UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2019

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ___________.

Commission File Number 1-8462

GRAHAM CORPORATION

(Exact name of Registrant as specified in its charter)

|

Delaware |

16-1194720 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

20 Florence Avenue, Batavia, New York |

14020 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code 585-343-2216

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, Par Value $0.10 Per Share |

|

GHM |

|

NYSE |

Securities registered pursuant to Section 12(g) of the Act: Preferred Stock Purchase Rights

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

|

Smaller reporting company |

☐ |

|

Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by checkmark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s Common Stock held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the NYSE Stock Market on September 30, 2018, was $268,295,644.

As of May 23, 2019, the Registrant’s Common Stock outstanding was 9,842,803 shares, $0.10 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement, to be filed in connection with the Registrant's 2019 Annual Meeting of Stockholders to be held on August 7, 2019, are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this filing.

GRAHAM CORPORATION

Annual Report on Form 10-K

Year Ended March 31, 2019

|

PART I |

|

PAGE |

|

|

|

|

|

Item 1 |

3 |

|

|

Item 1A |

7 |

|

|

Item 1B |

16 |

|

|

Item 2 |

16 |

|

|

Item 3 |

16 |

|

|

Item 4 |

16 |

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 5 |

17 |

|

|

Item 6 |

18 |

|

|

Item 7 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

19 |

|

Item 7A |

29 |

|

|

Item 8 |

30 |

|

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

66 |

|

Item 9A |

66 |

|

|

Item 9B |

66 |

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

Item 10 |

67 |

|

|

Item 11 |

67 |

|

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

67 |

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

67 |

|

Item 14 |

67 |

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

Item 15 |

68 |

|

|

|

|

|

|

Note: |

Portions of the registrant's definitive Proxy Statement, to be issued in connection with the registrant's 2019 Annual Meeting of Stockholders to be held on August 7, 2019, are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Annual Report on Form 10-K. |

2

(Dollar amounts in thousands except per share data)

Graham Corporation ("we," "us," "our") is a global business that designs, manufactures and sells critical equipment for the energy, defense and chemical/petrochemical industries. Our energy markets include oil refining, cogeneration, and alternative power. For the defense industry, our equipment is used in nuclear propulsion power systems for the U.S. Navy. For the chemical and petrochemical industries, our equipment is used in fertilizer, ethylene, methanol and downstream chemical facilities. Graham’s global brand is built upon our world-renowned engineering expertise in vacuum and heat transfer technology, responsive and flexible customer service and high quality standards. We design and manufacture custom-engineered ejectors, vacuum pumping systems, surface condensers and vacuum systems. Our equipment can also be found in other diverse applications such as metal refining, pulp and paper processing, water heating, refrigeration, desalination, food processing, pharmaceutical, heating, ventilating and air conditioning.

Our corporate headquarters are located in Batavia, New York. We have production facilities located with our headquarters in Batavia. We also have a wholly-owned foreign subsidiary, Graham Vacuum and Heat Transfer Technology (Suzhou) Co., Ltd. ("GVHTT"), located in Suzhou, China. GVHTT provides sales and engineering support for us in the People’s Republic of China and management oversight throughout Southeast Asia. In the fiscal quarter ended December 31, 2018, we established Graham India Private Limited ("GIPL") as a wholly-owned subsidiary. GIPL, located in Ahmedabad, India, serves as a sales and market development office focusing on the refining, petrochemical and fertilizer markets.

We were incorporated in Delaware in 1983 and are the successor to Graham Manufacturing Co., Inc., which was incorporated in New York in 1936. Our stock is traded on the NYSE under the ticker symbol "GHM".

Unless indicated otherwise, dollar figures in this Annual Report on Form 10-K are reported in thousands.

Business for Sale

Due to the changes in the commercial nuclear utility industry over the last several years and the subsequent decline in performance of our wholly-owned subsidiary, Energy Steel & Supply Co. ("Energy Steel"), located in Lapeer, Michigan, we have decided the business is better suited for another partner and have elected to divest of it. We are in discussions to sell the business. Subsequent to March 31, 2019, we received an offer for the purchase of Energy Steel. During fiscal 2019, Energy Steel had $8,336 in net sales.

Our Products, Customers and Markets

Our products are used in a wide range of industrial process applications, primarily in energy markets, including:

|

|

• |

Petroleum Refining |

|

|

— |

conventional oil refining |

|

|

— |

oil sands extraction and upgrading |

|

|

• |

Defense |

|

|

— |

propulsion systems for nuclear-powered aircraft carriers and submarines |

|

|

• |

Chemical and Petrochemical Processing |

|

|

— |

ethylene, methanol and nitrogen producing plants |

|

|

— |

fertilizer plants |

|

|

— |

plastics, resins and fibers plants |

|

|

— |

downstream petrochemical plants |

|

|

— |

coal-to-chemicals plants |

|

|

— |

gas-to-liquids plants |

•Power Generation /Alternative Energy

|

|

— |

biomass plants |

|

|

— |

cogeneration power plants |

|

|

— |

geothermal power plants |

|

|

— |

ethanol plants |

|

|

— |

fossil fuel plants |

3

•Other

|

|

— |

oleo chemical plants |

|

|

— |

air conditioning and water heating systems |

|

|

— |

food processing plants |

|

|

— |

pharmaceutical plants |

|

|

— |

liquefied natural gas production facilities |

Our principal customers include end users of our products in their manufacturing, refining and power generation processes, large engineering companies that build installations for companies in such industries, and the original equipment manufacturers who combine our products with their equipment prior to its sale to end users.

Our products are sold by a team of sales engineers we employ directly as well as by independent sales representatives located worldwide. There may be short periods of time, a fiscal year for example, where one customer may make up greater than 10% of our business. However, if this occurs in multiple years, it is usually not the same customer or project over such a multi-year period. One customer did account for greater than 10% of our business in fiscal 2019.

As a result of our diversification efforts to more extensively support the U.S. Navy, we have increased our domestic sales in 2019. Over a business cycle, our domestic sales will generally range between 50% and 75% of total sales. The mix of domestic and international sales can vary from year to year.

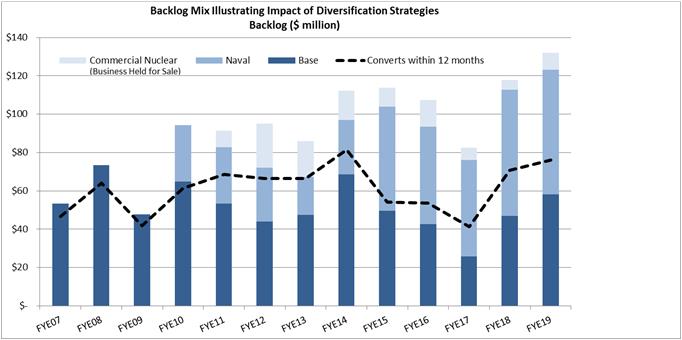

Our backlog at March 31, 2019 was $132,127 compared with $117,946 at March 31, 2018. Excluding backlog associated with assets and liabilities held for sale, backlog on March 31, 2019 was $124,088.

