EXHIBIT 10.1

HSBC BANK USA, NATIONAL ASSOCIATION

452 Fifth Avenue

New York, New York 10018

October 8, 2019

GRAHAM CORPORATION

20 Florence Avenue

Batavia, New York 14020

Ladies and Gentlemen:

HSBC Bank USA, National Association (the “Bank”) is pleased to advise you that, subject to the terms and conditions set forth herein, we are prepared to extend to Graham Corporation, a Delaware corporation (the “Company”), an uncommitted discretionary demand line of credit up to an aggregate amount of $10,000,000.00 to be used solely for Performance standby letters of credit (the “Facility”).

This letter agreement amends and restates in its entirety that certain facility letter dated March 24, 2014, between the Company and Bank (the “Existing Line Letter”). Nothing in this letter agreement shall constitute a novation or a termination of the obligations or liabilities under the Existing Line Letter.

The Facility.

The Facility , is subject to the provisions set forth herein and in the Standard Trade Terms (as may be amended, restated, supplemented or otherwise modified from time to time, the “STT”), which STT can be accessed, read and printed by Company at http://www.gbm.hsbc.com/gtrfstt or alternatively Company can request a copy of the STT from Company’s Relationship Manager at Bank. Any reference to the “Customer” in the STT shall mean Company. By signing this agreement, Company acknowledges receipt of a copy of the STT and confirms that it has read, understood and accepted such terms and conditions. To the extent that any of the terms of the STT (or any document replacing the STT) conflict with the provisions of this agreement then the terms of this agreement shall prevail.

Additionally, each issuance of a letter of credit under the Facility shall be issued only pursuant to Bank’s standard form of application (the “Application”). Company shall pay the fees specified in the pricing schedule set forth in Schedule A attached hereto and as applicable, quarterly in arrears, in immediately available funds, to Bank, together with Bank's customary fees and charges specified therein.

Cover Page | Line Letter

Each letter of credit shall have an expiry date (i) not later than twelve (12) months after such letter of credit’s date of issuance and (ii) not to occur after the expiration date of the Facility, unless Bank has approved in writing such expiry date in its sole and absolute discretion; provided that (a) if the expiry date of a letter of credit shall occur after the expiration date of the Facility, then within 60 days prior to the expiration date of the Facility (or such shorter period of time as Bank may agree to in writing) or (b) if any LC Obligations (as defined hereinafter) remain outstanding for any reason after the termination or expiration of the Facility, then immediately (but in no event later than one (1) business day after the termination or expiration of the Facility), Company shall either (in the case of clause (a) or (b), as applicable) (x) deliver to, and deposit with, Bank cash collateral in an amount equal to (i) 105% of the stated amount of such letter of credit with respect to clause (a) above or (ii) 105% of the LC Obligations with respect to clause (b) above or (y) cause to be issued an irrevocable standby letter of credit in favor of Bank and issued by a bank or other financial institution acceptable to Bank (in its sole discretion) and in form and substance, and in an amount, acceptable to Bank (in its sole discretion). Such cash collateral and deposits provided under this paragraph shall be held by Bank as collateral for the payment and performance of the LC Obligations. Company hereby grants to Bank and agrees to maintain a first priority security interest in all such cash, deposits accounts and all balances therein and in all proceeds of the foregoing to secure the LC Obligations and other obligations for which the cash collateral was so provided, free and clear of all other security interests and liens. Bank shall have exclusive dominion and control, including the exclusive right of withdrawal, over such deposit account in which the cash collateral is maintained. “LC Obligations” as used herein shall mean, on any date of determination, the aggregate amount of the undrawn stated amount of all outstanding letters of credit issued under the Facility, plus the aggregate amount drawn under letters of credit issued under the Facility for which Bank has not received payment or reimbursement.

General Terms of the Facility.

Borrowings and any other extensions of credit and obligations under the Facility shall be secured by secured Certificates of Deposit held by Bank.

The Facility is subject to annual renewal by Bank in its sole and absolute discretion on July 31st of each year (or if such day is not a business day, then on the next business day thereafter provided, however, THE CONTINUING AVAILABILITY OF THE FACILITY SHALL AT ALL TIMES BE AS DETERMINED BY BANK IN ITS SOLE AND ABSOLUTE DISCRETION. Either of Company or Bank may terminate all or any portion of the Facility at any time. In the event of termination by either party, Company’s obligations hereunder and under the STT, the Note and the other documentation entered into in connection with the Facility shall remain in full force and effect until all amounts outstanding under the Facility have been indefeasibly paid in full.

