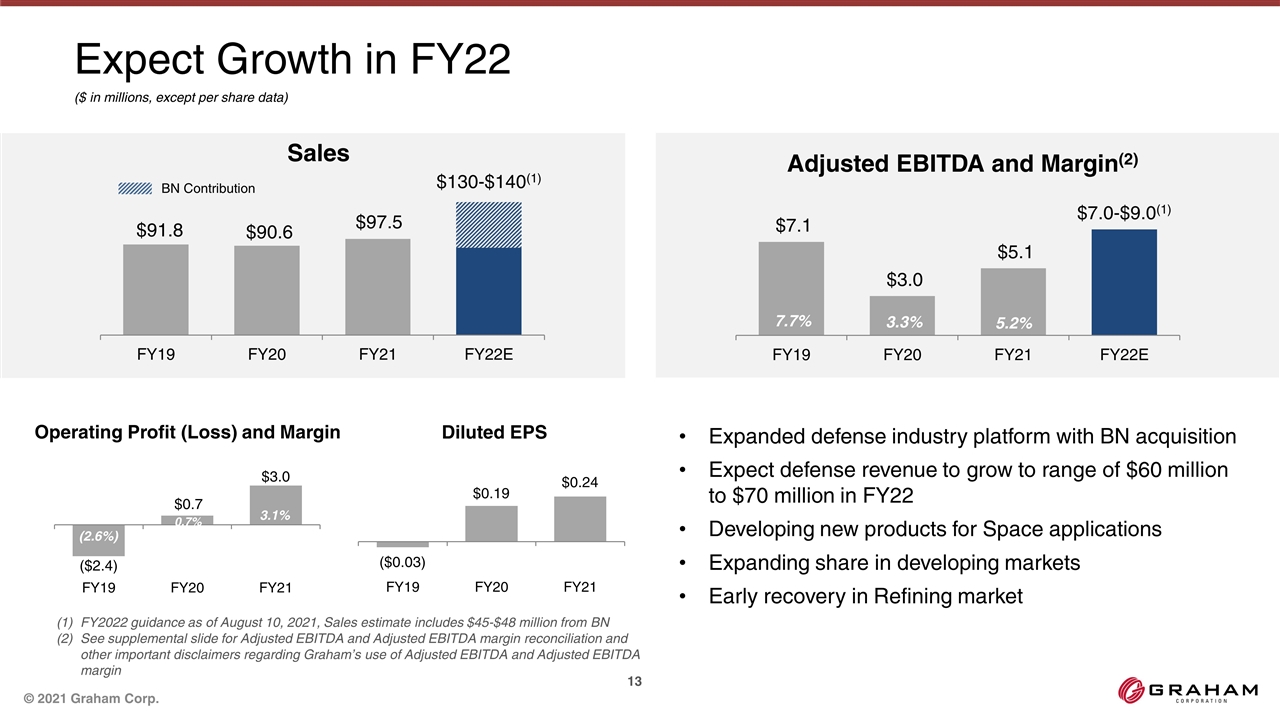

Operating Profit (Loss) and Margin Sales Adjusted EBITDA and Margin(2) ($ in millions, except per share data) FY2022 guidance as of August 10, 2021, Sales estimate includes $45-$48 million from BN See supplemental slide for Adjusted EBITDA and Adjusted EBITDA margin reconciliation and other important disclaimers regarding Graham’s use of Adjusted EBITDA and Adjusted EBITDA margin 3.1% 0.7% (2.6%) 7.7% 3.3% 5.2% Expanded defense industry platform with BN acquisition Expect defense revenue to grow to range of $60 million to $70 million in FY22 Developing new products for Space applications Expanding share in developing markets Early recovery in Refining market Diluted EPS Expect Growth in FY22 BN Contribution

