UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

GRAHAM CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25 (b) per Exchange Act Rules 14a-6 (i) (1) and 0-11. | |||

We are a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the defense, space, energy and process industries. Our core strengths include:

| • | We have a value-enhancing sales and development platform. |

| • | We are known for our strong capabilities to handle complex, custom orders. |

| • | We maintain a responsive, flexible production environment. |

| • | We have the capability to manage outsourced production. |

| • | We provide robust after-the-sale technical support. |

| • | We have a highly trained workforce. |

| • | We have the unique capability to manufacture to tight tolerances. |

Notice of Annual Meeting

of Stockholders

|

Meeting Details:

| ||||||||||||

| Meeting Business

The principal business of the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), as described in the accompanying proxy materials will be:

(1) Election of two director nominees;

(2) To approve, on an advisory basis, the compensation of our named executive officers (“say on pay”);

(3) To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2023;

(4) To approve Amendment No. 2 to the Employee Stock Purchase Plan; and

(5) To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

|

Date: Wednesday, July 27, 2022

|

|

Place: www.proxydocs.com/GHM

In order to virtually attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions at the meeting. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person. | ||||||||

|

|

Time: 11:00 a.m. Eastern Time

| |||||||||||

|

|

Record Date: June 8, 2022 | |||||||||||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JULY 27, 2022:

The Notice of Annual Meeting, Proxy Statement and the Annual Report are available at www.proxydocs.com/GHM

BY ORDER OF THE BOARD OF DIRECTORS

Christopher Thome Vice President – Finance, Chief Financial Officer and Corporate Secretary | ||||||||||||

Dated: June 17, 2022

Vote Your Shares

How to Vote

Your vote is very important, and we hope that you will participate in the Annual Meeting. You are eligible to vote if you were a stockholder of record at the close of business on June 8, 2022. In order to virtually attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting. Please read the proxy statement and vote right away using any of the following methods.

Stockholders of Record:

|

Vote By Internet Before or During the Meeting Visit: www.proxypush.com/GHM and follow the instructions |

|

Vote By Telephone Call 1-866-256-0715 and follow the instructions |

|

Vote By Mail Sign, date, and return your proxy card, if you received one, using the enclosed envelope | |||||||||

Beneficial Stockholders:

If you are a beneficial stockholder, you will receive instructions from your brokerage firm, bank, broker-dealer, nominee, custodian, fiduciary or other nominee that you must follow in order for your shares to be voted. Your broker may not vote your shares for director nominees or on the advisory vote on executive compensation unless you provide your broker with voting instructions.

Certain statements in this proxy statement contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “intends,” “anticipates,” “believes,” “opportunities,” “will,” “may,” “seeks,” “estimates,” and other similar words. All statements addressing operating performance, events, or developments that we expect or anticipate will occur in the future, including but not limited to our growth, diversification strategy, markets, returns and solutions, financial flexibility, and our ability to achieve our operating priorities are forward-looking statements and should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in our Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize or should any of our underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on our forward-looking statements. These forward-looking statements are not guarantees of future performance and speak only as of the date made, and except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained herein.

|

Proxy Statement Summary • The Annual Meeting

|

To assist you in reviewing the proposals to be considered and voted upon at our annual meeting of stockholders (the “Annual Meeting”) to be held on July 27, 2022, we have summarized information contained elsewhere in this proxy statement or in our Annual Report on Form 10-K for the fiscal year ended March 31, 2022 (the “Annual Report”). This summary does not contain all of the information you should consider about Graham Corporation (the “Company”) and the proposals being submitted to stockholders at the Annual Meeting. We encourage you to read the entire proxy statement and Annual Report carefully before voting.

| Date and Time: | Wednesday, July 27, 2022, 11:00 a.m. Eastern Time | |

| Location: | Online via: www.proxydocs.com/GHM | |

| Record Date: | June 8, 2022 | |

In order to virtually attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions at the meeting. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person.

Meeting Agenda and Voting Matters

| Item | Proposal | Board Vote Recommendation |

Page Reference (for more information) | |||

| 1 | Election of two director nominees named in this proxy statement | FOR each nominee | 7 | |||

| 2 | Advisory vote on the compensation of our named executive officers (“say on pay”) | FOR | 45 | |||

| 3 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2023 | FOR | 46 | |||

| 4 | To approve Amendment No. 2 to the Employee Stock Purchase Plan | FOR | 48 | |||

Directors and Nominees

|

Name |

Age | Recent Professional Experience | Board Committees |

|||||

| James J. Barber, Ph.D.* |

68 | Independent Consultant and Principal of Barber Advisors, LLC | CC**, NCGC | |||||

| Alan Fortier* |

65 | President of Fortier & Associates, Inc. | AC, NCGC** | |||||

| Cari L. Jaroslawsky*◆ |

53 | Senior Vice President and General Manager of Eaton Mission Systems | AC, NCGC | |||||

| Jonathan W. Painter*◆ |

63 | Chair of the Company’s Board; Chair of Kadant Inc. | AC, CC | |||||

| Lisa M. Schnorr* |

56 | Former Senior Vice President and Project Lead, Digital Enablement for Constellation Brands, Inc. | AC**, CC | |||||

| Troy A. Stoner* |

58 | Chief Executive Officer of Argon ST | CC, NCGC | |||||

| Daniel J. Thoren |

58 | Chief Executive Officer of the Company | — | |||||

* — Independent Director

◆ — Director Nominee

** — Chair

AC — Audit Committee

CC — Compensation Committee

NCGC — Nominating and Corporate Governance Committee

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

1 | |

|

Proxy Statement Summary • Our Business

|

Our Business

We are a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the defense, space, energy and process industries. For the defense industry, our equipment is used in nuclear and non-nuclear propulsion, power, fluid transfer, and thermal management systems. For the space industry our equipment is used in propulsion, power and energy management systems and for life support systems. Our energy and new energy markets include oil refining, cogeneration, and multiple alternative and clean power applications including hydrogen. For the chemical and petrochemical industries, our equipment is used in fertilizer, ethylene, methanol and downstream chemical facilities. We design and manufacture custom-engineered vacuum, heat transfer, pump and turbomachinery technologies.

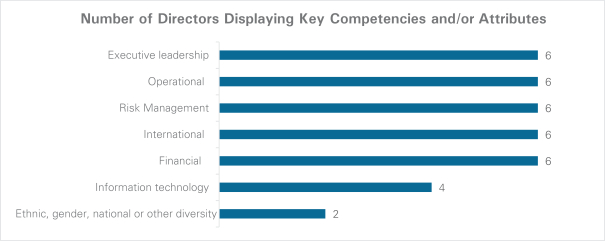

Director Skills and Attributes

We believe that our directors possess the requisite experience and skills necessary to carry out their duties and to serve our best interests and those of our stockholders.

| 2 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Questions and Answers About the Annual Meeting

|

Questions and Answers About the Annual Meeting

Why am I receiving these proxy materials?

