UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

GRAHAM CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☑ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Graham Corporation is a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the defense, space, energy and process industries. The Graham Manufacturing, Barber-Nichols, and P3 Technologies global brands are built upon world-renowned engineering expertise in vacuum, heat transfer, cryogenic pumps and turbomachinery technologies, as well as its responsive and flexible service and the unsurpassed quality customers have come to expect from our products and systems. Our core strengths include:

| • | our value-enhancing engineering sales and product development platform |

| • | our strong capabilities to handle complex, custom orders |

| • | a responsive, flexible production environment |

| • | our capability to manage outsourced production |

| • | robust technical support |

| • | our highly trained workforce |

| • | our capability to manufacture to tight tolerances |

Notice of Annual Meeting

of Stockholders

| Meeting Details:

| ||||||||||||

| Meeting Business

The principal business of the 2024 Annual

(1) Election of two director nominees;

(2) To approve, on an advisory basis, the compensation of our named executive officers;

(3) To ratify the appointment of Deloitte

(4) To transact such other business as may properly come before the Annual |

|

Date: Tuesday, August 20, 2024

|

|

Place: www.proxydocs.com/GHM

In order to virtually attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions at the meeting. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person. | ||||||||

|

|

Time: 9:00 a.m. Eastern Time

|

|||||||||||

|

|

Record Date: June 21, 2024 |

|||||||||||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON AUGUST 20, 2024:

The Notice of Annual Meeting, Proxy Statement and the Annual Report are available at www.proxydocs.com/GHM

BY ORDER OF THE BOARD OF DIRECTORS

Christopher J. Thome Vice President – Finance, Chief Financial Officer, Chief Accounting Officer and Corporate Secretary | ||||||||||||

Dated: July 8, 2024

Vote Your Shares

How to Vote

Your vote is very important, and we hope that you will participate in the Annual Meeting. You are eligible to vote if you were a stockholder of record at the close of business on June 21, 2024. In order to virtually attend the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting. Please read the proxy statement and vote right away using any of the following methods.

Stockholders of Record:

|

Vote By Internet Before or During the Meeting Visit: www.proxypush.com/GHM and follow the instructions |

|

Vote By Telephone Call 1-866-256-0715 and follow the instructions |

|

Vote By Mail Sign, date, and return your proxy card, if you received one, using the enclosed envelope | |||||||||

Beneficial Stockholders:

If you are a beneficial stockholder, you will receive instructions from your brokerage firm, bank, broker-dealer, nominee, custodian, fiduciary or other nominee that you must follow in order for your shares to be voted. Your broker may not vote your shares for director nominees or on the advisory vote on executive compensation unless you provide your broker with voting instructions.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this proxy statement contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “intends,” “anticipates,” “believes,” “opportunities,” “will,” “may,” “seeks,” “estimates,” “strives,” “continues,” “encourage,” and other similar words. All statements addressing operating performance, events, or developments that we expect or anticipate will occur in the future, including but not limited to our growth, diversification strategy, markets, returns and solutions, financial flexibility, and our ability to achieve our operating priorities are forward-looking statements and should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in our Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize or should any of our underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on our forward-looking statements. These forward-looking statements are not guarantees of future performance and speak only as of the date made, and except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained herein.

NOTE ABOUT OUR WEBSITES AND REPORTS: None of the statements on our websites or reports referenced or discussed in this proxy statement, are deemed to be part of, or incorporated by reference into, this proxy statement. The statements and reports may also change at any time and we undertake no obligation to update them, except as required by law. We have not incorporated by reference into this proxy statement the information included, or that can be accessed through, our website and you should not consider it to be part of this proxy statement.

|

Proxy Statement Summary • The Annual Meeting

|

To assist you in reviewing the proposals to be considered and voted upon at our annual meeting of stockholders to be held on August 20, 2024 (the “Annual Meeting”), we have summarized information contained elsewhere in this proxy statement or in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 (the “Annual Report”). This summary does not contain all of the information you should consider about Graham Corporation (the “Company”) and the proposals being submitted to stockholders at the Annual Meeting. We encourage you to read the entire proxy statement and Annual Report carefully before voting.

The Annual Meeting

| Date and Time: |

Tuesday, August 20, 2024, 9:00 a.m. Eastern Time | |

| Location: |

Online via: www.proxydocs.com/GHM | |

| Record Date: |

June 21, 2024 | |

In order to virtually attend the Annual Meeting, you must register at www.proxydocs.com/GHM in advance. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions at the meeting. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person.

Meeting Agenda and Voting Matters

| Item | Proposal | Board Vote Recommendation |

Page Reference (for more information) | |||

| 1 | Election of two director nominees named in this proxy statement | FOR each nominee | 8 | |||

| 2 | To approve, on an advisory basis, the compensation of our named executive officers | FOR | 49 | |||

| 3 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025 | FOR | 50 | |||

Directors and Nominees

|

Name |

Age | Recent Professional Experience | Board Committees |

|||||

| James J. Barber, Ph.D.* | 70 | Independent Consultant and Principal of Barber Advisors, LLC | AC, CC**, NCGC | |||||

| Alan Fortier* | 67 | President of Fortier & Associates, Inc. | CC, NCGC | |||||

| Cari L. Jaroslawsky* | 55 | Founder and President of Compliance Right, LLC | AC, NCGC** | |||||

| Jonathan W. Painter* | 65 | Chair of the Company’s Board; Chair of Kadant Inc. | AC, CC | |||||

| Lisa M. Schnorr*◆ | 58 | Former Senior Vice President and Project Lead, Digital Enablement for Constellation Brands, Inc. | AC**, CC | |||||

| Troy A. Stoner* | 60 | Senior Director, Electronic Systems, Maritime & Intelligence Systems, Space Intelligence & Weapons Systems division of Boeing Defense, Space and Security | CC, NCGC | |||||

| Daniel J. Thoren◆ | 61 | Chief Executive Officer of the Company | — | |||||

* — Independent Director

◆ — Director Nominee

** — Committee Chair

AC — Audit Committee

CC — Compensation Committee

NCGC — Nominating and Corporate Governance Committee

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

1 | |

|

Proxy Statement Summary • Our Business

|

Our Business

We are a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the defense, space, energy and process industries. For the defense industry, our equipment is used in nuclear and non-nuclear propulsion, power, fluid transfer, and thermal management systems. For the space industry, our equipment is used in propulsion, power and energy management systems and for life support systems. We supply equipment for vacuum, heat transfer and fluid transfer applications used in energy and new energy markets including oil refining, cogeneration, and multiple alternative and clean power applications including hydrogen. For the chemical and petrochemical industries, our equipment is used in fertilizer, ethylene, methanol and downstream chemical facilities.

Our brands are built upon our engineering expertise and close customer collaboration to design, develop, and produce mission critical equipment and systems that enable our customers to meet their economic and operational objectives. Continual improvement of our processes and systems to ensure qualified and compliant equipment are hallmarks of our brands. Our early engagement with customers and support until the end of service life are values upon which our brands are built.