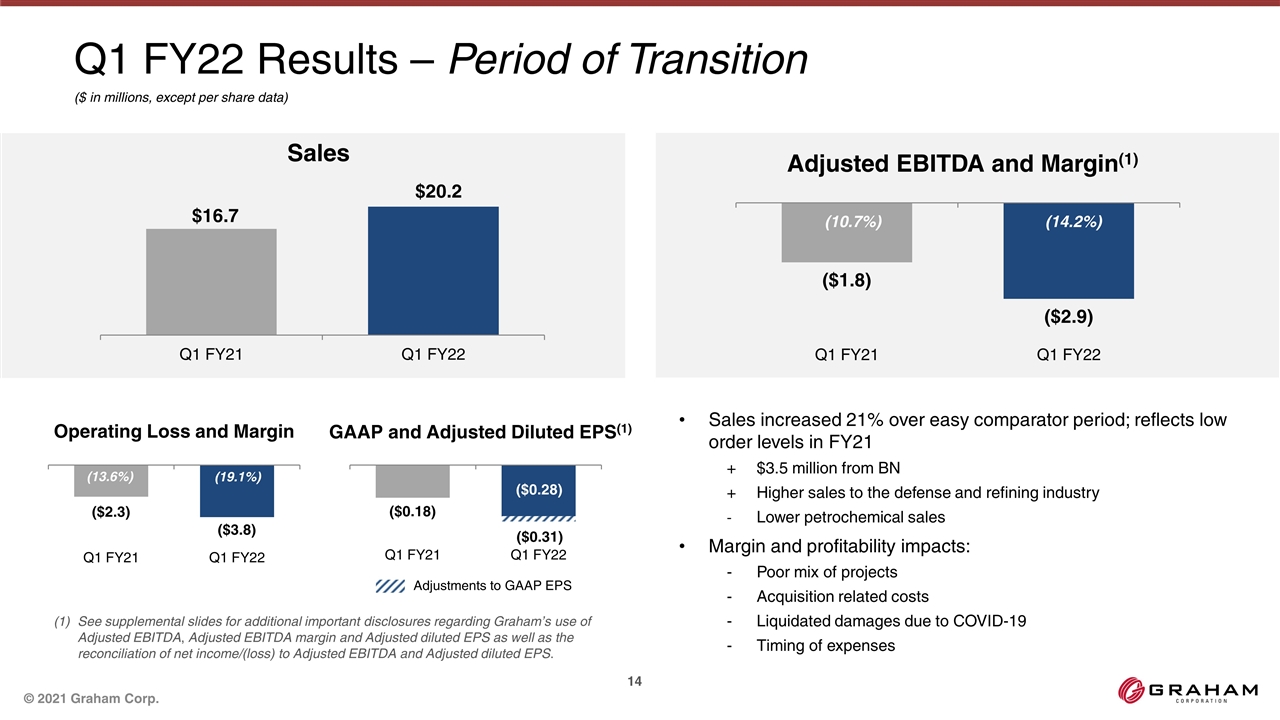

Operating Loss and Margin Sales Adjusted EBITDA and Margin(1) ($ in millions, except per share data) See supplemental slides for additional important disclosures regarding Graham’s use of Adjusted EBITDA, Adjusted EBITDA margin and Adjusted diluted EPS as well as the reconciliation of net income/(loss) to Adjusted EBITDA and Adjusted diluted EPS. (19.1%) (13.6%) (10.7%) (14.2%) Sales increased 21% over easy comparator period; reflects low order levels in FY21 $3.5 million from BN Higher sales to the defense and refining industry Lower petrochemical sales Margin and profitability impacts: Poor mix of projects Acquisition related costs Liquidated damages due to COVID-19 Timing of expenses GAAP and Adjusted Diluted EPS(1) Q1 FY22 Results – Period of Transition Adjustments to GAAP EPS

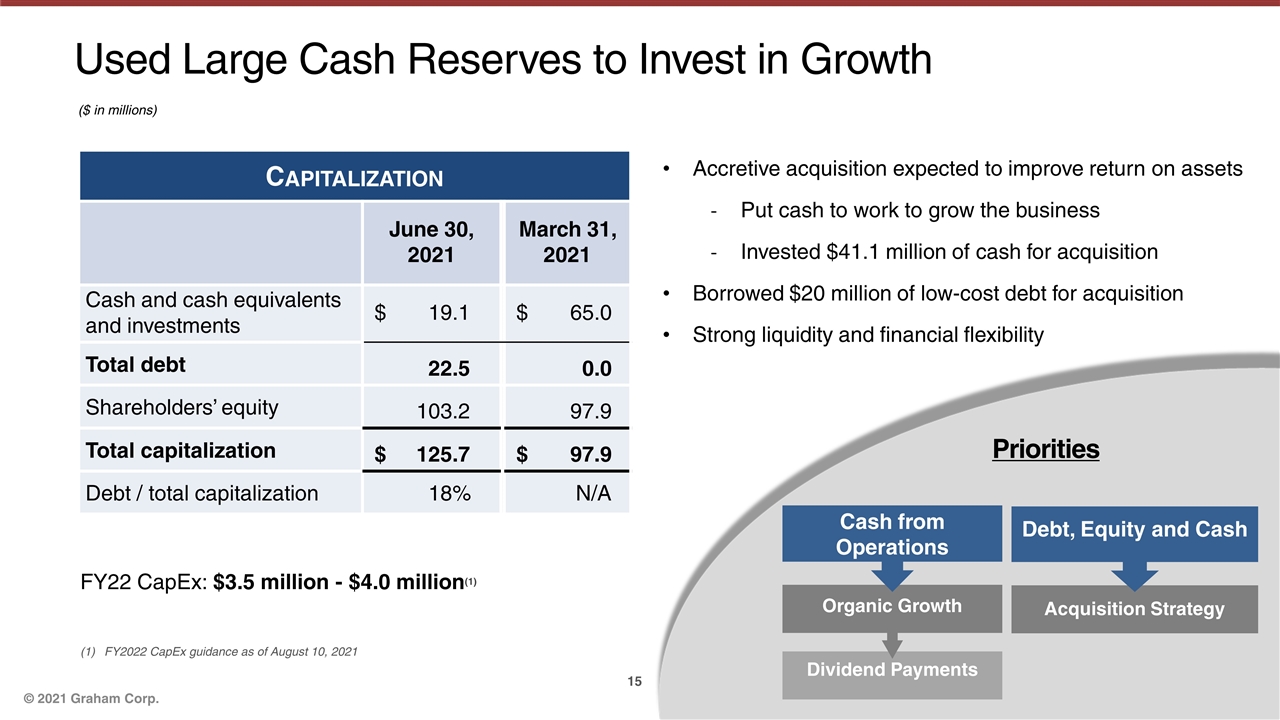

($ in millions) Used Large Cash Reserves to Invest in Growth Accretive acquisition expected to improve return on assets Put cash to work to grow the business Invested $41.1 million of cash for acquisition Borrowed $20 million of low-cost debt for acquisition Strong liquidity and financial flexibility Dividend Payments Organic Growth Acquisition Strategy Cash from Operations Debt, Equity and Cash Priorities Capitalization June 30, 2021 March 31, 2021 Cash and cash equivalents and investments $19.1 $65.0 Total debt 22.5 0.0 Shareholders’ equity 103.2 97.9 Total capitalization $125.7 $97.9 Debt / total capitalization 18% N/A FY22 CapEx: $3.5 million - $4.0 million(1) FY2022 CapEx guidance as of August 10, 2021

