Exhibit 99.4 G r a h a m C o r p o r a t i o n Strategy Briefing June 9, 2022 Daniel J. Thoren, President and Chief Executive Officer Christopher J. Thome, Vice President – Finance and Chief Financial Officer www.GrahamCorp.com

Safe Harbor and Non-GAAP This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “estimates,” “outlook,” “anticipates,” “believes,” “implies”, “could,” “opportunities,” “potential,” “should,” “plans,” “goal,” ”may,” “will,” and other similar words. All statements addressing operating performance, events, or developments that Graham Corporation expects or anticipates will occur in the future, including but not limited to, its dividend, its ability and the timing needed to address challenges in its defense business, including at the Batavia, NY operations, profitability of future projects, the development and impact of better documentation of build processes and pricing models, its ability to meet customers’ delivery expectations, the future impact of low margin defense projects and related cost overruns, anticipated capital contributions, the future expected contributions of BN, expected expansion and growth opportunities within its domestic and international markets, anticipated revenue and sales, adjusted EBITDA, adjusted EBITDA margins, and SG&A expenses, its ability to generate free cash flow and expected free cash flow conversion rates, future capital expenditures and R&D spend, any share repurchases, its ability to reduce debt, market presence, profit margins, foreign sales operations, its ability to improve cost competitiveness and productivity, customer preferences, changes in market conditions in the industries in which it operates, labor constraints, the effect on its business of volatility in commodities prices, including, but not limited to, changes in general economic conditions and customer behavior, forecasts regarding the timing and scope of the economic recovery in its markets, its acquisition and growth strategy and its operations in China, India and other international locations, are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in Graham Corporation’s most recent Annual Report filed with the Securities and Exchange Commission, included under the heading entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize or should any of Graham Corporation’s underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on Graham Corporation’s forward-looking statements. Except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this presentation. Use of Forward-Looking Non-GAAP Financial Measures Forward-looking free cash flow conversion, adjusted EBITDA and adjusted EBITDA margin are non-GAAP measures. The Company is unable to present a quantitative reconciliation of these forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures because such information is not available, and management cannot reliably predict the necessary components of such GAAP measures without unreasonable effort largely because forecasting or predicting our future operating results is subject to many factors out of our control or not readily predictable. In addition, the Company believes that such reconciliations would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on the Company’s fiscal 2023 and future financial results. These non-GAAP financial measures are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with purchase accounting, quarter-end and year-end adjustments. Any variation between the Company’s actual results and preliminary financial data set forth in this presentation may be material. 2

Our Mission Build Better Companies to Deliver Superior Performance

Vision & Competitive Advantage Build a group of related engineered product companies that operate independently yet collaborate to win bigger business, leverage best practices, share services across companies, and provide career paths for key employees so that each member company can remain focused and agile while accomplishing more than they could alone. Our People Leaders with an ownership mentality, a technical mindset, connecting passion with purpose, and a desire to develop others. Our Culture Continually improving, innovative, entrepreneurial, skin in the game, trusting relationships. Our Structure Independently operating business units are part of a larger ecosystem that provides business coaching/mentoring, best practices, common systems and shared services, cash management and capital allocation, M&A, and leadership development. Our Process Liquidity event with equity engagement, capital to grow, and modest leverage. 4

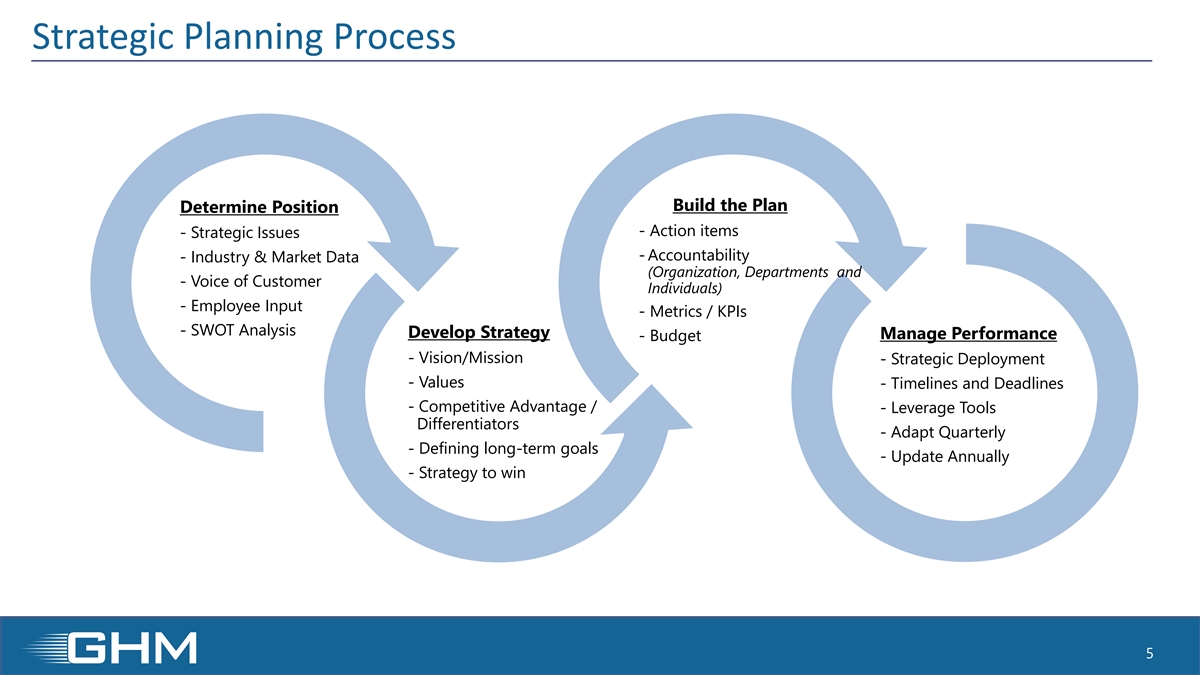

Strategic Planning Process Build the Plan Determine Position - Action items - Strategic Issues - Accountability - Industry & Market Data (Organization, Departments and - Voice of Customer Individuals) - Employee Input - Metrics / KPIs - SWOT Analysis Develop Strategy Manage Performance - Budget - Vision/Mission - Strategic Deployment - Values - Timelines and Deadlines - Competitive Advantage / - Leverage Tools Differentiators - Adapt Quarterly - Defining long-term goals - Update Annually - Strategy to win 5