ANYTHING IN THIS AGREEMENT, THE NOTE OR ANY OTHER DOCUMENTS RELATING TO THE FACILITY TO THE CONTRARY NOTWITHSTANDING, THE ENUMERATION IN THIS AGREEMENT, THE NOTE OR IN SUCH OTHER DOCUMENTS OF SPECIFIC OBLIGATIONS TO BANK AND/OR CONDITIONS TO THE AVAILABILITY OF THE FACILITY AND THE NOTE SHALL NOT BE CONSTRUED TO QUALIFY, DEFINE OR OTHERWISE LIMIT BANK’S RIGHT, POWER OR ABILITY, AT ANY TIME, UNDER APPLICABLE LAW, TO MAKE DEMAND FOR PAYMENT OF THE ENTIRE

EXHIBIT 10.1

OUTSTANDING PRINCIPAL OF, INTEREST AND OTHER AMOUNTS DUE UNDER THE FACILITY AND THE NOTE OR BANK’S RIGHT NOT TO MAKE ANY EXTENSION OF CREDIT UNDER THE FACILITY AND COMPANY AGREES THAT COMPANY’S BREACH OF OR DEFAULT UNDER ANY SUCH ENUMERATED OBLIGATIONS OR CONDITIONS IS NOT THE ONLY BASIS FOR DEMAND TO BE MADE OR FOR A REQUEST FOR AN EXTENSION OF CREDIT TO BE DENIED, AS COMPANY’S OBLIGATION TO MAKE PAYMENT SHALL AT ALL TIMES REMAIN A DEMAND OBLIGATION. NOTWITHSTANDING ANYTHING IN THIS AGREEMENT TO THE CONTRARY, THIS AGREEMENT DOES NOT CREATE A COMMITMENT OR OBLIGATION BY BANK TO EXTEND CREDIT TO COMPANY AND COMPANY ACKNOWLEDGES THAT BANK HAS NO OBLIGATION TO EXTEND ANY CREDIT UNDER THE FACILITY.

So long as any obligations, liabilities or other amounts payable under, arising from, or with respect to the Facility and the related documents shall remain unpaid and the Facility has not been terminated, Company shall furnish to Bank each of the following:

|

|

i. |

Annual audited financial statements of Company, prepared on a consolidated basis, to be received within 120 days from fiscal year end; |

|

|

ii. |

Prompt written notice of any default by Company that shall have occurred beyond any applicable grace period under any other agreement between Company and Bank or any of Bank’s affiliates; and |

|

|

iii. |

Such other information, including interim financial statements, concerning Company’s business, affairs, or financial condition as Bank may request from time to time. |

All payments of principal, interest and fees payable by Company under the Facility shall be made in U.S. dollars, in immediately available funds without set off, counterclaim or withholding at Bank’s office at 452 Fifth Avenue, New York, New York 10018 and may be charged to any account Company maintains with Bank.

The Facility is further subject to Bank’s receipt in form and substance satisfactory to Bank of the following, in each case, as applicable, duly executed and delivered on behalf of Company by an authorized person thereof:

|

|

i. |

certified copy of resolutions of Company’s board of directors (or equivalent governing body) authorizing Company’s execution, delivery and performance of this agreement, the Note and each of the other documents herein referred to; |

|

|

ii. |

signature cards for Company’s authorized signatories; |

|

|

iii. |

an executed copy of Bank’s standard form of Pledge Agreement; |

|

|

iv. |

an executed copy of the Application(s) related to the Facility; |

|

|

v. |

an executed copy of Bank’s standard form of Trade Finance Services Authorization related to the Facility ; and |

|

|

vi. |

all other documents, instruments and other agreements or deliverables requested by Bank. |

EXHIBIT 10.1

No amendment, modification or waiver of any provision of this agreement nor any consent to any departure by Bank therefrom shall be effective, irrespective of any course of dealing, unless the same shall be in writing and signed by Bank and then such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given.

Further, on the date hereof and on and as of the date any extension of credit is made under the Facility, Company makes the representations and warranties, and agrees to the provisions, set forth on Schedule B attached hereto. Each request for an extension of credit under the Facility shall be deemed to be a certification by Company both at the time of such request and at the time the related extension of credit is made that the representations and warranties contained on Schedule B are true and correct at each such time.

This agreement shall be governed by and construed in accordance with the laws of the State of New York. Please note that to the extent any of the terms or provisions of this agreement conflict with those contained in the Note or any of the other above-mentioned documents (other than the STT), the terms and provisions of such Note and of such other documents shall govern.