Continue to Look at Acquisitions to Complement Growth Extend core competencies, reduce volatility, improve revenue and earnings Priorities Defense: Broaden participation in other programs Additional products Aftermarket: Additional products Expand share Energy/Chemical: Additional products Cost advantage Primary focus on building defense exposure Strong management team with customer and quality focus Targeting $20 million to $60 million in revenue Cash return exceeds equity cost of capital Strong acquisition pricing discipline

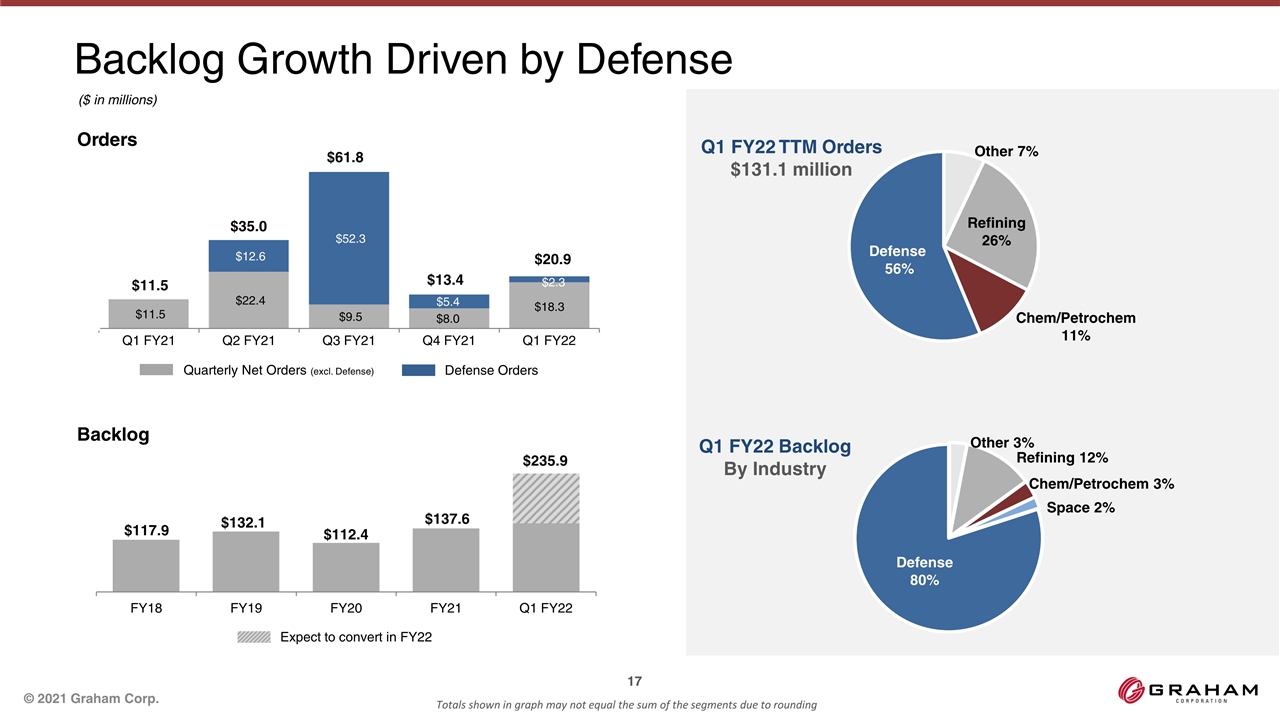

$61.8 $13.4 $11.5 $35.0 $20.9 Defense Orders Quarterly Net Orders (excl. Defense) Totals shown in graph may not equal the sum of the segments due to rounding Q1 FY22 TTM Orders $131.1 million ($ in millions) Backlog Orders Backlog Growth Driven by Defense Q1 FY22 Backlog By Industry Expect to convert in FY22

Transforming to Drive Value Leveraging transformational acquisition to accelerate growth in defense industry Preparing for refining and petrochem upcycle expansion Enhancing leading market positions and furthering strong brand recognition More efficient balance sheet with capacity for additional acquisitions and financial flexibility to invest in organic growth Strong operating leverage and powerful cash generation

For more information: Jeffrey F. Glajch Deborah K. Pawlowski Vice President – Finance and CFO Kei Advisors LLC Phone: (585) 343-2216 Phone: (716) 843-3908 jglajch@graham-mfg.com dpawlowski@keiadvisors.com