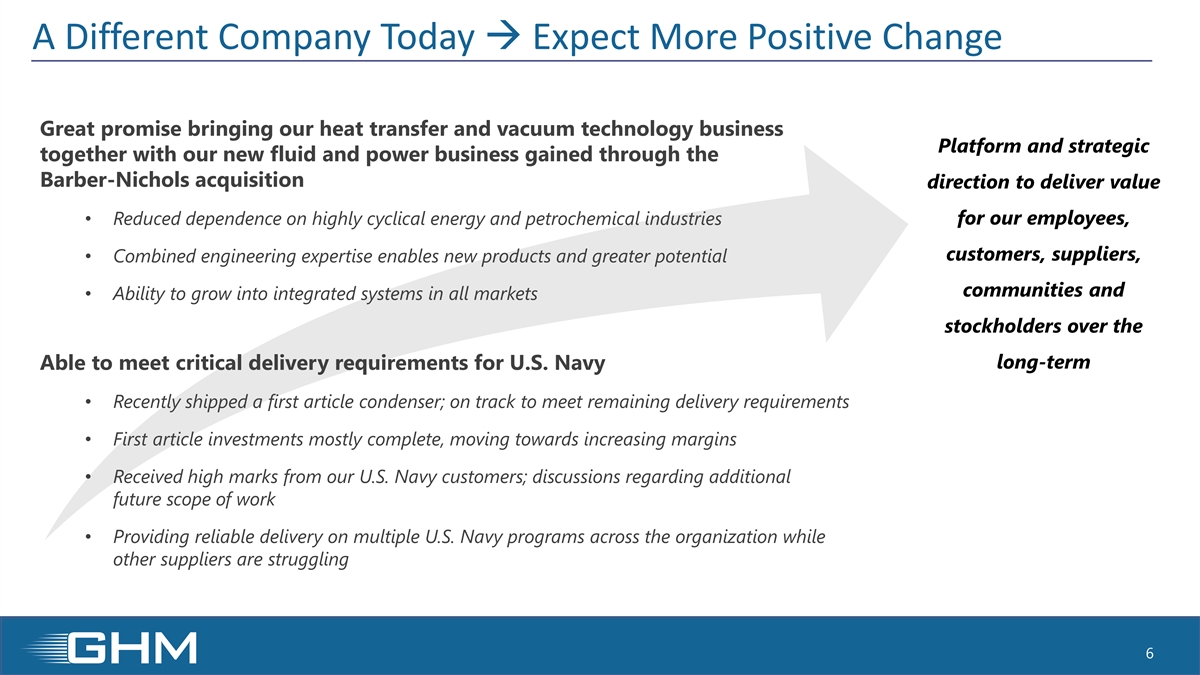

A Different Company Today → Expect More Positive Change Great promise bringing our heat transfer and vacuum technology business Platform and strategic together with our new fluid and power business gained through the Barber-Nichols acquisition direction to deliver value • Reduced dependence on highly cyclical energy and petrochemical industries for our employees, customers, suppliers, • Combined engineering expertise enables new products and greater potential communities and • Ability to grow into integrated systems in all markets stockholders over the long-term Able to meet critical delivery requirements for U.S. Navy • Recently shipped a first article condenser; on track to meet remaining delivery requirements • First article investments mostly complete, moving towards increasing margins • Received high marks from our U.S. Navy customers; discussions regarding additional future scope of work • Providing reliable delivery on multiple U.S. Navy programs across the organization while other suppliers are struggling 6

Added Critical Talent and Board of Directors Enhanced Structure Appointed two new directors in March 2022 with significant defense industry knowledge Reorganization and alignment of Daniel J. Thoren President and Chief Executive Officer key management positions • Joined GHM Jun 2021 • Over 30 years experience • Prior CEO of Barber-Nichols Director of Sales Director of Navy Operations Navy Supervisors Director of Commercial Operations Director of Engineering Director of Supply Chain Christopher J. Thome Alan E. Smith Matthew J. Malone Human Resource Manager Vice President Finance & Vice President and General Vice President and General Chief Financial Officer Manager- Batavia Manager of Barber-Nichols Product Managers • Joined GHM Apr 2022• Joined GHM July 2007• Joined GHM Jun 2021 • Over 30 years experience• Over 30 years experience• Over 10 years experience • Prior Corporate Controller & • Prior Director of Operations • Prior VP Operations at Treasurer at Allied Motion at Lydell Barber-Nichols Technologies 7

Corporate Strategies and Initiatives Build better companies through regular strategic evaluation, business practices and smart investments Leverage board and industry connections for accelerating corporate entity structure and processes Advance strategic market offerings to full life cycle system level and build our organization to serve Grow leaders at all levels Provide value-enhancing corporate support and services to our operating entities 8