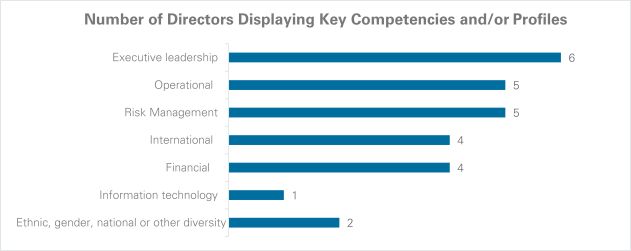

Director Skills and Attributes

We believe that our directors possess the requisite experience and skills necessary to carry out their duties and to serve our best interests and those of our stockholders.

| 2 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Questions and Answers About the Annual Meeting

|

Questions and Answers About the Annual Meeting

Why am I receiving these proxy materials?

These proxy materials are being furnished to you in connection with the solicitation of proxies by our board of directors (the “Board”) for the Annual Meeting to be held on Tuesday, August 20, 2024, at 9:00 a.m., Eastern Time, and at any adjournment or postponement thereof. The Annual Meeting will be conducted as a virtual meeting of stockholders by means of a live audio-only webcast. We believe that hosting a virtual meeting will enable greater stockholder participation from any location. There will not be a physical meeting location and you will not be able to attend the Annual Meeting in person.

We made our proxy materials available to stockholders via the Internet or in printed form if requested on or about July 8, 2024. Our proxy materials include the Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), the Notice of the Annual Meeting, this proxy statement and the Annual Report. If you requested and received paper copies of the proxy materials by mail, our proxy materials also include the proxy card. These proxy materials, other than the proxy card, can be accessed at www.proxydocs.com/GHM.

The Securities and Exchange Commission’s (the “SEC”) e-proxy rules allow companies to post their proxy materials on the Internet and provide only a Notice of Internet Availability to stockholders as an alternative to mailing full sets of proxy materials except upon request. Similar to last year, we have elected to use this notice and access model. Unless you previously indicated your preference to receive paper copies of our proxy statement and Annual Report, you should have received a Notice of Internet Availability. The Notice of Internet Availability includes information on how to access our proxy materials on the Internet, how to vote and how to request a paper or email copy of the proxy materials at no extra charge this year or on an ongoing basis.

What am I voting on?

At the Annual Meeting, you will vote upon:

| (1) | the election of two director nominees identified in this proxy statement; |

| (2) | a proposal to approve, on an advisory basis, the compensation of our named executive officers; and |

| (3) | a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025. |

Will there be any other items of business addressed at the Annual Meeting?

As of the date of this proxy statement, we are not aware of any other matter to be presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is intended that the holders of the proxies will act in accordance with their best judgment.

What must I do if I want to participate in the Annual Meeting?

You can participate in the Annual Meeting so long as you register in advance to virtually attend the Annual Meeting at www.proxydocs.com/GHM. You will be asked to provide the control number located inside the shaded gray box on your Notice of Internet Availability or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. Please be sure to follow the instructions found on your Notice of Internet Availability, proxy card and/or voting instruction card and subsequent instructions that will be delivered to you via email.

By visiting www.proxydocs.com/GHM, pre-registering and then accessing the Annual Meeting as instructed, you will be able to participate in the Annual Meeting, vote your shares and ask questions during the meeting. However, if you do not comply with the procedures outlined above, you may not be admitted to the Annual Meeting.

As always, we encourage you to vote your shares prior to the Annual Meeting. This proxy statement furnishes you with the information you need in order to vote, whether or not you participate in the Annual Meeting.

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

3 | |

|

Questions and Answers About the Annual Meeting

|

Who may vote and how many shares can be cast?

If you owned shares of our common stock at the close of business on June 21, 2024, which is the record date for the Annual Meeting, then you are entitled to vote your shares at the Annual Meeting. At the close of business on the record date, we had 10,870,564 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote on each proposal.

How do I vote?

Stockholder of Record: Shares Registered in Your Name. If on the record date, your shares of our common stock were registered directly in your name with our transfer agent, then you are a stockholder of record and your shares will be voted as you indicate. If you are a stockholder of record, there are four ways to vote:

| • | By Internet at www.proxypush.com/GHM. We encourage you to vote this way. |

| • | By touch tone telephone: call toll-free at 1-866-256-0715. |

| • | By completing and mailing your proxy card (if you have requested and received a printed copy of the proxy materials). |

| • | By voting during the Annual Meeting before the polls close: To be admitted to the Annual Meeting and vote your shares, you must register and provide the control number as described in the Notice of Internet Availability or proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. |

Your vote is important. Whether or not you plan to virtually attend the meeting, we urge you to vote to ensure your vote is counted. You may still virtually attend and vote during the meeting if you have already voted by proxy. Only the latest vote you properly submit will be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank. If on the record date, your shares of our common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, which we collectively refer to as a broker, then you are the beneficial owner of shares held in “street name” and these proxy materials are being made available to you by that organization along with a voting instruction card. As a beneficial owner, you must vote your shares in the manner prescribed by your broker. Your broker has enclosed or otherwise provided a voting instruction card for you to use in directing the broker how to vote your shares. Your shares will be voted as you indicate. Check the voting instruction card used by that organization to see if it offers Internet or telephone voting.

If you hold your shares in street name, you will receive instructions from your broker, bank or nominee that you must follow in order to submit your voting instructions and have your shares voted at the Annual Meeting. If you want to vote in person virtually at the Annual Meeting, you must register in advance at www.proxydocs.com/GHM. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

Even if you plan to virtually attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the Annual Meeting as described above so that your vote will be counted if you later decide not to attend or are unable to attend the Annual Meeting.

What happens if I do not give specific voting instructions?

If you are a stockholder of record and you indicate when voting over the Internet or by telephone that you wish to vote as recommended by our Board or sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by our Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

For a beneficial owner of shares held in street name, if a proposal is deemed “routine” and you do not give instructions to your broker or nominee, they may, but are not required to, vote your shares with respect to the proposal. If the proposal is deemed “non-routine” and you do not give instructions to your broker or nominee, they may not vote your

| 4 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Questions and Answers About the Annual Meeting

|

shares with respect to the proposal and the shares will be treated as broker non-votes. The determination of whether a proposal is “routine” or “non-routine” will be made by the New York Stock Exchange (“NYSE”) based on NYSE rules that regulate member brokerage firms. When our inspector of election tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but may not otherwise be counted. We therefore encourage you to provide voting instructions on each proposal to the organization that holds your shares.

What constitutes a quorum for the Annual Meeting?

A quorum is required for our stockholders to conduct business at the Annual Meeting. Pursuant to our Amended and Restated By-laws (the “By-laws”), the holders of record of a majority of the shares of our common stock present in person or by proxy and entitled to vote at the Annual Meeting will constitute a quorum. Abstentions, broker non-votes, and “withhold” votes for election of directors will be counted for the purpose of determining the existence of a quorum. If a quorum is not present, the Annual Meeting may be adjourned by the vote of a majority of the shares represented at the Annual Meeting until a quorum has been obtained.

What vote is required to approve each proposal and how does the Board recommend that I vote?

