UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ___________

Commission File Number

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

☒ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

As of August 6, 2021, there were outstanding

Graham Corporation and Subsidiaries

Index to Form 10-Q

As of June 30, 2021 and March 31, 2021 and for the three months ended June 30, 2021 and 2020

|

|

|

Page |

|

Part I. |

|

|

|

|

|

|

|

Item 1. |

3 |

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

|

|

|

|

Item 3. |

27 |

|

|

|

|

|

|

Item 4. |

27 |

|

|

|

|

|

|

Part II. |

|

|

|

|

|

|

|

Item 1A. |

29 |

|

|

|

|

|

|

Item 2. |

29 |

|

|

|

|

|

|

Item 6. |

31 |

|

|

|

|

|

|

33 |

||

|

|

|

|

2

GRAHAM CORPORATION AND SUBSIDIARIES

FORM 10-Q

JUNE 30, 2021

PART I – FINANCIAL INFORMATION

Item 1.Unaudited Condensed Consolidated Financial Statements

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

|

|

2021 |

|

|

2020 |

|

||

|

|

|

(Amounts in thousands, except per share data) |

|

|||||

|

Net sales |

|

$ |

|

|

|

$ |

|

|

|

Cost of products sold |

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

Other expenses and income: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

|

|

|

|

|

|

|

Selling, general and administrative – amortization |

|

|

|

|

|

|

— |

|

|

Other income |

|

|

( |

) |

|

|

( |

) |

|

Interest income |

|

|

( |

) |

|

|

( |

) |

|

Interest expense |

|

|

|

|

|

|

|

|

|

Total other expenses and income |

|

|

|

|

|

|

|

|

|

Loss before benefit for income taxes |

|

|

( |

) |

|

|

( |

) |

|

Benefit for income taxes |

|

|

( |

) |

|

|

( |

) |

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Per share data |

|

|

|

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Diluted: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

Dividends declared per share |

|

$ |

|

|

|

$ |

|

|

See Notes to Condensed Consolidated Financial Statements.

3

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(Unaudited)

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

|

|

2021 |

|

|

2020 |

|

||

|

|

|

(Amounts in thousands) |

|

|||||

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

|

|

|

|

|

|

|

Defined benefit pension and other postretirement plans net of income tax expense of $ ended June 30, 2021 and 2020, respectively |

|

|

|

|

|

|

|

|

|

Total other comprehensive income |

|

|

|

|

|

|

|

|

|

Total comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

See Notes to Condensed Consolidated Financial Statements.

4

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

June 30, 2021 |

|

|

March 31, 2021 |

|

||

|

|

|

(Amounts in thousands, except per share data) |

|

|||||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

Investments |

|

|

— |

|

|

|

|

|

|

Trade accounts receivable, net of allowances ($ March 31, 2021, respectively) |

|

|

|

|

|

|

|

|

|

Unbilled revenue |

|

|

|

|

|

|

|

|

|

Inventories |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

|

|

Income taxes receivable |

|

|

|

|

|

|

— |

|

|

Total current assets |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

|

|

|

|

|

|

|

Prepaid pension asset |

|

|

|

|

|

|

|

|

|

Operating lease assets |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

|

|

|

|

— |

|

|

Customer relationships |

|

|

|

|

|

|

— |

|

|

Technology and technical know how |

|

|

|

|

|

|

— |

|

|

Other intangible assets, net |

|

|

|

|

|

|

— |

|

|

Other assets |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

|

|

|

$ |

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Short-term debt obligations |

|

$ |

|

|

|

$ |

— |

|

|

Current portion of long-term debt |

|

|

|

|

|

|

— |

|

|

Current portion of finance lease obligations |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

|

|

|

|

|

|

|

Accrued compensation |

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

|

|

|

|

|

|

|

|

Customer deposits |

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

|

|

|

|

|

|

|

Income taxes payable |

|

|

— |

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

|

|

|

|

|

— |

|

|

Finance lease obligations |

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

|

|

|

|

|

|

|

Deferred income tax liability |

|

|

|

|

|

|

|

|

|

Accrued pension and postretirement benefit liabilities |

|

|

|

|

|

|

|

|

|

Other long-term liabilities |

|

|

|

|

|

|

— |

|

|

Total liabilities |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 11) |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

|

|

|

|

Common stock, $ issued and respectively |

|

|

|

|

|

|

|

|

|

Capital in excess of par value |

|

|

|

|

|

|

|

|

|

Retained earnings |

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive loss |

|

|

( |

) |

|

|

( |

) |

|

Treasury stock ( |

|

|

( |

) |

|

|

( |

) |

|

Total stockholders’ equity |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

|

|

|

$ |

|

|

See Notes to Condensed Consolidated Financial Statements.

5

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

|

|

2021 |

|

|

2020 |

|

||

|

Operating activities: |

|

(Dollar amounts in thousands) |

|

|||||

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net loss to net cash used by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

|

|

|

|

|

|

|

Amortization |

|

|

|

|

|

|

— |

|

|

Amortization of actuarial losses |

|

|

|

|

|

|

|

|

|

Equity-based compensation expense |

|

|

|

|

|

|

|

|

|

Gain on disposal or sale of property, plant and equipment |

|

|

— |

|

|

|

( |

) |

|

Deferred income taxes |

|

|

|

|

|

|

|

|

|

(Increase) decrease in operating assets: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

|

|

|

( |

) |

|

Unbilled revenue |

|

|

( |

) |

|

|

( |

) |

|

Inventories |

|

|

|

|

|

|

( |

) |

|

Prepaid expenses and other current and non-current assets |

|

|

( |

) |

|

|

( |

) |

|

Income taxes receivable |

|

|

( |

) |

|

|

( |

) |

|

Operating lease assets |

|

|

( |

) |

|

|

|

|

|

Prepaid pension asset |

|

|

( |

) |

|

|

( |

) |

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

( |

) |

|

|

( |

) |

|

Accrued compensation, accrued expenses and other current and non-current liabilities |