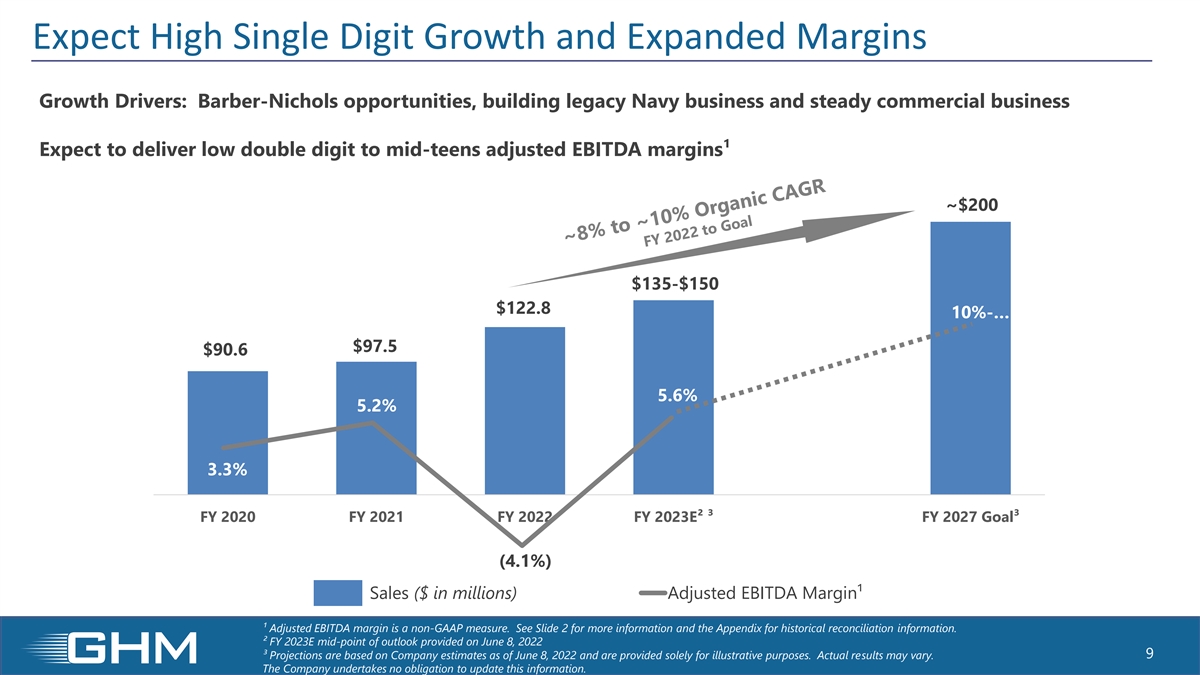

Expect High Single Digit Growth and Expanded Margins Growth Drivers: Barber-Nichols opportunities, building legacy Navy business and steady commercial business Expect to deliver low double digit to mid-teens adjusted EBITDA margins¹ ~$200 $135-$150 $122.8 10%-… $97.5 $90.6 5.6% 5.2% 3.3% FY 2020 FY 2021 FY 2022 FY 2023E² ³ FY 2027 Goal³ (4.1%) Sales ($ in millions) Adjusted EBITDA Margin¹ ¹ Adjusted EBITDA margin is a non-GAAP measure. See Slide 2 for more information and the Appendix for historical reconciliation information. ² FY 2023E mid-point of outlook provided on June 8, 2022 ³ Projections are based on Company estimates as of June 8, 2022 and are provided solely for illustrative purposes. Actual results may vary. 9 The Company undertakes no obligation to update this information.

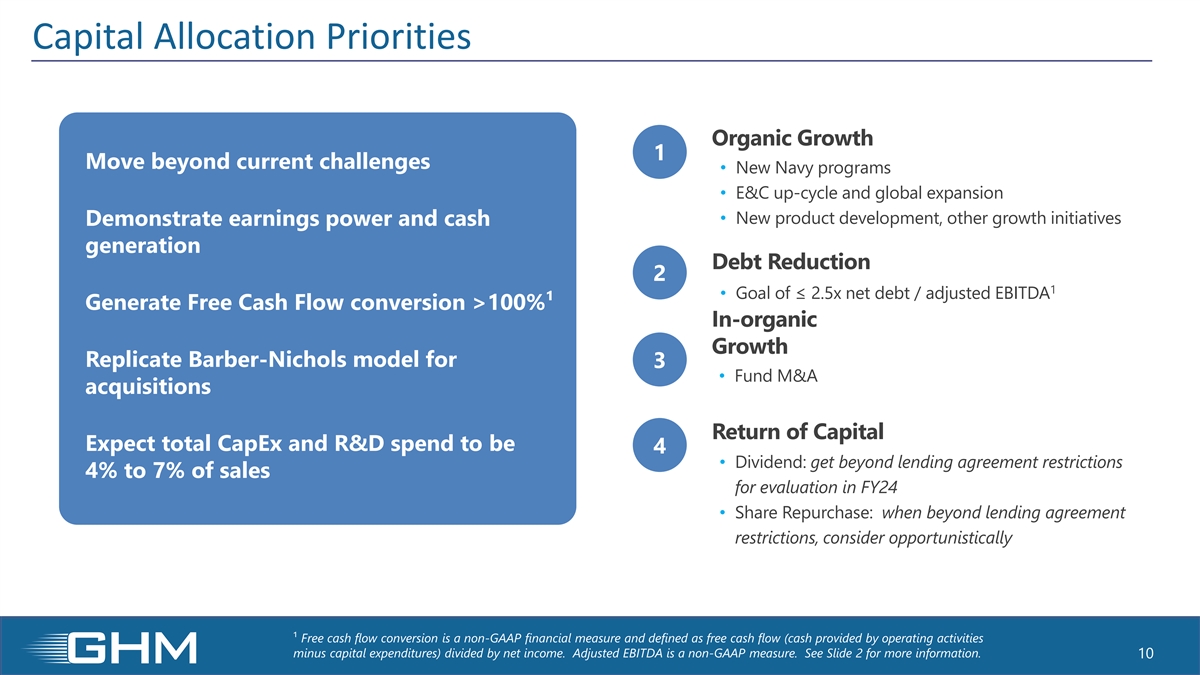

Capital Allocation Priorities Organic Growth 1 Move beyond current challenges • New Navy programs • E&C up-cycle and global expansion • New product development, other growth initiatives Demonstrate earnings power and cash generation Debt Reduction 2 1 • Goal of ≤ 2.5x net debt / adjusted EBITDA Generate Free Cash Flow conversion >100%¹ In-organic Growth Replicate Barber-Nichols model for 3 • Fund M&A acquisitions Return of Capital Expect total CapEx and R&D spend to be 4 • Dividend: get beyond lending agreement restrictions 4% to 7% of sales for evaluation in FY24 • Share Repurchase: when beyond lending agreement restrictions, consider opportunistically ¹ Free cash flow conversion is a non-GAAP financial measure and defined as free cash flow (cash provided by operating activities minus capital expenditures) divided by net income. Adjusted EBITDA is a non-GAAP measure. See Slide 2 for more information. 10