The vote required to approve each proposal, and the Board’s recommendation with respect to each proposal are described below:

| Proposal Number |

Proposal Description |

Board Recommendation |

Vote Required | Effect of Abstentions |

Effect of Broker Non-Votes | |||||

| One |

Election of the two director nominees identified in this proxy statement | FOR each nominee |

Plurality of the shares present, in person or by proxy, and entitled to vote at the Annual Meeting(1) | None | None | |||||

| Two |

To approve, on an advisory basis, the compensation of our named executive officers | FOR | Majority of the votes cast on the proposal(2) | None | None | |||||

| Three |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025 | FOR | Majority of the votes cast on the proposal(3) | None | N/A because this proposal is a matter on which brokers may vote | |||||

| (1) | Our stockholders elect directors by a plurality vote, which means that the director nominees receiving the most votes will be elected. A vote to “withhold” will have no effect on the election of director nominees because the nominees who receive the highest number of “for” votes are elected, and since the nominees are running unopposed they only need a single “for” vote to be elected. However, our Corporate Governance Guidelines provide that any nominee for director who receives a greater number of votes “withheld” from his or her election than “for” such election must tender his or her resignation for consideration by the Nominating and Corporate Governance Committee of our Board. The Nominating and Corporate Governance Committee will recommend to the Board the action to be taken with respect to such resignation. |

| (2) | The advisory vote to approve the compensation of our named executive officers is not binding upon our Board or the Compensation Committee of our Board. However, the Board and the Compensation Committee will consider the outcome of this vote when making future compensation decisions. |

| (3) | We are presenting the appointment of Deloitte & Touche LLP to our stockholders for ratification. The Audit Committee of our Board will consider the outcome of this vote in its future discussions regarding the appointment of our independent registered public accounting firm. |

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

5 | |

|

Questions and Answers About the Annual Meeting

|

How can I obtain a stockholder list?

A stockholder list will be available for examination by our stockholders during ordinary business hours throughout the ten-day period prior to the Annual Meeting at our principal executive offices at 20 Florence Avenue, Batavia, New York 14020, and during the meeting via the virtual meeting site, for any purpose germane to the meeting.

Can I change or revoke my vote?

Your attendance at the Annual Meeting will not automatically revoke your proxy. However, if you are a stockholder of record you can change or revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | timely voting again via the Internet or by telephone; |

| • | delivering a timely written notice of revocation to our Corporate Secretary at Graham Corporation, 20 Florence Avenue, Batavia, New York 14020; |

| • | returning a timely, properly completed, later-dated proxy card to the address above; or |

| • | attending the Annual Meeting and voting again. |

Only your last, properly submitted, timely vote will count at the Annual Meeting.

If you are a street name holder, you must contact your broker to receive instructions as to how you may revoke your proxy instructions.

We encourage you to vote in advance of the Annual Meeting to ensure your vote is counted should you be unable to participate in the Annual Meeting. Stockholders who have pre-registered to attend the Annual Meeting and who have not voted their shares prior to the Annual Meeting or who wish to change their vote will be able to vote their shares electronically at the Annual Meeting while the polls are open. If you properly provide your proxy in time to be voted at the Annual Meeting, it will be voted as you specify unless it is properly revoked prior thereto. If you properly provide your proxy but do not include your voting specifications, the shares represented by the proxy will be voted in accordance with the recommendations of the Board, as described in this proxy statement.

Who is paying for this proxy solicitation?

This proxy solicitation is made by our Board on our behalf, and we will bear the cost of soliciting proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone or other means of communication. We will not compensate our directors, officers or employees for making proxy solicitations on our behalf. We will provide persons holding shares in their name or in the names of nominees, which in either case are beneficially owned by others, soliciting materials for delivery to those beneficial owners and will reimburse the record owners for their expenses in doing so.

Can I ask questions at the Annual Meeting?

If you registered in advance and attend the Annual Meeting, you may submit questions during the Annual Meeting. We encourage you to submit questions at www.proxydocs.com/GHM after logging in with your unique control number provided in connection with your pre-registration for the Annual Meeting.

We expect to respond to questions during the Annual Meeting that are pertinent to meeting matters as time permits. We may group together questions that are substantially similar to avoid repetition.

How can I find out the voting results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. We will publish the voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days after the Annual Meeting.

| 6 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Questions and Answers About the Annual Meeting

|

Where can I obtain additional information?

You can obtain, free of charge, a copy of our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 (“fiscal year 2024”) by:

| • | accessing our website at www.grahamcorp.com under the heading “Investor Relations”; |

| • | writing to us at: Graham Corporation, Attention: Annual Report Request, 20 Florence Avenue, Batavia, New York 14020; or |

| • | telephoning us at (585) 343-2216. |

You can also obtain a copy of our Annual Report on Form 10-K and all other reports and information that we file with, or furnish to, the SEC from the SEC’s EDGAR database located at www.sec.gov.

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

7 | |

|

Proposal One: Election of Directors • Nominees Proposed for Election as Directors at the Annual Meeting

|

Election of Directors

The Board currently consists of seven members which will be reduced to six following the Annual Meeting. Our By-laws provide for a classified board of directors consisting of three classes of directors, with each class serving a staggered three-year term. As a result, stockholders elect only a portion of our Board each year. The terms of three of our directors, Alan Fortier, Lisa M. Schnorr and Daniel Thoren, will expire at the Annual Meeting.

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has unanimously nominated Lisa M. Schnorr and Daniel Thoren for election as directors. If elected, each of Ms. Schnorr and Mr. Thoren will hold office for a three-year term expiring in 2027 or until his or her successor is duly elected and qualified. Mr. Fortier’s service as a director will end at the Annual Meeting. Our Board does not contemplate that either of the nominees will be unable to serve as a director, but if that contingency should occur before the proxies are voted, the designated proxies reserve the right to vote for such substitute nominee(s) as they, in their discretion, determine. Our By-laws do not permit re-election after a director reaches the age of 75.

The Board unanimously recommends a vote FOR the election of each of Ms. Schnorr and Mr. Thoren as a director to serve for a three-year term expiring in 2027.

Nominees Proposed for Election as Directors at the Annual Meeting

| Lisa M. Schnorr

Ms. Schnorr has served as a director since 2014. Before retiring in May 2021, she worked for Constellation Brands (NYSE: STZ), a Fortune 500 company and a leading international producer of beer, wine and spirits with operations in the U.S., Mexico, New Zealand and Italy. Ms. Schnorr joined Constellation Brands in 2004 and earned promotions through a series of positions with increasing responsibility, including Vice President of Compensation and HRIS (2011-2013), Senior Vice President of Total Rewards (2014-2015), Corporate Controller (2015-2017), Chief Financial Officer of the Wine & Spirits Division (2017-2019), and Senior Vice President and Project Lead of Digital Enablement (2019-2021). Before joining Constellation Brands, Ms. Schnorr held financial and accounting positions at various public and private companies and she began her career in 1987 at PricewaterhouseCoopers (formerly Price Waterhouse), all in Rochester, New York. Ms. Schnorr has been a member of the board of directors of Vintage Wine Estates (NASDAQ: VWE), since June 2021 where she serves as Chair of the Audit Committee and Warrior Met Coal (NYSE: HCC), since August 2022 where she serves as Chair of the Nominating and Corporate Governance Committee. She holds a B.S. degree in Accounting from the State University of New York at Oswego.