Supplemental Information

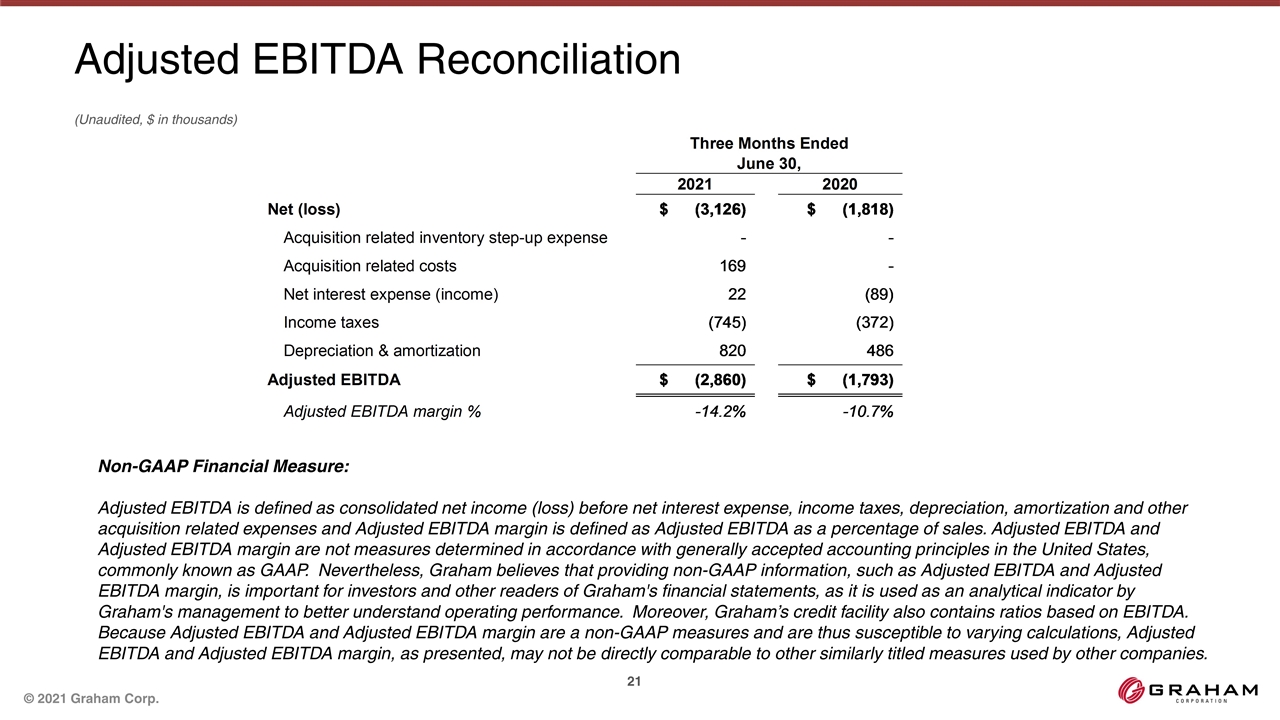

(Unaudited, $ in thousands) Adjusted EBITDA Reconciliation Non-GAAP Financial Measure: Adjusted EBITDA is defined as consolidated net income (loss) before net interest expense, income taxes, depreciation, amortization and other acquisition related expenses and Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of sales. Adjusted EBITDA and Adjusted EBITDA margin are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP. Nevertheless, Graham believes that providing non-GAAP information, such as Adjusted EBITDA and Adjusted EBITDA margin, is important for investors and other readers of Graham's financial statements, as it is used as an analytical indicator by Graham's management to better understand operating performance. Moreover, Graham’s credit facility also contains ratios based on EBITDA. Because Adjusted EBITDA and Adjusted EBITDA margin are a non-GAAP measures and are thus susceptible to varying calculations, Adjusted EBITDA and Adjusted EBITDA margin, as presented, may not be directly comparable to other similarly titled measures used by other companies.

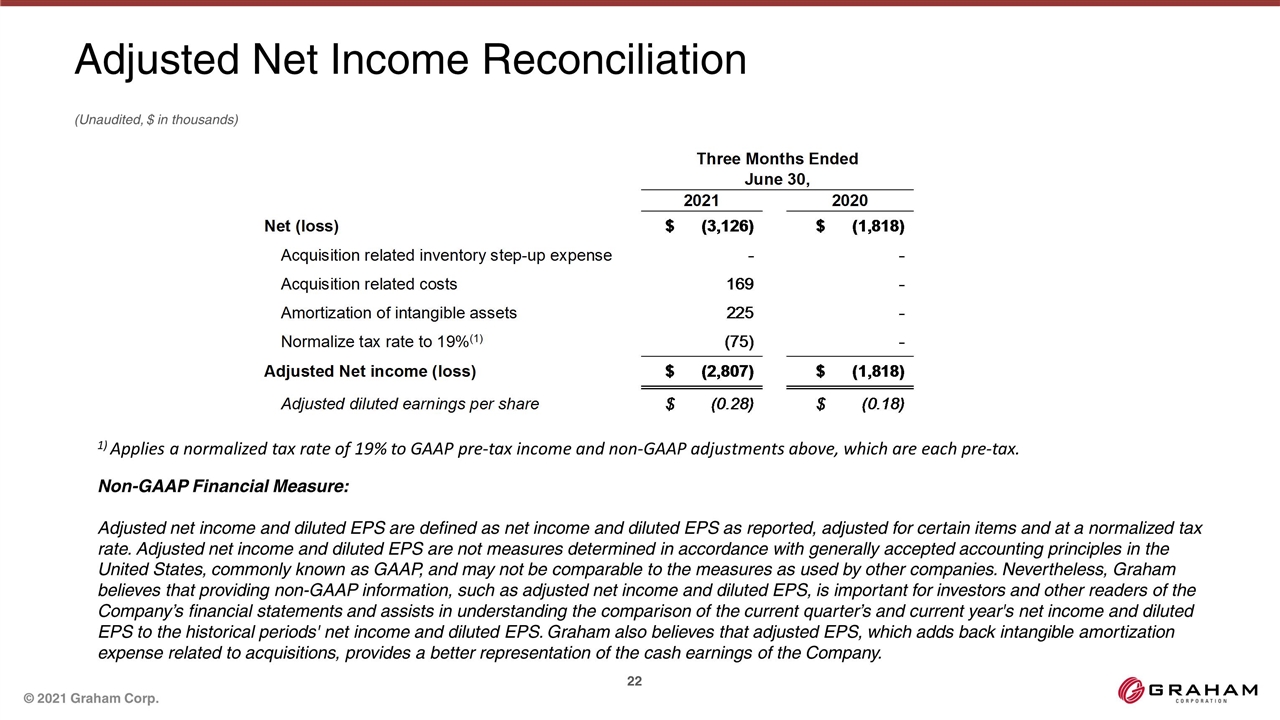

(Unaudited, $ in thousands) Adjusted Net Income Reconciliation 1) Applies a normalized tax rate of 19% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Non-GAAP Financial Measure: Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items and at a normalized tax rate. Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measures as used by other companies. Nevertheless, Graham believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income and diluted EPS to the historical periods' net income and diluted EPS. Graham also believes that adjusted EPS, which adds back intangible amortization expense related to acquisitions, provides a better representation of the cash earnings of the Company.