|

|

( |

) |

|

|

|

|

|

Customer deposits |

|

|

( |

) |

|

|

|

|

|

Operating lease liabilities |

|

|

|

|

|

|

( |

) |

|

Long-term portion of accrued compensation, accrued pension liability and accrued postretirement benefits |

|

|

|

|

|

|

|

|

|

Net cash used by operating activities |

|

|

( |

) |

|

|

( |

) |

|

Investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

( |

) |

|

|

( |

) |

|

Proceeds from disposal of property, plant and equipment |

|

|

— |

|

|

|

|

|

|

Purchase of investments |

|

|

— |

|

|

|

( |

) |

|

Redemption of investments at maturity |

|

|

|

|

|

|

|

|

|

Acquisition of Barber-Nichols, LLC |

|

|

( |

) |

|

|

— |

|

|

Net cash (used) provided by investing activities |

|

|

( |

) |

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

Increase in short-term debt obligations |

|

|

|

|

|

|

— |

|

|

Principal repayments on long-term debt |

|

|

— |

|

|

|

( |

) |

|

Proceeds from the issuance of long-term debt |

|

|

|

|

|

|

|

|

|

Principal repayments on finance lease obligations |

|

|

( |

) |

|

|

( |

) |

|

Repayments on lease financing obligations |

|

|

( |

) |

|

|

— |

|

|

Payment of debt issuance costs |

|

|

( |

) |

|

|

— |

|

|

Dividends paid |

|

|

( |

) |

|

|

( |

) |

|

Purchase of treasury stock |

|

|

( |

) |

|

|

( |

) |

|

Net cash provided (used) by financing activities |

|

|

|

|

|

|

( |

) |

|

Effect of exchange rate changes on cash |

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents |

|

|

( |

) |

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

|

|

|

$ |

|

|

See Notes to Condensed Consolidated Financial Statements.

6

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

|

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

|

Accumulated Other |

|

|

|

|

|

|

Total |

|

||||||||

|

|

|

|

|

|

|

Par |

|

|

Excess of |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

Stockholders' |

|

||||||

|

|

|

Shares |

|

|

Value |

|

|

Par Value |

|

|

Earnings |

|

|

Loss |

|

|

Stock |

|

|

Equity |

|

|||||||

|

Balance at April 1, 2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

Comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Issuance of shares |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

Forfeiture of shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Recognition of equity-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of treasury stock |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Balance at June 30, 2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

|

Accumulated Other |

|

|

|

|

|

|

Total |

|

||||||||

|

|

|

|

|

|

|

Par |

|

|

Excess of |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

Stockholders' |

|

||||||

|

|

|

Shares |

|

|

Value |

|

|

Par Value |

|

|

Earnings |

|

|

Loss |

|

|

Stock |

|

|

Equity |

|

|||||||

|

Balance at April 1, 2020 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Issuance of shares |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

Forfeiture of shares |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Recognition of equity-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Balance at June 30, 2020 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

See Notes to Condensed Consolidated Financial Statements.

7

GRAHAM CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Amounts in thousands, except per share data)

NOTE 1 – BASIS OF PRESENTATION:

Graham Corporation's (the "Company's") Condensed Consolidated Financial Statements include its wholly-owned subsidiaries located in Suzhou, China and Ahmedabad, India at June 30, 2021 and March 31, 2021, and its recently acquired wholly-owned subsidiary, Barber-Nichols, LLC ("BN"), located in Arvada, Colorado at June 30, 2021 and for the period June 1, 2021 through June 30, 2021 (See Note 2). The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. ("GAAP") for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X, each as promulgated by the U.S. Securities and Exchange Commission. The Company's Condensed Consolidated Financial Statements do not include all information and notes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Balance Sheet as of March 31, 2021 presented herein was derived from the Company’s audited Consolidated Balance Sheet as of March 31, 2021. For additional information, please refer to the consolidated financial statements and notes included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2021 ("fiscal 2021"). In the opinion of management, all adjustments, including normal recurring accruals considered necessary for a fair presentation, have been included in the Company's Condensed Consolidated Financial Statements.

The Company's results of operations and cash flows for the three months ended June 30, 2021 are not necessarily indicative of the results that may be expected for the current fiscal year, which ends March 31, 2022 ("fiscal 2022").

NOTE 2 – ACQUISITION:

On June 1, 2021, the Company completed its acquisition of Barber-Nichols, LLC ("BN"), a privately-owned designer and manufacturer of turbomachinery products located in Arvada, Colorado that serves the defense and aerospace industry as well as the energy and cryogenic markets. The Company believes this acquisition furthers its growth strategy through market and product diversification, broadens its offerings and strengthens its presence in the defense industry, builds on its presence in the energy markets and adds capabilities in the space industry.

This transaction was accounted for as a business combination which requires that assets acquired and liabilities assumed be recognized at their fair value as of the acquisition date. The purchase price of $

The cost of the acquisition was preliminarily allocated to the assets acquired and liabilities assumed based upon their estimated fair values at the date of the acquisition and the amount exceeding the fair value of $

8

methodology, and was computed as the present value of the expected sales attributable to backlog less the remaining costs to fulfill the backlog. Changes to the preliminary valuation may result in material adjustments to the fair value of assets and liabilities acquired.

The purchase price was allocated to specific intangible assets on a preliminary basis as follows:

|

|

|

Fair Value Assigned |

|

|

Weighted Average Amortization Period |

|

|

|

At June 30, 2021 |

|

|

|

|

|

|

|

|

Intangibles subject to amortization: |

|

|

|

|

|

|

|

|

Customer relationships |

|

$ |

|

|

|

|

|

|

Technology and technical know how |

|

|

|

|

|

|

|

|

Backlog |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Intangibles not subject to amortization: |

|

|

|

|

|

|

|

|

Tradename |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

Technology and technical know-how and customer relationships are amortized in selling, general and administrative expense on a straight line basis over their estimated useful lives. Backlog is amortized in cost of products sold over the projected conversion period based on management estimates at time of purchase. Intangible amortization was $

|

|

|

Annual Amortization |

|

|

|

Remainder of 2022 |

|

$ |

|

|

|

2023 |

|

|

|

|

|

2024 |

|

|

|

|

|

2025 |

|

|

|

|

|

2026 |

|

|

|

|

|

2027 and thereafter |

|

|

|

|

|

Total intangible amortization |

|

$ |

|

|

|

|

|

|

|

|

The following table summarizes the preliminary allocation of the cost of the acquisition to the assets acquired and liabilities assumed as of the close of the acquisition:

9

|

|

|

June 1, |

|

|

|

|

|

2021 |

|

|

|

Assets acquired: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

Accounts receivable |

|

|

|

|

|

Unbilled revenue |

|

|

|

|

|

Inventory |

|

|

|

|

|

Other current assets |

|

|

|

|

|

Property, plant & equipment |

|

|

|

|

|

Operating lease asset |

|

|

|

|

|

Goodwill |

|

|

|

|

|

Backlog |

|

|

|

|

|

Customer relationships |

|

|

|

|

|

Technology and technical know how |

|

|

|

|

|

Tradename |

|

|

|

|

|

Total assets acquired |

|

|

|

|

|

Liabilities assumed: |

|

|

|

|

|

Accounts payable |

|

|

|

|

|

Accrued compensation |

|

|

|

|

|

Other current liabilities |

|

|

|

|

|

Customer deposits |

|

|

|

|

|

Operating lease liabilities |

|

|

|

|

|

Other long term liabilities |

|

|

|

|

|

Total liabilities assumed |

|

|

|

|

|

Purchase price |

|

$ |

|

|

The Condensed Consolidated Statement of Operations for the three months ended June 30, 2021 includes net sales from BN of $

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

|

|

2021 |

|

|

2020 |

|

||

|

Net sales |

|

$ |

|

|

|

$ |

|

|

|

Net (loss) income |

|

|

( |

) |

|

|

|

|

|

(Loss) earnings per share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

( |

) |

|

$ |

|

|

|

Diluted |

|

$ |

( |

) |

|

$ |

|

|

The unaudited pro forma information presents the combined operating results of Graham Corporation and BN, with the results prior to the acquisition date adjusted to include the pro forma impact of the adjustment of depreciation of fixed assets based on the preliminary purchase price allocation, the adjustment to interest income reflecting the cash paid in connection with the acquisition, including acquisition-related expenses, at the Company’s weighted average interest income rate, interest expense and loan origination fees at the Company’s current interest rate, amortization expense related to the fair value adjustments for intangible assets, non-recurring acquisition-related costs and the impact of income taxes on the pro forma adjustments utilizing the applicable statutory tax rate.

The unaudited pro forma results are presented for illustrative purposes only. These pro forma results do not purport to be indicative of the results that would have actually been obtained if the acquisition occurred as of the beginning of each of the periods presented, nor does the pro forma data intend to be a projection of results that may be obtained in the future.

NOTE 3 – REVENUE RECOGNITION:

The Company recognizes revenue on contracts when or as it satisfies a performance obligation by transferring control of the product to the customer. For contracts in which revenue is recognized upon shipment, control is generally transferred when products

10

are shipped, title is transferred, significant risks of ownership have transferred, the Company has rights to payment, and rewards of ownership pass to the customer. For contracts in which revenue is recognized over time, control is generally transferred as the Company creates an asset that does not have an alternative use to the Company and the Company has an enforceable right to payment for the performance completed to date.

The following table presents the Company’s revenue disaggregated by product line and geographic area:

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

Product Line |

|

2021 |

|

|

2020 |

|

||

|

Heat transfer equipment |

|

$ |

|

|

|

$ |

|

|

|

Vacuum equipment |

|

|

|

|

|

|

|

|

|

Fluid systems |

|

|

|

|

|

|

— |

|

|

Power systems |

|

|

|

|

|

|

— |

|

|

All other |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographic Region |

|

|

|

|

|

|

|

|

|

Asia |

|

$ |

|

|

|

$ |

|

|

|

Canada |

|

|

|

|

|

|

|

|

|

Middle East |

|

|

|

|

|

|

|

|

|

South America |

|

|

|

|

|

|

|

|

|

U.S. |

|

|

|

|

|

|

|

|

|

All other |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

|

|

|

$ |

|

|

A performance obligation represents a promise in a contract to provide a distinct good or service to a customer. The Company accounts for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. Transaction price reflects the amount of consideration to which the Company expects to be entitled in exchange for transferred products. A contract’s transaction price is allocated to each distinct performance obligation and revenue is recognized as the performance obligation is satisfied. In certain cases, the Company may separate a contract into more than one performance obligation, while in other cases, several products may be part of a fully integrated solution and are bundled into a single performance obligation. If a contract is separated into more than one performance obligation, the Company allocates the total transaction price to each performance obligation in an amount based on the estimated relative standalone selling prices of the promised goods underlying each performance obligation. The Company has made an accounting policy election to exclude from the measurement of the contract price all taxes assessed by government authorities that are collected by the Company from its customers. The Company does not adjust the contract price for the effects of a financing component if the Company expects, at contract inception, that the period between when a product is transferred to a customer and when the customer pays for the product will be one year or less. Shipping and handling fees billed to the customer are recorded in revenue and the related costs incurred for shipping and handling are included in cost of products sold.

Revenue on the majority of the Company’s contracts, as measured by number of contracts, is recognized upon shipment to the customer. Revenue on larger contracts, which are fewer in number but represent the majority of revenue, is recognized over time. However, in the three months ended June 30, 2020, revenue recognized over time was lower than revenue recognized upon shipment due to limited production on large contracts as a result of the COVID-19 pandemic. Revenue from contracts that is recognized upon shipment accounted for approximately

11

opportunities, sourcing determinations, changes in estimates of costs yet to be incurred, availability of materials, and execution by subcontractors. Sales and earnings are adjusted in current accounting periods based on revisions in the contract value due to pricing changes and estimated costs at completion. Losses on contracts are recognized immediately when evident to management.