|

Former Senior Vice President

and

AGE DIRECTOR SINCE

58 2014

TERM EXPIRES

2024

COMMITTEES ▶ Audit (Chair) ▶ Compensation | |||||

|

Qualifications

With her background and experience in strategic planning, audit, financial planning and analysis, capital allocation, public company governance and risk management, human resources and investor relations, Ms. Schnorr offers a global business and organizational perspective to the Board. The Board believes that Ms. Schnorr’s background and expertise enables her to guide us through a continued period of organic and acquisition-related growth and allows her to provide insight and leadership to our Audit Committee and Compensation Committee.

|

| 8 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Proposal One: Election of Directors • Nominees Proposed for Election as Directors at the Annual Meeting

|

| Daniel J. Thoren

Mr. Thoren has served as our Chief Executive Officer since September 2021 and became our President and Chief Operating Officer in June 2021. Prior to joining the Company, Mr. Thoren had been employed by Barber-Nichols, LLC (“Barber-Nichols”), a premier supplier of specialty turbomachinery, pumps and electronic drives that address critical applications for the defense and aerospace/space industries, from 1991 until we acquired Barber-Nichols in June 2021, and served in progressively increasing roles, including his service as Barber-Nichols’ President and Chief Executive Officer from 1997 until May 2021 and its Chairman of the Board of Directors through June 2021.

|

Chief Executive Officer of the Company

AGE DIRECTOR SINCE

61 2021

TERM EXPIRES

2024

| |||||

|

Qualifications

As our Chief Executive Officer, and as a result of his day-to-day leadership of the business, Mr. Thoren provides the Board with valuable insight regarding the operations of our Company and our management team and he performs a critical role in the Board’s discussions regarding strategic planning and development. Our Board also benefits from Mr. Thoren’s proven strong leadership skills and experience at Barber-Nichols.

|

Directors Whose Terms Expire at the Annual Meeting

| Alan Fortier

Mr. Fortier has served as President of Fortier & Associates, Inc., a strategy and profit improvement consulting firm focused on capital goods and chemicals companies, since 1988. Over his 30+ year consulting career he has helped hundreds of manufacturing businesses exceed aggressive profit targets, in all regions globally. He has also been a Strategic Advisory Board member for Genstar Capital, a middle market private equity group with over $30 billion in assets under management, since January 2019. In addition, between 2007 and 2016, Mr. Fortier was a guest lecturer at Columbia Business School’s MBA and Executive Education programs. Prior to entering consulting he held technical and management positions with DuPont.

|

President of Fortier & Associates, Inc.

AGE DIRECTOR SINCE

67 2008

TERM EXPIRES

2024

COMMITTEES ▶ Compensation ▶ Nominating and Corporate Governance

| |||||

|

Qualifications

Mr. Fortier brings to the Board more than 35 years of global industrial experience as a strategy and execution consultant and manager. Our Board and management team benefit from his extensive background in our served markets, including energy, petrochemicals, chemicals and large engineering firms, as well as his extensive experience advising boards and senior executives of global capital goods businesses on business strategy, mergers and acquisitions, global growth, pricing, organizational development and management control.

|

Directors Whose Terms do not Expire at the Annual Meeting

| Cari L. Jaroslawsky

Ms. Jaroslawsky is the founder and President of Compliance Right, LLC, a board and executive consulting service provider formed in January 2022. Ms. Jaroslawsky served as the Senior Vice President and General Manager of Eaton Mission Systems, a leading aerospace and defense manufacturer and a division of Eaton Corporation plc (“Eaton”), from January 2019 until her retirement in December 2022, having previously served as Senior Vice President of Finance from October 2016 to December 2018 for Cobham International until it was acquired by Eaton. Prior to her position with Cobham International, Ms. Jaroslawsky served as the Chief Financial Officer and Treasurer of Servotronics, Inc. (NYSE American: SVT), a designer and manufacturer of advanced technology and consumer products, from 2005 until 2016. Ms. Jaroslawsky is a certified public accountant. She also serves on the board of directors of Rand Capital Corporation (Nasdaq: RAND).

|

President of Compliance Right, LLC

AGE DIRECTOR SINCE

55 2022

TERM EXPIRES

2025

COMMITTEES ▶ Audit ▶ Nominating and Corporate Governance (Chair)

| |||||

|

Qualifications

Ms. Jaroslawsky brings to the Board substantial operational and leadership experience, defense industry knowledge and a significant background in accounting and financial matters, including through her prior service as the Chief Financial Officer and Treasurer of a publicly traded company.

|

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

9 | |

|

Proposal One: Election of Directors • Directors Whose Terms do not Expire at the Annual Meeting

|

| Jonathan W. Painter

Mr. Painter has served as the Chair, since July 2019, and a director, since January 2010, of Kadant Inc. (NYSE: KAI), a leading global supplier of components and engineered systems used in process industries, including the pulp and paper industry. Mr. Painter served as President and Chief Executive Officer of Kadant from January 2010 to July 2019 and as President and Chief Operating Officer from September 2009 to December 2009.

|

Chair of Kadant Inc.

AGE DIRECTOR SINCE

65 2014

TERM EXPIRES

2025

CHAIR OF THE BOARD

COMMITTEES ▶ Audit ▶ Compensation

| |||||

|

Qualifications

Mr. Painter brings valuable experience to the Board and management as a former executive officer of a public company that, similar to us, is in the business of designing, manufacturing and marketing specialized, engineered equipment. The Board believes that Mr. Painter’s diverse experience in operations, finance, mergers and acquisitions and corporate strategy enables him to provide critical insight to the Board and management that will help us to achieve our strategic goals.

|

| James J. Barber, Ph.D.

Dr. Barber has been an independent consultant and the principal of Barber Advisors, LLC, a consulting business advising firms and non-profits in the areas of strategy, management, marketing and operations, since September 2007. From January 2000 to May 2007, Dr. Barber was the President and Chief Executive Officer of Metabolix, Inc. (NASDAQ: MBLX), currently known as Yield10 Bioscience, Inc. (OTC: YTEN), a bioscience company focused on plastics, chemicals and energy. He was responsible for transforming Metabolix, Inc. from a research boutique into a leader in “clean tech” and industrial biotechnology.