Our Strengths

Our core strengths include:

|

|

• |

We have a value-enhancing sales and development platform. We believe our customer-facing platform of sales, project estimating and application engineering are competitive advantages. We have tools and capabilities that we believe allow us to move quickly and comprehensively as customers evaluate how best to integrate our equipment into their facilities. We believe that our early and deep involvement adds significant value to the process and is an important competitive differentiator in the long sales cycle industries we serve. We believe customers need our engineering and fabrication expertise early in the project life cycle to understand how best to specify our equipment. |

|

|

• |

We are renowned for our strong capabilities to handle complex, custom orders. The orders we receive are extremely complex and we believe that the order management platforms in our businesses provide a second competitive differentiator for our company. Typically there is intense interaction between our project management teams and the end user or its engineering firm as product design and quality requirements are finalized after an order is placed. We have built strong capabilities which we believe allows us to successfully execute high quality, engineered-to-order and build-to-spec process-critical equipment. In our markets, we believe that order administration, risk management, cost containment, quality and engineering documentation are as important as the equipment itself. The supplier selection process begins with assessing whether a supplier can manage all aspects of an order. |

|

|

• |

We maintain a responsive, flexible production environment. We believe our operations platform is adept at handling low volume, high mix orders that are highly customized fabrications. We also believe that our production environment is much different from a highly engineered standard products business. While certain equipment in a product group may look similar, there are often subtle differences which are required to deliver the desired specification. Also, during production it is not uncommon for customer-driven engineering changes to occur that alter the configuration of what had been initially released into production. The markets that we serve demand this flexible operating model. |

|

|

• |

We provide robust after-the-sale technical support. Our engineering and service personnel go to customer sites to audit the performance of our equipment, provide operator training and troubleshoot performance issues. Technical service after a sale is important to our customer as we believe their focus is always on leveraging our equipment to maximize its capabilities. |

|

|

• |

We have a highly trained workforce. We maintain a long-tenured, highly skilled and extremely flexible workforce. |

4

|

|

• |

We have a high-quality credit facility. Our credit facilities provide us with a $30,000 borrowing capacity that is expandable at our option to provide us with up to a total of $55,000 in borrowing capacity. |

Our Strategy

We intend to strategically leverage and deploy our assets, including but not limited to, financial, technical, manufacturing and know-how, in order to capture expanded market share within the geographies and industries we serve, expand revenue opportunities in adjacent and countercyclical markets and continually improve our results of operations in order to:

•Generate sustainable earnings growth;

•Reduce earnings volatility;

•Improve our operating performance;

•Generate strong cash flow from operations;

•Meet or exceed our customers’ expectations;

•Improve the value we provide to our customers; and

•Provide an acceptable return to our shareholders.

To accomplish our objectives and maintain strategic focus, we believe that we must:

|

|

• |

Successfully deploy our corporate assets to expand our market share in the industries we currently serve, access and develop a stronger presence in industries where we do not have a historically strong presence, and pursue acquisitions, partnerships and/or other business combinations in order to enter new geographic or industrial markets, new product lines or expand our coverage in existing markets. |

|

|

• |

Identify organic growth opportunities and consummate acquisitions where we believe the strength of the Graham brand will provide us with the ability to expand and complement our core businesses. We intend to extend our existing product lines, move into complementary product lines and expand our global sales presence in order to further broaden our existing markets and reach additional markets. |

|

|

• |

Expand our market presence in the U.S. Navy's Nuclear Propulsion Program. We will continue to demonstrate our proficiency by successfully executing the complex Nuclear Propulsion Program orders that are currently in our backlog by controlling both cost and risk, providing high-quality custom fabrication to exacting military quality control requirements and through disciplined project management. We intend to continue to be a preferred supplier of equipment to the U.S. Navy’s Nuclear Propulsion Program for both surface and submarine vessels. |

|

|

• |

Continue to invest in people and capital equipment to meet the anticipated long-term growth in demand for our products in the oil refining, petrochemical processing and power generation industries, especially in emerging markets. |

|

|

• |

Continue to deliver the highest quality products and solutions that enable our customers to achieve their operating objectives. We believe that our high quality and technical expertise differentiates us from our competitors and allows us to win new orders based on value. |

In order to effectively implement our strategy, we also believe that we must continue to invest in and leverage our unique customer value enhancing differentiators, including:

|

|

• |

Invest in engineering resources and technology in order to advance our vacuum and heat transfer technology market penetration. |

|

|

• |

Enhance our engineering capacity and capability, especially in connection with product design, in order to more quickly respond to existing and future customer demands and opportunities. |

5

|

|

• |

Invest in our manufacturing operations to improve productivity where needed and identify out-sourced capacity to complement our growth strategies. |

|

|

• |

Accelerate our ability to quickly and efficiently bid on available projects through our ongoing implementation of front-end bid automation and design processes. |

|

|

• |

Invest in resources to further serve the U.S. Navy in our core competency areas of engineering and manufacturing, where our commercial capabilities meet U.S. Navy requirements. |

|

|

• |

Implement and expand upon our operational efficiencies through ongoing refinement of our flexible manufacturing flow model as well as achievement of other cost efficiencies. |

|

|

• |

Focus on improving quality to eliminate errors and rework, thereby reducing lead time and enhancing productivity. |

|

|

• |

Further develop a cross-trained, flexible workforce able to adjust to variable product demands by our customers. |