The timing of revenue recognition, invoicing and cash collections affect trade accounts receivable, unbilled revenue (contract assets) and customer deposits (contract liabilities) on the Condensed Consolidated Balance Sheets. Unbilled revenue represents revenue on contracts that is recognized over time and exceeds the amount that has been billed to the customer. Unbilled revenue is separately presented in the Condensed Consolidated Balance Sheets. The Company may have an unconditional right to payment upon billing and prior to satisfying the performance obligations. The Company will then record a contract liability and an offsetting asset of equal amount until the deposit is collected and the performance obligations are satisfied. Customer deposits are separately presented in the Condensed Consolidated Balance Sheets. Customer deposits are not considered a significant financing component as they are generally received less than one year before the product is completed or used to procure specific material on a contract, as well as related overhead costs incurred during design and construction.

Net contract assets (liabilities) consisted of the following:

|

|

|

June 30, 2021 |

|

|

March 31, 2021 |

|

|

Change |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unbilled revenue (contract assets) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Customer deposits (contract liabilities) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Net contract liabilities |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Contract liabilities at June 30, and March 31, 2021 include $

Receivables billed but not paid under retainage provisions in the Company’s customer contracts were $

Incremental costs to obtain a contract consist of sales employee and agent commissions. Commissions paid to employees and sales agents are capitalized when paid and amortized to selling, general and administrative expense when the related revenue is recognized. Capitalized costs, net of amortization, to obtain a contract were $

The Company’s remaining unsatisfied performance obligations represent a measure of the total dollar value of work to be performed on contracts awarded and in progress. The Company also refers to this measure as backlog. As of June 30, 2021, the Company had remaining unsatisfied performance obligations of $

NOTE 4 – INVESTMENTS:

12

NOTE 5 – INVENTORIES:

Inventories are stated at the lower of cost or net realizable value, using the average cost method.

Major classifications of inventories are as follows:

|

|

|

June 30, |

|

|

March 31, |

|

||

|

|

|

2021 |

|

|

2021 |

|

||

|

Raw materials and supplies |

|

$ |

|

|

|

$ |

|

|

|

Work in process |

|

|

|

|

|

|

|

|

|

Finished products |

|

|

|

|

|

|

|

|

|

Total |

|

$ |

|

|

|

$ |

|

|

NOTE 6 – EQUITY-BASED COMPENSATION:

The 2020 Graham Corporation Equity Incentive Plan (the (the "2020 Plan"), as approved by the Company’s stockholders at the Annual Meeting on August 11, 2020, provides for the issuance of

Restricted stock awards granted in the three-month periods ended June 30, 2021 and 2020 were

During the three months ended June 30, 2021 and 2020, the Company recognized equity-based compensation costs related to restricted stock awards of $

The Company has an Employee Stock Purchase Plan (the "ESPP"), which allows eligible employees to purchase shares of the Company's common stock at a discount of up to

13

NOTE 7 – LOSS PER SHARE:

Basic loss per share is computed by dividing net loss by the weighted average number of common shares outstanding for the period. Diluted loss per share is calculated by dividing net loss by the weighted average number of common shares outstanding and, when applicable, potential common shares outstanding during the period.

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

|

|

2021 |

|

|

2020 |

|

||

|

Basic loss per share |

|

|

|

|

|

|

|

|

|

Numerator: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Denominator: |

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic loss per share |

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Diluted loss per share |

|

|

|

|

|

|

|

|

|

Numerator: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Denominator: |

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

Stock options outstanding |

|

|

— |

|

|

|

— |

|

|

Weighted average common and potential common shares outstanding |

|

|

|

|

|

|

|

|

|

Diluted loss per share |

|

$ |

( |

) |

|

$ |

( |

) |

None of the options to purchase

NOTE 8 – PRODUCT WARRANTY LIABILITY:

The reconciliation of the changes in the product warranty liability is as follows:

|

|

|

Three Months Ended |

|

|||||

|

|

|

June 30, |

|

|||||

|

|

|

2021 |

|

|

2020 |

|

||

|

Balance at beginning of period |

|

$ |

|

|

|

$ |

|

|

|

BNI warranty accrual acquired |

|

$ |

|

|

|

|

— |

|

|

Income for product warranties |

|

|

( |

) |

|

|

( |

) |

|

Product warranty claims paid |

|

|

( |

) |

|

|

( |

) |

|

Balance at end of period |

|

$ |

|

|

|

$ |

|

|

Income of $

The product warranty liability is included in the line item "Accrued expenses and other current liabilities" in the Condensed Consolidated Balance Sheets.

NOTE 9 – CASH FLOW STATEMENT:

Interest paid was $

14

At June 30, 2021 and 2020, there were $

The cash utilized for the acquisition of BN of $

NOTE 10 – EMPLOYEE BENEFIT PLANS:

The components of pension cost are as follows:

|

|

|

Three Months Ended |

|

|

|||||

|

|

|

June 30, |

|

|

|||||

|

|

|

2021 |

|

|

2020 |

|

|

||

|

Service cost |

|

$ |

|

|

|

$ |

|

|

|

|

Interest cost |

|

|

|

|

|

|

|

|

|

|

Expected return on assets |

|

|

( |

) |

|

|

( |

) |

|

|

Amortization of actuarial loss |

|

|

|

|

|

|

|

|

|

|

Net pension cost |

|

$ |

( |

) |

|

$ |

|

|

|

The Company made

The components of the postretirement benefit cost are as follows:

|

|

|

Three Months Ended |

|

|

|||||

|

|

|

June 30, |

|

|

|||||

|

|

|

2021 |

|

|

2020 |

|

|

||

|

Interest cost |

|

$ |

|

|

|

$ |

|

|

|

|

Amortization of actuarial loss |

|

|

|

|

|

|

|

|

|

|

Net postretirement benefit cost |

|

$ |

|

|

|

$ |

|

|

|

The Company paid

The components of net periodic benefit cost other than service cost are included in the line item "Other income" in the Condensed Consolidated Statements of Operations.