Dr. Barber served as the independent non-executive Chair of Itaconix plc (formerly Revolymer plc) (LON: ITX), a specialty chemicals company, from December 2018 to July 2022, and served as a non-executive director of Itaconix plc from September 2016 to November 2018. He has also served as a director of numerous private companies.

|

Independent Consultant and Principal of Barber Advisors, LLC

AGE DIRECTOR SINCE

70 2011

TERM EXPIRES

2026

COMMITTEES ▶ Audit ▶ Compensation (Chair) ▶ Nominating and Corporate Governance

| |||||

|

Qualifications

Dr. Barber brings to our Board substantial executive level leadership experience and a deep understanding of product and business development in highly technical industries and alternative energy markets. Dr. Barber also has significant experience in structuring both joint venture and acquisition transactions.

|

| Troy A. Stoner

Mr. Stoner has served as the Senior Director, Electronic Systems for Maritime and Intelligence Systems, Space Intelligence and Weapons Systems division of Boeing Defense, Space and Security since June 2023. Mr. Stoner served as Chief Executive Officer of Argon ST, a specialist in systems engineering and a subsidiary of The Boeing Company from April 2020 until May 2023. Prior to that, Mr. Stoner served Boeing in a series of advancing roles including Senior Program Manager, Missions & Payloads, Autonomous Systems from December 2019 to March 2020, Senior Manager, Autonomous Systems, Boeing Strategy from November 2017 to November 2019, Senior Maritime Representative, Boeing Global Sales and Marketing, April 2016 to October 2017, and Senior Manager, Boeing Strategy from May 2015 to March 2016. Mr. Stoner retired from the U.S. Navy after 30 years of service.

|

Senior Director, Electronic Systems, Maritime & Intelligence Systems, Space Intelligence & Weapons Systems division of Boeing Defense, Space and Security

AGE DIRECTOR SINCE

60 2022

TERM EXPIRES

2026

COMMITTEES ▶ Compensation ▶ Nominating and Corporate Governance

| |||||

|

Qualifications

Mr. Stoner brings to the Board extensive business experience with strategy, leadership and operations at companies within the defense, space and security markets. Our Board and management team value his in-depth knowledge of the U.S. Navy as well as his extensive expertise in military defense systems and U.S. Navy planning and procurement processes.

|

| 10 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Corporate Governance • Director Independence

|

Our Corporate Governance Guidelines provide that the independence standards of the NYSE govern the independence determinations for the members of our Board. The Board has affirmatively determined that each of Messrs. Barber, Fortier, Painter and Stoner, and Mses. Jaroslawsky and Schnorr is independent and has no material relationship with us as required by the independence standards of the NYSE. Mr. Thoren, our Chief Executive Officer and employee, is not independent.

Mr. Painter, a non-executive independent director, serves as Chair of the Board. Our Board believes that its leadership structure, with a non-executive Chair position separate from our Chief Executive Officer, provides appropriate, independent oversight of management. The Chair of our Board presides at all meetings of the Board and stockholders; presides during regularly held sessions with only the independent directors; encourages and facilitates active participation of all directors; develops the calendar of and agendas for Board meetings in consultation with our Chief Executive Officer and other members of the Board; determines, in consultation with our Chief Executive Officer, the information that should be provided to the Board in advance of meetings; and performs any other duties requested by the Board from time to time.

Committees and Meetings of the Board; Meeting Attendance

Our Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The duties and responsibilities of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are set forth in their respective charters and are described below. The current charter of each committee is available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheading “Governance.”

The following table lists the current membership of the committees of the Board and the Chairs of each committee.

| Committee Membership | ||||||||||

| Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | |||||||

|

James J. Barber |

|

|

| |||||||

|

Alan Fortier |

|

| ||||||||

|

Cari L. Jaroslawsky |

|

| ||||||||

|

Jonathan W. Painter |

|

|

||||||||

|

Lisa M. Schnorr |

|

|

||||||||

|

Troy A. Stoner |

|

| ||||||||

= Chair

= Chair

= Member

= Member

During fiscal year 2024, the Board met seven times, the Audit Committee met fourteen times, the Compensation Committee met six times, and the Nominating and Corporate Governance Committee met four times. During fiscal year 2024, each of our then serving directors attended at least 75% of the meetings of the Board and the committees on which they served.

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

11 | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

The non-management directors meet without members of management present during regularly scheduled executive sessions and at such other times as they deem necessary or appropriate. The Chair of the Board presides over these executive sessions.

Our policy requires that each director attend our annual meeting of stockholders or provide the Chair of the Board with advance notice of the reason for not attending. All of our then serving directors attended our 2023 annual meeting of stockholders.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has affirmatively determined that each member of the Audit Committee satisfies the independence standards of the NYSE applicable to audit committee members and applicable SEC rules. The Board has also determined that each of Mses. Jaroslawsky and Schnorr qualifies as an “audit committee financial expert” in accordance with applicable SEC rules based on their education and extensive professional work experience as described in each of their biographies under “Proposal One: Election of Directors.”

The Audit Committee reviews with Deloitte & Touche LLP, our independent registered public accounting firm, our financial statements and internal control over financial reporting, Deloitte & Touche LLP’s auditing procedures and fees, and the possible effects of professional services upon the independence of Deloitte & Touche LLP.

The Audit Committee works closely with the Board, our executive management team and our independent registered public accounting firm to assist the Board in overseeing our accounting and financial reporting processes and financial statement audits. In furtherance of these responsibilities, the Audit Committee assists the Board in its oversight of:

| • | the integrity of our financial statements and internal controls; |

| • | our compliance with legal and regulatory requirements; |

| • | the qualifications and independence of our independent registered public accounting firm; |

| • | the performance of our independent registered public accounting firm; |

| • | the planning for and performance of our internal audit function; and |

| • | risk management (including risk management relating to cybersecurity). |

In addition, the Audit Committee’s responsibilities include reviewing and overseeing any transactions between us and any related person as defined by the SEC’s rules and discussing our guidelines and policies with respect to risk assessment and risk management. The Audit Committee is also responsible for preparing the Audit Committee’s report that the SEC’s rules require to be included in our annual proxy statement, and performing such other tasks that are consistent with the Audit Committee’s charter. The Audit Committee’s report appears under the heading “Report of the Audit Committee.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee evaluates, interviews and nominates candidates for election to the Board and is responsible for oversight of our corporate governance practices.

When identifying director nominees, the Nominating and Corporate Governance Committee solicits suggestions from incumbent directors, management and stockholders. In identifying and evaluating nominees, the Nominating and Corporate Governance Committee seeks candidates possessing the highest standards of personal and professional ethics and integrity; practical wisdom, independent thinking, maturity and the ability to exercise sound business judgment; skills, experience and demonstrated abilities that help meet the current needs of the Board; and a firm commitment to the interests of our stockholders. Although the Nominating and Corporate Governance Committee does not maintain a specific written diversity policy, it recognizes the value of diversity and seeks diverse candidates when possible and appropriate and considers diversity in its review of candidates. The Nominating and Corporate Governance Committee believes that diversity includes not only gender and ethnicity, but the various perspectives that come from having differing geographic and cultural backgrounds, viewpoints and life experiences.

| 12 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

In addition, the Nominating and Corporate Governance Committee takes into consideration such other factors as it deems appropriate. These factors may include knowledge of our industry and markets, experience with businesses and other organizations of comparable size, the interplay of the nominee’s experience with the experience of other members of the Board, and the extent to which the candidate would be a desirable addition to the Board and any of its committees. The Nominating and Corporate Governance Committee may consider, among other factors, experience or expertise in our industry, global business, science and technology, competitive positioning, corporate governance, risk management, finance or economics, and public affairs.