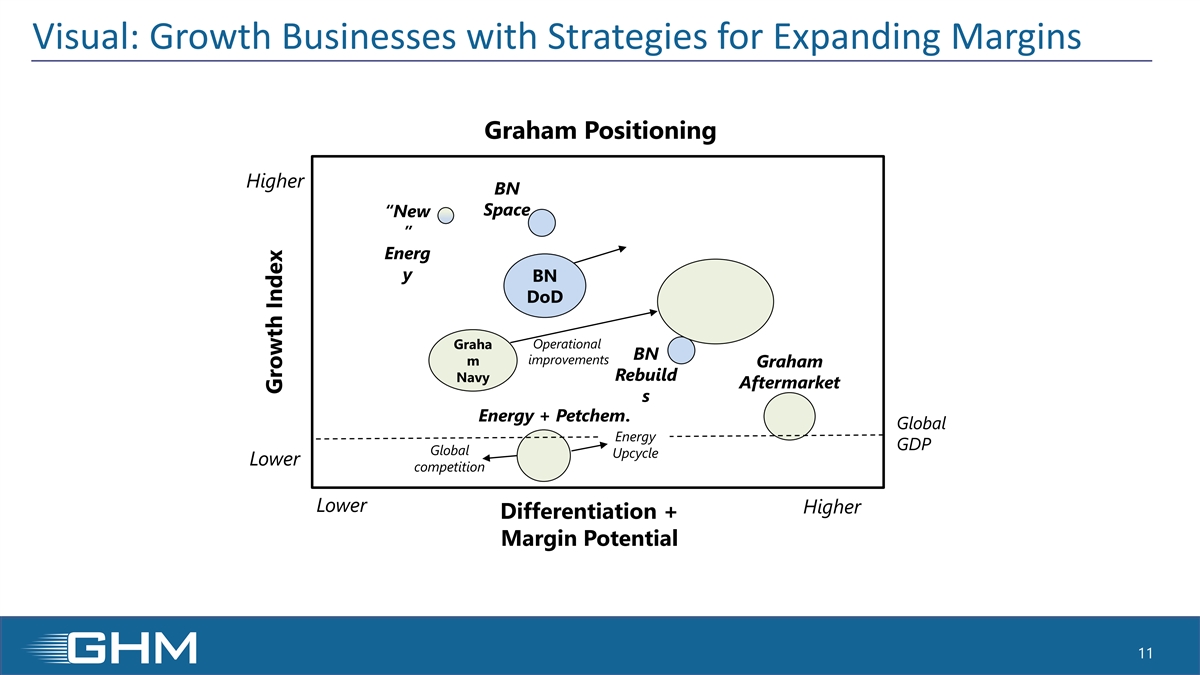

Visual: Growth Businesses with Strategies for Expanding Margins Graham Positioning Higher BN Space “New ” Energ y BN DoD Graha Operational BN improvements m Graham Rebuild Navy Aftermarket s Energy + Petchem. Global Energy GDP Global Upcycle Lower competition Lower Higher Differentiation + Margin Potential 11 Growth Index

• Founded: 1936 • Locations: Batavia, New York; Ahmedabad, India; Suzhou, China • Employees: 328 2 • Campus: 415,000 ft Competitive Advantages People Technical SMEs Architecture Int’l Offices, R&D, Fab Facilities, Installed Base Processes Quality, Weld, Service, Training Culture Problem Solving, Service Orientation 12

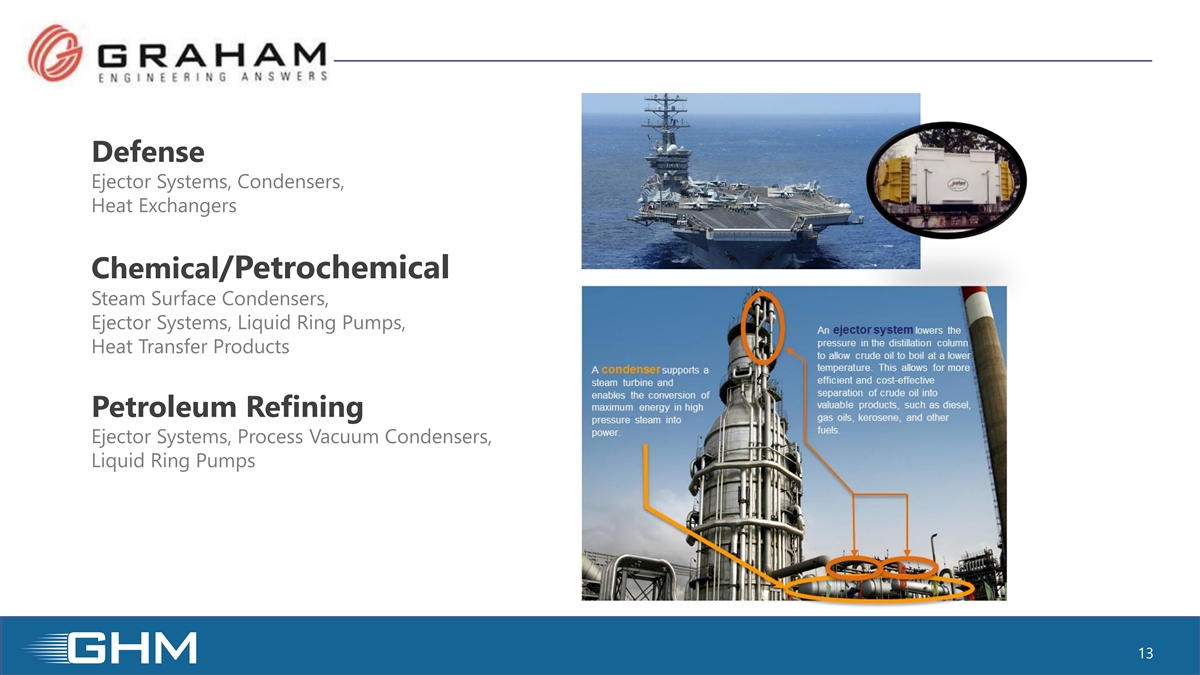

Defense Ejector Systems, Condensers, Heat Exchangers Chemical/Petrochemical Steam Surface Condensers, Ejector Systems, Liquid Ring Pumps, Heat Transfer Products Petroleum Refining Ejector Systems, Process Vacuum Condensers, Liquid Ring Pumps 13

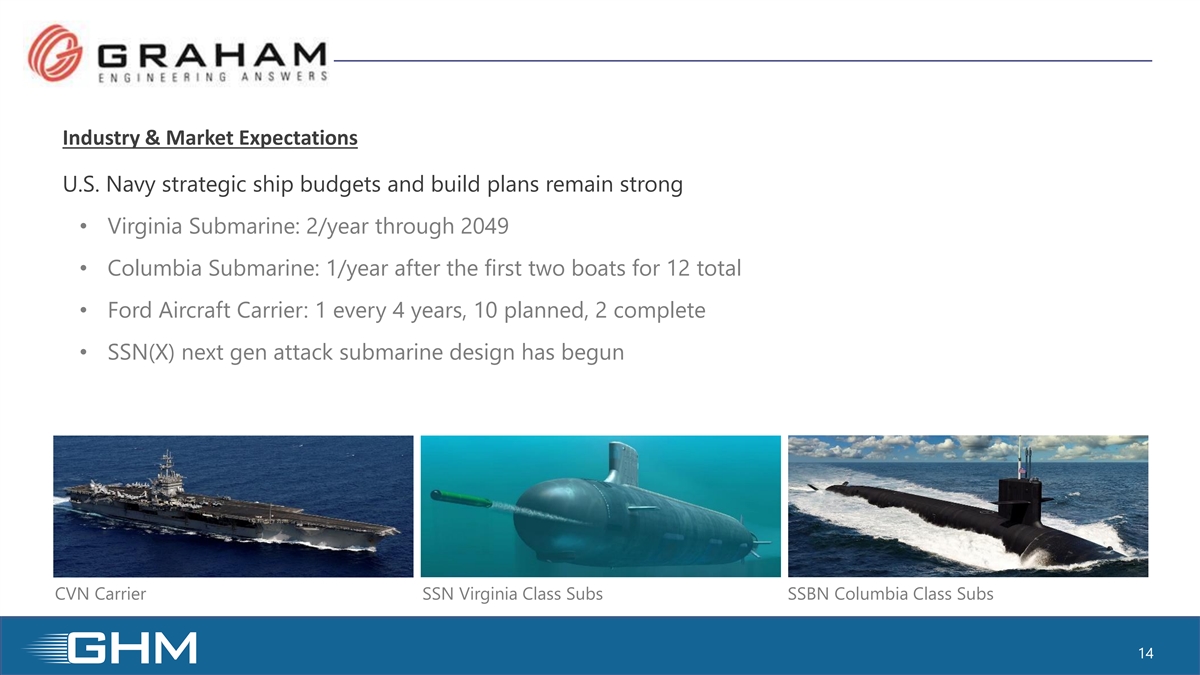

Industry & Market Expectations U.S. Navy strategic ship budgets and build plans remain strong • Virginia Submarine: 2/year through 2049 • Columbia Submarine: 1/year after the first two boats for 12 total • Ford Aircraft Carrier: 1 every 4 years, 10 planned, 2 complete • SSN(X) next gen attack submarine design has begun CVN Carrier SSN Virginia Class Subs SSBN Columbia Class Subs 14