The Company self-funds the medical insurance coverage it provides to its U.S. based employees in certain locations. The Company maintains a stop loss insurance policy in order to limit its exposure to claims. The liability of $

NOTE 11 – COMMITMENTS AND CONTINGENCIES:

The Company has been named as a defendant in lawsuits alleging personal injury from exposure to asbestos allegedly contained in, or accompanying, products made by the Company. The Company is a co-defendant with numerous other defendants in these lawsuits and intends to vigorously defend itself against these claims. The claims in the Company’s current lawsuits are similar to those made in previous asbestos-related suits that named the Company as a defendant, which either were dismissed when it was shown that the Company had not supplied products to the plaintiffs’ places of work or were settled for immaterial amounts. The Company cannot provide any assurances that any pending or future matters will be resolved in the same manner as previous lawsuits.

As of June 30, 2021, the Company was subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

Although the outcome of the lawsuits, legal proceedings or potential claims to which the Company is, or may become, a party to cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made for the majority of the claims, management does not believe that the outcomes, either individually or in the aggregate, will have a material adverse effect on the Company’s results of operations, financial position or cash flows.

15

NOTE 12 – INCOME TAXES:

The Company files federal and state income tax returns in several domestic and international jurisdictions. In most tax jurisdictions, returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. The Company is subject to U.S. federal examination for the tax years

There was

NOTE 13 – CHANGES IN ACCUMULATED OTHER COMPREHENSIVE LOSS:

The changes in accumulated other comprehensive loss by component for the three months ended June 30, 2021 and 2020 are as follows:

|

|

|

Pension and Other Postretirement Benefit Items |

|

|

Foreign Currency Items |

|

|

Total |

|

|||

|

Balance at April 1, 2021 |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

Other comprehensive income before reclassifications |

|

|

— |

|

|

|

|

|

|

|

|

|

|

Amounts reclassified from accumulated other comprehensive loss |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Net current-period other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2021 |

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

|

|

Pension and Other Postretirement Benefit Items |

|

|

Foreign Currency Items |

|

|

Total |

|

|||

|

Balance at April 1, 2020 |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Other comprehensive loss before reclassifications |

|

|

— |

|

|

|

|

|

|

|

|

|

|

Amounts reclassified from accumulated other comprehensive loss |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Net current-period other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2020 |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

The reclassifications out of accumulated other comprehensive loss by component for the three months ended June 30, 2021 and 2020 are as follows:

|

Details about Accumulated Other Comprehensive Loss Components |

|

Amount Reclassified from Accumulated Other Comprehensive Loss |

|

|

|

Affected Line Item in the Condensed Consolidated Statements of Income |

||||||

|

|

|

Three Months Ended |

|

|

|

|

||||||

|

|

|

June 30, |

|

|

|

|

||||||

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

||

|

Pension and other postretirement benefit items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of actuarial loss |

|

$ |

( |

) |

(1) |

|

$ |

( |

) |

(1) |

|

Loss before benefit for income taxes |

|

|

|

|

( |

) |

|

|

|

( |

) |

|

|

Benefit for income taxes |

|

|

|

$ |

( |

) |

|

|

$ |

( |

) |

|

|

Net loss |

|

(1) |

These accumulated other comprehensive loss components are included within the computation of pension and other postretirement benefit costs. See Note 10. |

NOTE 14 – LEASES:

The Company leases certain manufacturing facilities, office space, machinery and office equipment. An arrangement is considered to contain a lease if it conveys the right to use and control an identified asset for a period of time in exchange for consideration. If it is determined that an arrangement contains a lease, then a classification of a lease as operating or finance is determined by evaluating the five criteria outlined in the lease accounting guidance at inception. Leases generally have remaining

16

terms of

Right-of-use (“ROU”) lease assets and lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make payments in exchange for that right of use. Finance lease ROU assets and operating lease ROU assets are included in the line items “Property, plant and equipment, net” and “Operating lease assets”, respectively, in the Condensed Consolidated Balance Sheets. The current portion and non-current portion of finance and operating lease liabilities are all presented separately in the Condensed Consolidated Balance Sheets.

The discount rate implicit within the Company’s leases is generally not readily determinable, and therefore, the Company uses an incremental borrowing rate in determining the present value of lease payments based on rates available at commencement.

The weighted average remaining lease term and discount rate for finance and operating leases are as follows:

|

|

|

June 30, |

|

|

June 30, |

|

||

|

|

|

2021 |

|

|

2020 |

|

||

|

Finance Leases |

|

|

|

|

|

|

|

|

|

Weighted-average remaining lease term in years |

|

|

|

|

|

|

|

|

|

Weighted-average discount rate |

|

|

|

% |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

Operating Leases |

|

|

|

|

|

|

|

|

|

Weighted-average remaining lease term in years |

|

|

|

|

|

|

|

|

|

Weighted-average discount rate |

|

|

|

% |

|

|

|

% |

The components of lease expense are as follows:

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

||

|

|

|

June 30, |

|

|

June 30, |

|

||

|

|

|

2021 |

|

|

2020 |

|

||

|

Finance lease cost: |

|

|

|

|

|

|

|

|

|

Amortization of right-of-use assets |

|

$ |

|

|

|

$ |

|

|

|

Interest on lease liabilities |

|

|

|

|

|

|

|

|

|

Operating lease cost |

|

|

|

|

|

|

|

|

|

Short-term lease cost |

|

|

|

|

|

|

|

|

|

Total lease cost |

|

$ |

|

|

|

$ |

|

|

Operating lease costs during the three months ended June 30, 2021 and 2020 were included within cost of sales and selling, general and administrative expenses.

As of June 30, 2021, future minimum payments required under non-cancelable leases are:

17

|

|

|

Operating Leases |

|

|

Finance Leases |

|

||

|

Remainder of 2022 |

|

$ |

|

|

|

$ |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

|

— |

|

|

2026 |

|

|

|

|

|

|

— |

|

|

2027 and thereafter |

|

|

|

|

|

|

— |

|

|

Total lease payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less – amount representing interest |

|

|

|

|

|

|

|

|

|

Present value of net minimum lease payments |

|

$ |

|

|

|

$ |

|

|

NOTE 15 – DEBT:

On June 1, 2021, the Company entered into a $

On June, 1, 2021, the Company entered into an agreement to amend its letter of credit facility agreement with HSBC Bank USA, N.A. and decreased the Company’s line of credit from $

Letters of credit outstanding as of June 30, 2021 and March 31, 2021 were $

NOTE 16 – ACCOUNTING AND REPORTING CHANGES:

In the normal course of business, management evaluates all new accounting pronouncements issued by the Financial Accounting Standards Board ("FASB"), the Securities and Exchange Commission, the Emerging Issues Task Force, the American Institute of Certified Public Accountants or any other authoritative accounting body to determine the potential impact they may have on the Company's consolidated financial statements.