Stockholders entitled to vote in the election of directors at any annual meeting may recommend candidates for consideration by the Nominating and Corporate Governance Committee as potential nominees by submitting written recommendations to the attention of our Corporate Secretary at the following address: Graham Corporation, 20 Florence Avenue, Batavia, New York 14020. Stockholder recommendations must contain: (i) each candidate’s name, age, business and residence addresses; (ii) the candidate’s principal occupation or employment; (iii) each candidate’s written consent to serve as a director, if elected; (iv) whether each candidate would be an independent director if elected, and the basis therefore, under the NYSE listing standards; (v) a description of the candidate’s qualifications to be a director; and (vi) such other information regarding each candidate as would be required to be included in the proxy statement pursuant to the SEC’s rules. Any stockholder submitting a recommendation must provide his or her own name and address as they appear on our books and records, as well as the class and number of our shares owned of record and the dates he or she acquired such shares. In addition, any stockholder submitting a recommendation must provide (i) a description of all arrangements or understandings between the stockholder and each candidate and any other person pursuant to which the nominations were made; (ii) the identification of any person retained by the stockholder or by any candidate, or any person acting on his or her behalf to make solicitations for the purpose of electing such candidate and a brief description of the terms of such arrangement; (iii) a description of any arrangement, the effect or intent of which is to mitigate loss, manage risk or benefit from changes in the Company’s share price, or increase or decrease the voting power of the stockholder or beneficial owner with respect to the Company’s shares, and the stockholder’s agreement to notify the Company in writing within five business days after the record date for such meeting of any such arrangement in effect as of the record date for the meeting; and (iv) any such information regarding the stockholder as would be required to be included in a proxy statement or provided to the Company pursuant to the SEC’s rules. The Nominating and Corporate Governance Committee will evaluate director candidates proposed by stockholders using the same criteria, and in the same manner, as described above for other potential nominees.

In addition, the Nominating and Corporate Governance Committee assists the Board in its oversight of our strategies, policies and practices relating to environmental and social matters as well as executive officer succession.

Compensation Committee

The Compensation Committee annually reviews and approves the goals and objectives relevant to the compensation of the Chief Executive Officer, evaluates the Chief Executive Officer’s performance and either as a committee or with the other independent directors of the Board, determines and approves the Chief Executive Officer’s compensation levels.

The Compensation Committee also annually reviews and approves salaries, incentive cash awards and other forms of compensation paid to our other executive officers, approves recipients of equity-based awards and establishes the number of shares and other terms applicable to such awards. The Compensation Committee also construes the provisions of and generally administers the 2020 Graham Corporation Equity Incentive Plan, as amended (the “2020 Plan”), and any successor plan thereto. The Compensation Committee operates pursuant to its charter and may delegate its authority or responsibility to one or more subcommittees.

The Compensation Committee also reviews and makes recommendations regarding the compensation paid to the Board. More information about the compensation of our directors is set forth under the heading “Director Compensation.” The Compensation Committee annually conducts a performance evaluation of its operation and function and recommends any proposed changes to the Board for approval.

In addition, the Compensation Committee is responsible for reviewing and discussing with management the Compensation Discussion and Analysis that is included in our annual proxy statement and performing such other tasks that are consistent with its charter.

The Compensation Committee recognizes the importance of using an independent consultant that provides services solely to the Compensation Committee and not to management. The Compensation Committee engaged an

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

13 | |

|

Corporate Governance • Committees and Meetings of the Board; Meeting Attendance

|

independent compensation consultant in fiscal year 2024. For more information on the role of the Compensation Committee in determining executive compensation, including its use of an independent consultant, see “Compensation Discussion and Analysis” under the heading “Executive Compensation.”

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to promote the effective functioning of the Board in its governance of our business and corporate operations. The Corporate Governance Guidelines are available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheadings “Governance” and “Governance Documents.”

Political Contribution Policy Statement

The Board has adopted a political contribution policy statement, which outlines the Company’s policies, procedures and philosophy regarding its political contributions and activities. It is the Company’s policy not to make independent political expenditures in support of the election or defeat of particular candidates and not to maintain a political action committee. This policy is available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheadings “Governance” and “Governance Documents.”

Board Policy on Stockholder Rights Plans

We do not have a “poison pill” or stockholder rights plan. If we were to adopt a stockholder rights plan, the Board would seek prior stockholder approval of the plan unless, due to timing constraints or other reasons, a majority of independent directors of the Board determines that it would be in the best interests of stockholders to adopt a plan before obtaining stockholder approval. If a stockholder rights plan is adopted without prior stockholder approval, the Board will submit the plan for approval by stockholders prior to the first anniversary of the effective date of the plan or the plan will otherwise terminate.

The Board’s Role in Risk Oversight

The Board oversees our risk profile and management’s processes for managing risk, primarily through the Board’s committees. Our Audit Committee focuses on financial risks, including those that could arise from our accounting and financial reporting processes. Additionally, our Audit Committee monitors and directs the formal risk management projects implemented by management, including cybersecurity. Our Nominating and Corporate Governance Committee focuses on the management of risks associated with board organization, membership and structure, corporate governance, and the recruitment and retention of talented Board members. Additionally, our Nominating and Corporate Governance Committee focuses on the management of risks associated with executive officer succession. Our Compensation Committee focuses on the management of risks that could arise from our compensation policies and programs and, in particular, our executive compensation programs and policies.

As part of its risk oversight responsibilities, the Board and its committees review the policies and processes that senior management uses to manage our risk exposure. In doing so, the Board and its committees review our overall risk function and senior management’s establishment of appropriate systems and processes for managing areas of material risk to the Company, including, but not limited to, operational, financial, legal, regulatory, strategic and information technology risks (including with respect to cybersecurity).

Communications from Stockholders and other Interested Parties

Stockholders and other interested parties who wish to contact the Board or an individual director, including the independent Chair of the Board or independent directors as a group, should send their communications to the attention of the Corporate Secretary, Graham Corporation, 20 Florence Avenue, Batavia, New York 14020. The Corporate Secretary will forward all such communications as directed unless the communication is inappropriate.

| 14 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Environmental and Social Matters • Commitment to Sustainability

|

Environmental and Social Matters

Oversight

Graham Corporation is committed to embedding sustainability throughout our business. We believe that all our stakeholders must be considered in our everyday actions. We continue to enhance our sustainability strategy to align with the broader transformation of our business. Our executive management team recognizes the importance of embedding environmental and social priorities within our business operations and an enhanced and modernized strategy intended to drive additional progress on initiatives that promote sustainability and increase transparency. Mr. Thoren, our Chief Executive Officer, is the lead officer responsible for overseeing and advancing the Company’ efforts with respect to sustainability initiatives. In such capacity, Mr. Thoren reviews our environmental, social and governance (“ESG”) efforts with the Board and the various Board committees as appropriate.