Competition

Our business is highly competitive. The principal bases on which we compete include technology, price, performance, reputation, delivery, and quality. Our competitors listed in alphabetical order by market include:

|

North America |

||

|

|

||

|

Market |

|

Principal Competitors |

|

|

|

|

|

Refining vacuum distillation |

|

Croll Reynolds Company, Inc.; Gardner Denver, Inc.; GEA Wiegand GmbH |

|

|

|

|

|

Chemicals/petrochemicals |

|

Croll Reynolds Company, Inc.; Gardner Denver, Inc.; Schutte Koerting |

|

|

|

|

|

Turbomachinery Original Equipment Manufacturer ("OEM") – refining, petrochemical |

|

Donghwa Entec Co., Ltd.; KEMCO; Oeltechnik GmbH |

|

|

|

|

|

Turbomachinery OEM – power and power producer

|

|

Holtec; KEMCO; Maarky Thermal Systems; Thermal Engineering International (USA), Inc. |

|

|

|

|

|

Navy Nuclear Propulsion Program / Defense |

|

DC Fabricators; Joseph Oat; PCC; Triumph Aerospace; Xylem |

|

international |

||

|

|

||

|

Market |

|

Principal Competitors |

|

|

|

|

|

Refining vacuum distillation |

|

Edwards, Ltd.; Gardner Denver, Inc.; GEA Wiegand GmbH; Korting Hannover AG |

|

|

|

|

|

Chemicals/petrochemicals |

|

Croll Reynolds Company, Inc.; Edwards, Ltd.; Gardner Denver, Inc.; GEA Wiegand GmbH; Korting Hannover AG; Schutte Koerting |

|

|

|

|

|

Turbomachinery OEM – refining, petrochemical |

|

Chem Process Systems; Donghwa Entec Co., Ltd.; Hangzhou Turbine Equipment Co., Ltd.; KEMCO; Mazda (India); Oeltechnik GmbH |

|

|

|

|

|

Turbomachinery OEM – power and power producer |

|

Chem Process Systems; Holtec; KEMCO; Mazda (India); SPX Heat Transfer; Thermal Engineering International |

Intellectual Property

Our success depends in part on our ability to protect our proprietary technologies. We rely on a combination of patent, copyright, trademark, trade secret laws and contractual confidentiality provisions to establish and protect our proprietary rights. We also depend heavily on the brand recognition of the Graham name in the marketplace.

6

Historically, we have not been materially adversely impacted by the availability of raw materials.

Working Capital Practices

Our business does not require us to carry significant amounts of inventory or materials beyond what is needed for work in process. We negotiate progress payments from our customers on our large projects to finance costs incurred. We do not provide rights to return goods, or payment terms to customers that we consider to be extended in the context of the industries we serve. We do provide for warranty claims.

Environmental Matters

We believe that we are in material compliance with applicable existing environmental laws and regulations. We do not anticipate that our compliance with federal, state and local laws regulating the discharge of material in the environment or otherwise pertaining to the protection of the environment will have a material adverse effect upon our capital expenditures, earnings or competitive position.

Seasonality

No material part of our business is seasonal in nature. However, our business is highly cyclical in nature as it depends on the willingness of our customers to invest in major capital projects.

Research and Development Activities

During fiscal 2019, fiscal 2018 and the fiscal year ended March 31, 2017, which we refer to as "fiscal 2017", we spent $3,538, $3,211 and $3,863, respectively, on research and development activities related both to new products and services and the ongoing improvement of existing products and services.

Employees

As of March 31, 2019, we had 337 employees. We believe that our relationship with our employees is good.

Available Information

We maintain a website located at www.graham-mfg.com. On our website, we provide a link to the Securities and Exchange Commission’s (the "SEC") website that contains the reports, proxy statements and other information we file electronically. We do not provide this information on our website because it is more cost effective for us to provide a link to the SEC's website. Copies of all documents we file with the SEC are available free of charge in print for any stockholder who makes a request. Such requests should be made to our Corporate Secretary at our corporate headquarters. The other information found on our website is not part of this or any other report we file with, or furnish to, the SEC.

Our business and operations are subject to numerous risks, many of which are described below and elsewhere in this Annual Report on Form 10-K. If any of the events described below or elsewhere in this Annual Report on Form 10-K occur, our business and results of operations could be harmed. Additional risks and uncertainties that are not presently known to us, or which we currently deem to be immaterial, could also harm our business and results of operations.

Risks related to our business

The markets we serve include the petroleum refining and petrochemical industries. These industries are both highly cyclical in nature and dependent on the prices of crude oil and natural gas as well as on the differential between the two prices. As a result, volatility in the prices of oil and natural gas may negatively impact our operating results.

A substantial portion of our revenue is derived from the sale of our products to companies in the chemical, petrochemical, petroleum refining and power generating industries, or to firms that design and construct facilities for these industries. These industries are highly cyclical and have historically experienced severe downturns. The prices of crude oil and natural gas have historically been very volatile, as evidenced by the extreme volatility in oil prices over the past few years. During times of significant volatility in the market for crude oil or natural gas, our customers often refrain from placing orders until the market stabilizes and future demand projections are clearer. If our customers refrain from placing orders with us, our revenue would decline and there could be a material adverse effect on our business and results of operations. We believe that over the long-term, demand for our products will expand in the petrochemical, petroleum refining and power generating industries. A sustained deterioration in any of the

7

industries we serve would materially harm our business and operating results because our customers would not likely have the resources necessary to purchase our products, nor would they likely have the need to build additional facilities or improve existing facilities. As we have seen in the recent past, a cyclical downturn can occur suddenly and result in extremely different financial performance sequentially from quarter to quarter or on an annual comparative basis due to an inability to rapidly adjust costs.

The relative costs of oil, natural gas, nuclear power, hydropower and numerous forms of alternative energy production may have a material adverse impact on our business and operating results.

Global and regional energy supply comes from many sources, including oil, natural gas, coal, hydro, nuclear, solar, wind, geothermal and biomass, among others. A cost or supply shift among these sources could negatively impact our business opportunities going forward and the profitability of those opportunities. A demand shift, where technological advances favor the utilization of one or a few sources of energy may also impact the demand for our products. If demand shifts in a manner that increases energy utilization outside of our traditional customer base or expertise, our business and financial results could be materially adversely affected. In addition, governmental policy can affect the relative importance of various forms of energy sources. For example, non-fossil based sources may require and often receive government tax incentives to foster investment. If these incentives become more prominent, our business and results of operations could suffer.

Our business is highly competitive. If we are unable to successfully implement our business strategy and compete against entities with greater resources than us or against competitors who have a relative cost advantage, we risk losing market share to current and future competitors.

We encounter intense competition in all of our markets. Some of our present and potential competitors may have substantially greater financial, marketing, technical or manufacturing resources. Our competitors may also be able to respond more quickly to new technologies or processes and changes in customer demands and they may be able to devote greater resources towards the development, promotion and sale of their products. Certain of our competitors may also have a cost advantage compared to us due to their geography or changes in relative currency values and may compete against us based on price. This may affect our ability to secure new business and maintain our level of profitability. In addition, our current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties that increase their ability to address the needs of our customers. Moreover, customer buying patterns can change if customers become more price sensitive and accepting of lower cost suppliers. If we cannot compete successfully against current or future competitors, our business will be materially adversely affected.

A change in our end use customers, our markets, or a change in the engineering procurement and construction companies serving our markets could harm our business and negatively impact our financial results.