In December 2019, the FASB issued Accounting Standards Update ("ASU") No. 2019-12, “Simplifying the Accounting for Income Taxes.” The amended guidance simplifies the accounting for income taxes, eliminating certain exceptions to the general income tax principles, in an effort to reduce the cost and complexity of application. The amended guidance is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The guidance requires application on either a prospective, retrospective or modified retrospective basis, contingent on the income tax exception being applied. The Company adopted the new guidance, on a prospective basis, on

Management does not expect any other recently issued accounting pronouncements, which have not already been adopted, to have a material impact on the Company's consolidated financial statements.

18

NOTE 17 – SUBSEQUENT EVENTS:

On August 10, 2021, the Company announced that its Board of Directors has appointed Daniel J. Thoren as its President and Chief Executive Officer, effective August 31, 2021. Mr. Thoren will also join the Board of Directors upon assuming the new role. He will succeed James R. Lines, who plans to retire from the Company and step down from the Board of Directors. The Company will incur a one-time charge for the separation of James R. Lines that will be recorded in the second quarter of fiscal year 2022.

19

Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollar amounts in thousands, except per share data)

Overview

We are a global business that designs, manufactures and sells critical equipment for the defense, energy and chemical/petrochemical industries. For the defense industry our equipment is used in nuclear propulsion power systems and for undersea propulsion and power systems. Our energy markets include oil refining, cogeneration, and alternative power. For the chemical and petrochemical industries, our equipment is used in fertilizer, ethylene, methanol and downstream chemical facilities. We also are a provider of specialized systems and equipment for the aerospace and space industries.

Our global brand is built upon engineering expertise and close customer collaboration to design, develop, and produce mission critical equipment and systems that enable our customers to meet their economic and operational objectives. Continual improvement of our processes and systems to ensure qualified and compliant equipment are hallmarks of our brand. Our early engagement with customers and support until the end of service life are values upon which our brand is built.

Our corporate headquarters are located in Batavia, New York. We have production facilities co-located with our headquarters in Batavia. We have a wholly-owned subsidiary, Barber-Nichols, LLC, based in Arvada, Colorado, that designs, develops, manufactures and sells turbomachinery products for the aerospace, cryogenic, defense and energy markets (see "Acquisition" below). We also have wholly-owned foreign subsidiaries, Graham Vacuum and Heat Transfer Technology (Suzhou) Co., Ltd. ("GVHTT"), located in Suzhou, China and Graham India Private Limited ("GIPL"), located in Ahmedabad, India. GVHTT provides sales and engineering support for us in the People's Republic of China and management oversight throughout Southeast Asia. GIPL serves as a sales and market development office focusing on the refining, petrochemical and fertilizer markets in India.

We completed the acquisition of Barber-Nichols, LLC ("BN") on June 1, 2021.

Our current fiscal year (which we refer to as "fiscal 2022") ends March 31, 2022.

Acquisition

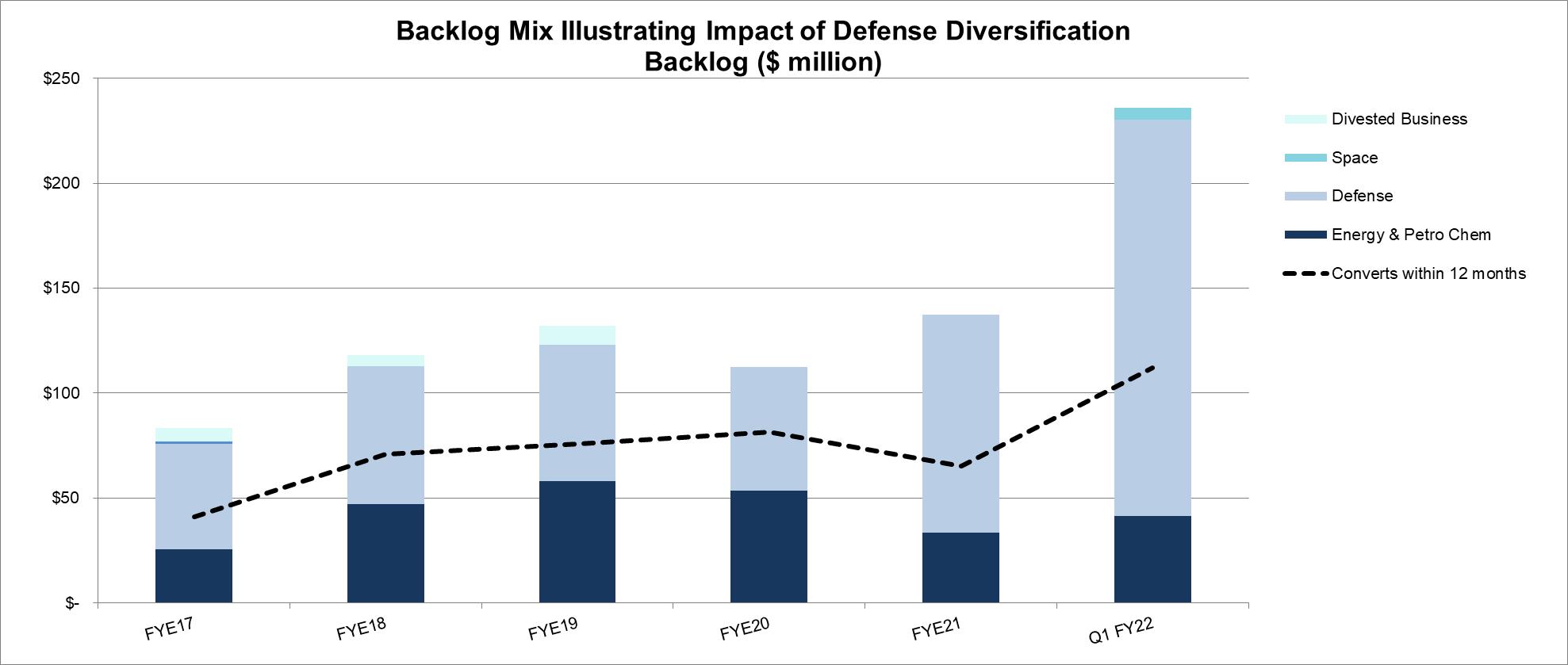

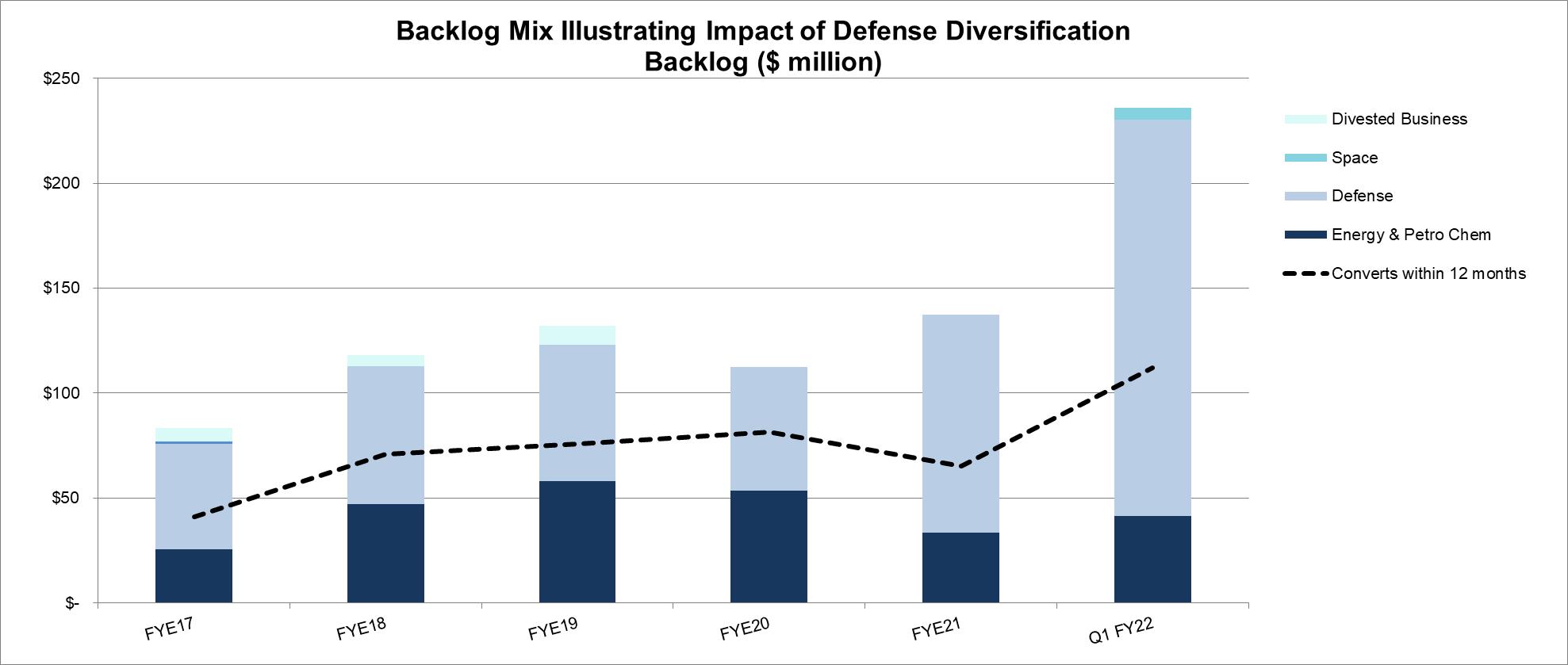

We completed the acquisition of Barber-Nichols, LLC ("BN") on June 1, 2021. BN was founded as a turbomachinery engineering company in 1966. BN has grown rapidly from programs that involve complex production and system integration. BN is located in Arvada, Colorado, a suburb of Denver. BN uses a combination of knowledge in rotating equipment, power generation cycles, and electrical management systems and has participated in the design and development of different power and propulsion systems used in underwater vehicles.

The acquisition of BN is expected to change the composition of the Company’s future end market mix. We expect approximately 45%-50% of our business for the last ten months of fiscal 2022, after the acquisition, to provide equipment to the U.S. Navy. We expect the energy market to be 35%-40% of sales and the aerospace and other markets to be 10%-15% of sales.

The transaction was accounted for as a business combination, which requires that assets acquired and liabilities assumed be recognized at their fair value as of the acquisition date. The purchase price of $72,014 was comprised of 610 shares of the Company’s common stock, representing a value of $8,964 at $14.69 per share, and cash consideration of $61,150, subject to certain potential adjustments, including a customary working capital adjustment. The cash consideration was funded through cash on-hand and debt proceeds (See Note 15). The purchase agreement with respect to the acquisition also includes a contingent earn-out dependent upon certain financial measures of BN post-acquisition, pursuant to which the sellers are eligible to receive up to $14,000 in additional cash consideration. As of June 30, 2021, a liability of $1,900 was recorded for the contingent earn-out. If achieved, the earn-out will be payable in fiscal year 2025 and will be treated as additional purchase price. Acquisition related costs of $169 were expensed in the first quarter of fiscal 2022 and are included in Selling, general and administrative expenses in the Condensed Consolidated Statement of Operations.