We have established ESG working groups at each of our companies that are responsible for leading our ESG strategy and monitoring our corporate social responsibility and environmental accountability initiatives. These groups include cross-functional subject matter experts from across the business. Against this backdrop, we have, with the assistance of outside expertise, performed an assessment of key indicators and engaged with our internal and external stakeholders on sustainability topics to help further inform our future direction and tenets. This ESG working group oversees Graham’s sustainability strategy and subsequent disclosures, including the production of our 2024 Sustainability Accounting Standards Board (SASB) Factsheet available on our website. The four tenets of our ESG strategy are shown below:

|

|

|

|

Environment

We believe that a focus on environmental stewardship is fundamental and integral to the work we do every day to serve our customers, create value for our stockholders, and benefit our global community. We have taken steps at both our business units in Batavia, New York and Arvada, Colorado to improve energy efficiencies and air quality that are intended to lessen our impact on the environment. Notably:

| • | Encouraged environmentally friendly workplace practices by supporting recycling and separation of waste throughout our offices; |

| • | Installed new Electro Chemical Machine reducing hazardous waste generation by 50%; |

| • | Received four additional electric vehicle charging stations to install in 2024; |

| • | Installed scrubber/handlers in plate burn area, improving air quality; |

| • | Developed NextGen steam nozzle to reduce steam use and CO2 emissions by up to 10%. |

We have over 595 employees across our global facilities, including our 43,000 square foot, state-of-the-art manufacturing plant that is part of the 101,000 square foot campus in Arvada, Colorado, where our commitment to reducing the waste we generate and utilizing our expertise to produce high quality and sustainable products. Each of our facilities are diligent in controlling hazardous waste and ensuring wastewater and storm sewer discharges are monitored to support greater access to clean water. Additionally, a key aspect of our ESG strategy is climate change. We help minimize our environmental footprint with Adopt-A-Street activities, factory recycling programs, electric car charging stations, and energy saving initiatives like LED lighting, motion sensors for lighting, smart compressors to manage energy loads and installing programmable thermostats in our facilities.

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

15 | |

|

Environmental and Social Matters • Commitment to Sustainability

|

Our People

At Graham, we believe our most important asset is our people. We are committed to fostering and embracing a Graham community in which employees share a mutual understanding and respect for each other. Our pledge to diversity and equality encompasses our commitment to create a work environment which embraces inclusion regardless of race, color, religion, gender, sexual orientation, gender identity, national origin, age, genetic information, marital status, amnesty, pregnancy, childbirth, disability, veteran status, or medical conditions. We continually strive to use our knowledge, talents, and resources to improve the quality of life of our workforce. In 2023, Barber-Nichols was recognized in Glassdoor’s Best Places to Work, ranking 10 out of 50 in the U.S. small and medium company category. Glassdoor’s analysis is based solely on the input of employees who complete an anonymous review about their job, work environment and employer.

Diversity, Equality & Inclusion (“DEI”) is very important to us at Graham. Our commitment starts with our goal of attracting, retaining, and developing a workforce that is diverse in background, knowledge, skill, and experience. In 2023, we started a Women in Manufacturing group to attract and promote women in our workplace. As of December 31, 2023, women represented approximately 20% and self-identified racial and ethnic minorities represented approximately 9.4% of our workforce, up from 8% as of March 31, 2023 and 5% as of March 31, 2022. We strive to mirror our local communities through recruitment in our high schools and community colleges.

Our management recognizes that a diverse workforce and a culture of equity and inclusion helps us compete more effectively, sustain success, and build long-term shareholder value. We encourage every one of our team members to form deeper relationships with those around them based on mutual respect, dignity, and understanding. Furthermore, to encourage productive conversations within our organization, we have implemented employee engagement surveys. Graham has robust non-discrimination and anti-harassment policies as outlined in our employee handbook, as well as a formal Code of Business Conduct and Ethics.

We believe that employee development is vital to our continued success, and we support the development of our employees through programs such as our internal weld school training, our partnerships with community colleges, our tuition assistance program, and management training classes. Our management is continuously focused on developing an inclusive and respectful work environment where our employees are highly engaged and motivated.

We are dedicated to ensuring the health and safety of our team members by supporting the whole person. Our dedicated global health and safety function is executed through our business unit safety committees to ensure that employees are trained on best practices to create a safe and healthy workplace for all. Arvada has met the requirements to be certified as a Safety and Health Achievement Recognition Program by the Occupational Safety and Health Administration. To ensure the health and wellbeing of our employees, we aim to provide a robust health and wellness package. Some of the various benefits we offer include:

| • | Competitive medical, dental and vision benefits; |

| • | Flexible spending and health savings accounts for both healthcare and dependent care; |

| • | Short- and long-term disability insurance; |

| • | Paid maternity and parental leave; |

| • | 401(k) retirement savings program, including company matching contributions, and employee stock purchase plan; |

| • | Employee Assistance Program providing free counseling services; and |

| • | Wellness incentives, including a wellness consultant. |

Our Communities

We believe that investing in local communities to create positive social and economic outcomes is at the heart of generating social impact. We believe that to be successful we need to push ourselves to do our best, for our customers, for our stockholders, for the Company, for ourselves, for those around us, and for the world that we all share. We are committed to supporting the communities in which we do business by leveraging the power of our Company through donations, scholarships, education and participation with certain charitable organizations. We strive to use our capabilities, reach and resources to make a lasting difference in the world. Notably:

| • | We are proud to have continued working with several local schools to help teach students about careers and opportunities in engineering and advanced manufacturing. |

| 16 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Environmental and Social Matters • Commitment to Sustainability

|

| • | We participated in the Genesee, Livingston, Orleans, and Wyoming (“GLOW”) Corporate Cup. The goal of this event is for local businesses to form racing teams, compete in a fun atmosphere, and crown a winner of the Corporate Cup. With the proceeds raised from this event, the YMCA is able to fulfill its mission of youth development, healthy living and social responsibility in the GLOW region. |

| • | We implemented a United Way Day of Giving, the largest community-wide volunteer event across our region serving Genesee, Livingston, Monroe, Ontario, Wayne, and Wyoming counties. |

| • | We donated time and resources to a number of charities including the Special Olympics, Habitat for Humanity, Family Tree, Community Table Food Bank, National Foundation to End Child Abuse and Neglect, Cystic Fibrosis Foundation, Outdoor Labs, Puppy Rescue, and Adopt-A-Tree Clean-ups. |

We believe the industry needs to engage with young people, be more inclusive and employ people from a diverse range of backgrounds. As key stakeholders in the industry, we partnered with nonprofit organizations to implement elementary school Science, Technology, Engineering and Math (“STEM”) programs, where over 30 volunteers engaged in science fair judging, tours, and career fairs and created STEM kits to support educational endeavors. Furthermore, we facilitated weld training programs with local high schools and community colleges, and serve on their industry partner committees. Also, we assisted with college scholarship funds at many local colleges and universities, including Red Rocks Community College, Warren Tech, University of Colorado and Colorado State University.

We believe it is our responsibility to respect human rights in our operations, including, among other things, by opposing human trafficking and the exploitation of children. Accordingly, we have adopted a Human Rights Policy Statement to emphasize our strong commitment to human rights. As another part of being a good corporate citizen, we adopted a Conflict Minerals Policy that is intended to support our commitment to sourcing components and materials from companies that share our values around human rights and ethics. Both policies are available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheadings “Governance” and “Governance Documents.”