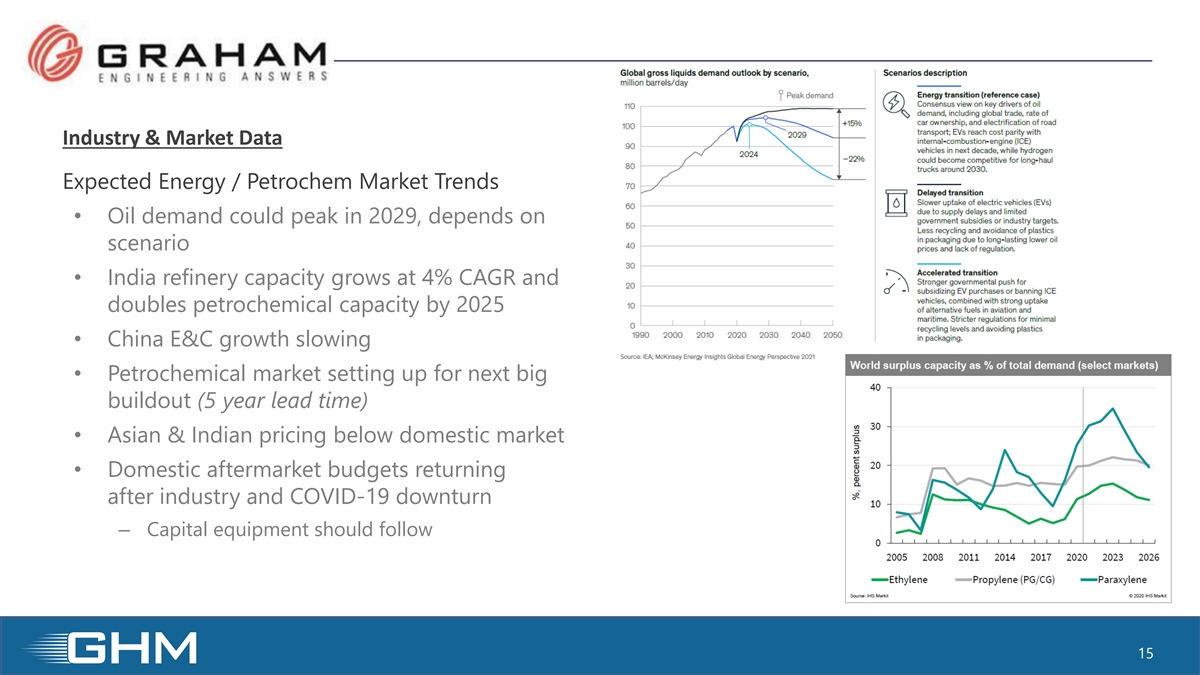

Industry & Market Data Expected Energy / Petrochem Market Trends • Oil demand could peak in 2029, depends on scenario • India refinery capacity grows at 4% CAGR and doubles petrochemical capacity by 2025 • China E&C growth slowing • Petrochemical market setting up for next big buildout (5 year lead time) • Asian & Indian pricing below domestic market • Domestic aftermarket budgets returning after industry and COVID-19 downturn – Capital equipment should follow 15

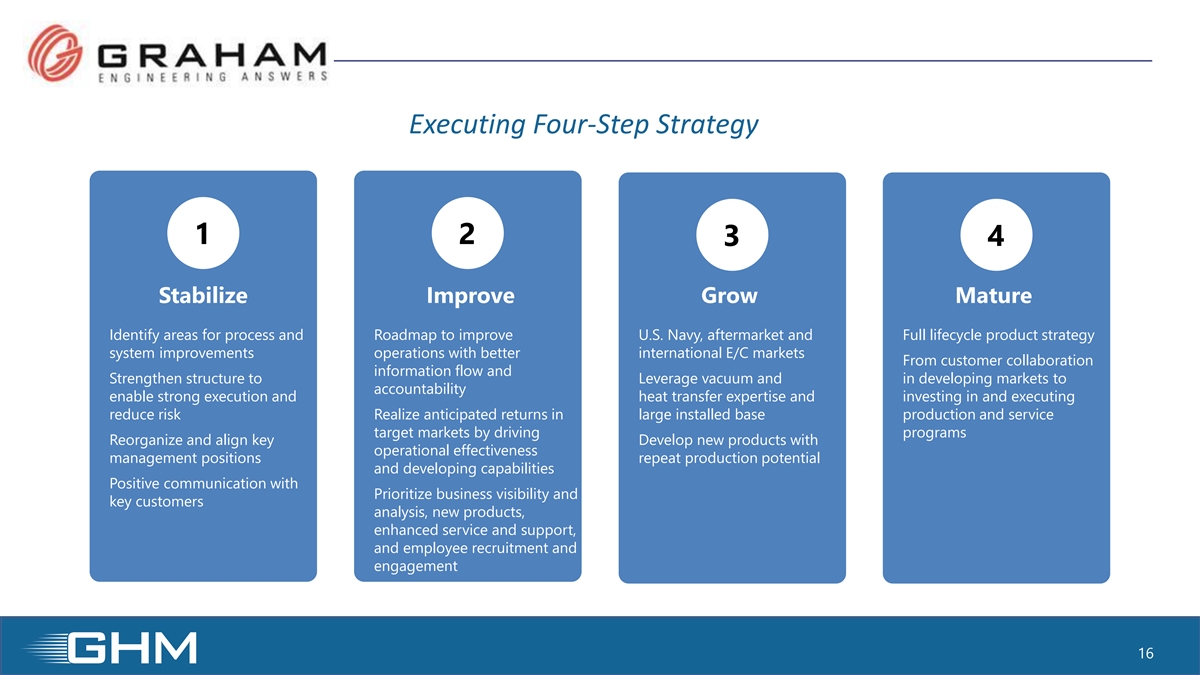

Executing Four-Step Strategy 1 2 3 4 Stabilize Improve Grow Mature Identify areas for process and Roadmap to improve U.S. Navy, aftermarket and Full lifecycle product strategy system improvements operations with better international E/C markets From customer collaboration information flow and Strengthen structure to Leverage vacuum and in developing markets to accountability enable strong execution and heat transfer expertise and investing in and executing reduce risk Realize anticipated returns in large installed base production and service target markets by driving programs Reorganize and align key Develop new products with operational effectiveness management positions repeat production potential and developing capabilities Positive communication with Prioritize business visibility and key customers analysis, new products, enhanced service and support, and employee recruitment and engagement 16