Although we have long-term relationships with many of our end use customers and with many engineering, procurement and construction companies, the project management requirements, pricing levels and costs to support each customer and customer type are often different. Our customers have historically focused on the quality of the engineering and product solutions which we have provided to them. As our markets continue to grow, and new market opportunities expand, we could see a shift in pricing as a result of facing competitors with lower production costs, which may have a material adverse impact on our results of operations and financial results. There has been more of a focus on relative importance of cost versus quality which looks at short-term costs instead of total long-term cost of operations. Our customers are unable to predict the length of the time period for the economic viability of their plants.

A change in the structure of our markets; the relationships between engineering and procurement companies, original equipment suppliers, others in the supply chain and any of their relationships with the end users could harm our business and negatively impact our financial results.

There are strong and long-standing relationships throughout the supply chain between the many parties involved in serving the end user of our products. A change in the landscape between engineering and procurement companies, original equipment suppliers, others in the supply chain and/or with the end users could have a material adverse effect on our business and results of operations. These changes might occur through acquisitions or other business partnerships and could have a material impact on our business and negatively impact our financial results.

The loss of, or significant reduction or delay in, purchases by our largest customers could reduce our revenue and adversely affect our results of operations.

A small number of customers has accounted for a substantial portion of our historical net sales. For example, sales to our top ten customers, who can vary each year, accounted for 41%, 41% and 38% of consolidated net sales in fiscal 2019, fiscal 2018 and fiscal 2017, respectively. We expect that a limited number of customers will continue to represent a substantial portion of our sales for

8

the foreseeable future. The loss of any of our major customers, a decrease or delay in orders or anticipated spending by such customers or a delay in the production of existing orders could materially adversely affect our revenues and results of operations.

We may experience customer concentration risk related to strategic growth for U.S. Navy projects.

We believe our strategy to increase the penetration of U.S. Navy related opportunities will lead to U.S. Navy related projects consistently being greater than 10% of our total revenue. While these projects are spread across multiple contractors for the U.S. Navy, the end customer for these projects is the same. This concentration of business could add additional risk to us should there be a disruption, short or long term, in the funding for these projects or our participation in the U.S. Navy Nuclear Propulsion program.

A large percentage of our sales occur outside of the U.S. As a result, we are subject to the economic, political, regulatory and other risks of international operations.

For fiscal 2019, 35% of our revenue was from customers located outside of the U.S. Moreover, through our subsidiaries, we maintain a sales office in China and a sales and market development office in India. We believe that revenue from the sale of our products outside the U.S. will continue to account for a significant portion of our total revenue for the foreseeable future. We intend to continue to expand our international operations to the extent that suitable opportunities become available. Our foreign operations and sales could be adversely affected as a result of:

|

|

• |

nationalization of private enterprises and assets; |

|

|

• |

political or economic instability in certain countries and regions, such as the ongoing instability throughout the Middle East and/or portions of the former Soviet Union; |

|

|

• |

political relationships between the U.S. and certain countries and regions; |

|

|

• |

differences in foreign laws, including difficulties in protecting intellectual property and uncertainty in enforcement of contract rights; |

|

|

• |

the possibility that foreign governments may adopt regulations or take other actions that could directly or indirectly harm our business and growth strategy; |

|

|

• |

credit risks; |

|

|

• |

currency fluctuations; |

|

|

• |

tariff and tax increases; |

|

|

• |

export and import restrictions and restrictive regulations of foreign governments; |

|

|

• |

shipping products during times of crisis or wars; |

|

|

• |

our failure to comply with U.S. laws regarding doing business in foreign jurisdictions, such as the Foreign Corrupt Practices Act; or |

|

|

• |

other factors inherent in maintaining foreign operations. |

The impact of potential changes in customs and trade policies and tariffs imposed by the U.S. and those imposed in response by other countries, including China, as well as rapidly changing trade relations, could materially and adversely affect our business and results of operations.

The U.S. government has made proposals that are intended to address trade imbalances, which include encouraging increased production in the United States. These proposals could result in increased customs duties and the renegotiation of some U.S. trade agreements. Changes in U.S. and foreign governments’ trade policies have resulted and may continue to result in tariffs on imports into, and exports from, the U.S. Throughout 2018 and 2019, the U.S. imposed tariffs on imports from several countries, including China, Canada, the European Union and Mexico. In response, China, Canada and the European Union have proposed or implemented their own tariffs on certain exports from the U.S. into those countries. Tariffs affecting our products and product components, including raw materials we use, particularly high-end steel and steel related products, may add significant costs to us and make our

9

products more expensive. As a result, our products could become less attractive to customers outside the U.S. due to U.S. import tariffs on our raw materials and our profit margins would be negatively impacted. Accordingly, continued tariffs may weaken relationships with certain of our trading partners and may adversely affect our financial performance and results of operations. When beneficial to us, we may consider alternate sourcing options, including off shore subcontracting, in order to minimize the impact of the tariffs. Because we conduct aspects of our business in China through our subsidiary, potential reductions in trade with China and diminished relationships between China and the U.S., as well as the continued escalation of tariffs, could have a material adverse effect on our business and results of operations.

Global demand growth could be led by emerging markets, which could result in lower profit margins and increased competition.

The increase in global demand could be led by emerging markets. If this is the case, we may face increased competition from lower cost suppliers, which in turn could lead to lower profit margins on our products. Customers in emerging markets may also place less emphasis on our high quality and brand name than do customers in the U.S. and certain other industrialized countries where we compete. If we are forced to compete for business with customers that place less emphasis on quality and brand recognition than our current customers, our results of operations could be materially adversely affected.

Climate change and greenhouse gas regulations may affect our customers’ investment decisions.

Due to concern over the risk of climate change, a number of countries have adopted, or are considering the adoption of, regulatory frameworks to reduce greenhouse gas emissions. These restrictions may affect our customers' abilities and willingness to invest in new facilities or to re-invest in current operations. These requirements could impact the cost of our customers’ products, lengthen project implementation times, and reduce demand for hydrocarbons, as well as shift hydrocarbon demand toward lower-carbon sources. Any of the foregoing could adversely impact the demand for our products, which in turn could have an adverse effect on our business and results of operations.

The operations of our Chinese subsidiary may be adversely affected by China’s evolving economic, political and social conditions.

We conduct our business in China primarily through our wholly-owned Chinese subsidiary. The results of operations and future prospects of our Chinese subsidiary may be adversely affected by, among other things, changes in China's political, economic and social conditions, changes in the relationship between China and its western trade partners, changes in policies of the Chinese government, changes in laws and regulations or in the interpretation of existing laws and regulations, changes in foreign exchange regulations, measures that may be introduced to control inflation, such as interest rate increases, and changes in the rates or methods of taxation. In addition, changes in demand could result from increased competition from local Chinese manufacturers who have cost advantages or who may be preferred suppliers for Chinese end users. Also, Chinese commercial laws, regulations and interpretations applicable to non-Chinese owned market participants, such as us, are continually changing. These laws, regulations and interpretations could impose restrictions on our ownership or the operation of our interests in China and have a material adverse effect on our business and results of operations.

Intellectual property rights are difficult to enforce in China and India, which could harm our business.

Chinese commercial law is relatively undeveloped compared with the commercial law in many of our other major markets and limited protection of intellectual property is available in China as a practical matter. Similarly, proprietary information may not be afforded the same protection in India as it is in our other major markets with more comprehensive intellectual property laws. Although we take precautions in the operations of our subsidiaries to protect our intellectual property, any local design or manufacture of products that we undertake could subject us to an increased risk that unauthorized parties will be able to copy or otherwise obtain or use our intellectual property, which could harm our business. We may also have limited legal recourse in the event we encounter patent or trademark infringers, which could have a material adverse effect on our business and results of operations.

Uncertainties with respect to the Chinese legal system may adversely affect the operations of our Chinese subsidiary.

Our Chinese subsidiary is subject to laws and regulations applicable to foreign investment in China. There are uncertainties regarding the interpretation and enforcement of laws, rules and policies in China. The Chinese legal system is based on written statutes, and prior court decisions have limited precedential value. Because many laws and regulations are relatively new and the Chinese legal system is still evolving, the interpretations of many laws, regulations and rules are not always uniform. Moreover, the relative inexperience of China's judiciary in many cases creates additional uncertainty as to the outcome of any litigation, and the interpretation of statutes and regulations may be subject to government policies reflecting domestic political agendas. Finally, enforcement of existing laws or contracts based on existing law may be uncertain and sporadic. For the preceding reasons, it may be difficult for us to obtain timely or equitable enforcement of laws ostensibly designed to protect companies like ours, which could have a material adverse effect on our business and results of operations.

10

Regulation of foreign investment in India may adversely affect the operations of our Indian subsidiary.

Our subsidiary in India is subject to laws and regulations applicable to foreign investment in India. India regulates ownership of Indian companies by foreign entities. These regulations may apply to our funding of our Indian operating subsidiary. For example, the government of India has set out criteria for foreign investments in India, including requirements with respect to downstream investments by Indian companies owned or controlled by foreign entities and the transfer of ownership or control of Indian companies in certain industries. These requirements may adversely affect our ability to operate our Indian subsidiary. There can be no assurance that we will be able to obtain any required approvals for future acquisitions, investments or operations in India, or that we will be able to obtain such approvals on satisfactory terms.

Changes in U.S. and foreign energy policy regulations could adversely affect our business.

Energy policy in the U.S. and in the other countries where we sell our products is evolving rapidly and we anticipate that energy policy will continue to be an important legislative priority in the jurisdictions where we sell our products. It is difficult, if not impossible, to predict the changes in energy policy that could occur, as they may be related to changes in political administration, public policy or other factors. The elimination of, or a change in, any of the current rules and regulations in any of our markets could create a regulatory environment that makes our end users less likely to purchase our products, which could have a material adverse effect on our business. Government subsidies or taxes, which favor or disfavor certain energy sources compared with others, could have a material adverse effect on our business and operating results.

Efforts to reduce large U.S. federal budget deficits could result in government cutbacks or shifts in focus in defense spending or in reduced incentives to pursue alternative energy projects, resulting in reduced demand for our products, which could harm our business and results of operations.

Our business strategy calls for us to continue to pursue defense-related projects as well as projects for end users in the alternative energy markets in the U.S. In recent years, the U.S. federal government has incurred large budget deficits. In the event that U.S. federal government defense spending is reduced or alternative energy related incentives are reduced or eliminated in an effort to reduce federal budget deficits, projects related to defense or alternative energy may become less plentiful. The impact of such reductions could have a material adverse effect on our business and results of operations, as well as our growth opportunities.

U.S. Navy orders are subject to annual government funding. A disruption in funding could adversely impact our business.

One of our growth strategies is to increase our penetration of U.S. Navy-related opportunities. Projects for the U.S. Navy and its contractors generally have a much longer order-to-shipment time period than our commercial orders. The time between the awarding of an order to complete shipment can take three to seven years. Annual government funding is required to continue the production of this equipment. Disruption of government funding, short or long term, could impact the ability for us to continue our production activity on these orders. Since this business is expected to increase as a percentage of our overall business, such a disruption, should it occur, could adversely impact the sales and profitability of our business.

Changes in the competitive environment for U.S. Navy procurement could adversely impact our ability to grow this portion of our business.

Over the past few years, we have expanded our business and the opportunities where we bid related to U.S. Navy projects. This has increased our market share and caused an adverse share position for some of our competitors for these products. Competitor response to our market penetration is possible. Our customers may also raise concerns about their supplier concentration issues and the risk exposure related to this concentration. As the U.S. Navy is looking to expand its fleet, there is also a risk that their facilities, their supply chain or our supply chain for raw materials, may not be able to support this expansion. This could adversely impact our ability to grow this portion of our business.

Contract liabilities for large U.S. Navy contracts may be beyond our normal insurance coverage and a claim could have an adverse impact on our financial results.

We are diligent at managing ongoing risks related to projects and the requirements of our customers. Our history at managing risk provides significant evidence that our exposure and risk is minimal. In addition, we secure business insurance coverage to minimize the impact of a major failure or liability related to our customers. Due to certain U.S. government procurement policies, we may take on the risk of a liability for large U.S. Navy projects in excess of our insurance coverage and at a level which is higher than our commercial projects. A claim related to one of these projects could have an adverse impact on our financial results.

11

New technology used by the ships for the U.S. Navy may delay projects and may impact our ability to grow this portion of our business.

Certain U.S. Navy vessels are implementing new technologies, unrelated to any of the equipment that we provide. If there is a complication or delay to any ship caused by this new technology, it may delay the procurement and fabrication of future vessels, which could have a negative impact on our business.

Any future lapse in U.S. government appropriations may disrupt U.S. export processing and related procedures and, as a result, may materially and adversely affect our revenue, results of operations and business.

The impact of the lapse in U.S. federal appropriations which commenced on December 22, 2018 had a short-term effect on our business. Any such future lapse (each, a "Government Shutdown") could negatively affect our ability to ship finished products to customers. We rely on federal government personnel, who are not able to perform their duties during a Government Shutdown, to conduct routine business processes related to the inspection and delivery of our products, process export licenses for us and perform other services for us that, when disrupted, may prevent us from timely shipping products outside the U.S. If we are unable to timely ship our products outside the U.S., there could be a material adverse impact on our results of operations and business. Moreover, our inability to ship products, or the perception by customers that we might not be able to timely ship our products in the future, may cause such customers to look to foreign competitors to fulfill their demand. If our customers look to foreign competitors to source equipment of the type we manufacture, there could be a material adverse impact on our results of operations and business.

Near-term income statement impact from competitive contracts could adversely affect our operating results.

During weaker market periods, we may choose to be more aggressive in pricing certain competitive projects to protect or gain market share or to increase the utilization of our facilities. In these situations, it is possible that an incrementally profitable order, while increasing contribution, may be unprofitable from an accounting perspective when including fixed manufacturing costs. In these situations, we are required to recognize the financial loss at the time of order acceptance, or as soon as our cost estimates are updated, whichever occurs first. It is possible we may accumulate losses either on a large project or more than one project such that, in a short time period, for example, a reporting quarter, these losses may have a meaningful impact on the earnings of the period.

Our operating results could be adversely affected by customer contract cancellations and delays.

The value of our backlog as of March 31, 2019 was $132,127. Our backlog can be significantly affected by the timing of large orders. The amount of our backlog at March 31, 2019 is not necessarily indicative of future backlog levels or the rate at which our backlog will be recognized as sales. Although historically the amount of modifications and terminations of our orders has not been material compared with our total contract volume, customers can, and sometimes do, terminate or modify their orders. This generally occurs more often in times of end market or capital market turmoil. As evidence of this, we had orders totaling $24,361 cancelled during the downturn between fiscal 2015 through fiscal 2017, but have had no cancellations in fiscal years 2018 and 2019. We cannot predict whether cancellations will occur or accelerate in the future. Although certain of our contracts in backlog may contain provisions allowing for us to assess cancellation charges to our customers to compensate us for costs incurred on cancelled contracts, cancellations of purchase orders or modifications made to existing contracts could substantially and materially reduce our backlog and, consequently, our future sales and results of operations. Moreover, delay of contract execution by our customers can result in volatility in our operating results.

Our current backlog contains a number of large orders from the U.S. Navy. In addition, we are continuing to pursue business in this end market which offers large multi-year projects which have an added risk profile beyond that of our historic customer base. A delay, long-term extension or cancellation of any of these projects could have a material adverse effect on our business and results of operations.

An extended downturn could adversely impact the financial stability of our customers and increase the risk of uncollectable accounts receivables.

Our customers participate in cyclical markets, such as petroleum refining, petrochemical and alternate energy. The financial strength of our customers can be impacted by a severe or lengthy downturn in these markets. This could lead to additional risk in our ability to collect outstanding accounts receivables. We attempt to mitigate this risk with the utilization of progress payments for many projects, but certain industries, end markets and geographies are not as willing to make progress payments. Certain projects require a small portion of the total payments to be held until the customer's facility is fully operational, which can be in excess of one year beyond our delivery of equipment to them. This additional time may add risk to our ability to collect on the outstanding accounts receivables.

12

Our exposure to fixed-price contracts and the timely completion of such contracts could negatively impact our results of operations.

A substantial portion of our sales is derived from fixed-price contracts, which may involve long-term fixed price commitments by us to our customers. While we believe our contract management processes are strong, we nevertheless could experience difficulties in executing large contracts, including but not limited to, estimating errors, cost overruns, supplier failures and customer disputes. To the extent that any of our fixed-price contracts are delayed, our subcontractors fail to perform, contract counterparties successfully assert claims against us, the original cost estimates in these or other contracts prove to be inaccurate or the contracts do not permit us to pass increased costs on to our customers, our profitability may decrease or losses may be incurred which, in turn, could have a material adverse effect on our business and results of operations. For our U.S. Navy projects, these fixed priced contracts have order to shipment periods which can exceed five years. This additional time-based risk, which we believe is manageable, nevertheless increases the likelihood of cost fluctuation, which could have a material adverse effect on our business and results of operation.

Given our size and specialization of our business, if we lose any member of our management team and we experience difficulty in finding a qualified replacement, our business could be harmed.

Competition for qualified management and key technical and sales personnel in our industry is intense. Moreover, our technology is highly specialized, and it may be difficult to replace the loss of any of our key technical and sales personnel. Many of the companies with which we compete for management and key technical and sales personnel have greater financial and other resources than we do or are located in geographic areas which may be considered by some to be more desirable places to live. If we are not able to retain any of our key management, technical or sales personnel, it could have a material adverse effect on our business and results of operations.

During certain high demand periods, there can be a shortage of skilled production workers, especially those with high-end welding capabilities. We could experience difficulty hiring or replacing those individuals, which could adversely affect our business.

Our fabrication processes require highly skilled production workers, especially welders. Welding has not been an educational field that has been popular over the past few decades as manufacturing has moved overseas. While we have an in-house weld training program, if we are unable to retain, hire or train an adequate number of individuals with high-end welding capability, this could adversely impact our ability to achieve our financial objectives. In addition, if demand for highly skilled production workers were to significantly outstrip supply, wages for these skilled workers could dramatically increase in our and related industries and that could affect our financial performance. Furthermore, should we not be able to expand our production workforce, we would expect to increase the amount of outsourced fabrication which is likely to result in higher costs and lower margins.

Our acquisition strategy may not be successful or may increase business risk.

The success of our acquisition strategy will depend, in part, on our ability to identify suitable companies or businesses to purchase and then successfully negotiate and close acquisition transactions. In addition, our success depends in part on our ability to integrate acquisitions and realize the anticipated benefits from combining the acquisition with our historical business, operations and management. We cannot provide any assurances that we will be able to complete any acquisitions and then successfully integrate the business and operations of those acquisitions without encountering difficulties, including unanticipated costs, issues or liabilities, difficulty in retaining customers and supplier or other relationships, failure to retain key employees, diversion of our management’s attention, failure to integrate information and accounting systems or establish and maintain proper internal control over financial reporting. Moreover, as part of the integration process, we must incorporate an acquisition’s existing business culture and compensation structure with our existing business. We also need to utilize key personnel who may be distracted from the core business. If we are not able to efficiently integrate an acquisition’s business and operations into our organization in a timely and efficient manner, or at all, the anticipated benefits of the acquisition may not be realized, or it may take longer to realize these benefits than we currently expect, either of which could have a material adverse effect on our business or results of operations.

If we become subject to product liability, warranty or other claims, our results of operations and financial condition could be adversely affected.

The manufacture and sale of our products exposes us to potential product liability claims, including those that may arise from failure to meet product specifications, misuse or malfunction of our products, design flaws in our products, or use of our products with systems not manufactured or sold by us. For example, our equipment is installed in facilities that operate dangerous processes and the misapplication, improper installation or failure of our equipment may result in exposure to potentially hazardous substances, personal injury or property damage.