These proxy materials are being furnished to you in connection with the solicitation of proxies by our board of directors (the “Board”) for the Annual Meeting to be held on Wednesday, July 27, 2022, at 11:00 a.m., Eastern Time, and at any adjournment or postponement thereof. The Annual Meeting will be conducted as a virtual meeting of stockholders by means of a live audio-only webcast. We believe that hosting a virtual meeting will enable greater stockholder participation from any location. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person.

We made our proxy materials available to stockholders via the internet or in printed form if requested on or about June 17, 2022. Our proxy materials include the Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), the Notice of the Annual Meeting, this proxy statement and the Annual Report. If you requested and received paper copies of the proxy materials by mail, our proxy materials also include the proxy card. These proxy materials, other than the proxy card, can be accessed at www.proxydocs.com/GHM.

The Securities and Exchange Commission’s (the “SEC”) e-proxy rules allow companies to post their proxy materials on the internet and provide only a Notice of Internet Availability to stockholders as an alternative to mailing full sets of proxy materials except upon request. Similar to last year, we have elected to use this notice and access model. Unless you previously indicated your preference to receive paper copies of our proxy statement and Annual Report, you should have received a Notice of Internet Availability. The Notice of Internet Availability includes information on how to access our proxy materials on the internet, how to vote and how to request a paper or email copy of the proxy materials at no extra charge this year or on an ongoing basis.

What am I voting on?

At the Annual Meeting, you will vote upon:

| (1) | the election of two director nominees identified in this proxy statement; |

| (2) | a proposal to approve, on an advisory basis, the compensation of our named executive officers; |

| (3) | a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2023; and |

| (4) | a proposal to approve Amendment No. 2 to the Employee Stock Purchase Plan. |

Will there be any other items of business addressed at the Annual Meeting?

As of the date of this proxy statement, we are not aware of any other matter to be presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is intended that the holders of the proxies will act in accordance with their best judgment.

What must I do if I want to participate in the Annual Meeting?

You can participate in the Annual Meeting so long as you register in advance to attend the Annual Meeting at www.proxydocs.com/GHM. You will be asked to provide the control number located inside the shaded gray box on your Notice of Internet Availability or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. Please be sure to follow the instructions found on your Notice of Internet Availability, proxy card and/or voting instruction card and subsequent instructions that will be delivered to you via email.

By visiting www.proxydocs.com/GHM, pre-registering and then accessing the Annual Meeting as instructed, you will be able to participate in the Annual Meeting, vote your shares and ask questions during the meeting. However, if you do not comply with the procedures outlined above, you may not be admitted to the Annual Meeting.

As always, we encourage you to vote your shares prior to the Annual Meeting. This proxy statement furnishes you with the information you need in order to vote, whether or not you participate in the Annual Meeting.

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

3 | |

|

Questions and Answers About the Annual Meeting

|

Who may vote and how many shares can be cast?

If you owned shares of our common stock at the close of business on June 8, 2022, which is the record date for the Annual Meeting, then you are entitled to vote your shares at the Annual Meeting. At the close of business on the record

date, we had 10,602,605 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote on each proposal.

How do I vote?

Stockholder of Record: Shares Registered in Your Name. If on the record date, your shares of our common stock were registered directly in your name with our transfer agent, then you are a stockholder of record and your shares will be voted as you indicate. If you are a stockholder of record, there are four ways to vote:

| • | By internet at www.proxypush.com/GHM. We encourage you to vote this way. |

| • | By touch tone telephone: call toll-free at 1-866-256-0715. |

| • | By completing and mailing your proxy card. |

| • | By voting during the Annual Meeting before the polls close: To be admitted to the Annual Meeting and vote your shares, you must register and provide the control number as described in the Notice of Internet Availability or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. |

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote to ensure your vote is counted. You may still attend and vote during the meeting if you have already voted by proxy. Only the latest vote you properly submit will be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank. If on the record date, your shares of our common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, which we collectively refer to as a broker, then you are the beneficial owner of shares held in “street name” and these proxy materials are being made available to you by that organization along with a voting instruction card. As a beneficial owner, you must vote your shares in the manner prescribed by your broker. Your broker has enclosed or otherwise provided a voting instruction card for you to use in directing the broker how to vote your shares. Your shares will be voted as you indicate. Check the voting instruction card used by that organization to see if it offers internet or telephone voting.

If you hold your shares in street name, you will receive instructions from your broker, bank or nominee that you must follow in order to submit your voting instructions and have your shares voted at the Annual Meeting. If you want to vote in person virtually at the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the Annual Meeting as described above so that your vote will be counted if you later decide not to attend or are unable to attend the Annual Meeting.

What happens if I do not give specific voting instructions?

If you are a stockholder of record and you indicate when voting over the internet or by telephone that you wish to vote as recommended by our Board or sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by our Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then a “broker non-vote” occurs. In that case, the broker has discretionary authority to vote your shares with respect to the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm (because it is considered a “routine” proposal under the rules of the New York Stock Exchange (the “NYSE”), but cannot vote your shares on any other matters being considered at the Annual Meeting (because they are considered to be non-routine proposals under NYSE rules). When our inspector of election tabulates the votes for

| 4 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Questions and Answers About the Annual Meeting

|

any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. We therefore encourage you to provide voting instructions on each proposal to the organization that holds your shares.

What constitutes a quorum for the Annual Meeting?

A quorum is required for our stockholders to conduct business at the Annual Meeting. Pursuant to our amended and restated by-laws, the holders of record of a majority of the shares of our common stock present in person or by proxy and entitled to vote at the Annual Meeting will constitute a quorum.

What vote is required to approve each proposal and how does the Board recommend that I vote?

The vote required to approve each proposal, and the Board’s recommendation with respect to each proposal are described below:

| Proposal Number |

Proposal Description | Board Recommendation |

Vote Required | Effect of Abstentions |

Effect of Broker Non-Votes | |||||

| One |

Election of the two director nominees identified in this proxy statement | FOR each nominee |

Plurality of the shares present, in person or by proxy, and entitled to vote at the Annual Meeting(1) | None | None | |||||

| Two |

Approval, on an advisory basis, of the compensation of our named executive officers | FOR | Majority of the shares eligible to be cast by holders present, in person or by proxy, and entitled to vote at the Annual Meeting(2) | Same effect as a vote cast against the proposal | Same effect as vote cast against proposal | |||||

| Three |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2023 | FOR | Majority of the shares eligible to be cast by holders present, in person or by proxy, and entitled to vote at the Annual Meeting(3) | Same effect as vote cast against proposal | N/A because this proposal is a routine matter on which brokers may vote | |||||

| Four |

Approve Amendment No. 2 to the Employee Stock Purchase Plan | FOR | Majority of the shares eligible to be cast by holders present, in person or by proxy, and entitled to vote at the Annual Meeting | Same effect as a vote cast against the proposal | Same effect as vote cast against proposal | |||||

| (1) | Our stockholders elect directors by a plurality vote, which means that the director nominees receiving the most votes will be elected. However, our Corporate Governance Guidelines provide that any nominee for director who receives a greater number of votes “withheld” from his or her election than “for” such election must tender his or her resignation for consideration by the Nominating and Corporate Governance Committee of our Board. The Nominating and Corporate Governance Committee will recommend to the Board the action to be taken with respect to such resignation. |

| (2) | The advisory vote to approve the compensation of our named executive officers is not binding upon our Board or the Compensation Committee of our Board. However, the Board and the Compensation Committee will consider the outcome of this vote when making future compensation decisions. |

| (3) | We are presenting the appointment of Deloitte & Touche LLP to our stockholders for ratification. The Audit Committee of our Board will consider the outcome of this vote in its future discussions regarding the appointment of our independent registered public accounting firm. |

How can I obtain a stockholder list?