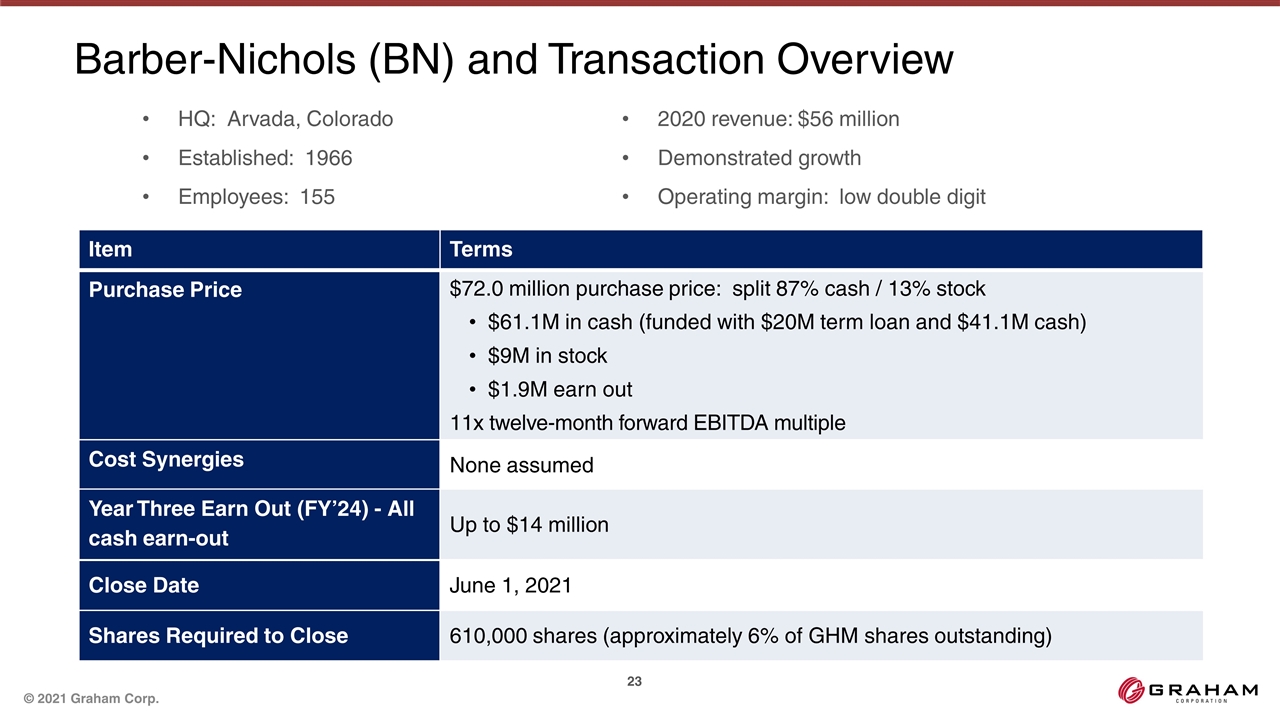

Item Terms Purchase Price $72.0 million purchase price: split 87% cash / 13% stock $61.1M in cash (funded with $20M term loan and $41.1M cash) $9M in stock $1.9M earn out 11x twelve-month forward EBITDA multiple Cost Synergies None assumed Year Three Earn Out (FY’24) - All cash earn-out Up to $14 million Close Date June 1, 2021 Shares Required to Close 610,000 shares (approximately 6% of GHM shares outstanding) Barber-Nichols (BN) and Transaction Overview HQ: Arvada, Colorado Established: 1966 Employees: 155 2020 revenue: $56 million Demonstrated growth Operating margin: low double digit