13

Provisions contained in our contracts with customers that attempt to limit our damages may not be enforceable or may fail to protect us from liability for damages and we may not negotiate such contractual limitations of liability in certain circumstances. Our insurance may not cover all liabilities and our historical experience may not reflect liabilities we may face in the future. Our risk of liability may increase as we manufacture more complex or larger projects. We also may not be able to continue to maintain such insurance at a reasonable cost or on reasonable terms, or at all. Any material liability not covered by provisions in our contracts or by insurance could have a material adverse effect on our business and financial condition.

Furthermore, if a customer suffers damage as a result of an event related to one of our products, even if we are not at fault, they may reduce their business with us. We may also incur significant warranty claims which are not covered by insurance. In the event a customer ceases doing business with us as a result of a product malfunction or defect, perceived or actual, or if we incur significant warranty costs in the future, there could be a material adverse effect on our business and results of operations.

If third parties infringe upon our intellectual property or if we were to infringe upon the intellectual property of third parties, we may expend significant resources enforcing or defending our rights or suffer competitive injury.

Our success depends in part on our proprietary technology. We rely on a combination of patent, copyright, trademark, trade secret laws and confidentiality provisions to establish and protect our proprietary rights. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer. We may also be required to spend significant resources to monitor and police our intellectual property rights. Similarly, if we were found to have infringed upon the intellectual property rights of others, our competitive position could suffer. Furthermore, other companies may develop technologies that are similar or superior to our technologies, duplicate or reverse engineer our technologies or design around our proprietary technologies. Any of the foregoing could have a material adverse effect on our business and results of operations.

In some instances, litigation may be necessary to enforce our intellectual property rights and protect our proprietary information, or to defend against claims by third parties that our products infringe upon their intellectual property rights. Any litigation or claims brought by or against us, whether with or without merit, could result in substantial costs to us and divert the attention of our management, which could materially harm our business and results of operations. In addition, any intellectual property litigation or claims against us could result in the loss or compromise of our intellectual property and proprietary rights, subject us to significant liabilities, require us to seek licenses on unfavorable terms, prevent us from manufacturing or selling certain products or require us to redesign certain products, any of which could have a material adverse effect on our business and results of operations.

We are subject to foreign currency fluctuations which may adversely affect our operating results.

We are exposed to the risk of currency fluctuations between the U.S. dollar and the currencies of the countries in which we sell our products to the extent that such sales are not based on U.S. dollars. Currency movements can affect sales in several ways, the foremost being our ability to compete for orders against foreign competitors that base their prices on relatively weaker currencies. Strength of the U.S. dollar compared with the Euro or Asian currencies may put us in a less competitive position. Business lost due to competition for orders against competitors using a relatively weaker currency cannot be quantified. In addition, cash can be adversely impacted by the conversion of sales made by us in a foreign currency to U.S. dollars. While we may enter into currency exchange rate hedges from time to time to mitigate these types of fluctuations, we cannot remove all fluctuations or hedge all exposures and our earnings are impacted by changes in currency exchange rates. In addition, if the counter-parties to such exchange contracts do not fulfill their obligations to deliver the contractual foreign currencies, we could be at risk for fluctuations, if any, required to settle the obligation. Any of the foregoing could adversely affect our business and results of operations. At March 31, 2019, we held no forward foreign currency exchange contracts.

Security threats and other sophisticated computer intrusions could harm our information systems, which in turn could harm our business and financial results.

We utilize information systems and computer technology throughout our business. We store sensitive data, proprietary information and perform engineering designs and calculations on these systems. Threats to these systems, and the laws and regulations governing security of data, including personal data, on information systems and otherwise held by companies is evolving and adding layers of complexity in the form of new requirements and increasing costs of attempting to protect information systems and data and complying with new cybersecurity regulations. Information systems are subject to numerous and evolving cybersecurity threats and sophisticated computer crimes, which pose a risk to the stability and security of our information systems, computer technology, and business. Global cybersecurity threats can range from uncoordinated individual attempts to gain unauthorized access to our information systems and computer technology to sophisticated and targeted measures known as advanced persistent threats. The techniques used in these attacks change frequently and may be difficult to detect for periods of time and we may face difficulties in anticipating and implementing adequate preventative measures. A failure or breach in security could expose our company as well as our customers and suppliers to risks of misuse of information, compromising confidential information and technology, destruction of data, production disruptions and other business risks which could damage our reputation, competitive position and financial results of

14

our operations. In addition, defending ourselves against these threats may increase costs or slow operational efficiencies of our business. If any of the foregoing were to occur, it could have a material adverse effect on our business and results of operations.

We face potential liability from asbestos exposure and similar claims that could result in substantial costs to us as well as divert attention of our management, which could have a material adverse effect on our business and results of operations.

We are a defendant in a number of lawsuits alleging illnesses from exposure to asbestos or asbestos-containing products and seeking unspecified compensatory and punitive damages. We cannot predict with certainty the outcome of these lawsuits or whether we could become subject to any similar, related or additional lawsuits in the future. In addition, because some of our products are used in systems that handle toxic or hazardous substances, any failure or alleged failure of our products in the future could result in litigation against us. For example, a claim could be made under various regulations for the adverse consequences of environmental contamination. Any litigation brought against us, whether with or without merit, could result in substantial costs to us as well as divert the attention of our management, which could have a material adverse effect on our business and results of operations.

Many of our large international customers are nationalized or state-owned businesses. Any failure to comply with the United States Foreign Corrupt Practices Act could adversely impact our competitive position and subject us to penalties and other adverse consequences, which could harm our business and results of operations.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or making other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Many foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in certain of the jurisdictions in which we may operate or sell our products. While we strictly prohibit our employees and agents from engaging in such conduct and have established procedures, controls and training to prevent such conduct from occurring, it is possible that our employees or agents will engage in such conduct and that we might be held responsible. If our employees or other agents are alleged or are found to have engaged in such practices, we could incur significant costs and suffer severe penalties or other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Provisions contained in our certificate of incorporation and bylaws could impair or delay stockholders' ability to change our management and could discourage takeover transactions that some stockholders might consider to be in their best interests.