COMPANY AND BANK AGREE THAT ANY ACTION, SUIT OR PROCEEDING IN RESPECT OF OR ARISING OUT OF THIS AGREEMENT, THE NOTE OR ANY OTHER DOCUMENTS RELATING TO THE FACILITY MAY BE INITIATED AND PROSECUTED IN THE STATE OR FEDERAL COURTS, AS THE CASE MAY BE, LOCATED IN NEW YORK COUNTY, NEW YORK.

EACH OF COMPANY AND BANK HEREBY WAIVES TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY OR AGAINST IT IN ANY MATTERS WHATSOEVER, IN CONTRACT OR IN TORT, ARISING OUT OF OR IN ANY WAY CONNECTED WITH THIS AGREEMENT, THE NOTE OR ANY OTHER DOCUMENTS RELATING TO THE FACILITY. COMPANY ALSO HEREBY WAIVES THE RIGHT TO INTERPOSE ANY DEFENSE BASED UPON ANY CLAIM OF LACHES OR SET-OFF OR COUNTERCLAIM OF ANY NATURE OR DESCRIPTION, ANY OBJECTION BASED ON FORUM NON CONVENIENS OR VENUE, AND ANY CLAIM FOR INDIRECT, CONSEQUENTIAL, PUNITIVE, INCIDENTAL, EXEMPLARY OR SPECIAL DAMAGES.

Bank hereby notifies Company that pursuant to the requirements of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (Pub. L. 107-56, 115 Stat. 272 (Oct. 26, 2001)) (the “USA Patriot Act”) and the requirements of 31 C.F.R. Sec. 1010.230 (the “Beneficial Ownership Regulation”), Bank is required to obtain, verify and record information that identifies Company, which information includes the name, address and beneficial ownership of Company and other information that will allow Bank to identify Company in accordance with the USA Patriot Act and the Beneficial Ownership Regulation, and Company agrees to provide such information and any applicable certifications from time to time to Bank.

This agreement may be executed in counterparts, each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery by a party of its executed signature page of this agreement, by telecopy, electronic transmission (e.g., a “pdf” or

EXHIBIT 10.1

“tif” file transmitted by e-mail) or other electronic means, shall be effective execution and delivery of this agreement by such party, the same as if an original manually executed counterpart were delivered by such party.

[Remainder of page intentionally left blank]

EXHIBIT 10.1

If this agreement is acceptable to you, please sign and return this agreement and the other documents referred to above within two weeks from the date of this agreement.

Very truly yours,

HSBC Bank USA, National Association

By: /s/Joseph W. Burden

Name: Joseph W. Burden

Title: Vice President

AGREED TO AND ACCEPTED:

GRAHAM CORPORATIONSIGNATURE VERIFICATION:

(For Bank use)

By: /s/Jeffrey F. GlajchBy: /s/Joseph W. Burden

Name:Jeffrey F. GlajchName: Joseph W. Burden

Title:Chief Financial OfficerTitle: Vice President

Schedule A

Pricing*

|

Performance Standby (Tenor of 1 year or less) |

65 basis points per annum, if tenor is less than 24 months from the date of issuance through the maturity date, payable annually

70 basis points per annum, if tenor is 25 to 48 months from the date of issuance through the maturity date, payable annually

75 basis points per annum if tenor is over 48 months from the date of issuance through the maturity date, payable annually