A stockholder list will be available for examination by our stockholders during ordinary business hours throughout the ten-day period prior to the Annual Meeting at our principal executive offices at 20 Florence Avenue, Batavia, New York 14020, and during the meeting via the virtual meeting site for any purpose germane to the meeting.

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

5 | |

|

Questions and Answers About the Annual Meeting

|

Can I change or revoke my vote?

Your attendance at the Annual Meeting will not automatically revoke your proxy. However, if you are a stockholder of record you can change or revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | timely voting again via the internet or by telephone; |

| • | delivering a timely written notice of revocation to our Corporate Secretary at Graham Corporation, 20 Florence Avenue, Batavia, New York 14020; |

| • | completing, signing, dating and mailing a timely new proxy card to the address above; or |

| • | attending the Annual Meeting and voting again. |

Only your last-submitted, timely vote will count at the Annual Meeting.

If you are a street name holder, you must contact your broker to receive instructions as to how you may revoke your proxy instructions.

We encourage you to vote in advance of the Annual Meeting to ensure your vote is counted should you be unable to participate in the Annual Meeting. Stockholders who have pre-registered to attend the Annual Meeting and who have not voted their shares prior to the Annual Meeting or who wish to change their vote will be able to vote their shares electronically at the Annual Meeting while the polls are open. If you properly provide your proxy in time to be voted at the Annual Meeting, it will be voted as you specify unless it is properly revoked prior thereto. If you properly provide your proxy but do not include your voting specifications, the shares represented by the proxy will be voted in accordance with the recommendations of the Board, as described in this proxy statement.

Who is paying for this proxy solicitation?

This proxy solicitation is made by our Board on our behalf, and we will bear the cost of soliciting proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone or other means of communication. We will not compensate our directors, officers or employees for making proxy solicitations on our behalf. We will provide persons holding shares in their name or in the names of nominees, which in either case are beneficially owned by others, soliciting materials for delivery to those beneficial owners and will reimburse the record owners for their expenses in doing so.

Can I ask questions at the Annual Meeting?

If you registered in advance and attend the Annual Meeting, you may submit questions during the Annual Meeting. We encourage you to submit questions at www.proxydocs.com/GHM after logging in with your unique control number provided in connection with your pre-registration for the Annual Meeting.

We expect to respond to questions during the Annual Meeting that are pertinent to meeting matters as time permits. We may group together questions that are substantially similar to avoid repetition.

How can I find out the voting results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. We will publish the voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days after the Annual Meeting.

Where can I obtain additional information?

You can obtain, free of charge, a copy of our annual report on Form 10-K for the fiscal year ended March 31, 2022 (“fiscal year 2022”) by:

| • | accessing our website at www.grahamcorp.com under the heading “Investor Relations”; |

| • | writing to us at: Graham Corporation, Attention: Annual Report Request, 20 Florence Avenue, Batavia, New York 14020; or |

| • | telephoning us at (585) 343-2216. |

You can also obtain a copy of our annual report on Form 10-K and all other reports and information that we file with, or furnish to, the SEC from the SEC’s EDGAR database located at www.sec.gov.

| 6 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Proposal One: Election of Directors • Nominees Proposed for Election as Directors at the Annual Meeting

|

Election of Directors

The Board currently consists of seven members. Our amended and restated by-laws provide for a classified board of directors consisting of three classes of directors, with each class serving a staggered three-year term. As a result, stockholders elect only a portion of our Board each year. The terms of two of our directors, Cari L. Jaroslawsky and Jonathan W. Painter, will expire at the Annual Meeting.

The Nominating and Corporate Governance Committee of our Board has nominated Cari L. Jaroslawsky and Jonathan W. Painter for election as directors. If elected, each of Ms. Jaroslawsky and Mr. Painter will hold office for a three-year term expiring in 2025 or until his or her successor is duly elected and qualified. Our Board does not contemplate that either of the nominees will be unable to serve as a director, but if that contingency should occur before the proxies are voted, the designated proxies reserve the right to vote for such substitute nominee(s) as they, in their discretion, determine. Our amended and restated by-laws do not permit re-election after a director reaches the age of 75.

The Board unanimously recommends a vote FOR the election of each of Ms. Jaroslawsky and Mr. Painter as a director to serve for a three-year term expiring in 2025.

Nominees Proposed for Election as Directors at the Annual Meeting

| Cari L. Jaroslawsky

Ms. Jaroslawsky has served as the Senior Vice President and General Manager of Eaton Mission Systems, a leading manufacturer of air-to-air refueling systems, environmental systems, and actuation, primarily for defense markets and a division of Eaton Corporation plc (“Eaton”) since January 2019, having previously served as Senior Vice President of Finance from October 2016 to December 2018 for Cobham International until it was acquired by Eaton. Prior to her position with Cobham Mission Systems, Ms. Jaroslawsky served as the Chief Financial Officer and Treasurer of Servotronics, Inc. (NYSE American: SVT), a designer and manufacturer of advanced technology and consumer products, from 2005 until 2016. Ms. Jaroslawsky is a certified public accountant. She also serves on the board of directors of Rand Capital Corporation (Nasdaq: RAND).

|

Senior Vice President and General Manager of Eaton Mission Systems

AGE DIRECTOR SINCE

53 2022

COMMITTEES ▶ Audit Committee ▶ Nominating and Corporate Governance

| |||||

|

Qualifications

Ms. Jaroslawsky brings to the Board substantial operational and leadership experience and a significant background in accounting and financial matters, including through her prior service as the Chief Financial Officer and Treasurer of a publicly traded company.

|

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

7 | |

|

Proposal One: Election of Directors • Nominees Proposed for Election as Directors at the Annual Meeting

|

| Jonathan W. Painter

Mr. Painter has served as the Chair, since July 2019, and a director, since January 2010, of Kadant Inc. (NYSE: KAI), a leading global supplier of components and engineered systems used in process industries, including the pulp and paper industry. Mr. Painter served as President and Chief Executive Officer of Kadant from January 2010 to July 2019 and as President and Chief Operating Officer from September 2009 to December 2009. Mr. Painter also serves on the board of governors of the Handel and Haydn Society, a symphony orchestra based in Boston Massachusetts.

|

Chair of Kadant Inc.

AGE DIRECTOR SINCE

63 2014

CHAIR OF THE BOARD

COMMITTEES ▶ Audit ▶ Compensation

| |||||

|

Qualifications

Mr. Painter brings valuable experience to the Board and management as a former executive officer of a public company that, similar to us, is in the business of designing, manufacturing and marketing specialized, engineered equipment. The Board believes that Mr. Painter’s diverse experience in operations, finance, mergers and acquisitions and corporate strategy enables him to provide critical insight to the Board and management that will help us to achieve our strategic goals.

|

Directors Whose Terms do not Expire at the Annual Meeting

| James J. Barber, Ph.D.