Provisions of our certificate of incorporation and bylaws could impede attempts by our stockholders to remove or replace our management and could discourage others from initiating a potential merger, takeover or other change of control transaction, including a potential transaction at a premium over the market price of our common stock, that our stockholders might consider to be in their best interests. Such provisions include:

|

|

• |

We could issue shares of preferred stock with terms adverse to our common stock. Under our certificate of incorporation, our Board of Directors is authorized to issue shares of preferred stock and to determine the rights, preferences and privileges of such shares without obtaining any further approval from the holders of our common stock. We could issue shares of preferred stock with voting and conversion rights that adversely affect the voting power of the holders of our common stock, or that have the effect of delaying or preventing a change in control of our company. |

|

|

• |

Only a minority of our directors may be elected in a given year. Our bylaws provide for a classified Board of Directors, with only approximately one-third of our Board elected each year. This provision makes it more difficult to effect a change of control because at least two annual stockholder meetings are necessary to replace a majority of our directors. |

|

|

• |

Our bylaws contain advance notice requirements. Our bylaws also provide that any stockholder who wishes to bring business before an annual meeting of our stockholders or to nominate candidates for election as directors at an annual meeting of our stockholders must deliver advance notice of their proposals to us before the meeting. Such advance notice provisions may have the effect of making it more difficult to introduce business at stockholder meetings or nominate candidates for election as director. |

|

|

• |

Our certificate of incorporation requires supermajority voting to approve a change of control transaction. Seventy-five percent of our outstanding shares entitled to vote are required to approve any merger, consolidation, sale of all or substantially all of our assets and similar transactions if the other party to such transaction owns 5% or more of our shares entitled to vote. In addition, a majority of the shares entitled to vote not owned by such 5% or greater stockholder are also required to approve any such transaction. |

15

|

|

• |

Amendments to our bylaws require supermajority voting. Although our Board of Directors is permitted to amend our bylaws at any time, our stockholders may only amend our bylaws upon the affirmative vote of both 75% of our outstanding shares entitled to vote and a majority of the shares entitled to vote not owned by any person who owns 50% or more of our shares. This provision makes it more difficult for our stockholders to implement a change they may consider to be in their best interests without approval of our Board. |

Not applicable.

Our corporate headquarters, located at 20 Florence Avenue, Batavia, New York, consists of a 45,000 square foot building. Our manufacturing facilities, also located in Batavia, consist of approximately 33 acres and contain about 260,000 square feet in several buildings, including 206,000 square feet in manufacturing facilities, 48,000 square feet for warehousing and a 6,000 square-foot building for product research and development. Additionally, we lease an approximately 1,500 square foot U.S. sales office in Houston, Texas and GVHTT leases an approximately 4,900 square foot sales and engineering office in Suzhou, China. In fiscal 2019, the Company established Graham India Private Limited ("GIPL") as a wholly-owned subsidiary. GIPL, located in Ahmedabad, India, serves as a sales and market development office focusing on the refining, petrochemical and fertilizer markets. We lease a sales and marketing office of approximately 777 square feet in Ahmedabad, India.

For our business held for sale, we lease approximately 15,000 square feet of office space and 45,000 square feet of manufacturing facilities.

We believe that our properties are generally in good condition, are well maintained, and are suitable and adequate to carry on our business.

Item 3. Legal Proceedings

The information required by this Item 3 is contained in Note 18 to our consolidated financial statements included in Item 8 of Part II of this Annual Report on Form 10-K and is incorporated herein by reference.

Item 4. Mine Safety Disclosures

Not applicable.

16

(Amounts in thousands, except per share data)

|

Item 5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is traded on the NYSE exchange under the symbol "GHM". As of May 23, 2019, there were 9,842,803 shares of our common stock outstanding that were held by approximately 138 stockholders of record.

Subject to the rights of any preferred stock we may then have outstanding, the holders of our common stock are entitled to receive dividends as may be declared from time to time by our Board of Directors out of funds legally available for the payment of dividends. Our Board of Directors declared dividends per share of $0.09 for the first quarter of fiscal 2019 and $0.10 in each of the second, third and fourth quarters of fiscal 2019. While we anticipate that we will continue to pay quarterly cash dividends in the future, there can be no assurance that we will pay such dividends in any future period or that the level of cash dividends paid by us will remain constant.

Our senior credit facility contains provisions pertaining to the maintenance of a maximum funded debt to earnings before interest expense, income taxes, depreciation and amortization, or EBITDA, ratio and a minimum level of earnings before interest expense and income taxes to interest ratio as well as restrictions on the payment of dividends to stockholders. The facility limits the payment of dividends to stockholders to 25% of net income if our funded debt to EBITDA ratio is greater than 2.0 to 1. As of March 31, 2019 and May 31, 2019 we did not have any funded debt outstanding. More information regarding our senior credit facility can be found in Note 9 to the Consolidated Financial Statements included in Item 8 of Part II of this Annual Report on Form 10-K.

17

GRAHAM CORPORATION – FIVE YEAR SUMMARY OF SELECTED FINANCIAL DATA

(Amounts in thousands, except per share data)

(for fiscal years ended March 31)

|

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|||||

|

Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

91,831 |

|

|

$ |

77,534 |

|

|

$ |

91,769 |

|

|

$ |

90,039 |

|

|

$ |

135,169 |

|

|

Gross profit |

|

|

21,909 |

|

|

|

16,975 |

|

|

|

22,157 |

|

|

|

23,255 |

|

|

|

41,804 |

|

|

Gross profit percentage |

|

|

23.9 |

% |

|

|

21.9 |

% |

|

|

24.1 |

% |

|

|

25.8 |

% |

|

|

30.9 |

% |

|

Net (loss) income (1) |

|

|

(308 |

) |

|

|

(9,844 |

) |

|

|

5,023 |

|

|

|

6,131 |

|

|

|

14,735 |

|

|

Cash dividends |

|

|

3,834 |

|

|

|

3,517 |

|

|

|

3,492 |

|

|

|

3,296 |

|

|

|

2,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings from continuing operations per share |

|

$ |

(0.03 |

) |

|

$ |

(1.01 |

) |

|

$ |

0.52 |

|

|

$ |

0.61 |

|

|

$ |

1.46 |

|

|

Diluted (loss) earnings from continuing operations per share |

|

|

(0.03 |

) |

|

|

(1.01 |

) |

|

|

0.52 |

|

|

|

0.61 |

|

|

|

1.45 |

|

|

Stockholders' equity per share |

|

|

10.05 |

|

|

|

10.58 |

|

|

|

11.72 |

|

|

|

11.34 |

|

|

|

11.50 |

|

|

Dividends declared per share |

|

|

0.39 |

|

|

|

0.36 |

|

|

|

0.36 |

|

|

|

0.33 |

|

|

|

0.20 |

|

|

Market price range of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

28.98 |

|

|

|

24.03 |

|

|

|

24.99 |

|

|

|

25.25 |

|

|

|

35.35 |

|

|

Low |

|

|

19.00 |

|

|

|

17.97 |

|

|

|

17.11 |

|

|

|

14.39 |

|

|

|

20.58 |

|

|

Average common shares outstanding – diluted |

|

|

9,823 |

|

|

|

9,764 |

|

|

|

9,728 |

|

|

|

9,983 |

|

|

|

10,143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial data at March 31: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|