Corporate Governance

Graham is committed to achieving excellence in our corporate governance practices. We emphasize a culture of accountability and conduct our business in a manner that is fair, ethical, and responsible to earn the trust of our stakeholders. The Company has corporate governance and sustainability policies and structures in place to foster accountability and transparency. These policies reflect our underlying commitment to maintain the highest standards of ethics and integrity and to operate our business in compliance with all applicable anti-corruption, anti-bribery, and anti-trust laws and regulations.

The Board of Directors is comprised of a majority of independent directors as defined by the NYSE listing standards and the Board’s Corporate Governance Guidelines. All of the Board committees are comprised entirely of independent directors.

Graham recognizes that effectively managing enterprise risks is critically important to the long-term success of our business. Management is responsible for our company’s day-to-day risk management activities. Our company relies on a comprehensive risk management process to aggregate, monitor, measure, and manage risks. While we exercise oversight, we do not have full control over our supply chain nor the suppliers we do business with; however, we continually seek to partner with suppliers that share common values and a shared commitment to our ESG objectives.

As a global leader in the design and manufacture of critical electronics-enhanced turbomachines and turbomachine-based subsystems as well as vacuum and heat exchangers technologies, Graham is a trusted partner that meets the industry’s high bar for data resiliency and security. We leverage the latest encryption configurations and technologies on our systems, devices, and third-party connections and further vet third-party vendors’ encryption, as required, through our vendor management process.

We routinely engage with our stakeholders to better understand their views on ESG matters, carefully considering the feedback we receive and acting when appropriate. For more information, please visit our website at www.grahamcorp.com under the heading “Investor Relations.”

Additionally, in furtherance of our ESG objectives, we implemented in fiscal year 2024 our Anti-Bribery and Anti-Corruption Policy, we implemented in the fiscal year ended March 31, 2023 (“fiscal year 2023”) our Human Rights Policy, Code of Vendor Conduct, and Enterprise Level Environmental Policy, and we implemented in the fiscal year

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

17 | |

|

Environmental and Social Matters • Commitment to Sustainability

|

ended March 31, 2021, our Conflict Minerals Policy, each described below and available on our website at www.grahamcorp.com under the heading “Investor Relations” and the subheadings “Governance” and “Governance Documents.”

Human Rights Policy

Our Human Rights Policy sets forth our views on the health and safety standards we strive to provide to our employees, our intolerance for forced or involuntary labor of any kind, and our commitment to providing equal opportunity in all aspects of employment. Human rights are generally defined as the basic freedoms believed to be inherent to all people as outlined in the United Nations Universal Declaration for Human Rights, which focuses on dignity, respect and equality, without discrimination.

Enterprise Level Environmental Policy

Our Enterprise Level Environmental Policy focuses on our belief that environmental stewardship is fundamental and integral to the work we do every day to serve our customers, create value for our stockholders, and benefit our global community. We believe that our focus on environmental sustainability, with the objective of reducing costs and improving sustainability of our operations, will provide us with a strategic benefit. Through our Enterprise Level Environmental Policy we will continue to engage with suppliers throughout our global value chain to manage these impacts in order to conserve resources, reduce costs, and promote ethical practices.

Conflict Minerals Policy

Our Conflict Minerals Policy outlines our commitment to sourcing components and materials from companies that share our values around human rights and ethics. We strive to utilize suppliers with products that are conflict free. We undertake due diligence processes to support our efforts and expect our suppliers to source products and develop reasonable due diligence frameworks and policies designed to prevent conflict minerals from being included in our products. We encourage our employees, vendors, or other partners to notify us of any issues or concerns regarding our supply chain, including issues and concerns relating to conflict minerals.

Anti-Bribery and Anti-Corruption Policy

Our Anti-Bribery and Anti-Corruption Policy sets forth our commitment to ensuring that our employees, affiliates, and others acting on our behalf abide by all international and local laws that collectively prohibit bribery and corruption in countries where we conduct business. We prohibit any form of bribery or corruption, including giving, offering, promising or receiving Anything of Value (as defined in the Anti-Bribery and Anti-Corruption Policy), directly or indirectly with the intent to obtain an improper business advantage.

Code of Vendor Conduct

Our Code of Vendor Conduct specifies the behaviors, practices and regulations we expect to see practiced in all stages of our supply chain. The Code of Vendor Conduct is focused on ensuring that our vendors, suppliers, and other business partners, including their employees, agents, and suppliers, act in a way that is ethical, corporately responsible, and aims to promote compliance with applicable laws and regulations.

| 18 |

GRAHAM CORPORATION 2024 PROXY STATEMENT | |

|

Executive Officers

|

As of June 21, 2024, we were served by the following executive officers and Section 16 officers, each of whom was appointed by the Board:

Daniel J. Thoren, age 61, has served as our Chief Executive Officer since September 2021 and became our President and Chief Operating Officer in June 2021. Further information about Mr. Thoren is set forth under “Proposal One: Election of Directors.”

Christopher J. Thome, age 53, became our Vice President – Finance and Chief Financial Officer in April 2022 and our Chief Accounting Officer and Corporate Secretary in July 2022. Prior to joining the Company since February 2020, Mr. Thome served as Corporate Controller and Treasurer of Allient Inc. (NASDAQ: ALNT), formerly known as Allied Motion Technologies Inc., a producer of precision and specialty motion, control and power quality components and systems. From July 2006 to February 2020, he held progressively advancing roles at Integer Holdings Corporation (NYSE: ITGR), a provider of advanced medical device outsourcing, including Senior Director–Treasurer and Senior Director–Financial Reporting, Treasury Operations and Shared Services. Mr. Thome is a certified public accountant.

Matthew Malone, age 37, became our Vice President and General Manager – Barber-Nichols in June 2021. Prior to joining the Company, Mr. Malone served as the President and Chief Executive Officer of Barber-Nichols since May 2021, having previously served as Barber-Nichols Vice President of Operations from May 2020 to May 2021, Project Management Office Manager from November 2017 to May 2020, and Project Engineer from July 2015 to November 2017. Prior to Barber-Nichols, Mr. Malone began his career at GE Transportation where he held a variety of progressively challenging engineering and management positions.

Alan E. Smith, age 57, became our Vice President and General Manager – Batavia in July 2015. Mr. Smith served as our Vice President of Operations from July 2007 until July 2015. Previously, from 2005 until July 2007, Mr. Smith served as Director of Operations for Lydall, Inc., a designer and manufacturer of specialty engineering products. Prior to that, he had been employed by us for fourteen years, progressing from Project Engineer to Engineering Manager.

| GRAHAM CORPORATION 2024 PROXY STATEMENT |

19 | |

|

Executive Compensation • Compensation Discussion and Analysis

|

As a smaller reporting company under the Exchange Act we are not required to provide certain disclosures pursuant to Item 402 of Regulation S-K, however, we have elected not to take advantage of certain scaled disclosure requirements allowed for smaller reporting companies to provide transparency with respect to the compensation of our named executive officers.

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis (“CD&A”) provides information about the compensation programs for our executive officers named in the fiscal year 2024 Summary Compensation Table. These named executive officers and their respective titles are: