January 26, 2026 Graham Corporation Acquires FlackTek Exhibit 99.2

Safe Harbor Regarding Forward Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as “expects,” “future,” “outlook,” “anticipates,” “believes,” “could,” “should,” “target,” ”may”, “will,” and other similar words. All statements addressing operating performance, events, or developments that Graham Corporation expects or anticipates will occur in the future, including but not limited to, profitability of future projects and the business, its ability to deliver to plan, realization of benefits from the acquisition of FlackTek, the integration and operation of FlackTek, and the effect of the FlackTek acquisition on our growth are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These risk factors and uncertainties are more fully described in Graham Corporation’s most recent Annual Report filed with the Securities and Exchange Commission (the “SEC”), included under the heading entitled “Risk Factors”, and in other reports filed with the SEC. Should one or more of these risks or uncertainties materialize or should any of Graham Corporation’s underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on Graham Corporation’s forward-looking statements. Except as required by law, Graham Corporation disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this presentation. Use of Key Performance Indicators This presentation includes key performance indicators such as backlog. Management uses backlog as a measure of current and future business and financial performance, and may not be comparable with measures provided by other companies. Backlog is defined as the total dollar value of net orders received for which revenue has not yet been recognized. Management believes tracking backlog is useful as it often times is a leading indicator of future performance. Given that backlog is an operational measure and that the Company's methodology for calculating it does not meet the definition of a non-GAAP measure, as that term is defined by the U.S. Securities and Exchange Commission, a quantitative reconciliation for backlog is not required or provided. Use of Forward-Looking Non-GAAP Financial Measures Forward-looking adjusted EBITDA is a non-GAAP measure. The Company is unable to present a quantitative reconciliation of these forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures because such information is not available, and management cannot reliably predict the necessary components of such GAAP measures without unreasonable effort largely because forecasting or predicting our future operating results is subject to many factors out of our control or not readily predictable. In addition, the Company believes that such reconciliations would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on the Company’s financial results. These non-GAAP financial measures are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with purchase accounting, quarter-end, and year-end adjustments. Any variation between the Company’s actual results and preliminary financial estimates set forth above may be material. Safe Harbor Statement

Transaction Overview Transaction Highlights + Purchase price of $35 million, compromised of 85% cash and 15% of GHM’s common stock (75,818 shares) Four-year potential earn out of an additional $25 million beginning with fiscal year 2027, based upon achieving progressively increasing adjusted EBITDA performance targets each year The base purchase price represents approximately 12x FlackTek’s projected adjusted EBITDA for 2026 Adds advanced materials processing as a scalable third core platform Adds proprietary mixing products, utilizing bladeless dual asymmetric centrifugal principles, which builds off the strong foundation in vacuum, heat transfer, and high-speed turbomachinery Process-critical and market-agnostic, serving defense, energetics, oil & gas, food, battery, aerospace and space, medical, and other industrial applications Annual revenue of approximately $30 million FlackTek’s Chief Executive Officer, Matt Gross, will join Graham’s leadership team as VP & General Manager and will continue to lead the FlackTek business Acquisition consistent with defined M&A criteria: moated engineered product, 80% domestic customer base, privately owned with post-deal leadership continuity The Company will provide additional details on the acquisition and update its fiscal 2026 outlook on its Fiscal 2026 Third Quarter earnings call scheduled for 11:00 am ET on Friday, February 6, 2026 Graham Acquires FlackTek

STABILIZE ~$30M Annual Revenue 12x Valuation 2026 Adj. EBITDA 2,500+ Units Installed Base Patents & Pending 20+ ~55 Employees Company Overview End Markets & Applications Headquartered in Louisville, CO; Distribution facility in Greenville, SC Recognized as a leader in high-performance, bladeless centrifugal mixing, FlackTek designs and manufactures advanced mixing systems, accessories, consumables, and material processing solutions built on its proprietary product portfolio Trusted by a global customer base that includes industry-leading OEMs, research and development centers, defense laboratories, and industrial manufacturers Serves diverse end-users across advanced materials markets including adhesives, sealants, functional coatings, composites, electronics, and many more Large install base that drives predictable, recurring demand for proprietary consumables, accessories, and services, enhancing revenue visibility and lifetime value. Defense Mission-critical materials for energetics, radar, missiles, sensors, avionics, UAVs electronics, drones, etc. Space Precision materials mixing for thermal coatings, thrust control, insulation systems, structure coatings, etc. Energy & Process Coatings, sealants & adhesives for nuclear fuel, oil & gas, chemical, food, pharmacy, batteries, etc. Products Industrial Composites & advanced materials for aerospace, medical, personal care, additive mfg., etc. Transaction Overview Lab (<1kg) to Production (300kg) Mixers Consumables Integrated Systems 1996 Established

A pioneer in high-performance, mission-critical materials processing Strategic Rationale Acquisition adds advanced mixing and materials processing as the third pillar to Graham’s technology platform Expands Graham’s ability to solve complex customer challenges that increasingly demand integrated solutions spanning rotating machinery, vacuum environments, thermal management, and advanced materials processing FlackTek’s technology sits naturally alongside Barber-Nichols’ turbomachinery and Graham Manufacturing’s vacuum and heat transfer systems, creating a more comprehensive engineered solutions platform FlackTek adds a proven and defensible product portfolio with a shared customer base and an installed footprint that extends across the full value chain, from upstream to downstream production and quality control Mixing systems are process-critical and market-agnostic, serving defense, energetics, oil & gas, food, battery, aerospace and space, medical, and other industrial applications where precision, repeatability, and consistency drive value Growing installed base drives repeat consumables, accessories, and service revenue, enhancing revenue visibility, durability, and margin profile over time Deal structure with upfront consideration and performance-based earnout supports strong returns while preserving balance sheet flexibility and long-term value creation

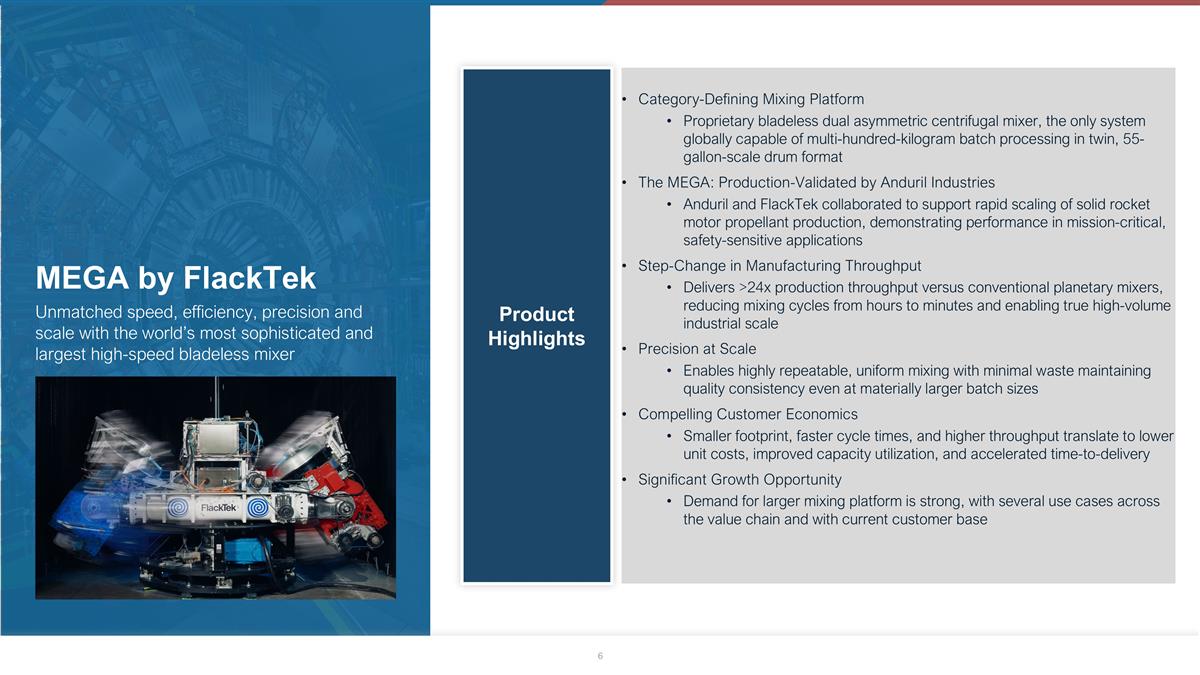

Product Highlights Category-Defining Mixing Platform Proprietary bladeless dual asymmetric centrifugal mixer, the only system globally capable of multi-hundred-kilogram batch processing in twin, 55-gallon-scale drum format The MEGA: Production-Validated by Anduril Industries Anduril and FlackTek collaborated to support rapid scaling of solid rocket motor propellant production, demonstrating performance in mission-critical, safety-sensitive applications Step-Change in Manufacturing Throughput Delivers >24x production throughput versus conventional planetary mixers, reducing mixing cycles from hours to minutes and enabling true high-volume industrial scale Precision at Scale Enables highly repeatable, uniform mixing with minimal waste maintaining quality consistency even at materially larger batch sizes Compelling Customer Economics Smaller footprint, faster cycle times, and higher throughput translate to lower unit costs, improved capacity utilization, and accelerated time-to-delivery Significant Growth Opportunity Demand for larger mixing platform is strong, with several use cases across the value chain and with current customer base MEGA by FlackTek Unmatched speed, efficiency, precision and scale with the world’s most sophisticated and largest high-speed bladeless mixer

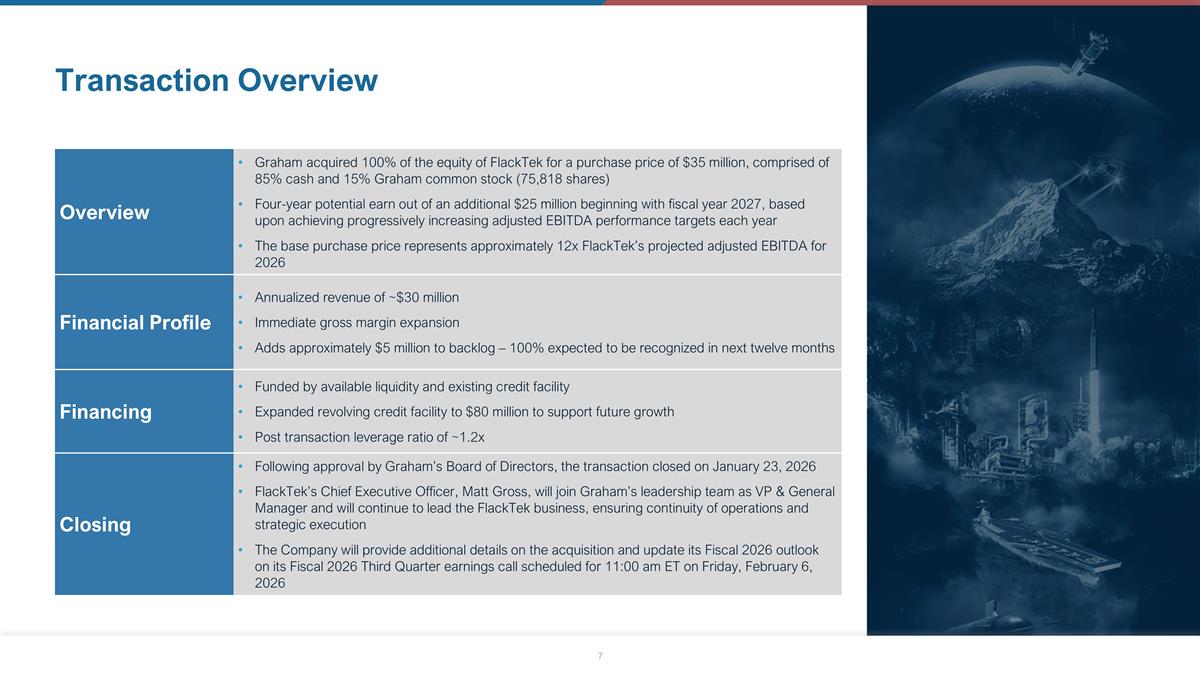

Overview Graham acquired 100% of the equity of FlackTek for a purchase price of $35 million, comprised of 85% cash and 15% Graham common stock (75,818 shares) Four-year potential earn out of an additional $25 million beginning with fiscal year 2027, based upon achieving progressively increasing adjusted EBITDA performance targets each year The base purchase price represents approximately 12x FlackTek’s projected adjusted EBITDA for 2026 Financial Profile Annualized revenue of ~$30 million Immediate gross margin expansion Adds approximately $5 million to backlog – 100% expected to be recognized in next twelve months Financing Funded by available liquidity and existing credit facility Expanded revolving credit facility to $80 million to support future growth Post transaction leverage ratio of ~1.2x Closing Following approval by Graham’s Board of Directors, the transaction closed on January 23, 2026 FlackTek’s Chief Executive Officer, Matt Gross, will join Graham’s leadership team as VP & General Manager and will continue to lead the FlackTek business, ensuring continuity of operations and strategic execution The Company will provide additional details on the acquisition and update its Fiscal 2026 outlook on its Fiscal 2026 Third Quarter earnings call scheduled for 11:00 am ET on Friday, February 6, 2026 Transaction Overview