• Founded: 1966 • Location: Arvada, Colorado • Employees: 170 2 • Campus: 96,000 ft 2 – Added a 43,000 ft state-of-the-art manufacturing facility January 2021 Competitive Advantages People Relationship driven technical SMEs Architecture Measured diverse growth, Integrated Design/Mfg/Assy/Test/OH Processes Consistent, predictable, stable Culture Connecting Passion with Purpose 17

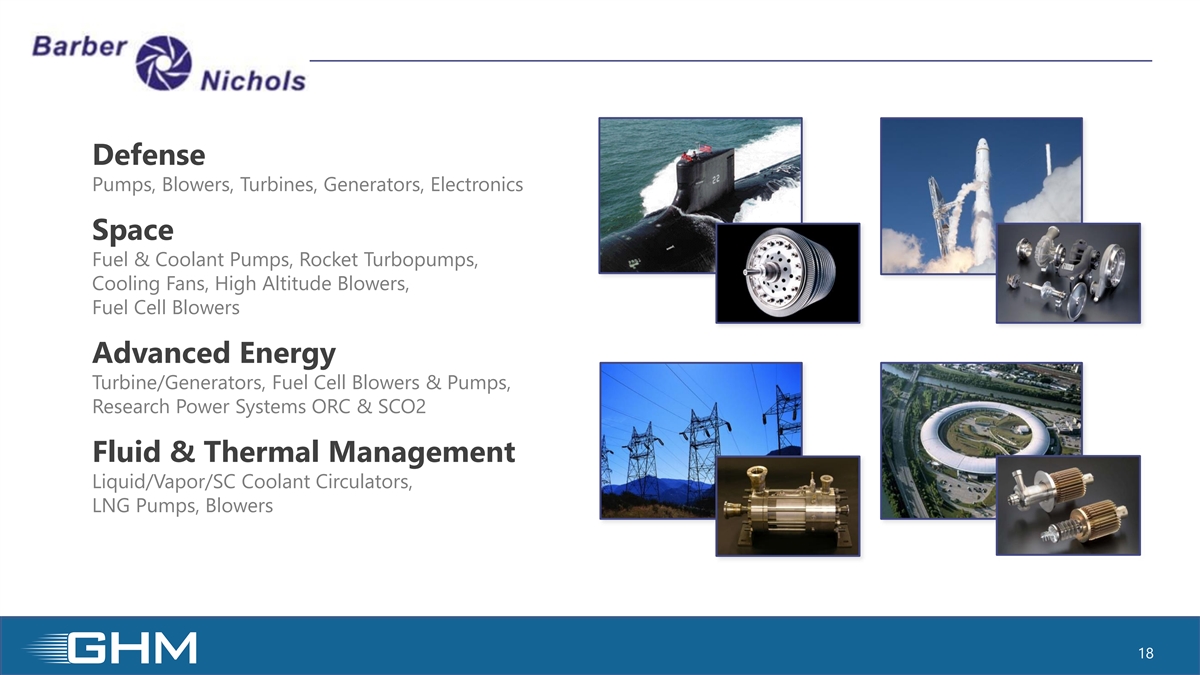

Defense Pumps, Blowers, Turbines, Generators, Electronics Space Fuel & Coolant Pumps, Rocket Turbopumps, Cooling Fans, High Altitude Blowers, Fuel Cell Blowers Advanced Energy Turbine/Generators, Fuel Cell Blowers & Pumps, Research Power Systems ORC & SCO2 Fluid & Thermal Management Liquid/Vapor/SC Coolant Circulators, LNG Pumps, Blowers 18

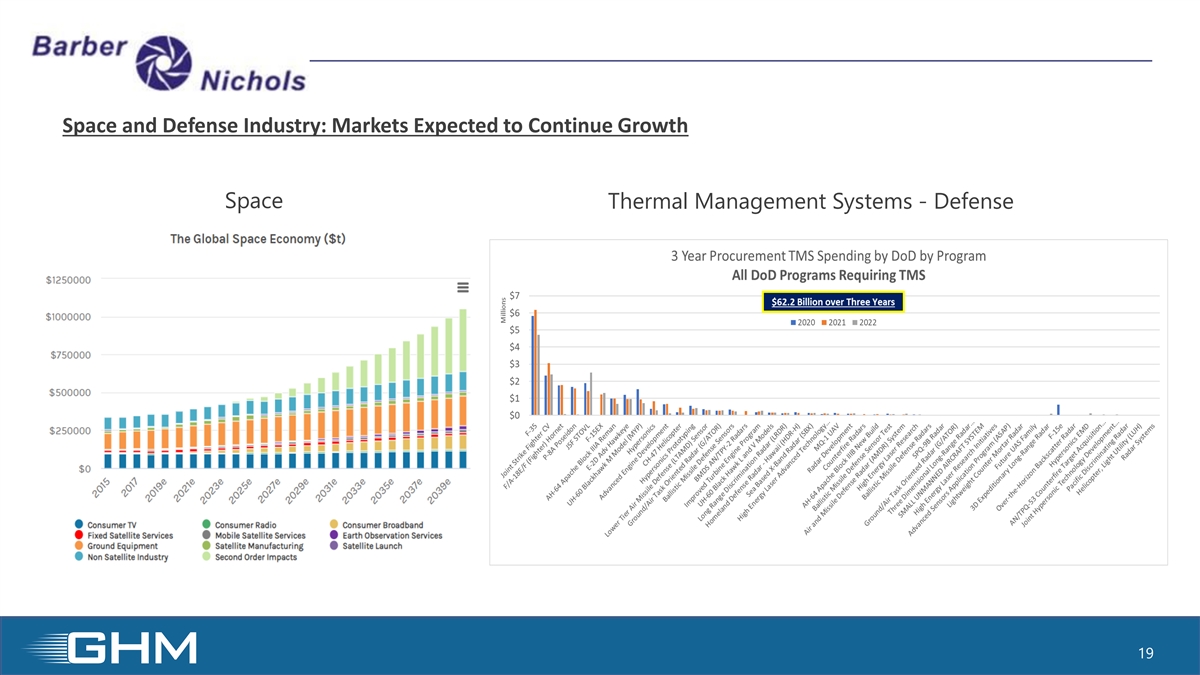

Space and Defense Industry: Markets Expected to Continue Growth Space Thermal Management Systems - Defense 19

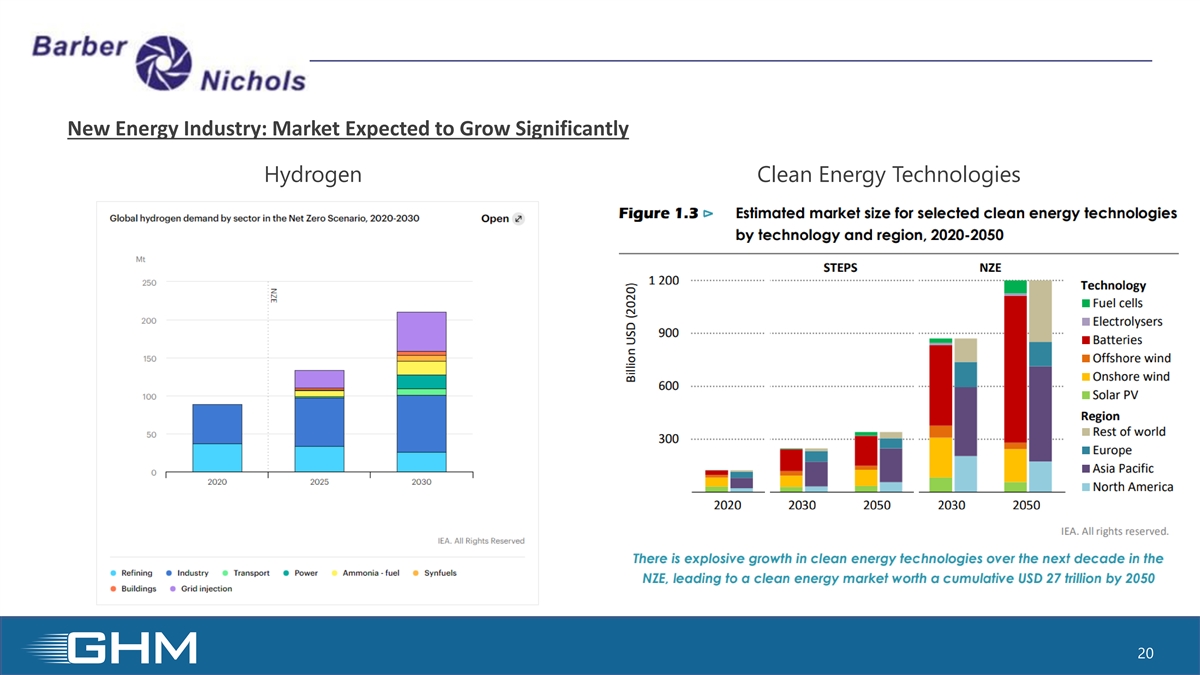

New Energy Industry: Market Expected to Grow Significantly Hydrogen Clean Energy Technologies 20

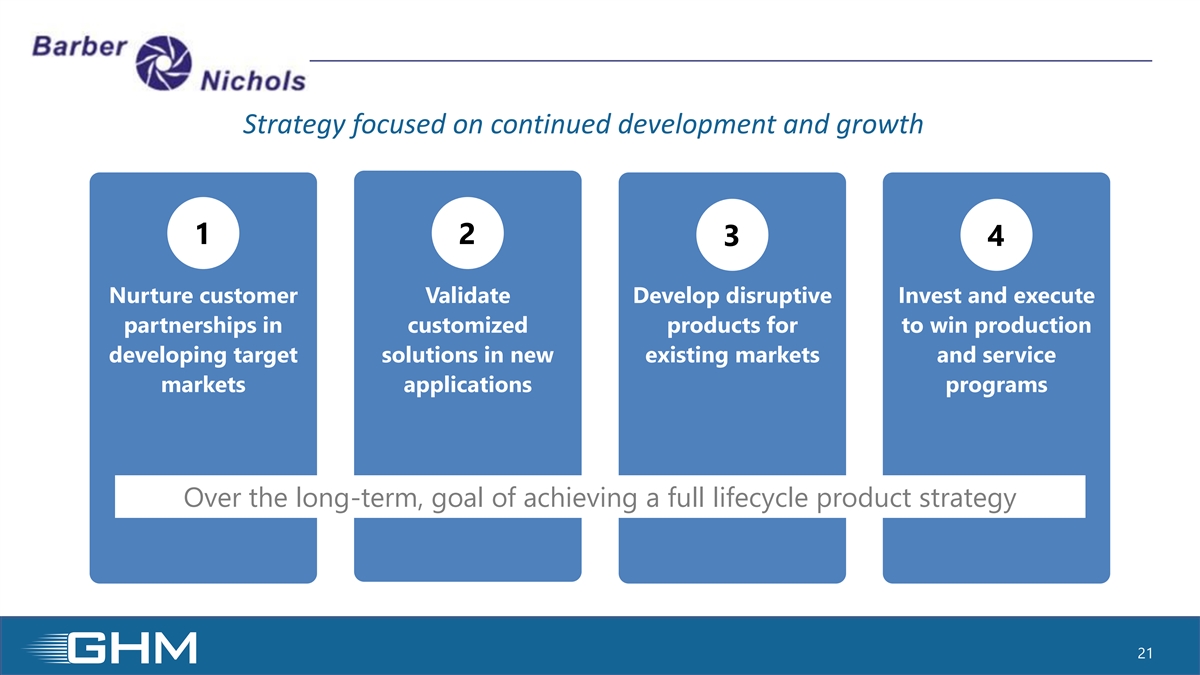

Strategy focused on continued development and growth 1 2 3 4 Nurture customer Validate Develop disruptive Invest and execute partnerships in customized products for to win production developing target solutions in new existing markets and service markets applications programs Over the long-term, goal of achieving a full lifecycle product strategy 21