Dr. Barber has been an independent consultant and the principal of Barber Advisors, LLC, a consulting business advising firms and non-profits in the areas of strategy, management, marketing and operations, since September 2007. From January 2000 to May 2007, Dr. Barber was the President and Chief Executive Officer of Metabolix, Inc. (NASDAQ: MBLX), a bioscience company focused on plastics, chemicals and energy. He was responsible for transforming Metabolix, Inc. from a research boutique into a leader in “clean tech” and industrial biotechnology.

Dr. Barber has served as the independent non-executive Chair of Itaconix plc (formerly Revolymer plc) (LON: ITX), a specialty chemicals company, since December 2018, and served as a non-executive director of Itaconix plc from September 2016 to November 2018. He has also served as a director of numerous private companies.

|

Independent Consultant

and

AGE DIRECTOR SINCE

68 2011

TERM EXPIRES

2023

COMMITTEES ▶ Compensation (Chair) ▶ Nominating and Corporate Governance

| |||||

|

Qualifications

Dr. Barber brings to our Board substantial executive level leadership experience and a deep understanding of product and business development in highly technical industries and alternative energy markets. Dr. Barber also has significant experience in structuring both joint venture and acquisition transactions.

|

| Troy A. Stoner

Mr. Stoner has served as the Chief Executive Officer of Argon ST, a specialist in systems engineering and a subsidiary of The Boeing Company, since April 2020 having served Boeing in a series of advancing roles including Senior Program Manager, Missions & Payloads, Autonomous Systems from December 2019 to March 2020, Senior Manager, Autonomous Systems, Boeing Strategy from November 2017 to November 2019, Senior Maritime Representative, Boeing Global Sales and Marketing, April 2016 to October 2017, and Senior Manager, Boeing Strategy from May 2015 to March 2016. Mr. Stoner retired from the U.S. Navy after 30 years of service.

|

Chief Executive Officer of Argon ST

AGE DIRECTOR SINCE

58 2021

TERM EXPIRES

2023

COMMITTEES ▶ Compensation ▶ Nominating and Corporate Governance

| |||||

|

Qualifications

Mr. Stoner brings to the Board extensive business experience with strategy, leadership and operations at companies within the defense, space and security markets. Our Board and management team value his in-depth knowledge of the U.S. Navy as well as his extensive expertise in military defense systems and U.S. Navy planning and procurement processes.

|

| 8 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Proposal One: Election of Directors • Directors Whose Terms do not Expire at the Annual Meeting

|

| Alan Fortier

Mr. Fortier has served as President of Fortier & Associates, Inc., a strategy and profit improvement consulting firm focused on capital goods and chemicals companies, since 1988. Over his 30+ year consulting career he has helped hundreds of manufacturing businesses exceed aggressive profit targets, in all regions globally. He has also been a Strategic Advisory Board member for Genstar Capital, a middle market private equity group with over $30 billion in assets under management, since January 2019. In addition, between 2007 and 2016, Mr. Fortier was a guest lecturer at Columbia Business School’s MBA and Executive Education programs. Prior to entering consulting he held technical and management positions with DuPont.

|

President of Fortier & Associates, Inc.

AGE DIRECTOR SINCE

65 2008

TERM EXPIRES

2024

COMMITTEES ▶ Nominating and Corporate Governance (Chair) ▶ Audit

| |||||

|

Qualifications

Mr. Fortier brings to the Board more than 35 years of global industrial experience as a strategy and execution consultant and manager. Our Board and management team benefit from his extensive background in our served markets, including energy, petrochemicals, chemicals and large engineering firms, as well as his extensive experience advising boards and senior executives of global capital goods businesses on business strategy, mergers and acquisitions, global growth, pricing, organizational development and management control.

|

| Lisa M. Schnorr

Ms. Schnorr has served as a director since 2014. She retired in May 2021 from Constellation Brands (NYSE: STZ), a Fortune 500 company and a leading international producer of beer, wine and spirits with operations in the U.S., Mexico, New Zealand and Italy. Ms. Schnorr joined Constellation Brands in 2004 and earned promotions through a series of positions with increasing responsibility, including Vice President of Compensation and HRIS (2011-2013), Senior Vice President of Total Rewards (2014-2015), Corporate Controller (2015-2017), Chief Financial Officer of the Wine & Spirits Division (2017-2019), and Senior Vice President and Project Lead of Digital Enablement (2019-2021). Before joining Constellation Brands, Ms. Schnorr held financial and accounting positions at various public and private companies and she began her career in 1987 at PricewaterhouseCoopers (formerly Price Waterhouse), all in Rochester, New York. Since June 2021, Ms. Schnorr has been a member of the board of directors of Vintage Wine Estates (NASDAQ: VWE), where she serves as Audit Committee Chair, since 2021. She holds a B.S. degree in Accounting from the State University of New York at Oswego.

|

Former Senior Vice President

and

AGE DIRECTOR SINCE

56 2014

TERM EXPIRES

2024

COMMITTEES ▶ Compensation ▶ Audit (Chair) | |||||

|

Qualifications

With her background and experience in strategic planning, audit, financial planning and analysis, capital allocation, public company governance and risk management, human resources and investor relations, Ms. Schnorr offers a global business and organizational perspective to the Board. The Board believes that Ms. Schnorr’s background and expertise enables her to guide us through a continued period of organic and acquisition-related growth and allows her to provide insight and leadership to our Audit Committee and Compensation Committee.

|

| Daniel J. Thoren

Mr. Thoren has served as our Chief Executive Officer since September 2021 and became our President and Chief Operating Officer in June 2021. Prior to joining the Company, Mr. Thoren had been employed by Barber-Nichols, LLC (“Barber-Nichols”), a premier supplier of specialty turbomachinery, pumps and electronic drives that address critical applications for the defense and aerospace/space industries, from 1991 until we acquired Barber-Nichols in June 2021, and served in progressively increasing roles, including his service as Barber-Nichol’s President and Chief Executive Officer from 1997 until May 2021 and its Chairman of the Board of Directors through June 2021.

|

Chief Executive Officer of the Company

AGE DIRECTOR SINCE

58 2021

TERM EXPIRES

2024

| |||||

|

Qualifications

As our Chief Executive Officer, and as a result of his day-to-day leadership of the business, Mr. Thoren provides the Board with valuable insight regarding the operations of our Company and our management team and he performs a critical role in the Board’s discussions regarding strategic planning and development. Our Board also benefits from Mr. Thoren’s proven strong leadership skills and experience at Barber-Nichols.

|

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

9 | |

|

Corporate Governance • Director Independence

|

Our Corporate Governance Guidelines provide that the independence standards of the NYSE govern the independence determinations for the members of our Board. The Board has affirmatively determined that each of Messrs. Barber, Fortier, Painter, and Stoner, and Mses. Jaroslawsky and Schnorr is independent and has no material relationship with us as required by the independence standards of the NYSE. In addition, the Board has determined that Messrs. Malvaso and Mazurkiewicz were independent during their respective period of service with the Company under the NYSE independence standards. Mr. Thoren, our Chief Executive Officer and employee, and Mr. Lines, our former Chief Executive Officer and former employee, are not independent.

Mr. Painter, a non-executive independent director, serves as Chair of the Board. Our Board believes that its leadership structure, with a non-executive Chair position separate from our Chief Executive Officer, provides appropriate, independent oversight of management. The Chair of our Board presides at all meetings of the Board and stockholders; presides during regularly held sessions with only the independent directors; encourages and facilitates active participation of all directors; develops the calendar of and agendas for Board meetings in consultation with our Chief Executive Officer and other members of the Board; determines, in consultation with our Chief Executive Officer, the information that should be provided to the Board in advance of meetings; and performs any other duties requested by the Board from time to time.

Committees and Meetings of the Board; Meeting Attendance

Our Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The duties and responsibilities of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are set forth in their respective charters and are described below. The current charter of each committee is available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheading “Governance.” Information contained on our website is not a part of this proxy statement.

The following table lists the membership of the committees of the Board, the Chairs of each committee, and the number of committee meetings held in fiscal year 2022.

| Committee Membership | ||||||||||

| Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | |||||||

| James J. Barber, Ph.D.(1) |

|

|

|

|

|

| ||||

| Alan Fortier(2) |

|

|

|

|

|

| ||||

| Cari L. Jaroslawsky(3) |

|

|

|

|

|

| ||||

| Jonathan W. Painter |

|

|

|

|

|

| ||||

| Lisa M. Schnorr |

|

|

|

|

|

| ||||

| Troy A. Stoner(4) |

|

|

|

|

|

| ||||

| Number of meetings in fiscal year 2022: |

|

|

|

5 | 6 | 5 | ||||

= Chair

= Chair

= Member

= Member

| 10 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

| (1) | Mr. Barber served on the Audit Committee from April 1, 2021 to August 31, 2021. Since September 1, 2021, Mr. Barber has served on the Compensation Committee. Mr. Barber served on the Nominating and Corporate Governance Committee during all of fiscal year 2022. |

| (2) | Mr. Fortier served on the Compensation Committee from April 1, 2021 to August 31, 2021. Since September 1, 2021, Mr. Fortier has served on the Audit Committee. Mr. Fortier served on the Nominating and Corporate Governance Committee during all of fiscal year 2022. |

| (3) | Ms. Jaroslawsky joined the Board in March 2022. |

| (4) | Mr. Stoner joined the Board in March 2022. |

During fiscal year 2022, the Board held a total of eight meetings. Each director attended at least 75% of the aggregate of the total number of meetings of the Board, and the total number of meetings of all committees of the Board on which he or she served.

The non-management directors meet without members of management present during regularly scheduled executive sessions and at such other times as they deem necessary or appropriate. The Chair of the Board presides over these executive sessions.

Our policy requires that each director attend our annual meeting of stockholders or provide the Chair of the Board with advance notice of the reason for not attending. All of our then serving directors attended our 2021 annual meeting of stockholders.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has affirmatively determined that each member of the Audit Committee satisfies the independence standards of the NYSE applicable to audit committee members and applicable SEC rules. The Board has also determined that each of Mses. Jaroslawsky and Schnorr qualifies as an “audit committee financial expert” in accordance with applicable SEC rules based on their education and extensive professional work experience as described in each of their biographies under “Proposal One: Election of Directors.”

The Audit Committee reviews with Deloitte & Touche LLP, our independent registered public accounting firm, our financial statements and internal control over financial reporting, Deloitte & Touche LLP’s auditing procedures and fees, and the possible effects of professional services upon the independence of Deloitte & Touche LLP.

The Audit Committee works closely with the Board, our executive management team and our independent registered public accounting firm to assist the Board in overseeing our accounting and financial reporting processes and financial statement audits. In furtherance of these responsibilities, the Audit Committee assists the Board in its oversight of:

| • | the integrity of our financial statements and internal controls; |

| • | our compliance with legal and regulatory requirements; |

| • | the qualifications and independence of our independent registered public accounting firm; |

| • | the performance of our independent registered public accounting firm; |

| • | the planning for and performance of our internal audit function; and |

| • | risk management (including risk management relating to cybersecurity). |

In addition, the Audit Committee’s responsibilities include reviewing and overseeing any transactions between us and any related person as defined by the SEC’s rules and discussing our guidelines and policies with respect to risk assessment and risk management. The Audit Committee is also responsible for preparing the Audit Committee’s report that the SEC’s rules require to be included in our annual proxy statement, and performing such other tasks that are consistent with the Audit Committee’s charter. The Audit Committee’s report appears under the heading “Report of the Audit Committee.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee evaluates, interviews and nominates candidates for election to the Board and is responsible for oversight of our corporate governance practices.

When identifying director nominees, the Nominating and Corporate Governance Committee solicits suggestions from incumbent directors, management and stockholders. In identifying and evaluating nominees, the Nominating and

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

11 | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

Corporate Governance Committee seeks candidates possessing the highest standards of personal and professional ethics and integrity; practical wisdom, independent thinking, maturity and the ability to exercise sound business judgment; skills, experience and demonstrated abilities that help meet the current needs of the Board; and a firm commitment to the interests of our stockholders. Although the Nominating and Corporate Governance Committee does not maintain a specific written diversity policy, it recognizes the value of diversity and seeks diverse candidates when possible and appropriate and considers diversity in its review of candidates. The Nominating and Corporate Governance Committee believes that diversity includes not only gender and ethnicity, but the various perspectives that come from having differing geographic and cultural backgrounds, viewpoints and life experiences.

In addition, the Nominating and Corporate Governance Committee takes into consideration such other factors as it deems appropriate. These factors may include knowledge of our industry and markets, experience with businesses and other organizations of comparable size, the interplay of the nominee’s experience with the experience of other members of the Board, and the extent to which the candidate would be a desirable addition to the Board and any of its committees. The Nominating and Corporate Governance Committee may consider, among other factors, experience or expertise in our industry, global business, science and technology, competitive positioning, corporate governance, risk management, finance or economics, and public affairs.

Stockholders entitled to vote in the election of directors at any annual meeting may recommend candidates for consideration by the Nominating and Corporate Governance Committee as potential nominees by submitting written recommendations to the attention of our Corporate Secretary at the following address: Graham Corporation, 20 Florence Avenue, Batavia, New York 14020. Stockholder recommendations must contain: (i) each candidate’s name, age, business and residence addresses; (ii) the candidate’s principal occupation or employment; (iii) each candidate’s written consent to serve as a director, if elected; (iv) whether each candidate would be an independent director if elected, and the basis therefore, under the NYSE listing standards; (v) a description of the candidate’s qualifications to be a director; and (vi) such other information regarding each candidate as would be required to be included in the proxy statement pursuant to the SEC’s rules. Any stockholder submitting a recommendation must provide his or her own name and address as they appear on our books and records, as well as the class and number of our shares owned of record and the dates he or she acquired such shares. In addition, any stockholder submitting a recommendation must provide (i) a description of all arrangements or understandings between the stockholder and each candidate and any other person pursuant to which the nominations were made; (ii) the identification of any person retained by the stockholder or by any candidate, or any person acting on his or her behalf to make solicitations for the purpose of electing such candidate and a brief description of the terms of such arrangement; (iii) a description of any arrangement, the effect or intent of which is to mitigate loss, manage risk or benefit from changes in the Company’s share price, or increase or decrease the voting power of the stockholder or beneficial owner with respect to the Company’s shares, and the stockholder’s agreement to notify the Company in writing within five business days after the record date for such meeting of any such arrangement in effect as of the record date for the meeting; and (iv) any such information regarding the stockholder as would be required to be included in a proxy statement or provided to the Company pursuant to the SEC’s rules. The Nominating and Corporate Governance Committee will evaluate director candidates proposed by stockholders using the same criteria, and in the same manner, as described above for other potential nominees.

Compensation Committee

The Compensation Committee annually reviews and approves the goals and objectives relevant to the compensation of the Chief Executive Officer, evaluates the Chief Executive Officer’s performance and either as a committee or with the other independent directors of the Board, determines and approves the Chief Executive Officer’s compensation levels.

The Compensation Committee also annually reviews and approves salaries, incentive cash awards and other forms of compensation paid to our other executive officers, approves recipients of equity-based awards and establishes the number of shares and other terms applicable to such awards. The Compensation Committee also construes the provisions of and generally administers the 2020 Graham Corporation Equity Incentive Plan (the “Equity Incentive Plan”), and any successor plan thereto. The Compensation Committee operates pursuant to its charter and may delegate its authority or responsibility to one or more subcommittees.

The Compensation Committee also reviews and makes recommendations regarding the compensation paid to the Board. More information about the compensation of our directors is set forth under the heading “Director Compensation.” The Compensation Committee annually conducts a performance evaluation of its operation and function and recommends any proposed changes to the Board for approval.

| 12 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

In addition, the Compensation Committee is responsible for reviewing and discussing with management the Compensation Discussion and Analysis that is included in our annual proxy statement and performing such other tasks that are consistent with its charter.

The Compensation Committee recognizes the importance of using an independent consultant that provides services solely to the Compensation Committee and not to management. The Compensation Committee engaged an independent compensation consultant in fiscal year 2022. For more information on the role of the Compensation Committee in determining executive compensation, including its use of an independent consultant, see “Compensation Discussion and Analysis” under the heading “Executive Compensation.”

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to promote the effective functioning of the Board in its governance of our business and corporate operations. The Corporate Governance Guidelines are available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheadings “Governance” and “Governance Documents.”

Political Contribution Policy Statement

The Board has adopted a political contribution policy statement, which outlines the Company’s policies, procedures and philosophy regarding its political contributions and activities. It is the Company’s policy not to make independent political expenditures in support of the election or defeat of particular candidates and not to maintain a political action committee. This policy is available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheadings “Governance” and “Governance Documents.”

Board Policy on Stockholder Rights Plans

We do not have a “poison pill” or stockholder rights plan. If we were to adopt a stockholder rights plan, the Board would seek prior stockholder approval of the plan unless, due to timing constraints or other reasons, a majority of independent directors of the Board determines that it would be in the best interests of stockholders to adopt a plan before obtaining stockholder approval. If a stockholder rights plan is adopted without prior stockholder approval, the Board will submit the plan for approval by stockholders prior to the first anniversary of the effective date of the plan or the plan will otherwise terminate.

The Board’s Role in Risk Oversight

The Board oversees our risk profile and management’s processes for managing risk, primarily through the Board’s committees. Our Audit Committee focuses on financial risks, including those that could arise from our accounting and financial reporting processes. Additionally, our Audit Committee monitors and directs the formal risk management projects implemented by management. Our Nominating and Corporate Governance Committee focuses on the management of risks associated with board organization, membership and structure, corporate governance, and the recruitment and retention of talented Board members. Our Compensation Committee focuses on the management of risks that could arise from our compensation policies and programs and, in particular, our executive compensation programs and policies.

As part of its risk oversight responsibilities, the Board and its committees review the policies and processes that senior management uses to manage our risk exposure. In doing so, the Board and its committees review our overall risk function and senior management’s establishment of appropriate systems and processes for managing areas of material risk to the Company, including, but not limited to, operational, financial, legal, regulatory, strategic and information technology risks (including with respect to cybersecurity).

Communications from Stockholders and other Interested Parties

Stockholders and other interested parties who wish to contact the Board or an individual director, including the independent Chair of the Board or independent directors as a group, should send their communications to the attention of the Corporate Secretary, Graham Corporation, 20 Florence Avenue, Batavia, New York 14020. The Corporate Secretary will forward all such communications as directed unless the communication is inappropriate.

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

13 | |

|

Environmental and Social Matters • Commitment to Sustainability

|

Environmental and Social Matters

Oversight

Graham Corporation is committed to embedding sustainability throughout our business. We believe that all our stakeholders must be considered in our everyday actions. In 2021, we enhanced our environmental, social and governance (“ESG”) strategy to align with the broader transformation of our business. Our executive management team recognized the importance of embedding environmental and social priorities within our business operations and approved an enhanced and modernized ESG strategy intended to drive additional progress on initiatives that promote sustainability and increase transparency. Notably, to help ensure our accountability and progress, the Board has appointed Mr. Thoren, Graham’s Chief Executive Officer, as the lead officer with responsibility for overseeing and advancing the Company’ efforts with respect to ESG initiatives. In such capacity, Mr. Thoren reviews our ESG efforts with the Board and the various Board committees as appropriate.

This year, we also established an ESG working group, which is responsible for leading our ESG strategy and monitoring our corporate social responsibility and environmental sustainability initiatives. This group includes cross-functional subject matter experts from across the business. Against this backdrop, we have, with the assistance of outside ESG expertise, performed an assessment of key indicators and engaged with our internal and external stakeholders on ESG topics to help further inform our future direction and tenets. This ESG working group oversees Graham’s sustainability strategy and subsequent disclosures, including the production of our recently released 2022 Sustainability Accounting Standards Board (SASB) Factsheet available on our website www.grahamcorp.com. The four tenets of our ESG strategy are shown below:

|

|

|

|

Environment

We believe that a focus on environmental stewardship is fundamental and integral to the work we do every day to serve our customers, create value for our stockholders, and benefit our global community. We have taken steps at both our business units in Batavia, New York and Arvada, Colorado to improve energy efficiencies and air quality that are intended to lessen our impact on the environment. Notably:

| • | Encouraged environmentally friendly work practices by supporting recycling, reuse, and by continuing to install energy efficient equipment; |

| • | Increased the use of e-records and e-signing technology resulting in paper waste and carbon emissions reduction; |

| • | Engaged with energy professionals to conduct regular inspections and provide utility and financial savings information to relevant decision makers; |

| • | Maintained a concerted effort to reduce our reliance on energy, which in turn mitigates the strain we place on the power grid; and |

| • | Protecting biodiversity at our sites and in surrounding habitats. |

Furthermore, in addition to serving mature fossil-based end markets, we are well established in and support the development of emerging and transformative products for alternate and renewable energy sources. Graham Batavia, NY maintains compliance with multiple quality programs including The American Society of Mechanical Engineers (ASME) and the National Board of Boiler & Pressure Vessel Inspectors while maintaining ISO 9001 certification. Barber-Nichols is certified to AS9100 and ISO 9001.

| 14 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Environmental and Social Matters • Commitment to Sustainability

|

We have over 490 employees across our facilities, including our new 43,000 square foot, state-of-the-art manufacturing plant that is part of the 96,000 square foot facility in Arvada, Colorado, where our commitment to reducing the waste we generate and utilizing our expertise to produce high quality and sustainable products. Each of our facilities are diligent in controlling hazardous waste and ensuring wastewater and storm sewer discharges are monitored to support greater access to clean water. Additionally, a key aspect of our ESG strategy is climate change. We help minimize our environmental footprint with Adopt A Street activities, factory recycling programs, electric car charging stations, and energy saving initiatives like LED lighting, motion sensors for lighting, smart compressors to manage energy loads and installing programmable thermostats in our facilities.

Our People

At Graham, we believe our most important asset is our people. We are committed to fostering and embracing a Graham community in which employees share a mutual understanding and respect for each other. Our pledge to diversity and equality encompasses our commitment to create a work environment which embraces inclusion regardless of race, color, religion, gender, sexual orientation, gender identity, national origin, age, genetic information, marital status, amnesty, pregnancy, childbirth, disability, veteran status, or medical conditions. We continually strive to use our knowledge, talents, and resources to improve the quality of life of our workforce.

Diversity, Equality & Inclusion (“DEI”) is very important to us at Graham. Our commitment starts with our goal of attracting, retaining, and developing a workforce that is diverse in background, knowledge, skill, and experience. As of March 31, 2022, women represented approximately 19% and self-identified racial and ethnic minorities represented approximately 5% of our workforce. We strive to mirror our local communities through recruitment in our high schools and community colleges.

Our management recognizes that a diverse workforce and a culture of equity and inclusion helps us compete more effectively, sustain success, and build long-term shareholder value. We encourage every one of our team members to form deeper relationships with those around them based on mutual respect, dignity, and understanding. Furthermore, to encourage productive conversations within our organization, we have implemented employee surveys. Graham has robust non-discrimination and anti-harassment policies as outlined in our employee handbook, as well as a formal Code of Business Conduct and Ethics.

We believe that employee development is vital to our continued success, and we support the development of our employees through programs such as our internal weld school training, our partnerships for external weld training, our tuition assistance program, and management training classes. Our management is continuously focused on developing an inclusive and respectful work environment where our employees are highly engaged and motivated.

We are dedicated to ensuring the health and safety of our team members by supporting the whole person. Our dedicated global health and safety function is executed through our business unit safety committees to ensure that employees are trained on best practices to create a safe and healthy workplace for all. Arvada has met the requirements to be certified as a Safety and Health Achievement Recognition Program (SHARP) by OSHA. To ensure the health and wellbeing of our employees, we aim to provide a robust health and wellness package. Some of the various benefits we offer include:

| • | Competitive medical, dental and vision benefits. |

| • | Flexible spending and health savings accounts for both healthcare and dependent care. |

| • | Short- and long-term disability insurance. |

| • | Paid maternity and parental leave. |

| • | 401(k) retirement savings program, including company matching contributions. |

| • | Employee Assistance Program providing free counseling services. |

| • | Wellness incentives, including a wellness consultant. |

Since the start of the COVID-19 pandemic in 2020 and throughout 2021, the health, safety, and wellness of Graham’s employees and their families have been our highest priority. We ask our employees and visitors to stay home if ill and we maintain visitor logs to enable contact tracing if necessary. Our leadership continues to monitor the health and safety of our employees in accordance with the U.S. Centers for Disease Control and Prevention (CDC) and World Health Organization (WHO) guidelines.

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

15 | |

|

Environmental and Social Matters • Commitment to Sustainability

|

Our Communities

We believe that investing in local communities to create positive social and economic outcomes is at the heart of generating social impact. We believe that to be successful we need to push ourselves to do our best, for our customers, for our stockholders, for the Company, for ourselves, for those around us, and for the world that we all share. We are committed to supporting the communities in which we do business by leveraging the power of our Company through donations, scholarships, education and participation with certain charitable organizations. We strive to use our capabilities, reach and resources to make a lasting difference in the world. Notably:

| • | We are proud to be a partner with the Leukemia and Lymphoma Society Team in Training, and we support the American Cancer Society, Habitat for Humanity along with a long list of other charities. |

| • | We participated in the GLOW Corporate Cup. The goal of this event is for local businesses to form racing teams, compete in a fun atmosphere, and crown a winner of the Corporate Cup. With the proceeds raised from this event, the YMCA is able to fulfill its mission of youth development, healthy living and social responsibility in the GLOW region. |

| • | We participated in the United Way Day of Giving, the largest community-wide volunteer event across our region serving Genesee, Livingston, Monroe, Ontario, Wayne, and Wyoming counties. |

| • | We partner with nonprofit and for-profit organizations to enable low cost trades and university education through endowed scholarships, and implement elementary school STEM programs, where 30+ volunteers created STEM kits to support educational endeavors; and |

| • | We spearheaded Women in Manufacturing events to further bolster industry participation. |

We believe it is our responsibility to respect human rights in our operations, including, among other things, by opposing human trafficking and the exploitation of children. Accordingly, we have adopted a Human Rights Policy Statement to emphasize our strong commitment to human rights. As another part of being a good corporate citizen, we adopted a Conflict Minerals Policy that is intended to support our commitment to sourcing components and materials from companies that share our values around human rights and ethics. Both policies are available on our website: www.grahamcorp.com.

Corporate Governance

Graham is committed to achieving excellence in our corporate governance practices. We emphasize a culture of accountability and conduct our business in a manner that is fair, ethical, and responsible to earn the trust of our stakeholders. The Company has corporate governance and sustainability policies and structures in place to foster accountability and transparency. These policies reflect our underlying commitment to maintain the highest standards of ethics and integrity and to operate our business in compliance with all applicable anti-corruption, anti-bribery, and anti-trust laws and regulations.

The Board of Directors is comprised of a majority of independent directors as defined by the NYSE listing standards and the Board’s Corporate Governance Guidelines. All of the Board committees are comprised entirely of independent directors. The Board also believes that director refreshment is an important component of good corporate governance, and therefore, in March of 2022, nominated two new directors.

Graham recognizes that effectively managing enterprise risks is critically important to the long-term success of our business. Management is responsible for our company’s day-to-day risk management activities. Our company relies on a comprehensive risk management process to aggregate, monitor, measure, and manage risks. While we exercise oversight, we do not have full control over our supply chain nor the suppliers we do business with; however, we continually seek to partner with suppliers that share common values and a shared commitment to our ESG objectives.

As a global leader in the design and manufacture of critical electronics-enhanced turbomachines and turbomachine-based subsystems as well as vacuum and heat exchangers technologies, Graham is a trusted partner that meets the industry’s high bar for data resiliency and security. We leverage the latest encryption configurations and technologies on our systems, devices, and third-party connections and further vet third-party vendors’ encryption, as required, through our vendor management process.

We routinely engage with our stakeholders to better understand their views on ESG matters, carefully considering the feedback we receive and acting when appropriate. For more information, please visit our website: https://grahamcorp.com.

| 16 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Executive Officers

|

As of June 8, 2022, we were served by the following executive officers and Section 16 officers, each of whom was appointed by the Board:

Daniel J. Thoren, age 58, has served as our Chief Executive Officer since September 2021 and became our President and Chief Operating Officer in June 2021. Further information about Mr. Thoren is set forth under “Proposal One: Election of Directors.”

Christopher J. Thome, age 51, became our Vice President—Finance and Chief Financial Officer in April 2022. Prior to joining the Company, Mr. Thome served as Corporate Controller and Treasurer of Allied Motion Technologies Inc., a producer of precision and specialty motion control components and systems, since February 2020 and held progressively advancing roles at Integer Holdings Corporation, a provider of advanced medical device outsourcing, from July 2006 to February 2020, including Senior Director—Treasurer and Senior Director—Financial Reporting, Treasury Operations and Shared Services. Mr. Thome is a certified public accountant.

Matthew Malone, age 35, became our Vice President—Barber-Nichols in June 2021. Prior to joining the Company, Mr. Malone served as the President and Chief Executive Officer of Barber-Nichols in May 2021, having previously served as Barber-Nichols Vice President of Operations from May 2020 to May 2021, Project Management Office Manager from November 2017 to May 2020, and Project Engineer from July 2015 to November 2017.

Alan E. Smith, age 55, became our Vice President and General Manager—Batavia in July 2015. Mr. Smith served as our Vice President of Operations from July 2007 until July 2015. Previously, from 2005 until July 2007, Mr. Smith served as Director of Operations for Lydall, Inc., a designer and manufacturer of specialty engineering products. Prior to that, he had been employed by us for fourteen years, progressing from Project Engineer to Engineering Manager.

Jennifer R. Condame, age 57, became our Chief Accounting Officer in July 2008. She also serves as our Corporate Controller, a position she has held since 1994. From 1992 to 1994, she was our Manager of Accounting and Financial Reporting. Prior to joining us in 1992, Ms. Condame was employed as an Audit Manager by Price Waterhouse, a predecessor to PricewaterhouseCoopers LLP.

| GRAHAM CORPORATION 2022 PROXY STATEMENT |

17 | |

|

Executive Compensation • Compensation Discussion and Analysis

|

As a smaller reporting company under the Exchange Act we are not required to provide certain disclosures pursuant to Item 402 of Regulation S-K, however, we have elected to provide such executive compensation information in accordance with certain scaled disclosure requirements allowed of smaller reporting companies to provide transparency with respect to the compensation of our named executive officers.

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis (“CD&A”) provides information about the compensation programs for certain of our executive officers named in the Fiscal Year 2022 Summary Compensation Table. These named executive officers are:

| • | Daniel J. Thoren, our Chief Executive Officer; |

| • | Matthew Malone, our Vice President and General Manager - Barber-Nichols; |

| • | James R. Lines, our former Chief Executive Officer; and |

| • | Jeffrey F. Glajch, our former Vice President - Finance & Administration, Chief Financial Officer and Corporate Secretary. |

Mr. Lines retired from the Company effective as of August 31, 2021 and is included as a named executive officer because he served as our Chief Executive Officer during fiscal year 2022. Mr. Glajch retired from the Company effective April 15, 2022 and is included as a named executive officer because he was among the two most highly compensated executive officers (other than the Chief Executive Officer) on the last day of fiscal year 2022.

This CD&A includes the philosophy and objectives of the Compensation Committee of our Board, descriptions of each of the elements of our executive compensation programs, and the basis for the compensation decisions we made during fiscal year 2022.

Executive Summary

Fiscal Year 2022 Results

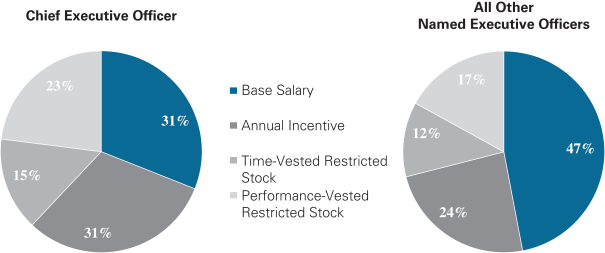

The Compensation Committee’s philosophy focuses on aligning the interests of our named executive officers with those of our stockholders by rewarding performance that enhances the objective of increasing both current and long-term stockholder value. Our executive compensation programs are designed to provide a strong link between the amounts earned by our named executive officers and Company and individual performance.

During fiscal year 2022, our named executive officers continued to implement our strategic plan to diversify, increase productivity, improve processes, and grow our market share and profits in our existing businesses.

Early in fiscal year 2022, we acquired Barber-Nichols which has changed the composition of the Company’s end market mix as we substantially increased sales to the defense industry and added sales to the space industry. While Barber-Nichols outperformed expectations in fiscal year 2022, Graham manufacturing faced challenges during the same period which resulted in added costs. Highlights of our financial results for fiscal year 2022 are as follows:

| • | Net sales for fiscal year 2022 were $122.8 million, up 26% compared with $97.5 million in the fiscal year ended March 31, 2021 (“fiscal year 2021”). Barber-Nichols contributed $47.9 million of sales for fiscal year 2022, which more than offset the $22.5 million decline in our legacy business. Barber-Nichols has outperformed our expectations during the first ten months of ownership. |

| • | Net loss for fiscal year 2022 was $8.8 million, or $0.83 per diluted share, compared to net income for fiscal year 2021 of $2.4 million, or $0.24 per diluted share. The net losses incurred in fiscal year 2022 were primarily due to our strategic decision to take on additional costs in order to meet our customers’ delivery schedules. We estimate that these strategic decisions, as well as material cost increases for first article projects impacted our results by over $10.0 million. The losses at our Batavia, NY facility were partly offset by income from Barber-Nichols and higher refinery and chemical aftermarket sales. |

| • | At March 31, 2022, we had $0 outstanding on our line of credit. We believe this along with our cash balances provide us adequate financial flexibility to meet our obligations. |

| 18 |

GRAHAM CORPORATION 2022 PROXY STATEMENT | |

|

Executive Compensation • Compensation Discussion and Analysis

|

Our “Pay for Performance” Philosophy

Our executive compensation programs contain key components and features that reinforce our “pay for performance” philosophy. For example:

| • | A significant portion of our named executive officers’ compensation is “at-risk,” and depends on either meeting performance-based criteria or continuing in service to the Company. Both our short-term and long-term incentive compensation programs use goals that tie to our performance in key financial metrics. During fiscal year 2022, we paid 50% of our long-term incentive compensation in shares of performance-vested restricted stock. The shares of performance-vested restricted stock cliff vest on the third anniversary of the date of grant only upon the achievement of predetermined performance metrics. Our named executive officers received the other 50% of long-term incentive compensation in restricted stock that time vests in equal installments of 331/3% on each anniversary of the date of grant, subject to the executive officer’s continued service at each such date. |