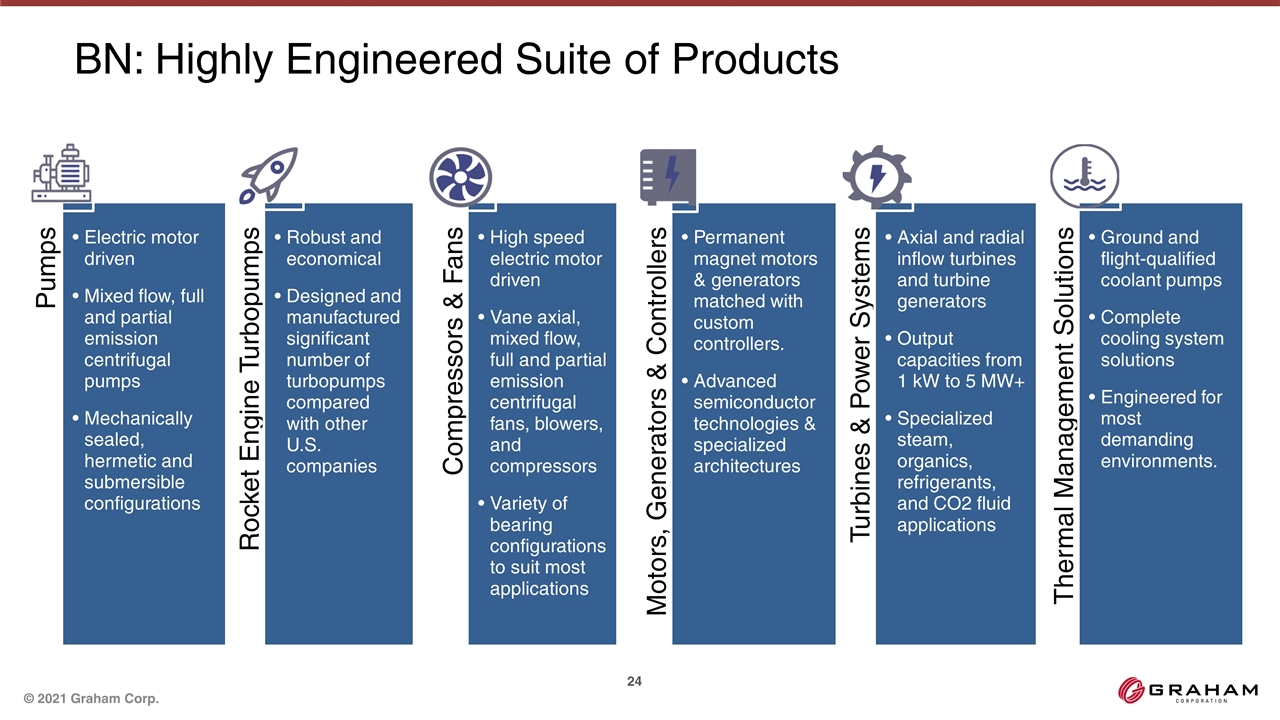

Pumps Electric motor driven Mixed flow, full and partial emission centrifugal pumps Mechanically sealed, hermetic and submersible configurations Rocket Engine Turbopumps Robust and economical Designed and manufactured significant number of turbopumps compared with other U.S. companies Compressors & Fans High speed electric motor driven Vane axial, mixed flow, full and partial emission centrifugal fans, blowers, and compressors Variety of bearing configurations to suit most applications Motors, Generators & Controllers Permanent magnet motors & generators matched with custom controllers. Advanced semiconductor technologies & specialized architectures Turbines & Power Systems Axial and radial inflow turbines and turbine generators Output capacities from 1 kW to 5 MW+ Specialized steam, organics, refrigerants, and CO2 fluid applications Thermal Management Solutions Ground and flight-qualified coolant pumps Complete cooling system solutions Engineered for most demanding environments. BN: Highly Engineered Suite of Products

North American Competition Market Competitors Naval Nuclear Propulsion Program/Defense DC Fabricators; Joseph Oat; PCC; Triumph Aerospace; Xylem Refining vacuum distillation Croll Reynolds Company, Inc.; Gardner Denver, Inc.; GEA Wiegand GmbH Chemicals/Petrochemicals Croll Reynolds Company, Inc.; Gardner Denver, Inc.; Schutte Koerting Defense and aerospace/space - turbomachinery Kratos Defense & Security Solns, Concepts NREC, Ametek, Inc. Turbomachinery OEM – refining, petrochemical Donghwa Entec Co., Ltd..; KEMCO; Oeltechnik GmbH Turbomachinery OEM – power and power producer Holtec; KEMCO; Maarky Thermal Systems; Thermal Engineering International (USA), Inc.

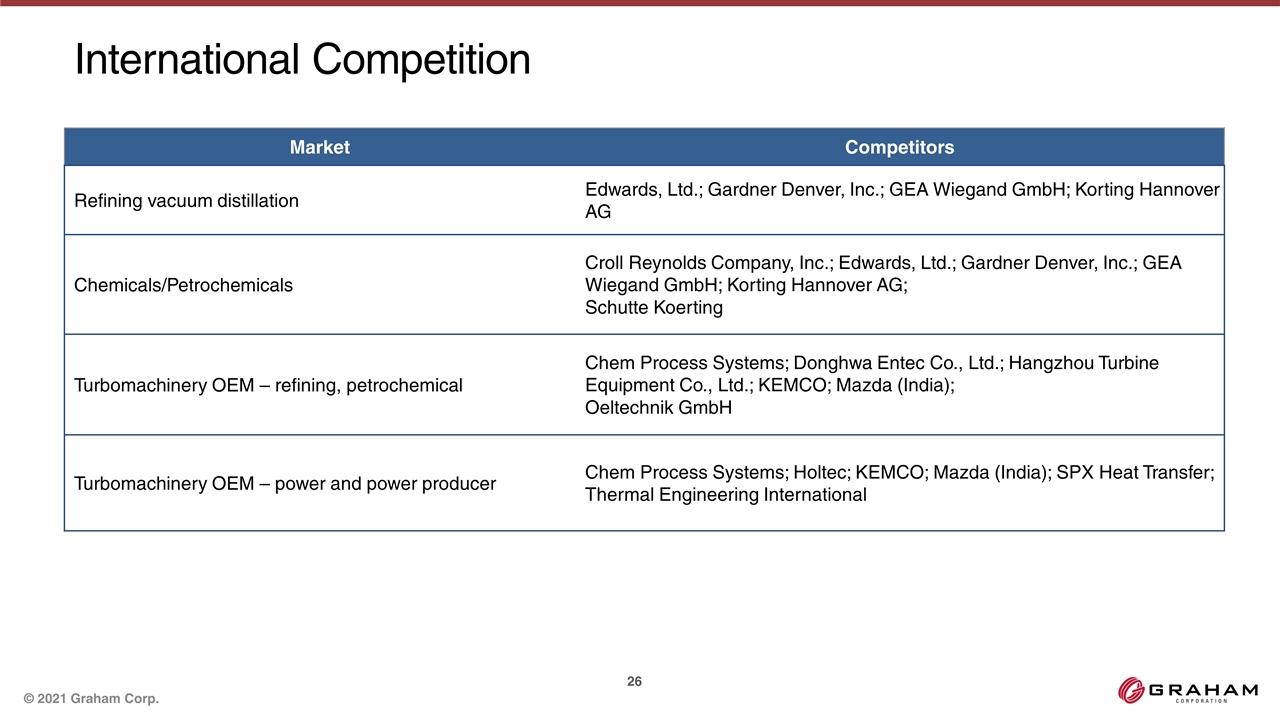

Market Competitors Refining vacuum distillation Edwards, Ltd.; Gardner Denver, Inc.; GEA Wiegand GmbH; Korting Hannover AG Chemicals/Petrochemicals Croll Reynolds Company, Inc.; Edwards, Ltd.; Gardner Denver, Inc.; GEA Wiegand GmbH; Korting Hannover AG; Schutte Koerting Turbomachinery OEM – refining, petrochemical Chem Process Systems; Donghwa Entec Co., Ltd.; Hangzhou Turbine Equipment Co., Ltd.; KEMCO; Mazda (India); Oeltechnik GmbH Turbomachinery OEM – power and power producer Chem Process Systems; Holtec; KEMCO; Mazda (India); SPX Heat Transfer; Thermal Engineering International International Competition

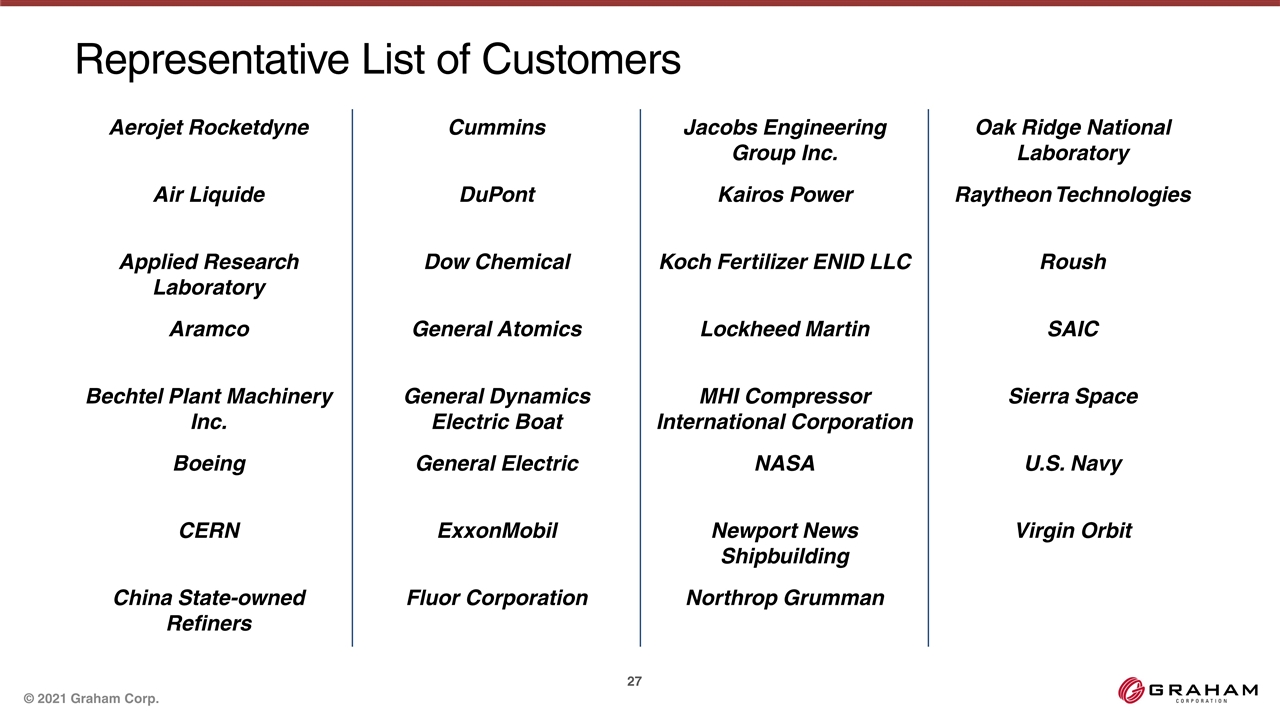

Representative List of Customers Aerojet Rocketdyne Cummins Jacobs Engineering Group Inc. Oak Ridge National Laboratory Air Liquide DuPont Kairos Power Raytheon Technologies Applied Research Laboratory Dow Chemical Koch Fertilizer ENID LLC Roush Aramco General Atomics Lockheed Martin SAIC Bechtel Plant Machinery Inc. General Dynamics Electric Boat MHI Compressor International Corporation Sierra Space Boeing General Electric NASA U.S. Navy CERN ExxonMobil Newport News Shipbuilding Virgin Orbit China State-owned Refiners Fluor Corporation Northrop Grumman

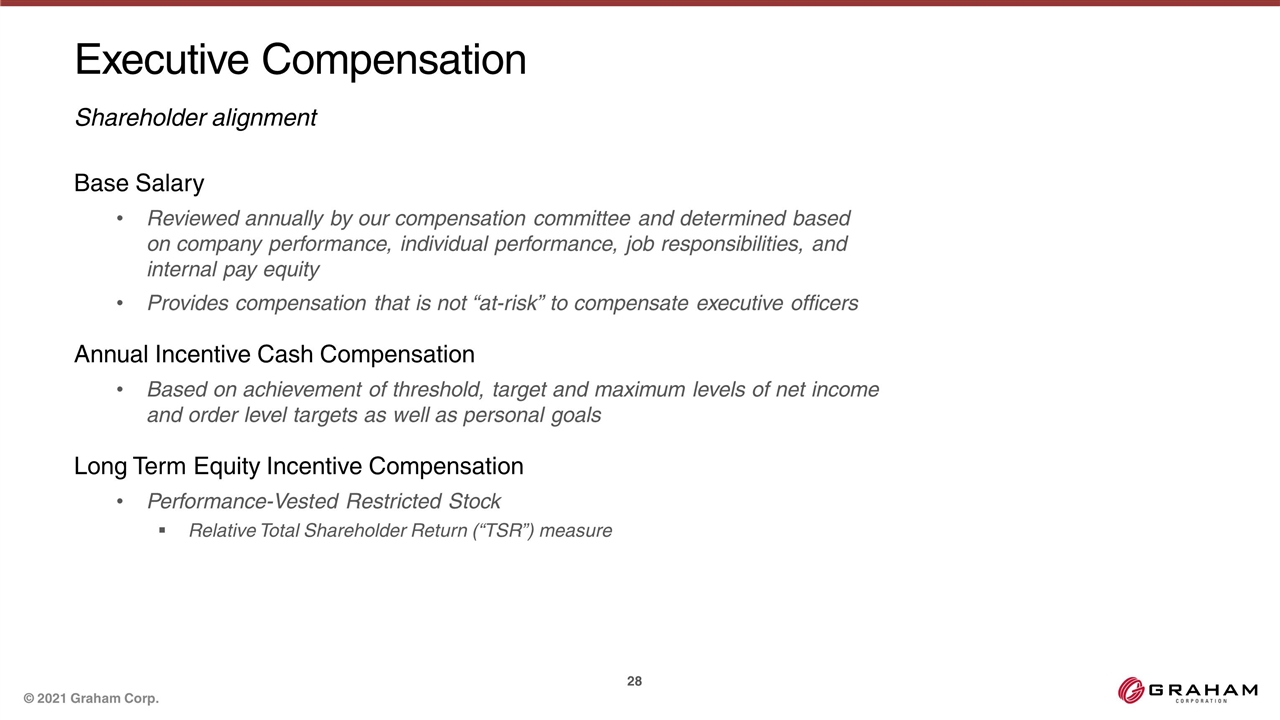

Executive Compensation Base Salary Reviewed annually by our compensation committee and determined based on company performance, individual performance, job responsibilities, and internal pay equity Provides compensation that is not “at-risk” to compensate executive officers Annual Incentive Cash Compensation Based on achievement of threshold, target and maximum levels of net income and order level targets as well as personal goals Long Term Equity Incentive Compensation Performance-Vested Restricted Stock Relative Total Shareholder Return (“TSR”) measure Shareholder alignment

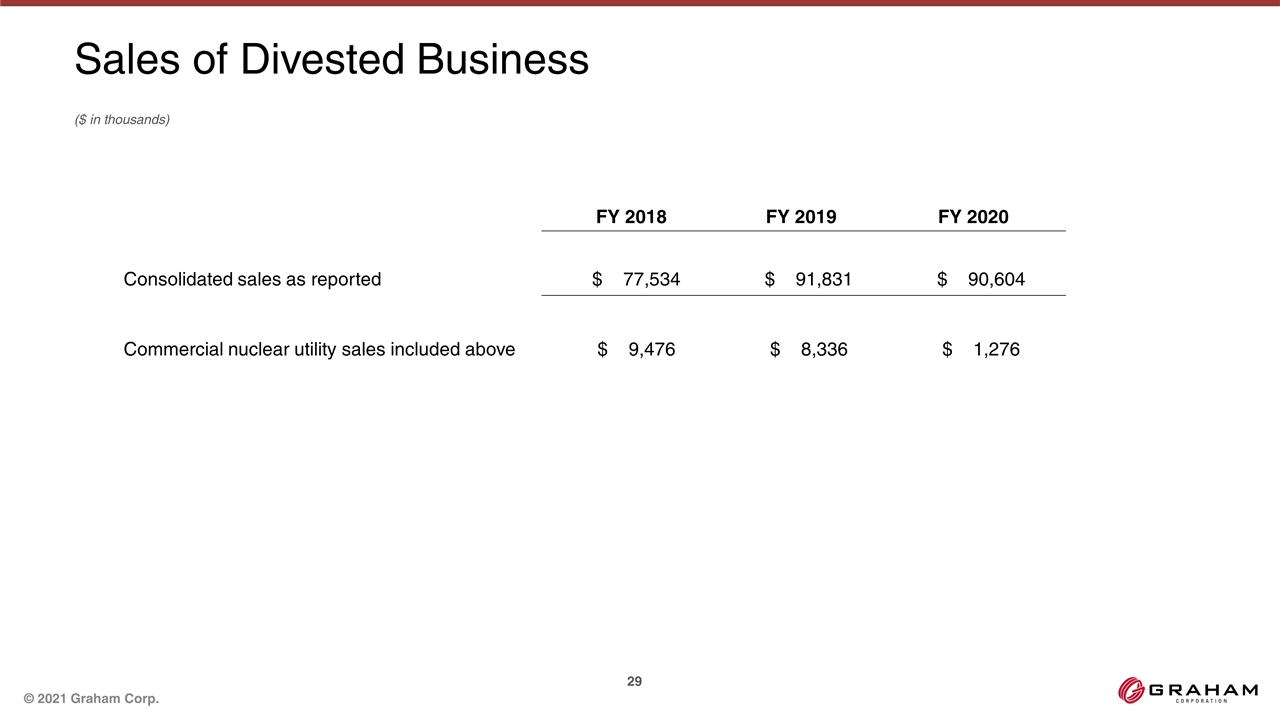

($ in thousands) FY 2018 FY 2019 FY 2020 Consolidated sales as reported $ 77,534 $ 91,831 $ 90,604 Commercial nuclear utility sales included above $ 9,476 $ 8,336 $ 1,276 Sales of Divested Business