- Minimum commission of USD 500 |

|

|

|

|

Annual Facility Fee |

$5,000.00 |

|

Default Interest |

3% plus the Prime Rate

|

|

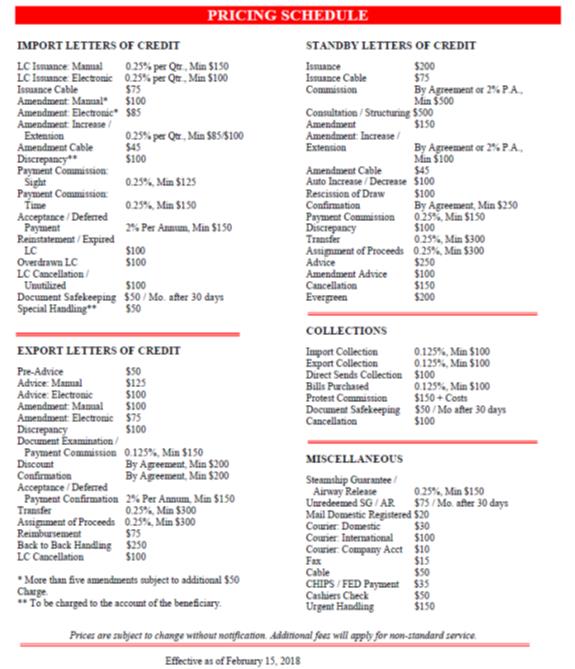

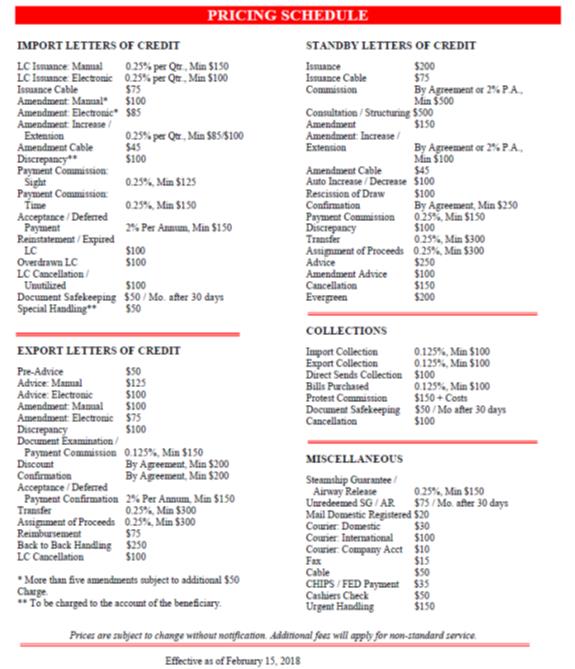

*Please see Annex I to Schedule A, attached hereto, for other relevant fees. |

|

Pricing is subject to change upon thirty (30) days’ prior written notice to Company.

Definitions:

“Performance Standby Letter of Credit” means a letter of credit or similar arrangement, however named or described, other than a Financial Standby Letter of Credit, issued, confirmed or paid, or in respect of which value is transferred (including acceptance of a draft), by Bank and/or an affiliate of Bank (or correspondent bank), for account of one or more applicants, that represents an irrevocable obligation to the beneficiary on the part of the issuer to make payment on account of any default by the account party in the performance of a non-financial or commercial obligation. The determination that a letter of credit or similar arrangement is a Performance Standby Letter of Credit shall be made by Bank in its sole and absolute discretion.

“Prime Rate” means the rate of interest publicly announced by Bank from time to time as its prime rate and is a base rate for calculating interest on certain loans. In no event shall the interest rate under this agreement exceed the maximum rate authorized by applicable law. Any change in the interest rate resulting from a change in the Prime Rate shall be effective on the date of such change.

EXHIBIT 10.1

Annex I to Schedule A

Representations and Warranties

Anti-money Laundering

Company represents and warrants that each of Company and its subsidiaries is in compliance, in all material respects, with all applicable anti-money laundering rules and regulations.

Sanctions

Company represents and warrants that none of Company, any of its subsidiaries, or any director, officer, employee, agent, or affiliate of Company or any of its subsidiaries, is an individual or entity (“Person”) that is, or is owned or controlled by Persons that are: (i) the target of any sanctions administered or enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control, the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury, the Hong Kong Monetary Authority or other relevant sanctions authority (collectively, “Sanctions”) or (ii) located, organized or resident in a country or territory that is the target of Sanctions, including, currently, the Crimea region, Cuba, Iran, North Korea and Syria. Company will not, directly or indirectly, use the proceeds of the Facility, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person, (i) to fund any activities or business of or with any Person, or in any country or territory, that, at the time of such funding, is the target of Sanctions, or (ii) in any other manner that would result in a violation of Sanctions by any Person (including any Person participating in the Facility, whether as underwriter, advisor, investor, or otherwise).

Anti-Bribery and Corruption

Company represents and warrants that none of Company, nor to the knowledge of Company, any director, officer, agent, employee, affiliate or other Person acting on behalf of Company or any of its subsidiaries is aware of or has taken any action, directly or indirectly, that would result in a violation by such Persons of any applicable anti-bribery law, including but not limited to, the United Kingdom Bribery Act 2010 (the “UK Bribery Act”) and the U.S. Foreign Corrupt Practices Act of 1977 (the “FCPA”). Furthermore, Company represents and warrants that Company and, to the knowledge of Company, its affiliates have conducted their businesses in compliance with the UK Bribery Act, the FCPA and similar laws, rules or regulations and have instituted and maintain policies and procedures designed to ensure, and which are reasonably expected to continue to ensure, continued compliance therewith. No part of the proceeds of the Facility will be used, directly or indirectly, for any payments that could constitute a violation of any applicable anti-bribery law.

USA Patriot Act and Beneficial Ownership Regulation

Company represents and warrants that any information, documentation or certification provided by Company as required by the USA Patriot Act, the Beneficial Ownership Regulation or any other anti-money laundering rules and regulations is true and correct in all respects.