Highlights

Highlights for the three months ended June 30, 2021 include:

|

|

• |

Net sales for the first quarter of fiscal 2022 were $20,157, up 21% compared with $16,710 for the first quarter of the fiscal year ended March 31, 2021 (which we refer to as "fiscal 2021"). Included in the first quarter of fiscal 2022 were one month of sales for the recently acquired BN business which was $3,471. |

|

|

• |

Net loss and loss per diluted share for the first quarter of fiscal 2022 were $3,126 and $0.31, respectively, compared with $1,818 and $0.18, respectively, for the first quarter of fiscal 2021. |

20

|

|

• |

Orders booked in the first quarter of fiscal 2022 were $20,867, compared with $11,468 of orders booked in the first quarter of fiscal 2021. |

|

|

• |

Backlog was $235,938 at June 30, 2021, compared with $137,567 at March 31, 2021. Included in the backlog was $94,414 for BN. |

|

|

• |

Gross profit margin and operating margin for the first quarter of fiscal 2022 were 5% and (19%), respectively, compared with 9% and (14%), respectively, for the first quarter of fiscal 2021. |

|

|

• |

Cash and short-term investments at June 30, 2021 were $19,143, compared with $65,032 at March 31, 2021. |

Forward-Looking Statements

This report and other documents we file with the Securities and Exchange Commission include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results implied by the forward-looking statements. Such factors include, but are not limited to, the risks and uncertainties identified by us under the heading "Risk Factors" in Item 1A of our Annual Report on Form 10-K for fiscal 2021.

Forward-looking statements may also include, but are not limited to, statements about:

|

|

• |

the continuing impacts of, and risks caused by, the COVID-19 pandemic on our business operations, our customers and our markets; |

|

|

• |

the current and future economic environments, including the volatility associated with the COVID-19 pandemic, affecting us and the markets we serve; |

|

|

• |

our ability to successfully integrate and operate BN; |

|

|

• |

expectations regarding investments in new projects by our customers; |

|

|

• |

sources of revenue and anticipated revenue, including the contribution from anticipated growth; |

|

|

• |

expectations regarding achievement of revenue and profitability; |

|

|

• |

plans for future products and services and for enhancements to existing products and services; |

|

|

• |

our operations in foreign countries; |

|

|

• |

political instability in regions in which our customers are located; |

|

|

• |

tariffs and trade relations between the United States and its trading partners; |

|

|

• |

our ability to affect our growth and acquisition strategy; |

|

|

• |

our ability to maintain or expand work for the U.S. Navy; |

|

|

• |

our ability to maintain or expand work for the commercial space market; |

|

|

• |

our ability to successfully execute our existing contracts; |

|

|

• |

estimates regarding our liquidity and capital requirements; |

|

|

• |

timing of conversion of backlog to sales; |

|

|

• |

production preferences directed toward DX or DO related orders with priority ratings; |

|

|

• |

our ability to attract or retain customers; |

|

|

• |

the outcome of any existing or future litigation; and |

|

|

• |

our ability to increase our productivity and capacity. |

Forward-looking statements are usually accompanied by words such as "anticipate," "believe," "contemplate," "continue," "could," "estimate," "may," "might," "intend," "interest," "appear," "expect," "suggest," "plan," "predict," "project," "encourage," "potential," "should," "view," "will," and similar expressions. Actual results could differ materially from historical results or those implied by the forward-looking statements contained in this report.

21

Undue reliance should not be placed on our forward-looking statements. Except as required by law, we undertake no obligation to update or announce any revisions to forward-looking statements contained in this report, whether as a result of new information, future events or otherwise.

Current Market Conditions

Demand for our equipment and systems for the defense industry is expected to remain strong and continue to expand based on the planned procurement of submarines, aircraft carriers and undersea propulsion and power systems. Submarines, both Virginia and Columbia classes, are considered critical to national defense. We do not anticipate demand for our equipment and systems will abate and is actually reported to continue to increase in the coming years. With the addition of revenue from the BN acquisition, consolidated revenue for the U.S. Navy is projected to be $60 million to $70 million in the current fiscal year, with growth expected in subsequent years. In addition to U.S. Navy applications, we also provide specialty pumps, turbines, and compressors and controllers for various fluid and thermal management systems used in DoD radar, laser, electronics and power systems. We have built a leading position, and in some instances, sole sourcing position, for certain systems and equipment supporting the confidence we have in near term outlook.

The energy and petrochemical markets continue to be impacted by demand disruption caused by the COVID-19 global pandemic. Western energy markets are further impacted by alternative energy growth with reduced reliance of fossil-based fuels. This, we believe, has caused our crude oil refining customers to reduce sustaining or MRO spending and dramatically scale back strategic growth investment. Our western energy and crude oil refining customers are not expected to return to previous levels of investment in the near term, though we are seeing some improvements compared with the second half of last year. Within our emerging or developing markets, we anticipate new capacity investment will occur in the latter half of the current fiscal year. This market needs local refining capacity to meet local demand for petroleum products.

We continue to believe that the energy markets, in particular crude oil refining, simultaneous with the above-described reduction in demand, are undergoing a more fundamental evolution. We believe that systemic changes in the energy markers are occurring and that such changes are being driven, in part, by the increasing use by consumers of alternative fuels in lieu of fossil fuels. As a result, we anticipate demand growth for fossil-based fuels will be less than the global GDP growth rate. Accordingly, we expect that crude oil refiners will focus new investments toward the installed base, and that inefficient refineries will close and new refining capacity will be co-located where fuels and petrochemicals are produced. We also anticipate that future investment by refiners in renewable fuels (e.g., renewable diesel), in existing refineries (e.g., to expand feedstock processing flexibility and to improve conversion of oil to refined products), to gain greater throughput, or to build new capacity (e.g., integrated refineries with petrochemical products capabilities) will continue to drive demand for our products and services.

We expect Asian investment in chemical/petrochemical new capacity will return during the next 12-18 months while our Western integrated energy companies with petrochemical production assets will continue to limit capital investment. The timing and catalyst for a recovery in our commercial markets (crude oil refining and chemical/petrochemical markets) remains uncertain. Accordingly, we believe that in the near term the quantity of projects available for us to compete for will be fewer and that the pricing environment will remain challenging.

The alternative and clean energy opportunities for our heat transfer, power production and fluid transfer systems are expected to continue to grow. We assist in designing, developing and producing equipment for hydrogen production, distribution and fueling systems, concentrated solar power and storage, and small modular nuclear systems. While this business is small currently, we believe that we are positioning the Company to be a more significant contributor as these markets continue to develop.