Our Commitment to Sustainability https://www.grahamcorp.com/sustainability 22

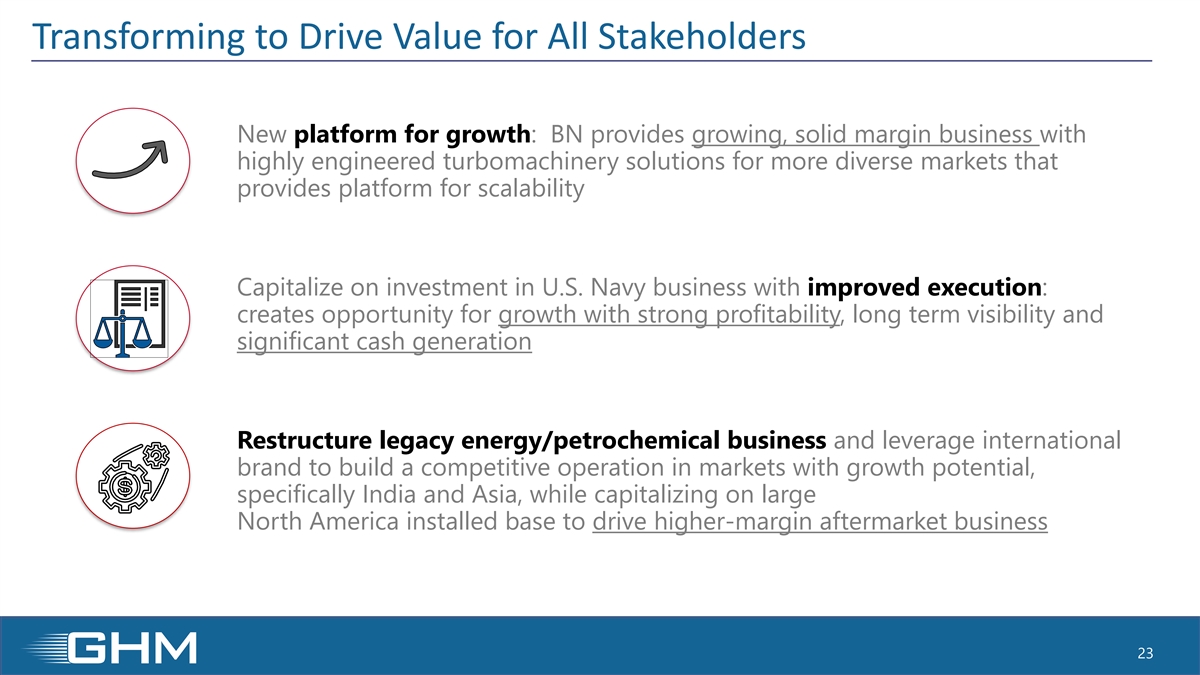

Transforming to Drive Value for All Stakeholders New platform for growth: BN provides growing, solid margin business with highly engineered turbomachinery solutions for more diverse markets that provides platform for scalability Capitalize on investment in U.S. Navy business with improved execution: creates opportunity for growth with strong profitability, long term visibility and significant cash generation Restructure legacy energy/petrochemical business and leverage international brand to build a competitive operation in markets with growth potential, specifically India and Asia, while capitalizing on large North America installed base to drive higher-margin aftermarket business 23

Questions and Answer Session Questions may be submitted through the webinar portal - Or - To ask in person dial 1-201-689-8560, where an operator will place you in the question queue. Please mute the audio on the webinar if asking questions on the conference line.

Supplemental Information www.GrahamCorp.com

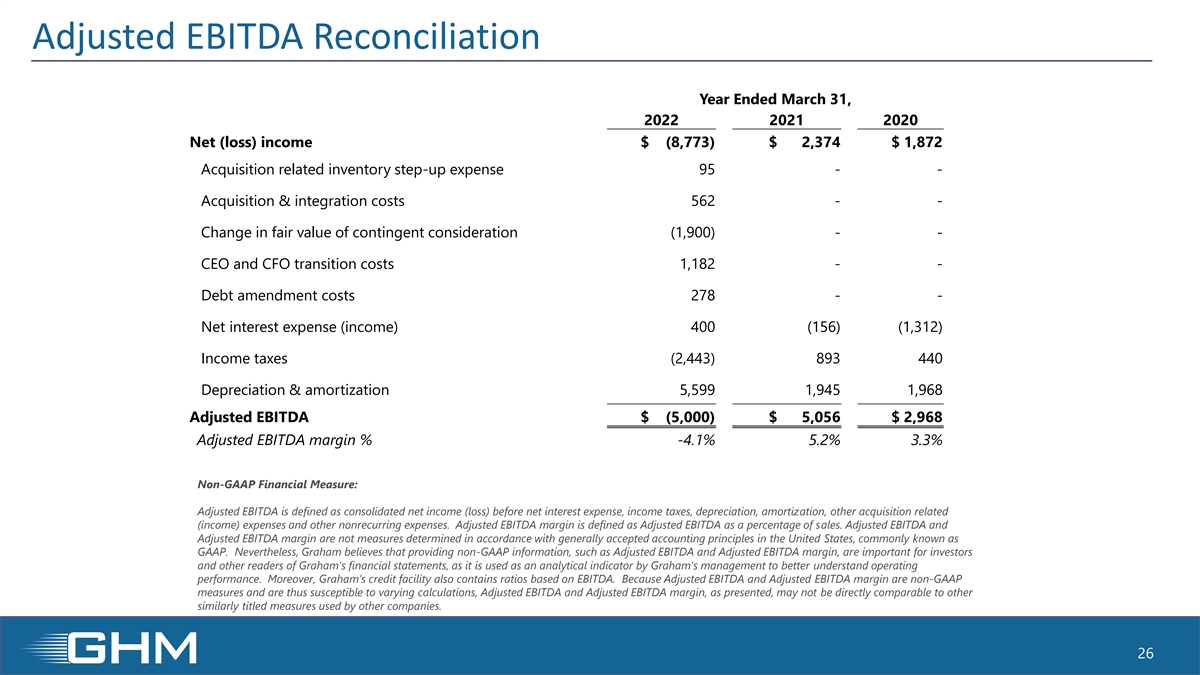

Adjusted EBITDA Reconciliation Year Ended March 31, 2022 2021 2020 Net (loss) income $ (8,773) $ 2,374 $ 1,872 Acquisition related inventory step-up expense 95 - - Acquisition & integration costs 562 - - Change in fair value of contingent consideration (1,900) - - CEO and CFO transition costs 1,182 - - Debt amendment costs 278 - - Net interest expense (income) 400 (156) (1,312) Income taxes (2,443) 893 440 Depreciation & amortization 5,599 1,945 1,968 Adjusted EBITDA $ (5,000) $ 5,056 $ 2,968 Adjusted EBITDA margin % -4.1% 5.2% 3.3% Non-GAAP Financial Measure: Adjusted EBITDA is defined as consolidated net income (loss) before net interest expense, income taxes, depreciation, amortization, other acquisition related (income) expenses and other nonrecurring expenses. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of sales. Adjusted EBITDA and Adjusted EBITDA margin are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP. Nevertheless, Graham believes that providing non-GAAP information, such as Adjusted EBITDA and Adjusted EBITDA margin, are important for investors and other readers of Graham's financial statements, as it is used as an analytical indicator by Graham's management to better understand operating performance. Moreover, Graham’s credit facility also contains ratios based on EBITDA. Because Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures and are thus susceptible to varying calculations, Adjusted EBITDA and Adjusted EBITDA margin, as presented, may not be directly comparable to other similarly titled measures used by other companies. 26